Some say that L 30+ key cities have executed the lower limit of housing loan interest rates

Author:Cover news Time:2022.09.05

Cover reporter Ran Zhimin

On August 22, the latest 5 -year LPR offer was 4.3%, which was reduced by 15 BP. The lower limit of the interest rate of commercial personal housing loans has also been reduced. The minimum can be executed by 4.1%, and the minimum of the two sets can be executed by 4.9%. Rong 360 Digital Science and Technology Research Institute in August 2022 (data monitoring period from July 2022-August 18, 2022), 33 cities have the lowest level of national mortgage interest rates, 30 cities, 30, 30, 30, 30 The mainstream mortgage interest rate in the city is the national lower limit.

Interest rates generally begin to perform the latest mortgage interest rate lower limit

After the decrease of LPR on August 22, as of August 24, at least 37 cities in 42 cities already had banks who reduced the mortgage interest rate to 15bp. Previously, the mainstream interest rates have been implemented before the adjustment of the nation's lower limit (the first set of 4.25%, two sets of 5.05%), and the latest mortgage interest rates are generally implemented (4.1%first set, two sets of 4.9%).

Relatively speaking, the mortgage interest rate of first -tier cities is still relatively strong, especially in Beijing and Shanghai. In the tide of mortgage interest rates in 2022, it basically only followed the decline of LPR more than 5 years. On the other hand, most of the other second- and third -tier cities, most of them have declined after several declines, maintained at the nation's lower limit or 5 -year LPR level. Haikou and Lanzhou are second -tier cities with the only two -tier mortgage interest rate of more than 4.5%.

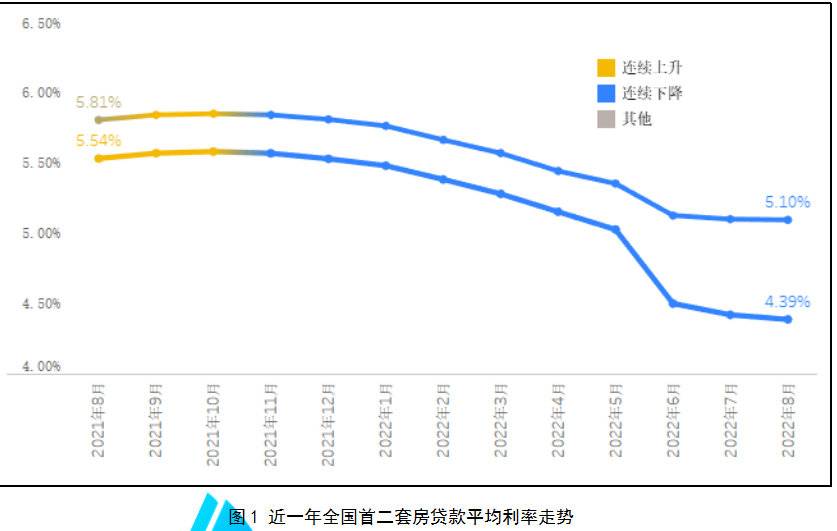

The average interest rate of the first home loan in the country fell to 4.39%

The monitoring data of Rong 360 Digital Science and Technology Research Institute on 42 key cities nationwide, showing that in August 2022 (data monitoring period from July 2022-August 18, 2022), housing loan interest rates continued to decline, the country's first nationwide The average interest rate of suite loans was 4.39%, a decrease of 3bp from the previous month; the average interest rate of the second house loan was 5.10%, a decrease of 1bp from the previous month.

The local mortgage policies may welcome more differentiated innovation space

On August 22, after the latest quotation of LPR above 5 years, after 15bp, the 42 cities monitored by Rong 360 Digital Science and Technology Research Institute, almost all of the LPR downgraded the first day of the house and a mortgage level. Based on the current 1 -year and 5 -year LPR spread, the long -term LPR still has a downlink space in the future. At the same time, combined with the current policies, the local “one city, one policy” allows local “one city and one policy” to use credit policies to reasonably support rigid and improved housing needs. There may be more differentiated and innovative adjustment space in the future of the local mortgage policy in terms of down payment ratio, mortgage interest rate and quota.

- END -

The Korla Management Department has multiple measures to help the enterprise to help the enterprise's rescue and benefit the people's policy implementation

In order to further increase the housing provident fund to help the enterprise rel...

Frequent biography!The warmth of the Fuqing property market is getting apparent

In the first half of the year, the scores of soil auction were bright, and the tra...