Ding Zuyu: Concentrate to the ground, the investment of the top 100 housing companies presents the "solidification" signs

Author:Zhongxin Jingwei Time:2022.09.05

Zhongxin Jingwei September 5th. Question: Concentrate to the ground, the investment of the top 100 housing companies presents the "solidification" signs

Author Ding Zuyu Yiju Enterprise Group CEO CEO

In the third quarter, the enthusiasm of real estate companies has not been mobilized. As of the end of August, some real estate companies have not won land since 2022, and the sales of TOP21-30 have been contracted most significantly.

Obviously, not getting land or even using land will directly affect the future performance of the enterprise. If the new soil storage is too small, it may cause the company to sell without houses and ultimately affect the market share.

In August, in accordance with the transfer plan, concentrated land supply ushered in the short -term "intermittent period", which also indirectly affected the investment in real estate enterprises. On the whole, the real estate industry is still sluggish. 83%of the investment amount of the top 100 housing companies is still concentrated in the key 22 cities. Investment in real estate enterprises has gradually shown a "solidification" trend.

The soil storage resources gather further towards head housing companies

After the concentrated land supply ushered in the "intermittent period", the land transaction volume price fell in August. According to Kerry's research data, as of August 28, the total operating land of 300 cities across the country in August was 79.38 million square meters, a decrease of 17.6%month -on -month, and the year -on -year decrease was narrowed to 35.1%.

Focusing on the sales of TOP50 housing companies, the amount of land acquisition in a single month is less than 70 billion yuan, and the same ring -on -month decreases by 48%and 49%, respectively, and the investment peak in 2021 decreased by 88%.

Only 20%of the real estate companies have soil stores in the top 50, of which less than 10%of the real estate companies with a land acquisition amount of more than 5 billion yuan.

Counting land companies, the large investment is still dominated by large-scale state-owned enterprises and central enterprises, such as China Sea, China Resources, Poly and China Merchants. China Resources ranked first from January to August with a value of 179 billion yuan in land storage value.

The soil reservoir resource gathered further towards head housing companies.

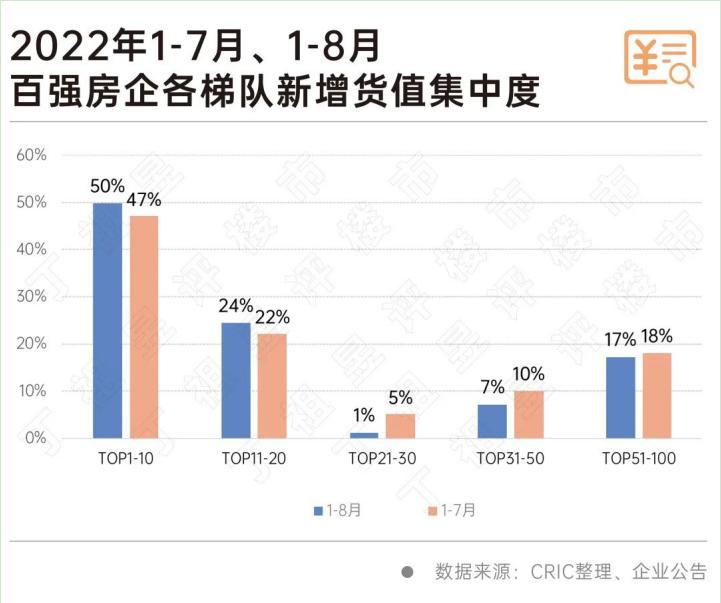

Judging from the performance of different echelon housing companies, the newly added goods value of the TOP20 housing companies accounted for 74%of the total value of the top 100, an increase of 6 percentage points from the end of the last month. 50%of the total value.

From January to August 2022, there were 6 new real estate companies with a value-added value of more than 100 billion yuan during the year, a decrease of 12 from the same period in 2021. China Resources, Poly and Binjiang ranked among the top three.

Since 2022, TOP21-30 housing companies have been weakened significantly. As of the end of August, such companies have only accounted for only 1%of new housing goods value, and most of the housing companies in the echelon have been since 2022. No land.

At the same time, the weakened enthusiasm of housing companies is also reflected in the decline in sales ratio of land acquisition. As of the end of August, the overall sales ratio of the top 100 land acquisition was 0.18, a slight decline of 0.01 from the end of the last month. Among them, the TOP21-30 real estate companies have contracted the land to the most significant, and the sales ratio of land acquisition is only 0.02.

The amount of land from state -owned enterprises and state -owned enterprises has dropped sharply

In August 2022, large -scale state -owned enterprises and state -owned enterprises were relatively positive in concentrated on supply. From the TOP20 of the land acquisition amount, it can be seen that nearly 80%of the real estate enterprises are state -owned enterprises and state -owned enterprises, and the national enterprises and central enterprises with large -scale state -owned enterprises and central enterprises have more than 500 billion yuan, accounting for 76%of the amount of TOP20 housing companies, accounting for TOP100 real estate enterprises amount 49%.

The investment efforts of typical state -owned enterprises and central enterprises are far exceeding the industry average. Among them, Yuexiu, Jianfa, and China Trade land sales ratio exceeds 0.5, and China Resources, China Merchants, and CICC are also above the industry average.

Even though state-owned enterprises and state-owned enterprises show high investment enthusiasm, they are weakened by the market. From January to August, its land acquisition amount and land storage value have shown a significant decline.

According to the typical state -owned enterprise and central enterprise investment performance of more than 10 billion yuan in the previous August, the average value of 14 state -owned enterprises and central enterprises was 41.65 billion yuan, and the average value of new goods was 84.11 billion yuan. The value of new costs decreased by 43%and 47%year -on -year.

Specifically, the amount of Vanke and Jinmao's land decreased by more than 60%year -on -year, and the value of the goods decreased by 56%and 73%from the same period. CCCC, Poly and other real estate companies were almost cut off.

In contrast, the amount and value of the land and the value of China Resources and China Resources decreased less than the year -on -year value, and the decrease was less than 30%. The reason is that its land acquisition is concentrated in core cities. The amount of land and soil storage is relatively high compared to other cities. Taking China Resources as an example, from January to August, China Resources added more than 50%of the new land value in Beijing and Shenzhen; Yuexiu's land was almost surrounded by first-tier and quasi-first-tier cities such as Shanghai, Shenzhen, Guangzhou, and Hangzhou.

83%of the investment amount of the top 100 housing companies is concentrated in 22 cities

The centralized land supply policy introduced in February 2021 changed the investment pattern of housing companies. In this context, as of the end of August, 83%of the investment amounts of the top 100 housing companies were concentrated in 22 cities, down about 1 percentage point from the end of July.

As more cities start the third round of concentrated land supply in September, we expect that the total investment in the top 100 housing companies will continue to rise in the 22 -city investment amount. Outside of the key 22 cities, the top 100 housing companies mainly invest in cities with good economic fundamentals such as Foshan, Dongguan, and Xi'an.

In addition, the investment in the top 100 housing companies shows a "solidification" trend in concentrated land supply.

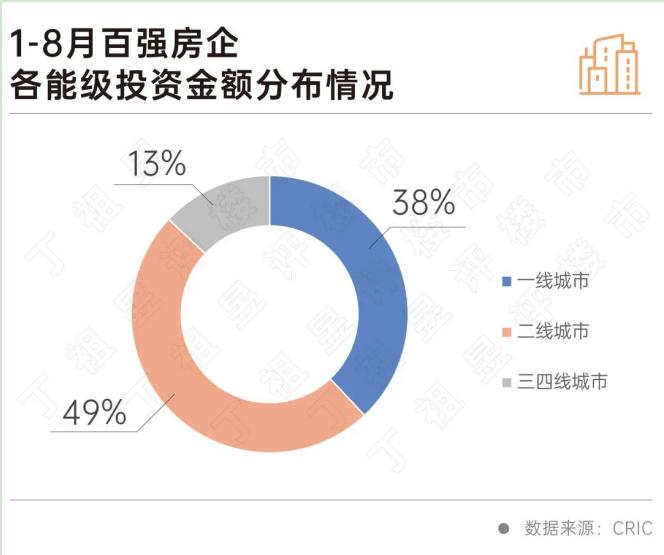

First of all, first -tier cities are still the "heavy town" of real estate enterprises.

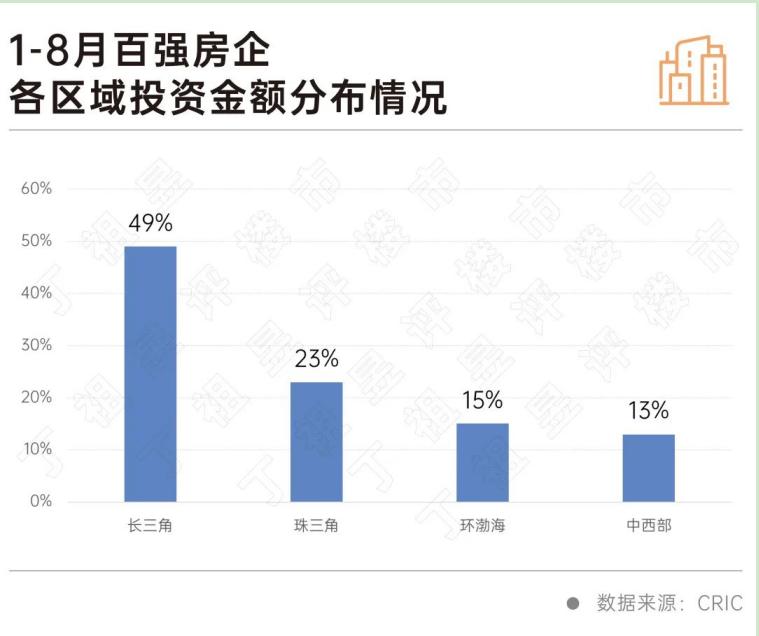

Specifically, because Shenzhen concentrated land supply transactions reached 33.9 billion yuan, which increased the proportion of first -tier cities to the top 100 investment amounts to 38%, and the number of second -tier cities due to the small concentrated land supply this month, the proportion of the amount decreased to the decline in the amount to the amount to the number 49%, the proportion of third- and fourth -tier cities remains at about 13%. According to Kerry research data, the Yangtze River Delta is still the absolute main area for the top 100 investment. As of the end of August, the top 100 housing companies invested 49%in the Yangtze River Delta region; followed by the Pearl River Delta region, investment accounted for 23%. The proportion of investment in the Yangtze River Delta region is equal to the sum of the Pearl River Delta, the Bohai Rim and the Midwest.

Judging from the TOP10 cities in the top 100 housing companies, half of the Yangtze River Delta occupy half, namely Hangzhou, Shanghai, Ningbo, Nanjing, and Hefei. In addition, Guangzhou, Shenzhen and Xiamen in the Pearl River Delta are also on the list. , Chengdu enters the top 10 land acquisition amount.

The third quarter of 2022 was close to the finals, but the investment situation of real estate companies has not improved significantly. In the survey, we found that the reduction of sales repayments and insufficient cash flow are still the core reasons for restricting the enthusiasm of housing enterprises.

With the gradual emergence of regulatory policies in various places in recent times, the real estate market is expected to repair the confidence of enterprise investment, and the recovery of confidence will drive sales improvement. A wave of "window period". (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Relief

The reporter learned from the Cangzhou Housing Provident Fund Management Center that from now until June 30, 2023, Cangzhou City's depositor employees paid the deposit and loan linked policy when ca...

The launch conference of Xiangshan City Space Value

Reporter Ma ZhenOn July 1, the conference of Xiangshan City Space Value Value Value Value Value Value Value Value Value Value of Binhai Garden, Urban New Space was held in Ningbo. Chaoyang, Secretar