Three sets of 50 billion sets!What is this in the Qingdao property market in June?

Author:Rule of Law Qingdao Time:2022.07.01

The new house was sold for 29,238 units, with a amount of 52.2 billion.

This is the data from the Qingdao property market in June.

Everyone knows that the results in June will be very good. After all, the property market in May has the energy that can't hold back. But when the data came out, it was still amazing everyone.

When summing up in June, a professional media described this stunning, using the word "rowing mountains and sea".

The ups and doubts are too fierce, and there are still doubts with the stunning.

Let's take a look at this burst.

Stunning

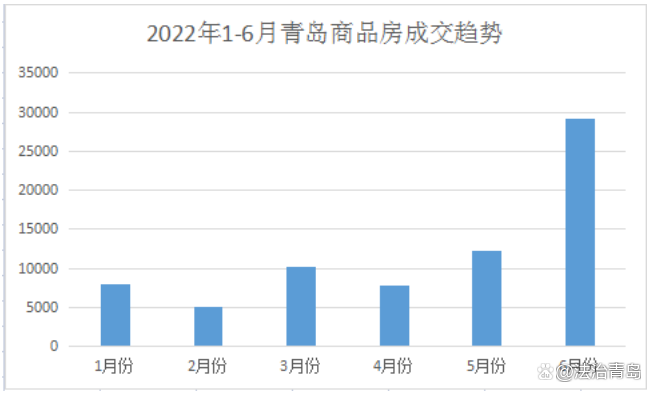

Data show that in June, Qingdao's newly -built commercial housing transactions were 29,238 units, with a total transaction area of 3.6228 million square meters and a total transaction amount of 52.18 billion, creating a single monthly history. In May of May, 147%, 166%, and 183%, respectively; rose 110%, 130%and 109%year -on -year, respectively.

In the first four months of this year, in the case of downturn to dust, in June, the entire first half of the data was pulled up with the power of January: the transaction volume of the new house increased by 0.8%year -on -year.

You know, in the first four months of this year, Qingdao's newly -built commercial houses were sold only 3,2128, a year -on -year decrease of 27.5 %.

In terms of monthly, the monthly transaction volume from January to June was 8490 sets, 5098 sets, 10660 sets, 7044 sets, 11868 sets, and 29238 sets. Obvious Rocket -like rising.

In history, the transaction data of the new commercial housing in June in June of last year was: June 15887 in June 2021, June 15,448 sets in June 2020, 9956 sets in 2019, 12,248 sets in 2018, and 13,387 sets in 2017.

In June just in the past, data also crushed.

Look at the national data.

As of June 25, the trading volume of four first -tier cities in Beijing, Shanghai, Guangzhou and Shenzhen increased by 122.1%month -on -month, and decreased by 16.1%year -on -year. Among them, in Shanghai due The month -on -month increase is about 50%: 57%in Beijing, 56%in Guangzhou, and 48%in Shenzhen.

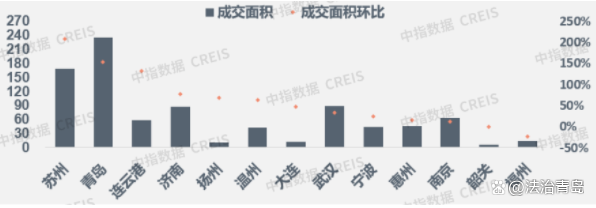

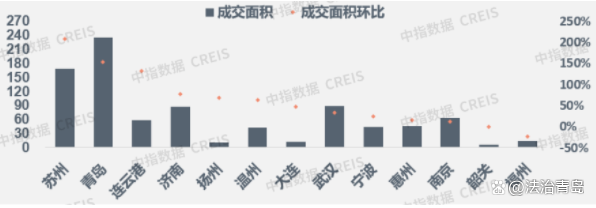

The transaction volume of 13 second- and third -tier cities rose 84.4%month -on -month and decreased by 17.5%year -on -year. Among them, Suzhou rose 208.5%month -on -month, and Qingdao rose 153.5%, ranking second, and the third ranking Jinan rose 77.5%.

In the last week of June, Qingdao sold 2365 new houses, which is also good data. However, even if the last week is not included in the statistics, Qingdao's data is still leading in the country. In order to double the trend of rising, he lives in the top two with Suzhou, and has been over the same period year -on -year.

From the perspective of which aspect, the June data of the Qingdao property market is extremely stunning, and it is not an exaggeration to describe it with explosive tables.

What is the momentum?

Why does the data in June burst?

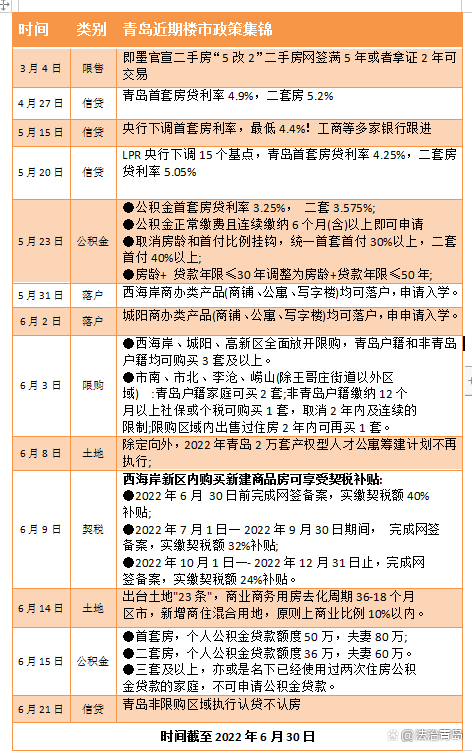

Policy stimulus effects and delayed demand release are obvious reasons.

Since 2022, more than 100 cities across the country have released nearly 300 optimization and adjustment of real estate policies. Especially after May, the scope, strength, and means of optimizing policies have begun to increase. The provident fund policy adjustment, deed tax subsidy, and house tickets are issued. The macro level is also frequently blowing the wind. It is hoped that the city will expose the good attitude as soon as possible, and the market confidence will be gradually aroused.

Qingdao's heart to promote the city is also spared no effort: Chengyang and West Coast Commercial -owned property can be settled to apply for enrollment to relax the settlement conditions; the newly -built new commercial houses on the West Coast can enjoy the new policy of 40%of subsidies for subsidies; The maximum of 800,000 husbands and wives; non -purchase -restricted regions do not recognize houses; restricted purchase, relaxation, one -time purchase of one, tax subsidy, etc.

The land side is also exerting force: in 2022, the preparation plan of the property rights -type talent apartment is no longer implemented, and the commercial proportion of new commercial and residential land is less than 10%.

The raging favorable policies, the frequent macro -oriented warmth, make the industry confidence, and also make the momentum of June surging again.

Especially confidence, although it cannot be compared with data, it has obviously changed.

The general view of the industry is that the market has entered a rapid recovery stage. Danke, who has always been a bit pessimistic about the image, also said that the short -term market has bottomed out, and the market will enter a slow and mild recovery process.

Optimism is supportive. In addition to the sales data improvement, the signs of accelerating the soil shooting market are even more obvious: By June 20th, the land transaction amount of 100 cities was 166.1 billion yuan, and the growth rate was 53%from the 20th day of May. The confidence of housing companies has boosted, and market survival has the most basic driving force.

There is also a improvement in the financing environment of housing companies. Not only do many high -quality private housing companies have been included in demonstration housing companies, they can issue RMB bonds. At the same time, the competent authorities are also continuously promoting commercial banks to rationally issue real estate development loans. Under the favorable policies, the market is generally expected that the financing environment of housing companies will continue to improve in the future.

Data show that as of June 29, the number of credit bonds in the real estate industry was 58, a significant increase from 43 in the same period in May.

The continuous improvement of the financing environment has given the larger space for housing companies, and the market's expectations for the future will be heated up.

Of course, the reason for the data explosion is not only the above. The reasons such as centralized release of online signing and the centralized release of deed tax in order to decorate the semi -annual reports have also played a role in helping the flame. Always hot, or for a while?

The data explosion does not mean that chickens and dogs are rising.

It can only be said that there are a few happy and happy sorrows.

Not all real estate companies and all projects feel the hotness of June, after experiencing the downturn of the wind and rain.

Taking Qingdao as an example, the main urban area and the Chengyang Baiyun Mountain, the west coast of the Yangtze River Lingshan Bay and other regional centers, with the quality real estate with the core resources of the city, the popularity and sales are two prosperous, and the outskirts with relatively remote and lack of supporting are still difficult. Essence

Market feedback also shows that the number of visits and transactions in hot spot areas has increased significantly. The actual transaction price is basically the same as similar products last year. Due to the continuous increase in heat, some preferential policies have been canceled. Another reason for the cancellation of the discount is that the task of most real estate in the first half of the year is good, and some even exceed 60%.

In the first four months of the mission completion, the climax of the 5, 6 -month transactions greatly relieved the pressure, and the cancellation of the discounts and the profit became optional.

Many of the real estate in the non -hot -spot areas such as Chengyang, Jiaozhou, and Jimo have not slowed down, and the number of visits and transaction volume has not significantly rebounded.

Obviously, after experiencing severe regulation and baptism, the differentiation of the real estate market is inevitable. The habitual logic of buying a house to wait for the appreciation has failed. Instead, it is the pursuit of added value such as quality, resources, supporting facilities, and development prospects. These added values on the blessing of the house are the greatest factors that affect future value.

Therefore, if you want to ask if the popularity in June will continue, it is better to ask who will be hot, who can't get angry.

To put it simply, even if the industry is warming, the situation that is greater than the demand will continue. The market choices are divided by resources. The projects of core resources will always be hot. Conversely, even the fire is difficult to find.

Text/Li Jinwen

Edit: Xiao Hualin

- END -

[Singing the "light theory" of the Chinese economy] High -tech zone adheres to the "project as king" and accelerates the construction of key projects

Since the beginning of this year, the High -tech Zone has adhered to the project a...

risky!Shijiazhuang Chang'an District Latest Tips →

In order to further regulate the order of the real estate market in our district, ...