Ding Zuyu: Baicheng property market accelerates destocking

Author:Zhongxin Jingwei Time:2022.06.28

Zhongxin Jingwei June 28th.

Author Ding Zuyu Yiju Enterprise Group CEO CEO

At present, the downward pressure on the property market is still continuing, de -inventory of most domestic cities has risen, and the property market has once again entered the era of high inventory.

According to Kerry's research data, in May 2022, the inventory of commercial housing in Baicheng reached 607 million square meters, an increase of 5%year -on -year. The exfoliating cycle of weak second -tier cities such as Shenyang and Dalian has exceeded 3 years. Many cities' destocking pressures are imminent. For example, behind the 19th city of Zhengzhou's restarting "house tickets" policy, the core is to accelerate destocking.

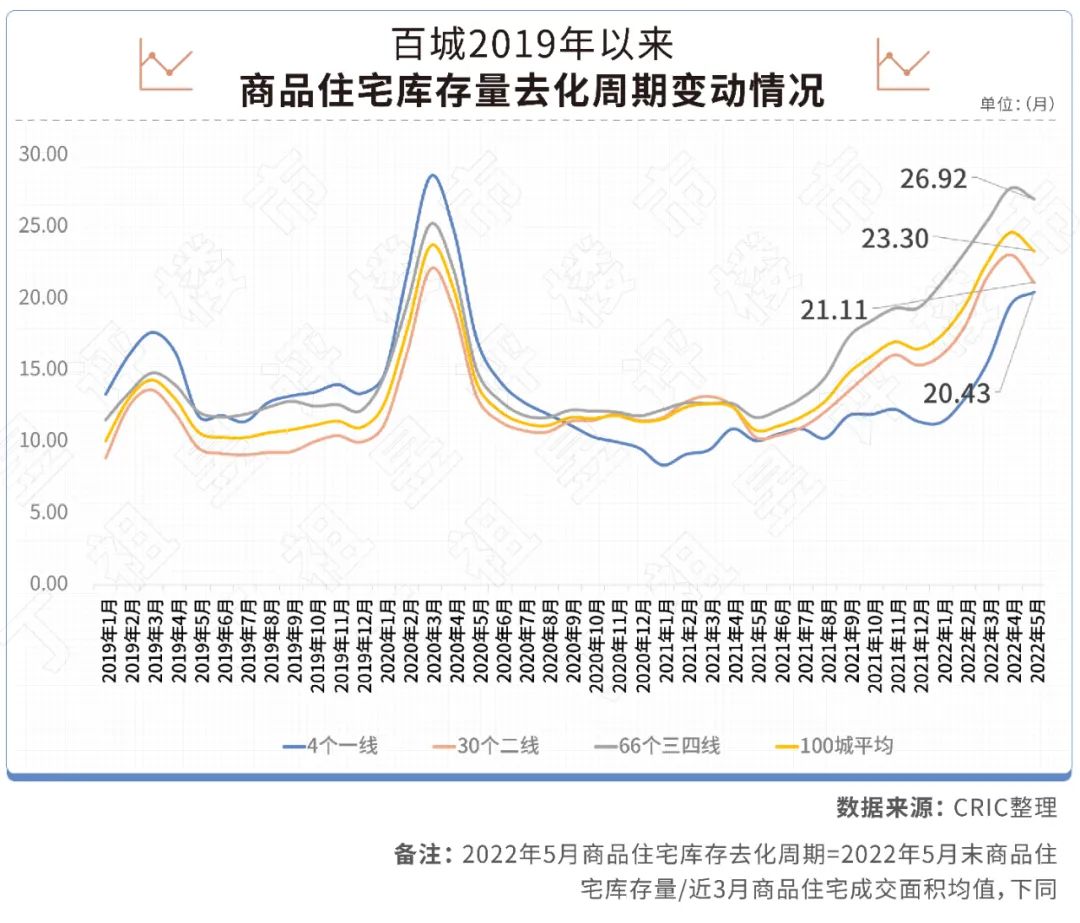

Hundred Castle Development cycle reaches 23.3 months

In May, multiple local governments across the country introduced a loose policy, and the market showed positive signals. The narrow inventory of Baicheng has declined slightly, and the dewlocation cycle has fallen for the first time since 2022. As of the end of May, the inventory of hundreds of cities fell to 23.3 months, a decrease of 1.3 months from the end of April.

At present, the inventory risk of the real estate industry is still large. The risk of inventory in first- and second -tier cities is relatively controllable, but due to the impact of the epidemic, the supply and demand of first -tier cities have been weak, the de -de -periodic cycle has increased to 20.4 months, and second -tier cities have fallen to 21.1 months. Third and fourth -tier cities have the largest exfoliating pressure. At the end of May, the dewlocular cycle reached 26.9 months.

The highest inventory in Qingdao

Data show that among the cities with total housing inventory TOP20, there are 19 cities with a total inventory of more than 10 million square meters, and the total inventory of 3 cities exceeds 20 million square meters.

Among the total inventory TOP20 city, second -tier cities accounted for 65%. Specific to the city, Qingdao ranked first in the country with a total inventory of 25.25 million square meters.

In the past six months, Qingdao has continuously launched various policies for destocking. The first is the minimum interest rate of mortgages. In some areas, one -and -second -handed housing restricted sales of "5 changes to 2". The purchase of new houses on the West Coast New Area can enjoy the tax subsidy.

Under the role of policies, in May, Qingdao's newly -built commercial residential transaction area was 953,000 square meters, a year -on -year decrease of 32%, and the decline was narrowed by nearly 19 percentage points from the previous month. From January to May, Qingdao's newly -built commercial residential transactions were traded 4.23 million square meters, a year -on -year decrease of 33%, but the markets in the suburbs and suburbs were still unclear.

Qingdao is a typical example of destocking in second -tier cities. Similar to Qingdao, the total inventory of Wuhan and Shenyang also exceeds 20 million square meters.

Taking Wuhan as an example, in 2022, Wuhan's downturn and high inventory, the total inventory reached 21.44 million square meters. In addition, in the past few years, the construction area of Wuhan's transfer of land is 1.4 times the residential transaction area. As of the end of April 2022, the broad inventory was as high as 97.36 million square meters. Essence

In addition, the inventory of a large number of third- and fourth -tier cities is accelerating. For example, the inventory of Sanming, Taizhou, and Yancheng has doubled in inventory. As of the end of May, Sanming has led the country with a 285%increase. These cities are characterized by the total inventory of the single city below 5 million square meters, but the transaction has intensified in the short term, resulting in a sharp rise in inventory.

Data show that in cities where inventory increased year -on -year TOP20, cities with large total inventory and high increase in second -tier cities are dominated by second -tier cities. For example, Nanjing and Zhengzhou, the total inventory of the two places at the end of May was 7.94 million square meters and 13.35 million square meters, respectively, an increase of 36%and 33%year -on -year, ranking 15th and 16th nationwide.

It is worth noting that Nanjing and Zhengzhou have implemented "house tickets" in shed reform, of which Nanjing is in Laishui District. The destocking pressure of the two cities is evident.

Changchun destroyed cycle is up to 125 months

The data shows that the de -sellering cycle of third- and fourth -tier cities is generally long. For example, in the TOP20 cities in the inventory dewne period in May, the North China, Qinzhou, and Baoji de -chickens have exceeded 50 months, while the exfoliating cycle of Fangchenggang in Guangxi reached 157 A month means that it takes at least 13 years to digest.

In addition, Jiaxing, Huizhou, Zhuhai, and Shantou have a downturn in the short term due to the downturn in the short period of time, causing the outcome cycle to rise.

Focusing on the first and second -tier cities, at the end of May, 14 cities have the digestive cycle of inventory of more than 24 months. Among them, Changchun's exfoliating cycle was extended to 125 months, an increase of 479%year -on -year, ranking first in second -tier cities. This means that Changchun's existing real estate inventory will take at least 10 years to digest.

Affected by the epidemic, Changchun experienced a long period of static control. In April 2022, the transaction area was only 591 square meters, a year -on -year decrease of 99%, and the transaction area of new houses increased negatively for 13 consecutive months. From January to May, a total of 860,000 square meters were sold, a year-on-year decrease of 70%. Harbin followed closely, and the dewlocular cycle reached 106 months, and the short -term derivation pressure was shown.

In addition, the pressure on the inventory of first -tier cities cannot be ignored. At the end of May, Beijing's commercial residential dewracation cycle has reached 27 months, an increase of 44%year -on -year.

It is worth noting that under the policy stimulus, the market has risen in June. Kri Ruiyan

According to the data, the cumulative transactions in 80 key cities had a total of 14.16 million square meters in the first 20 days, an increase of 18%from the previous month; the opening rate of the opening of 35 cities increased to 52%.

At present, the real estate industry is from "deleveraging" to "stable leverage."In this process, destocking has become a typical feature of the current property market.In the short term, the inventory pressure may be eased, but because the market heat is difficult to return to the peak of 2021, the overall inventory of the property market in 2022 will continue to high.Before the real estate market really stabilizes, destocking will still be the main task of some stressful urban property markets.(Zhongxin Jingwei APP) This article was selected by the Zhongxin Jingwei Research Institute. Due to the selected works, the new Jingwei copyright generated by the selected work, without written authorization, no unit or individual may reprint, extract or use it in other ways.The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Gulang County held the 10th meeting of the Land and Space Planning Committee

On June 17, Gulang County held the 10th meeting of the Land and Space Planning Com...

Civil sentiment 丨 Couples buy a house before marriage. Should I pay taxes on the "two suites" after marriage?

The man and the woman bought the property before marriage. The man's house paid th...