From September, the housing provident fund payable can be withdrawn

Author:Yunshang Jiaozhou Time:2022.09.06

Recently, the author learned from the Jiaozhou Management Office of the Qingdao Housing Provident Fund Management Center that in order to further play the role of housing provident fund support and support rigid and improved housing needs, starting from September 1, 2022, employee withdrawal of housing provident funds is launched to pay the down payment for house purchase purchase. For the purchase of new commercial houses in the administrative area of Qingdao, you can apply for the housing provident fund under the name of the buyer and its spouse to pay the first payment of the house.

It is understood that the scope of the withdrawal of the above -mentioned policies in stages is within one year from the date of effectiveness of the new policy, and the first self -occupied house of home -living houses will support buyers and their direct relatives to withdraw the housing provident fund to pay the first payment of the house purchase. Valid from September 1, 2022 to August 31, 2023. Relative relatives refer to the spouse, parents and children of the buyer themselves. The New Deal will be officially implemented since September 1, 2022. Others have not been adjusted in accordance with the original policy documents.

According to relevant staff, each set of housing down payment withdraws from the provident fund only supports the withdrawal once. Eligible buyers and their direct relatives shall submit the application application at one time. The total amount of withdrawal shall not exceed the amount of the down payment agreed on the online purchase contract.

In order to ensure the rights and interests of employees' loan, the Jiaozhou Management Office of the Qingdao Housing Provident Fund Management Center will adopt the business model of loans and withdrawals, and shall handle loan acceptance and down payment withdrawal business together for employees who intend to apply for housing provident fund loans to ensure that the withdrawal amount is ensured Does not affect the loan amount.

Service guide

Application materials and processes:

(1) After the real estate development enterprise brings a letter of commitment, and the real estate fund supervision agreement, after applying for the registration of real estate with the region (city) service hall of the Municipal Housing Provident Fund Management Center, the employees of the house can apply for the down payment withdrawal business.

(2) The provident fund service hall where the withdrawal person has handled the real estate filing of the development enterprise applies for the withdrawal housing provident fund. Carrying the "Requesting Notes for Dingdao Housing Provident Fund withdrawal", the home payment information form issued by the developer, the online purchase contract, the identity card of the buyer, and the spouse withdrawal should also provide proof of marriage relationship, the extraction of parents or children should also provide it. Certificate of direct family relationship.

Consultation Tel: 82232927

- END -

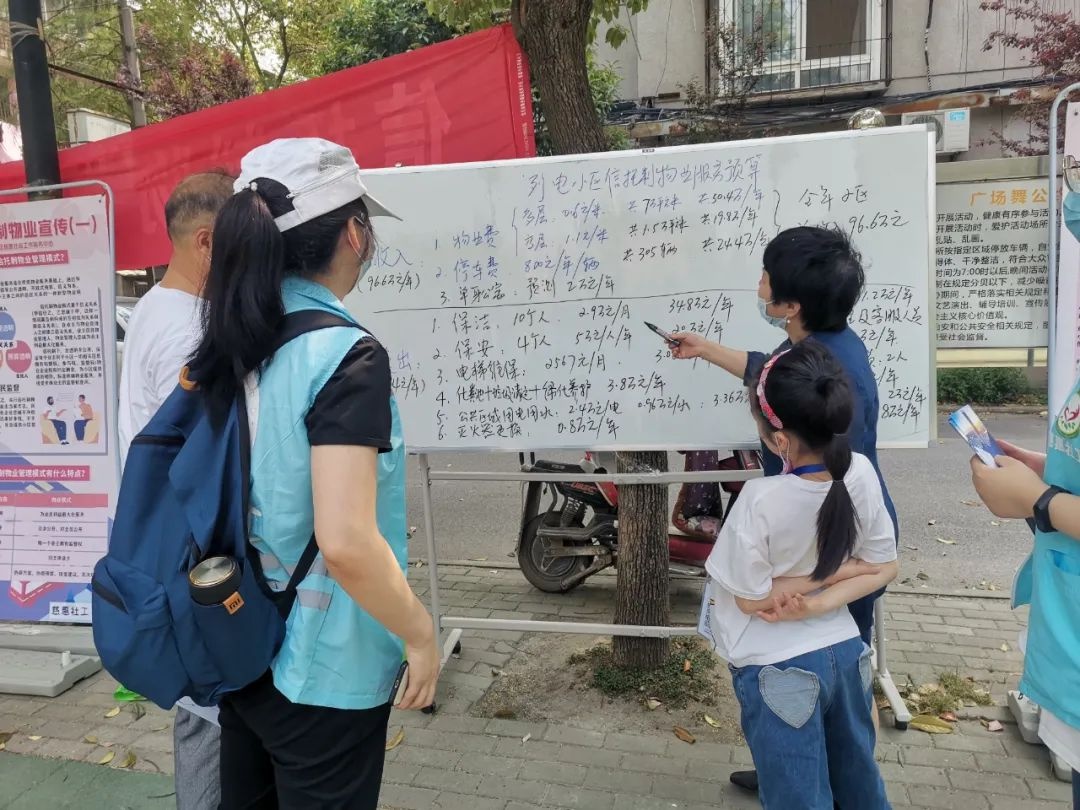

Wuhan's first!How much is the property income?

How much remuneration can the property company depends on the satisfaction score o...

Structural cap!Chongmingyi farmers concentrated residential resettlement housing projects ushered in new progress

From the village into the residence, adding orders for the happy life of more peop...