Ding Zuyu: The market share of private housing companies in the first August declined significantly

Author:Zhongxin Jingwei Time:2022.09.27

Zhongxin Jingwei, September 27th.

Author Ding Zuyu Yiju Enterprise Group CEO CEO

According to Kerry data, from January to August 2022, there were 28 private enterprises in TOP50 housing companies, a decrease of 4 from the same period in 2021. The market share of private housing companies showed a significant decline.

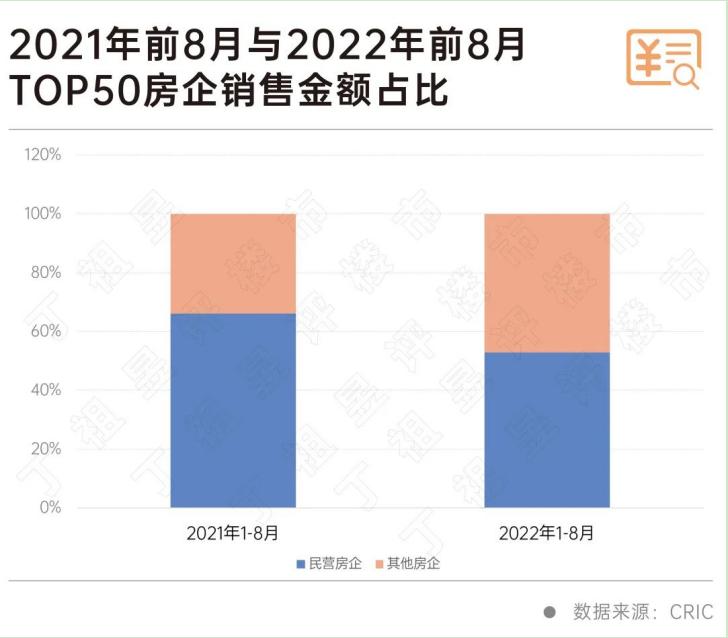

The TOP50 share of private enterprises fell 13% year -on -year

In August, the sales of housing companies were still sluggish. Nearly 60%of the top 100 real estate companies had a month -on -month performance. Among them, 12 companies decreased between 30%and 50%from the previous month, and 10 companies decreased by more than 50%from the previous month.

At the same time, in August, some large -scale real estate enterprises project performance was better. Among them, some state -owned enterprises and central enterprises, such as China Shipping, Jianfa, Jinmao, etc., under the positive stimulation of the market, they have achieved good dewlocation.

The performance of private housing companies is relatively poor. According to Kerrui research data, from January to August 2022, the number of private enterprises in TOP50 housing companies on the list was 28, a decrease of 4 from the same period in 2021. The total sales amount was 2067.29 billion yuan, a year-on-year decrease of 58%.

At the same time, the polarization of private housing enterprises is relatively obvious, the ranking of heads in heads is relatively stable, and many private housing enterprises have declined.

From the perspective of sales, the sales amount of private housing companies accounted for 53%of TOP50 housing companies, a decrease of 13 percentage points from the same period in 2021. Although the overall sales of private housing companies are still slightly higher than other housing companies, the market share is significantly declined.

70 % declined year -on -year, and the profit space was squeezed

In recent years, the overall profitability of housing companies has continued to bottom out, and the company's various profit margins have fallen to a low level of history.

In August, a number of real estate companies issued profit early warnings in the mid -term performance disclosure of 2022, mainly manifested in the negative growth of profit scale and a significant decline in profit margins. Among them, some private enterprises have recorded net profit losses.

Of course, there are also private housing companies that perform well in the market. For example, in the first half of 2022, Vanke became the first place in sales performance of private housing enterprises for 206.92 billion yuan, and Country Garden ranked second with 162.36 billion yuan. Among the typical real estate companies, 70%of the revenue of real estate companies declined, and 6 of revenue increased year -on -year, of which Longhu's revenue increased by more than 55%year -on -year.

In the first half of the year, Vanke achieved net profit of 18.0 billion yuan, ranking first among typical housing companies, and five housing companies suffered losses during the period. Among them, the net profit of the four housing companies changed from profit to losses, and Rongxin's net profit fell 539.42%. In terms of net profit attributable to mother, Vanke maintained above 10 billion yuan, ranking top, and the net profit of only 4 real estate companies was positive and achieved year -on -year growth.

Among the typical housing companies, only Longhu and Vanke have achieved increasing revenue and profits. About 60 % of housing companies have been affected by the market environment, and revenue and profits have fallen.

80 % of the soil auction market comes from state -owned enterprises and central enterprises

At present, the market share of private housing companies has declined significantly, and it has shown a significant differentiation pattern. Some of the heads of private housing companies still maintain a leading situation, and more private enterprises have signs of falling behind in this round of market adjustment.

Not only that, since 2022, the performance of private enterprises in the soil shooting market has been relatively small.

It can also be seen from the amount of TOP20 of Kerrine that only a small number of private enterprises such as Binjiang, Longhu, and Weixing are on the list, and state -owned enterprises and central enterprises account for nearly 80 %. Yuan, accounting for 76%of the TOP20 TOP20, and 49%of the TOP100 of Land Land. From the perspective of investment intensity, typical state -owned enterprises and central enterprises far exceed the industry average. Among them, Yuexiu, Jianfa, and Sino -Trade landing sales ratio exceeded 0.5, China Resources, China Merchants, China Communications, etc. are also on the industry average.

Recently, the central and local governments have frequently released positive signals. In mid -to -late August, most cities announced the third round of centralized land supply plans. In order to maintain the stability of the land market, the government has continued to release "favorable", and the supply of multiple cities has increased significantly compared with the second round, and the land supply structure is relatively balanced.

It is worth noting that the soil shooting policy still maintains the loose trend of "concession" and "drainage". Hangzhou and Shanghai have slightly adjusted the rules of the soil auction, which is intended to attract more companies to participate in shooting.

As market confidence resumes the increase in sales and the loose soil shooting of the core city will bring investment opportunities to small and medium -sized real estate companies. However, considering the high land price of the core cities, in the short term, the main structure of state -owned enterprises and central enterprises can be changed. Private enterprises may usher in a wave of land acquisition "window period" after the market recovers. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Vanke Yu Liang: Excessive market shrinkage will accumulate spontaneous repair momentum.

Vanke President Zhu Jiusheng said that he believed that Vanke's sales performance ...

Three departments: In 2021, personal housing loan ratio exceeds 80 %

Zhongxin Jingwei, June 24th. According to the website of the Ministry of Residence, the Ministry of Housing and Urban -Rural Development, the Ministry of Finance, and the People's Bank of China releas...