"One person to buy a house for the whole family", will the whole family be "stuck"?

Author:China News Weekly Time:2022.07.03

not

The risk of the real estate industry needs to think more about it

On the occasion of various fancy marketing such as watermelon, wheat, garlic, peaches, etc., the house purchase policy of "one person to buy a house" was also launched in Xianning City, Hubei, and Zhuhai, Guangdong.

Moreover, compared to the six wallets to buy a house four or five years ago, the "family gang" this time was to help buy a house through the provident fund of home buyers and their parents and children.

Under the influence of the tradition and reality of our country, this new regulation has its logic. However, in the context of the risk of high housing prices, will the family gang of one house buying a house evolved into a family?

6 wallets are not enough, plus 6 provident fund cards

In just about half a year, the property market has undergone a dramatic change.

On November 29, 2021, Xianning City Housing and Urban -Rural Development Bureau jointly issued regulations to strengthen precision regulation and control of real estate supply, strictly implement the requirements for pre -sale funds, and strictly implement the pre -sale price filing system for commercial housing.

On June 23 this year, the six committee bureaus of Xianning City issued a joint document to stimulate the vitality of the market and promote the virtuous cycle and healthy development of the real estate market.

In the justified regulations that Xianning City just introduced, in addition to the common purchase of the first set of ordinary commercial housing down payment ratio of not less than 20%, two and above, no less than 30%, etc. In addition, it also stipulates that when the housing provident fund deposit employees need to purchase a housing provident fund, they can apply for the housing provident fund balance of parents and children at the same time (the account is reserved for 100 yuan).

This is today's "one -person house gang". With the housing provident fund of parents and children, coupled with the provident fund of both the buyers and the couple, there may be 6 more provident fund cards to support buying houses at once.

As early as 2017, in that wave of property markets rising sharply, "one person to buy a house for the whole family" also appeared, but the family gang at that time was "not enough to buy a house, 6 wallets came together", that is, the buyer couple and both parties plus the two parties plus the two parties. Parents can directly use wallets. Nowadays, the provident fund of buyers and their parents and children has also been leveled to buy a house, which highlights the current situation of the property market.

Coincidentally. On June 1, the Zhuhai Housing Provident Fund Management Center clearly issued a document to fully meet the needs of housing consumption and "implement a one -person house gang." Moreover, this "gang" has two "gangs" method. First, 90%of the balance of direct relatives (spouses, parents, children) accounts can be extracted to help pay the down payment.

More than that, as of now, there have been more than 10 cities including Tianjin, Hebei Qinhuangdao, Chaozhou, Guangdong, Chaozhou, Jiangxi, Chuxiong, Yunnan, Cangzhou, Hebei, Shaoyang, Hunan, Ziyang, Sichuan, and Chizhou, Anhui, and introduced the "one -person house gang" policy.

Zhao Xiuchi, a professor at the University of Capital Economic and Trade and vice chairman and secretary -general of the Beijing Real Estate Law Society, told China News Weekly that buying a house is based on a family, and the power of the whole family to buy a house is the current normal. The housing provident fund has its rationality, and at the same time, this also shows that the policy of the property market has a greater policy.

Customers from other places come to see the house, and reimburse all tolls

Judging from the above -mentioned cities that adjust the provident fund policy, it is basically three or four lines.

Institutional monitoring shows that in the first half of this year, the area of newly -built commercial housing in 100 cities across the country was 132.82 million square meters, a year -on -year decrease of 49%; compared with the second half of last year, it fell by 33%. An industry insider said that the transaction of the property market was cut.

In contrast, the decline in third- and fourth -tier cities. Among them, the transaction area of new commercial housing in 26 first -tier and second -tier cities was 72.86 million square meters, a year -on -year decrease of 48%; and the transaction area of new commercial housing in 74 third -tier and fourth -tier cities was 59.96 million square meters, a year -on -year decrease of 51%.

Wang Bing has undertaken the marketing agency of multiple real estate in Xiangyang and other places in Hubei. He told China News Weekly that "starting from the second half of last year, sales have continued to decline, and the sales office is often very deserted. A small holiday can form a wave of home ownership, but I did not expect these sales nodes to fail. "

Zhao Xiuchi said that under the previous strict property market regulation and control policy, the rapid rise in house prices was suppressed, and speculative investment demand was also controlled. In addition, the impact of the epidemic, the downturn in the property market in various places, and the willingness to buy houses and expectations were also greatly affected.

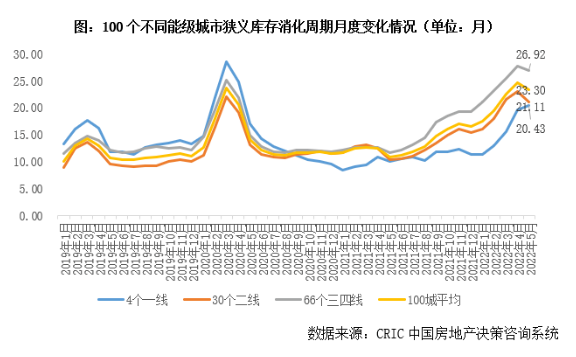

Under the decline in sales, the property market inventory rapidly accumulated and extended the exfoliating cycle. Institutional monitoring shows that as of May this year, the average exfoliating cycle of 100 cities was 23.3 months. Among them, the destination cycle of first- and second -tier cities was 21 months and the third- and fourth -tier cities were 27 months.

Take Zhuhai City, which introduced the policy of "one person to buy a house" policy, as an example. Due to the short -term transaction downturn, its de -periodic cycle has risen rapidly. At present, it has been in TOP20 among 100 cities. Compared with the same period last year, it rose 200%.

At present, the inventory cycle of Zhuhai is still running high. In June alone, 28 projects in Zhuhai City obtained a pre -sale certificate, with a pre -sale construction area of 380,000 square meters, of which the residential area was 240,000 square meters. According to the monitoring of the Hefu Research Institute, from January to March 2022, there were 7,991 units in Zhuhai Commodity Housing, with a transaction area of 592899㎡, which means that the supply volume of a single month in June alone has exceeded half of the sales volume in the first quarter. Zhuhai Vanke Metropolitan Said marketing staff told China News Weekly that their projects are selling outside. Due to the good location, developers are big brands, attracting some home buyers and even investors to see the house. If foreign customers come to see the project, they arrange cars in Zhuhai to pick up vehicles. For tolls, they can be reimbursed in full.

At the same time, China News Weekly noticed that the average sales price of the project was as high as 38,000 yuan/square meter earlier this year. The current sales price is only 36,000 yuan/square meter, and its price is in a stagnant or even decline.

Miao Meng, deputy general manager of the Development Department of Ruicheng City, told China News Weekly that in many places, the "one -person house gang" was introduced.

He further stated that with the decline in sales, high inventory, and slowing around, not only did housing companies encounter serious financial problems, but they also generally did not make much profit in the projects sold. In this context, real estate companies have no enthusiasm for landing. Even if there are some local state -owned enterprises, the land market is very deserted. Moreover, the operation of this left hand down and right hand is not sustainable. Essence

Multiple risks to be vigilant

For groups that need to use the whole family to buy houses, huge market risks cannot be ignored or may even be overwhelmed.

On the one hand, with the rise of house prices step by step, room prices have further increased.

According to data from the National Bureau of Statistics, from January to May, the sales area of commercial housing was 507.38 million square meters, the sales of commercial houses were 4833.7 billion yuan, and the sales price of commercial houses was as high as 9,500 yuan/square meter. House prices were still running at a high level.

At the same time, in May, among 70 large and medium cities, the price of new commercial housing decreased by 43 cities month -on -month, and the sales price of second -hand housing decreased by 53 cities.

On the other hand, with the rapid advancement of urbanization, housing demand in some areas has been greatly met.

Data show that the per capita residential area of households in my country reaches 41.76 square meters, with an average number of houses per household in 3.2, and the average residential area of each household reaches 111.18 square meters.

Miao Meng told China News Weekly that these data show that the problem of housing has been greatly alleviated, and people in some areas have no shortage of housing, especially some cities with strong stimulating strength. Popular needs of purchasing power may not be very large in the short term.

In this context, the market trend is still tested.

Zhao Xiuchi said that from the perspective of investment, if house prices do not rise, they will be covered. Relatively speaking, the urban risk of net outflow of population is higher. If you have a self -dwelling angle, there is no complex problem. Of course, even if you need to live, you can buy it at a historical low, which is understandable.

At present, the effect of favorable policies has begun to appear in some cities such as Suzhou and Foshan. Some institutions predict that the transaction is expected to gradually go out of the trough in the second half of 2022, and the year -on -year decline in transactions is expected to continue to narrow, but the scale of transactions will show a high decline throughout the year.

Zhao Xiuchi said that the market may slowly go out of the trough under a series of policies that support reasonable house purchase demand. After all, my country's urbanization is still in the medium stage of rapid development. There are about 14 million people entering the city each year. Real estate is also an important carrier for people's production and life.

A few days ago, Yu Liang, chairman of the board of directors of Vanke Group, publicly stated that the real estate market has bottomed out in the short term, and market recovery is a slow and mild process.

In 2021, Vanke achieved operating income of 452.8 billion yuan, an increase of 8.0%year -on -year. However, its net profit was only 22.5 billion yuan, a year -on -year decrease of 45.7%, which can be described as cut.

The above -mentioned marketing personnel of the Zhuhai Vanke Metropolitan Metropolitan Metropolitan Metropolitan Metropolitan Metropolitan said that some special listings have been launched recently, and house prices are only 26,000 yuan/square meter.

In fact, it is not just a "one -person home gang of houses", including the recent risk behind the changing incidents of watermelons, wheat, garlic, and peaches.

But the problem is not there.

Once the market risk broke out, there may be a series of problems such as rotten tails, decline in quality, and fund chain, which is obviously worthy of vigilance.

Author: Liu Debing ([email protected])

Edit: Li Zhiquan

- END -

1200 suite sources!This high -tech zone this affordable housing project is officially opened for application

1200 suites!Priority to meet corporate needs!High -tech zone affordable housing pr...

662 suites!Caiyun in Changping District Caiyuyu shakes the coefficient of property rights housing projects was held

Today (June 16), Caiyuyu in Changping District was held. The entire lottery proces...