Yang Kewei et al.: "Golden Nine Silver Ten" in the hot city property market may be absent

Author:Zhongxin Jingwei Time:2022.09.06

Zhongxin Jingwei September 6th. Question: The "Golden Nine Silver Ten" in the hot city property market may be absent

Author Yang Kewei Kerry Research Center Deputy General Manager

Researcher at Bai Pinhui Kerry Research Center

In August, the real estate market was almost comprehensively cooling. Not only did Zhengzhou and Chongqing's pressure cities such as pressure continued to slump, but the overall market popularity of hotspot cities such as Shanghai, Hangzhou, and Chengdu was also declining. Can the "Jinjiu" market substantially improve? How will various cities go?

Hangzhou Rong and other hot cities collectively cool down

According to Kerry's research data, hot cities such as Shanghai, Hangzhou, and Chengdu have cooled down, especially in the peripheral areas to exacerbate the pressure of dependent real estate. For example, Shanghai, the average exfoliating rate of the opening in August rose to 80%, an increase of 18 percentage points from the previous month. Among them, the urban and suburbs of the scarce sectors and the core area of the five major new cities accounted for about 80%of the inverted disks, and the average de -chemical rate can reach 90%. The transactions of non -inverted projects such as Songjiang and Fengxian and other suburban areas have slowed down significantly, and the average exfoliating rate fell to 30%.

Another example is Chengdu, affected by the repeated epidemic, extreme high temperature weather and other factors, in August, the enthusiasm of customers' viewing of the house decreased, and the actual number of applicants in the hot -selling disk reduced by nearly 60 %. The average exfoliating rate of the opening was reduced to 39%, especially the three -circle layer, and the de -rate rate was as low as 21%. Many projects are not ideal because of frequent pushing or diversion of surrounding competing products.

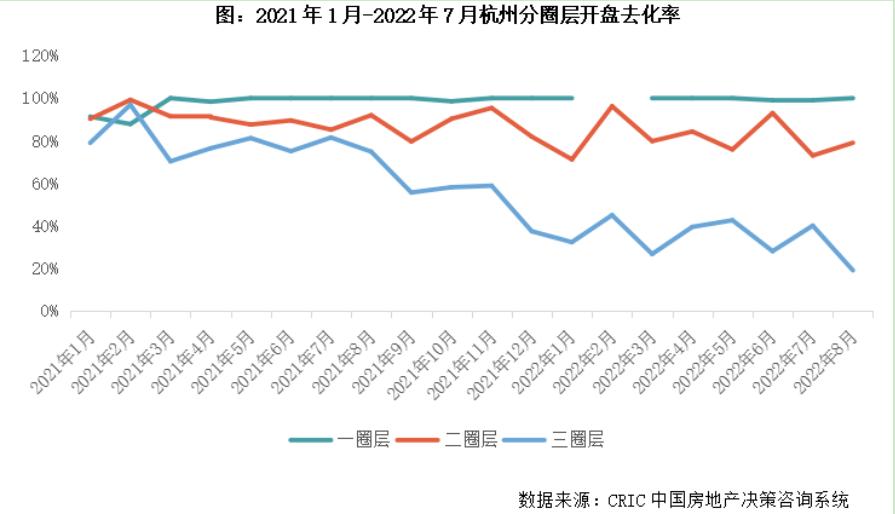

Focusing on the opening of various circles of Hangzhou, four typical characteristics of the four aspects show:

First, the first circle of de -decoration rate is still 100%, and there are only 200 sets of housing inventory with a unit price of over 69,000 yuan/square meter and a total price of over 15 million yuan. The dilemma.

Secondly, the second -circle destruction rate remained at a high level of 79%, but the winning rate rose, and projects with poor location or not matching the total price of the location were abandoned by customers. In particular, projects with a unit price of 35,000 to 40,000 yuan/square meter are piled up, forcing real estate companies to start the first market and compete for high-quality customer resources.

Third, the third circle of destruction continued to undergo pressure, and the August destroyed rate fell to 19%, a decrease of 21 percentage points from the previous month. Affected by this, the possibility of further relaxation in the third circle of policies.

Fourth, the parking space began to reduce the price, and some project parking spaces reached 50,000 yuan. In view of the main profit of real estate companies in the parking space, the price reduction of real estate parking spaces is to quickly return cash and fulfill their profits as soon as possible.

Su Xia Rong and other strong second -tier cities have lowered the first payment of the second suites

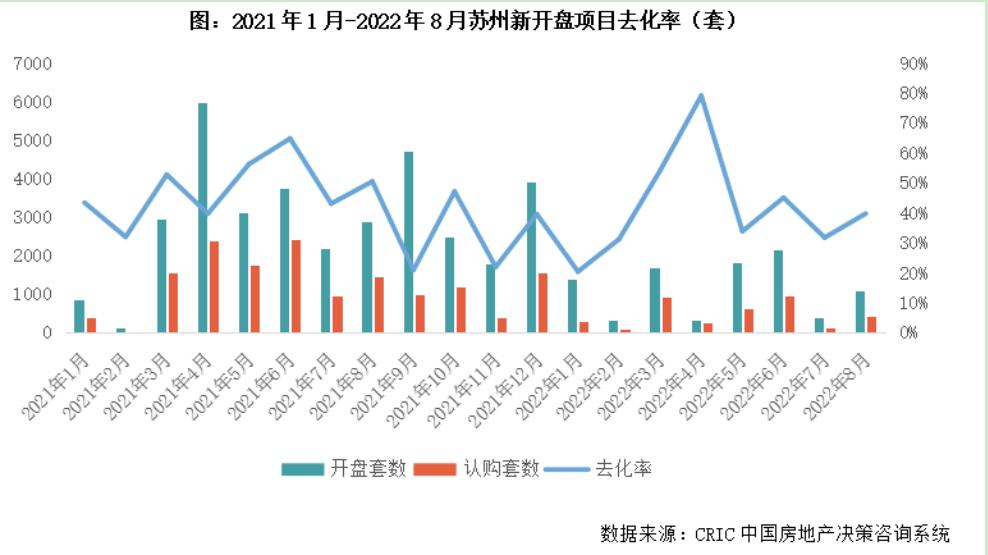

Suzhou, Xiamen, Fuzhou and other strong second -tier cities have relaxed loans and lowered the down payment ratio of the second suites, but the market improvement is not obvious. For example, in Suzhou, the two sets and loans have settled the down payment ratio from 50%to 30%, and the two sets of two sets, and the loan's unreasonable down payment ratio was reduced from 80%to 60%. In August, there was no sign of improvement in the real estate market in Suzhou, and the transaction area dropped to 550,000 square meters, a year -on -year and month -on -month decrease of 23%and 5%, respectively. In August, there were 6 projects opened, with an average exfoliating rate of about 40%, an increase of 8 percentage points from the previous month.

Another example is Fuzhou, two household registrations in the five cities, and the settlement ratio of the loan has been settled from 50%to 40%. The non -Wucheng District household registration purchase the first house on the first house in Wucheng District is adjusted from 40%to 30%. In August, Fuzhou's market enthusiasm dropped again, and the confidence of housing companies was insufficient. The total number of subscribed for 74 projects in the Fifth City District fell to 677, a decrease of 9%month -on -month, and the declines of 44%year -on -year.

The number of subscription sets in most projects in the market is less than 10 units, and the subscription volume of special housing projects launched is significantly increased, which shows that the local property market still mainly relies on the model of price reduction and volume.

Shenzhen Qingji and other channels have led customers to pick up the number of customers' visits

Shenzhen, Qingdao, Jinan and other places have adopted marketing methods such as increasing channel commission, which has driven the number of visits to rise significantly, but the actual conversion rate is still low, reflecting the strong market watching.

For example, in Shenzhen, most of the surrounding areas of the peripheral areas are mostly promoted by discounted price reductions and channels for high channels. The new opening project is de -pressure.

Another example is Qingdao, in August, thanks to the hot sales of opening the market, the average exfoliating rate rose to 66%. However, the continuation situation is not satisfactory. The number of visits in the case increased by about 10%month-on-month. Among them, the main urban area averaged 800-100 groups a month. The dependence of channels continues to rise, and the proportion of channel customers generally exceed 60%. The subscription volume is basically the same as the month-on-month. Most of the projects are sold in 10-40 units, and 60 sets of hot sales in the main urban area are maintained at a low level.

Zhengyu Market is only better than central enterprises and state -owned enterprises and state -owned enterprises and quasi -existing houses.

The property markets in Zhengzhou, Chongqing and other places are limited to the exfoliating performance of state -owned enterprises and state -owned enterprises and quasi -present housing projects. For example, Zhengzhou, 323 projects in August, a total of 3911 units, decreased by 8%month -on -month. In the project of the state -owned enterprise, the ownership group is generally favored. Among the projects of the TOP10 in August, the central enterprises occupy 6 seats, and the transactions can maintain a normal flow rate. The remaining projects take cost -effective or quasi -existing houses as selling points.

Another example is Chongqing, the market has a strong look at the market in August. The average depression rate of the opening is as low as 19%, and it is better to remove the projects of central enterprises, state -owned enterprises, or projects with product power advantages.

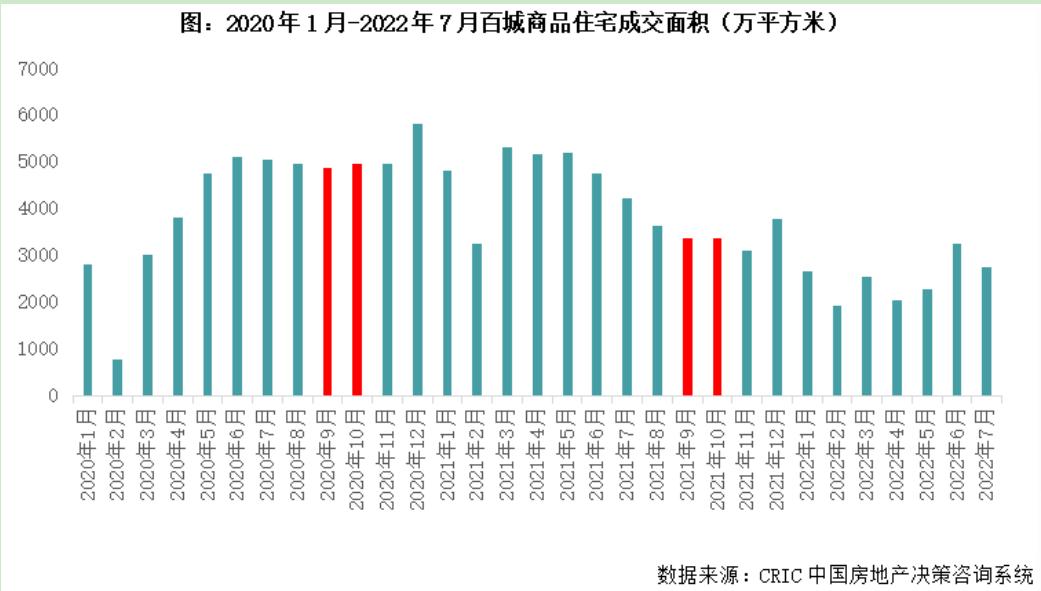

Traditional "Golden Nine" has been absent for two consecutive years

Kerry research data shows that the "Golden Nine Silver Ten" performance of the traditional significance of the property market has been plain. In September 2020, the transaction area of hundreds of cities fell to 48.59 million square meters, a decrease of 2%month -on -month, and the year -on -year increase narrowed to 7%. In September 2021, the transaction of hundreds of cities continued to decline to 33.78 million square meters, a 7%decrease from the previous month, and a year -on -year decrease of 30%. Looking forward to September, the real estate market is still difficult to speak. The absence of "Jin Jiu" will be a high probability event. Even if the supply volume increases, the transaction will not significantly rebound. On the one hand, the inflection point of the industry is coming. With the downturn trend of the market, it is difficult to rise in the peak season of traditional sales. On the other hand, the effect of stabilizing the real estate policy is still yet to be released, the market confidence is unstable, and it is difficult to reverse market downward expectations in the short term.

We believe that in the future, the performance of the property market in domestic hot cities will continue to differentiate: First, the markets such as Beijing and Hefei will be more flexible. With the volume of supply, the transaction is expected to rebound significantly. Second, markets such as Guangzhou and Nanjing may continue to be repaired, but regional differentiation will intensify, the demand for the main urban area is strong, and the exfoliating in the suburbs is still difficult. Third, the markets such as Chongqing and Qingdao may get out of the valley, and the transaction is expected to rise. Fourth, Nanning, Changchun and most of the third- and fourth -tier markets may continue to undergo pressure, transactions may maintain low operation, and some cities may become more intense. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Changsha, No. 1!

A big wave of young peopleIt is pouring into ChangshaOn June 29, the Research Team...

China Railway Yubao Mansion owner's inspection house found 180 questions?The Housing and Construction and Transportation Bureau of Taurus District: verify and deal with immediately

Professional home inspectors have found about 180 construction quality problems. A...