Tangshan joined the "one person to buy a house for the whole family" and encouraged the provident fund to buy a house "more loan can loan" more loans "

Author:21st Century Economic report Time:2022.07.05

21st Century Business Herald reporter Li Sha Beijing report

On July 5th, Tangshan issued the "Notice of the Tangshan Housing Provident Fund Management Center on the implementation of the" one -person house gang "policy" (later referred to as "notification" "), clarifying children or parents loans to buy a house, and the other party can repay the other party. The new policy will be processed from July 15.

Specifically, the "Notice" clearly states that after June 1, Tangshan deposit employees who use housing provident fund loans and commercial loans to buy houses in the administrative area of Tangshan City can be used as common repayments for children and parents. Provident fund withdrawal business. Different loans are still implemented in accordance with the original policy.

In addition, the "Notice" pointed out that parents or children buying a house with provident fund loans in Tangshan City, in the case of insufficient loan repayment capabilities, as a common repayment person allows participation in loan repayment capabilities to increase the loan amount.

The Tangshan Housing Provident Fund Management Center stated in the policy interpretation that the policy is not only suitable for housing provident fund loans to purchase houses, but also for commercial loans to buy housing for commercial loans of provident fund employees.

The Tangshan Housing Provident Fund Management Center pointed out that the policy has three "gold points", one is to help solve the housing demand of new citizens, youth groups, and close retirees; "Fund" transforms the family's "dark supplement" into the "bright supplement" of the housing provident fund.

In terms of increasing the quota of provident fund loans, the agency explained that the current new citizens and young groups and foreign talents start their own business. There are also demand for improving house purchase. The biggest obstacle is that the loan period can only be extended to 5 years after the legal retirement age. The problem that reaches the highest limit can improve loan repayment capabilities through the "family gang".

The "Notice" clearly states that the maximum amount of personal housing loans of single and dual employees' family provident funds is 800,000 yuan; new passive ultra -low energy consumption of autonomous houses for two -star and above green building standards, the maximum loan amount is 960,000 yuan; Tangshan "Phoenix Phoenix The highest loan amount of talents in English is 1 million yuan; the highest loan quota introduced by the Caofeidian District of China (Hebei) Free Trade Zone is 1.2 million yuan.

In order to support the purchase of two -child and three -child families, the "Notice" proposes that on the premise of meeting the requirements of the loan repayment capacity, if the two -child employee family uses a provident fund loan to buy a house, the maximum loan amount can increase the maximum maximum increase of 100,000 yuan, and the family of three -child employee families can be increased. It can increase an additional up to 200,000 yuan. This also means that the three -child family of non -specific talents can loan up to 1.16 million yuan.

In order to make the New Deal more targeted and accurate, the "Notice" has also proposed some constraints, such as parents or children who have not settled the loan housing provident fund loan and commercial loan, and do not enjoy the policy.

Meng Xinzheng, an analyst of the Index Division of the Institute of the Institute of the Institute of the Institute of Independence, told a reporter from the 21st Century Business Herald that Tangshan's "one person buy a house gang" policy is based on the policy tone of "supporting reasonable housing needs". Limited funds or limited loan repayment capabilities, but with family support, the purchasing power of the buyers can be purchased.

Meng Xinzeng believes that the support of the policy for talents and many children's families is also consistent with the policy orientation of leading talents and helping to solve the demand for multi -child households.

Yan Yuejin, a research director of the Think Tank Center of the E -House Research Institute, pointed out to the 21st Century Business Herald that the Tangshan policy is actually a new expression of increasing the loan amount. In the past, the increase in the amount was generally performed directly through the floating quota, while Tangshan used the "one -person house to buy a family gang" to ensure that the family could loan more and loaned more, thereby maximizing the reduction of house purchase costs.

From the perspective of Yan Yuejin, as the increase in the amount of such loans is based on the increase in the number of repayments, the risk of subsequent repayment of provident fund loans is very small, which is also a way worthy of advocating.

At the same time, Meng Xinzeng reminded that the policy should also pay attention to the persistence of its provident fund repayment ability after retiring the retirement of the parents who share the loan.

In fact, Tangshan is not the first city to launch a "one -person house gang". Previously, Cangzhou, Qinhuangdao, and Tianjin, Jiangxi Ganzhou, Guangdong Chaozhou and Zhuhai, Hunan Shaoyang, Sichuan Ziyang, Hubei Xianning and other cities all made them There are similar policies.

It is not difficult to find that most of the "one -person house gang" policy is mostly third and fourth -tier cities. Meng Xinzeng believes that this is the embodiment of the demand for buying a house in third- and fourth -tier cities with the limited policy optimization toolbox.

- END -

The acceptance of public rental housing and leasing subsidies in Lanshan District has begun

A few days ago, the Linyi Housing and Urban -Rural Development Bureau issued the A...

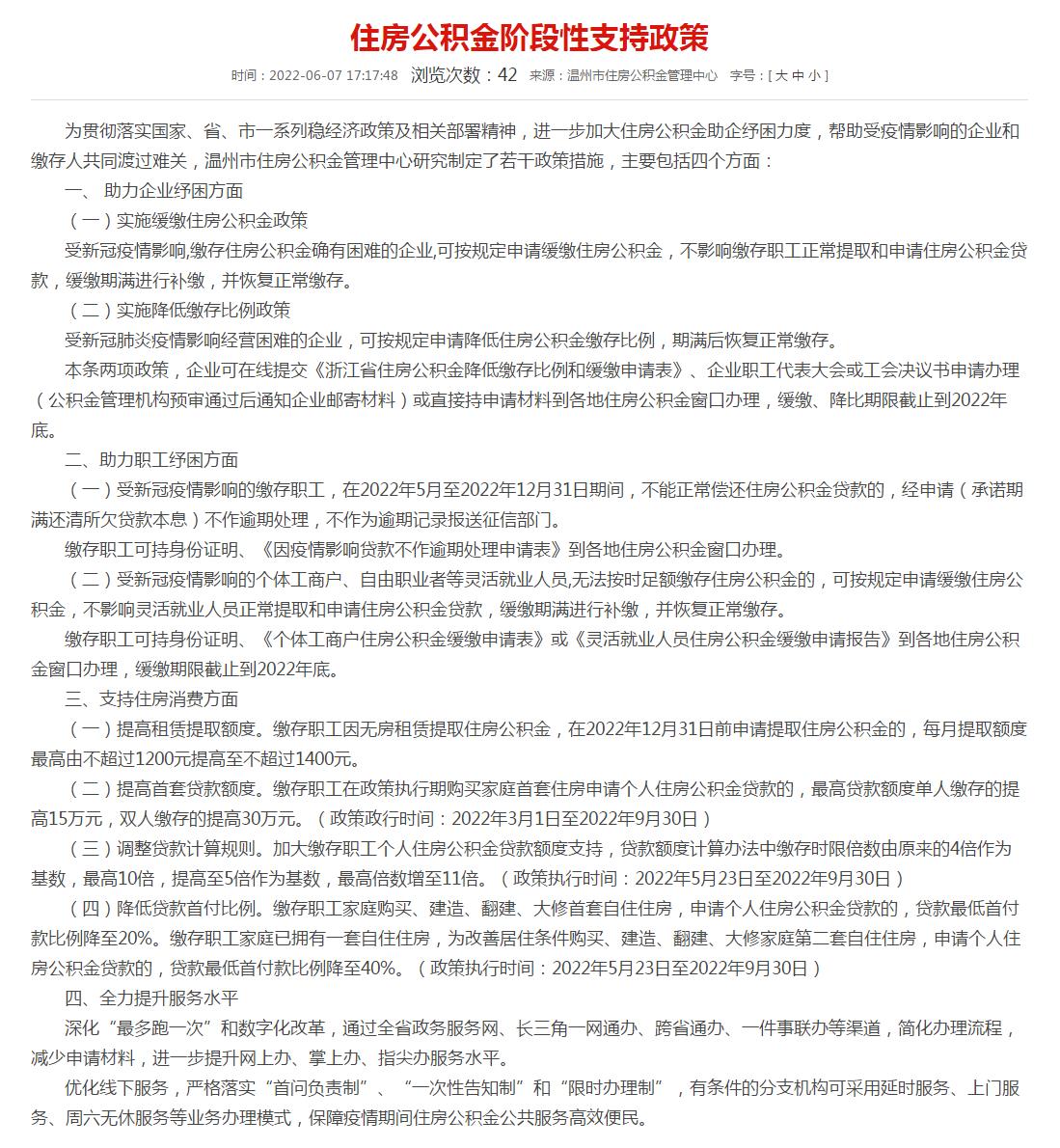

Wenzhou and Nanchang join!More than 10 urban provident fund loans have dropped to 20 %

Zhongxin Jingwei, June 8th (Dong Wenbo) Residents from Wenzhou, Nanchang, Jiangxi...