Real estate new forces 丨 Help housing corporate bonds, AMCs do nothing

Author:21st Century Economic report Time:2022.09.14

21st Century Business Herald reporter Tang Shaokui Shanghai report

AMC (Bad asset Management Company) is selectively entering real estate, provided that commercial operation and capital preservation.

Public information disclosed that there are 5 national AMCs in my country, and the registered place is in Beijing, including China Huarong, the Great Wall of China, China Oriental, China Cinda, and China Galaxy Asset Management Co., Ltd. Judging from the information disclosed by the financial report, the credit exposure of the first four AMCs involved in housing is about 40%, that is, their real estate concentration is high.

With the adjustment period of the real estate industry, AMC has also joined the residential army to resolve the debt problem of real estate companies. By mobilizing its own resources, AMC may take this opportunity to deepen the real estate layout.

Earlier this year, due to the principle of "marketization and legalization", the financial regulatory authorities convened a national AMC meeting to study AMC's debt problems for AMC participation in real estate companies, but they did not further disclose AMC's solution to debt processing.

Hu Yurui, a senior director of the rating of the S & P global rating financial institutions, believes that the four major AMC's own financial resources are limited. It can also be seen in 2022. It can also be seen that due to the adjustment of the real estate market, their financial performance is not good, and some AMC losses significantly. Therefore, AMC is currently involved in residential real estate. Although it has a certain amount of cooperation with some real estate companies, it has not seen the support of the funds with clear and strong funds so far.

Perhaps, relying on its own resource integration and other methods to help real estate debt is the mainstream method for AMC to enter real estate. On the one hand, AMC is supervised by the CBRC, and has clear requirements in terms of leverage and capital adequacy ratio; on the other hand, AMC participates in some bailout projects, and is more inclined to choose commercial projects. AMC will be more cautious, and may seek credit increase and other security measures before entering.

Great direction: return to the main business

By combing AMC's participation in the debt solution agreement of the real estate company, AMC's case directly involved in the acquisition of real estate companies is currently rare. Although some AMCs have already been involved in real estate business, their practical experience in real estate projects is not rich. Currently, real estate companies also need to face a series of new compliance and operation problems, so it is difficult.

Since the second half of last year, AMC has been involved in real estate rescue projects. There are participation in the project level, as well as participating in the company level. On August 10, Jiangsu Asset Management Co., Ltd. and Zhongnan Construction signed a party building co -construction and business cooperation agreement to set up a 2 billion yuan development fund; earlier May, China Huarong and Central South Construction signed a strategic cooperation agreement to provide up to up to up to up to up to the most 5 billion yuan, set up cooperation entities in the form of limited partnerships and funds, supporting the transformation and development of Zhongnan Holdings, the controlling shareholder of Central and South Construction, including the re -production and re -production of projects in construction, mergers and acquisitions in high -quality projects, and activation of social and capital cooperation projects.

AMC's development of housing enterprises has made a slow progress, which is for a reason. In the past, AMC was used to acquiring the debt and non -performing assets of housing companies from financial institutions, and obtained profit margins through commercial operations. For example, after the acquisition of debts, AMC has injects funds or finds other developers to sell projects or builds under construction or built on behalf of them. Essence AMC's participation may be a project with net cash flow back. If a single project has no net cash flow back, it may be possible to match other assets to participate in space.

Hu Yirui pointed out that there are two main types of non -performing asset management business for AMC to return to the main business: the first is the reorganization business, that is, the credit risk -related loan business. ; The other is a traditional non -performing business, that is, discount assets. AMC purchases non -performing assets through banks, trusts or other institutional channels, and obtains benefits by dealing with assets.

AMC has been familiar with traditional non -performing assets. It is currently using this business logic to participate in the operation of housing companies' bailout projects.

In April of this year, the financial regulatory authorities provided a list of 12 real estate companies to major AMCs and 18 banks, and planned to have 6 policy guidance for their assets and mergers and acquisitions. This speeds up the pace of AMC's entry into real estate to some extent.

Hu Yanrui further analyzed that under the call of the central government, AMC will also actively participate in real estate rescue, but they roughly have the following ways for the bonds of real estate bailout projects: first divide the assets into two categories. One category is unprepared items for sale. Most of the pre -sale funds of such projects are risky because of the misappropriation of the developers. AMC will also be cautious. If you must participate, you will also make some requirements. Letter and subsidies, or negotiate through the debt committee, allow housing companies to allocate other assets in the asset package at a low price to supplement the repayment source of housing companies. The other is the general creditor's existing creditors of the AMC and the project, that is, the banks issued by the development loan, discuss the discount of the developer's pledge or loan, or the purchase of some loans to obtain priority initiative. With such credit protection, AMC is more willing to intervene.

The other is projects that are still under construction and have not entered the sales cycle. Because the market is in the downward cycle and the project has profit risks, AMC will use project development loan space, plus the above -mentioned security measures, and inject more leverage into this project. AMC housing challenge

As Hu Yanrui said, commercial operation and capital preservation are the two major principles of AMC's borrowing real estate rescue into this industry.

Although AMC has rich experience in dealing with non -performing assets, there have been 20 years of bad debt disposal experience in the past. They have participated in the disposal of the four major bank bad debts and the recent Bohai Iron and Steel, Jinzhou Bank and other institutions. Coordinate upstream and downstream, traders and government resources, but in the face of the current complex real estate financing situation, it is self -evident.

Many real estate projects have complicated debt and debt relationships, and the disputes in multiple parties in the disposal are relatively controversial, different requirements, and they are willing to concessions to different levels.

Moody's research report pointed out that AMC is expected to provide support for real estate projects facing liquidity issues, instead of directly providing financing to trapped developers. AMC can cooperate with third -party investors to set up real estate funds or use its own funds to support unfinished projects. In order to encourage AMC to participate in the real estate rescue, regulators have broaden their scope of assets they can acquire and reduce the risk weights of related acquisition assets.

However, the regulatory authorities generally coordinate all parties through the overall situation of project materials. It is also insufficient for splitting, clarifying and handling complex debt and debt relationships. At this time, AMC joins, you can use all the acquisition of debt to disconnect, better geographic debt and debt relationship, complete planning, make more effective debt settlement arrangements, and jointly activate the project together.

Judging from the current actual situation, Hu Yurui believes that there are many different institutions of real estate bailout financing in it, and the insurance real estate companies themselves are also commercial enterprises. There are also many potential conflicts between them. Intersection This has become the biggest resistance of AMC in the operation of debt -to -debt, and needs to coordinate the coordination of resources. It is not difficult to understand that AMC's commercial thinking when rescue real estate.

However, Hu Yirui believes that the government's participation is larger than before. For example, the ticket involved in housing involved in housing since 2020 has increased significantly, which also means that more and more money in the supervision account of real estate projects has been misappropriated, and the government has caused the government to trigger the government High attention at the level.

In short, AMC faces several practical problems in the process of participating in the debt resolution: who will bear the loss of asset impairment; whether the newly injected funds will be preferentially used for the preservation of the property; the compensation order of AMC. These all determine the speed of AMC entering the real estate layout.

The risk of AMC's house is also here. The previous Moody's report pointed out that due to capital restrictions and business considerations, AMC is unlikely to support the real estate industry by a large number of self -operated investment. Compared with the size of insurance housing companies, the amount of AMC that has been announced at present is not high.

One fact is that since 2018, it has been subject to a series of capital adequacy ratios and leverage supervision requirements. Although AMC's current capital adequacy ratio meets the minimum regulatory requirements, it does not have a very sufficient capital buffer, especially the core first -level capital.

- END -

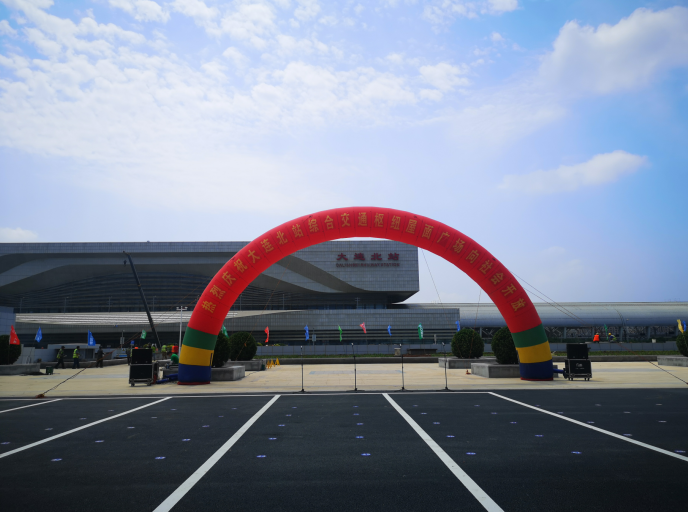

Dalian North Station Comprehensive Transportation Hub Roof Square Open

On July 1, Dalian North Station Comprehensive Transportation Hub Roof Plaza was of...

Shijiazhuang plans to build a new elementary school, the location is →

Yuhua District, Shijiazhuang CityProposed to build a primary schoolPosition↓↓↓S...