Shenzhen "Net Red God Plate" for 8 years, the unit price has ranging from 45,000/square meter to 132,000/square meter

Author:Daily Economic News Time:2022.06.20

The housing selection is around at about 13 pm. Only 03 of the six types of units are available. The building area is 117.5 square meters, and the total price is about 15 million yuan.

On June 19, the 589 batches of China Resources City Runxi's 589 cities selected 344 suites, and the first day of the first day of the first sale of 303 units, the de -control rate reached 8.80 %, and about 4.6 billion yuan.

As an old Internet celebrity, even at the moment when the Shenzhen property market is transmitted for a long time, the topic and hot disk effect of China Resources City are still there. However, as the end, China Resources City failed to repeat the highlights of the past 10,000 people grabbing houses and opening the market.

In the past 8 years, the popularity of China Resources City is also the epitome of the Shenzhen property market to some extent.

Runxi Phase 1 Phase Selection site is taken by reporter Zhen Sujing (data map)

Discard the election because of the ranking

China Resources City Runxi Phase 2 plus housing) is the final change of the old reform of China Resources High -tech Park. Before the official selection of the house on June 19, the major platforms and new groups have already reported a house selection strategy. Although they are all three-bedroom units of about 120 square meters, the unit price is 120,000 to 147,000 yuan/square meter, with a total price of about 14 million to 17.5 million yuan, but the popularity is high.

In the sorting strategy, the first selected is 02 and 01 units, the last is 03 and 04 units, and the results of the final house selection also confirms the market prediction. After the selection of the house is over Choose.

Mr. Zhao participated in the selection room, but the result of the shaking number did not do it as he wish, ranking after No. 400. Even with the remaining model room left at the end of last year, the total number of sets is only 344.

Even if someone abandoned the election, the chance of being recognized by the recognized units is still not high. When the selection of the house was carried out in the second half, Mr. Zhao officially decided to give up. "

In the shaking number, the better seed player, the earlier section of the earlier opening of the earlier opening is more than 11.6 million to 24.5 million yuan. The four low -floor model houses were selected within 10th.

In fact, the addition of the Phase 2 of the Runxi Phase 2 Before the announcement of the sales plan and the recognition, China Resources also rarely predicted that the opening of the listings at the end of last year was all sold out, and it was promoted on the website. Essence

Li Yujia, chief researcher of the Housing Policy Research Center of the Guangdong Provincial Planning Institute, said in an interview with reporters that the phenomenon of multi -party financing and leverage buying is more prominent. After not allowing the leverage, the support capacity of the entire property price is significantly weakened.

"The price of second -hand houses continues to fall, which also makes everyone realize that investing in real estate speculation may lose money." Li Yujia believes that the enthusiasm of buyers to enter the market is obviously hit, and choice is more cautious.

The reporter learned in the interview that the reason why China Resources City was not popular in the market also had a lot to do with the continuous narrowing price difference between second -hand housing. At present, the transaction price of second-hand housing in China Resources City is 150,000 to 180,000 yuan/square meter, and the gap between 132,000 yuan/square meter of the new houses sold has gradually narrowed, and the new houses have the time to pay the house.

From the results, the addition of the last phase of China Resources City's liquidation is no longer like the legendary legend in the past 8 years. After completing the first opening of the house, the sales team also shared the results of the housing selection on the social platform and said it was not easy. Many people in the industry also analyzed that "the performance is pretty good" and "it is so good to sell it."

193% increase in 8 years

China Resources City has always been a god -like existence in the Shenzhen property market, which can be found in various information and news. The introduction of Baidu Encyclopedia on Shenzhen China Resources City is that the largest urban village renovation project in Guangdong Province is also the largest project under construction in China in China. It will be delivered in batches.

While making a wealthy listing company in Gaoxinyuan Industry and making many tens of millions of beating workers, Darong Village and China Resources City have also developed with the city. Double.

China Resources was one of the earliest developers to participate in the old reform of Shenzhen. After the Shenzhen official set the project to update the Dawong Village City Update Project, China Resources actively participated in it. Participating in negotiations, clearing and reconstruction, the Dawong Business Center replaced Dawong Village, completed industrial upgrading and butterfly change.

In the urban interface planning, the people who have aroused heated discussion and wealth have been developed in 5 phases. The first three periods are the Runfu series, and the latter two periods are the Runxi series. The development and sales of 8 years have made it experienced two complete Shenzhen property market rising cycles. To some extent, it is the shortware of the hot and cold property market.

In July 2014, China Resources City opened, with an average price of 45,000 yuan/square meter, and sold out 3 hours after the opening. In November 2014, China Resources City was pushed in the first phase, with an average price of 50,000 yuan/square meter, and it was still 3 hours. Selling out; in December 2015, China Resources City entered the market with a price range of 62,000-81,000 yuan/square meter, and it was sold out when it opened.

After that, the Shenzhen property market has gone through the most crazy section. When the 3rd -handed product of China Resources City's 3rd product entered the market in June 2018, the unit price per square meter of the surrounding second -hand houses has reached 120,000+. Due to the previous rich effect and obvious spread, China Resources The city's third phase entered the market and directly pushed it to the peak of public opinion.

For details, please refer to the report "200,000 yuan, can earn 5 million in buying in the buying? Shenzhen Ten Thousands of" Glit -Dedicated "to grab the house for living beings" at that time due to the existence of the price limit policy, the average price of 85,000 yuan/square meter in the third phase was 85,000 yuan/square meter. The lucky buns in the shake staged a "5 million rainy squat", and they were sold out again without being expected, causing the city's attention.

In the Runxi series, the atmosphere of hot sales even caused heated discussions in the country. In November 2020, China Resources City Runxi Phase 1 1171 houses, with an average record price of 131,000 yuan/square meter, a unit price range of 120,100-44,700 yuan/square meter, and the total price range was 11.84 million to 29.84 million yuan. At that time Nearly 10,000 people recognized the crazy, and the chaos such as the replacement was frequent.

This has aroused official key supervision and central media's name comments. Since then, Shenzhen New Housing Trading has also changed rules, setting up the staggering regulations of integration sorting and housing 1: 3, but this has not affected China Resources City many times to sit on Shenzhen Real Estate annual year. The contribution of the transaction amount.

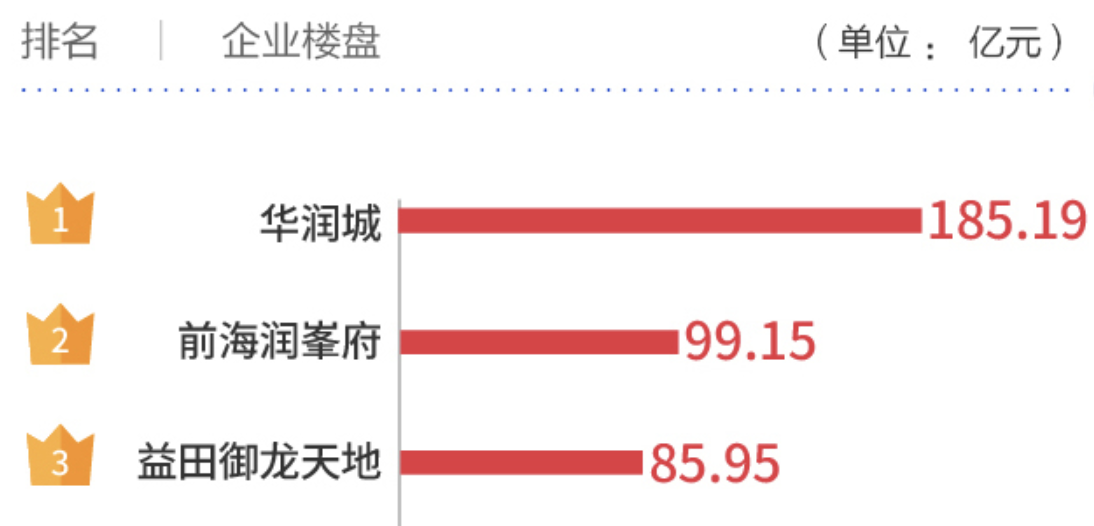

China Resources City is also the first five months of this year, Shenzhen Crown Selling Picture Source: Daily Economic News

However, since the second half of last year, the Shenzhen property market has changed dramatically. From the earlier seeking developers to sell the house, to the intermediary chasing home buyers to buy a house, the conversion was only less than one year, which also brought huge huge sales to the sales of new houses. pressure.

In December 2021, Runxi launched 1024 suites in the 2nd phase, with an average record price of 132,000 yuan/square meter. Frozen capital was shortlisted for 1,486 batches. Before pushing, the developer released the selling poster early to warm up. However, the second phase of pushing the house as the final work was unable to reproduce the early highlight record due to the market, and the opening of the market was not sold out.

From the first 45,000 yuan/square meter to 132,000 yuan/square meter, the price of China Resources City has reached 193%in 8 years.

Second -hand net red disk is also close to the reference price sale

According to the data released by the Shenzhen Housing and Urban Construction Bureau, in May 2022, Shenzhen's new house residential transactions were 1877 units, a decrease of 37.28%month -on -month; second -hand housing residential transactions were 2,318 units, a month -on -month increase of 24.62%, close to July 2021 data; as of 6 as of 6; On the 19th, the new house residential transactions were 1620 units, and the number of second -hand housing residential transactions was 1294.

The transaction office is at a low position, and the balance of the current mood of buying a house is still inclined to the buyer's market. In the interview, the reporter learned that in order to meet the needs of rapid dewlocation and accelerate the return of funds, the new house grabbed a potential customer base with a willing willingness to buy. The more sincere discounts and concessions, and invite major platforms such as intermediaries and self -media to increase their promotion.

Before China Resources City's final house, many people in the industry were more conjecture. Whether it can open the market more than half a month ago, it can be created in the market where the bottom -up transactions. Good words.

Not only new houses, the owners of second -hand houses with concept blessing are also being sold in the reference price.

The reporter learned from the silver manager of a large -scale intermediary structure staff that it is located in a set of Hanjing -nine Rongtai luxury homes in Qianhai District. The documentary market price was 35 million yuan. It is very close to the guidance price of 21.12 million yuan.

In the French shooting housing market, there is a set of 191 square meters of residential housing in China Resources City, with a starting price of 21.4 million yuan, and the reference price is about 25.23 million yuan; another nearby large city garden is 125 square meters of three bedrooms, which is equivalent The unit price is about 144,000 yuan/square meter, which is closer to the regional reference price compared to the high point. Intermediary staff said it was a transaction price 3 years ago.

Li Yujia believes that from the second half of 2021 to the present, the second -hand housing prices in Shenzhen have fallen for a long time year -on -year, and the second -hand housing price in the latest 70 city housing price index is still falling. Previously, Beijing and Shanghai's recovery was obvious. Guangzhou and Shenzhen were weaker. In addition, the previous rumored relaxation and control policies have not landed. The reference price of the second -hand housing in Shenzhen has interrupted the chain of leverage, and the market expects to change.

It is worth noting that under the influence of market messages issued by stimulation or relaxation policies in the near future, developers have also accelerated the rhythm of the promotion of new houses. As of now, there have been 14 newly entered markets in Shenzhen in June, and a total of 18 projects have entered the market in May.

Cover: Each reporter Zhen Su Jing Jing (Data Map)

Daily Economic News

- END -

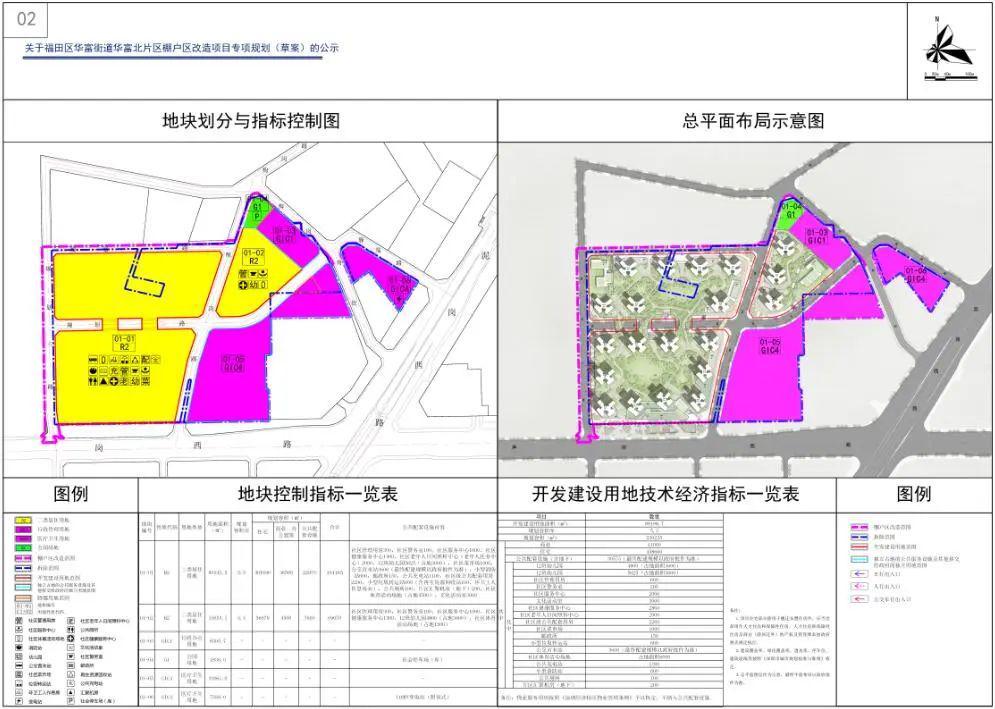

Futian Huaofebei District Shed Reform Project Latest Special Planning Draft Black: Planning 20 Housi

On June 6, Futian District released the publicity of the special plan (draft) of ...

Behind the stop work of "Zhengzhou's highest education real estate": Developers misappropriated funds to cause the project to fall into a deadlock, and the owner entered the dilemma.

New Yellow River Reporter: Zhang BoIn the past few days, the incident of Zhengzhou...