The listing volume in August decreased, and the price reduction was at the beginning. The inflection point of the US property market was present?

Author:First financial Time:2022.09.04

04.09.2022

Number of this text: 1872, the reading time is about 3 minutes.

Guide: In August, many indicators of the US property market issued significant cooling signals.

Author | First Finance Li Ailin

"Last month, my client won an independent house with an area of 1,800 square feet (equivalent to about 167 square meters) in a US San Francisco Bay Area for $ 2.4 million. For more than three months, the price drops to nearly one million US dollars. "

US real estate investment platform Tao Sand Find Housing CEO, co -founder Mike told First Financial reporter that the above -mentioned buyers are a programmer of Silicon Valley Factory. In August, he assisted the client in the city of Apple Headquarters, Cubitino "Pick up" a house, such examples have been seen in the past three months.

"The house price of the Bay Area reached the apex in May this year, and the market was cooled rapidly. Individual real estate prices even experienced 30%of the oversold. Many sellers did not know how the market would develop. Case. "Mike said.

The inflection point of the US property market is present?

On the 1st local time, the latest monthly housing trend report released the latest monthly housing trend report on the US Real Estate Broker Website (RealTor.com). Send an obvious cooling signal.

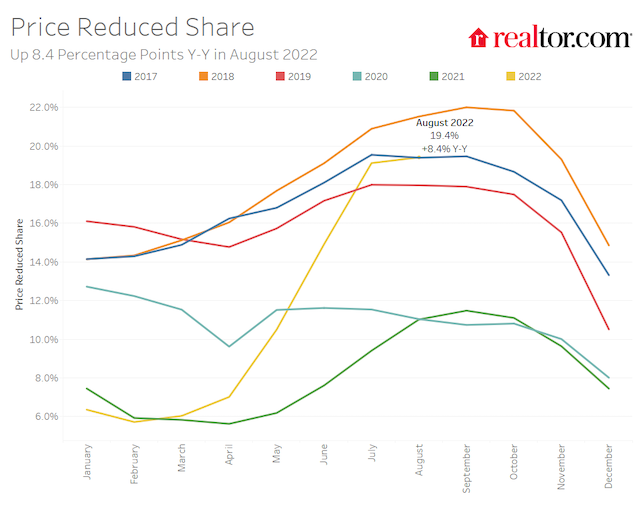

In terms of housing prices, the median listing price in the national housing in August fell from a record high of US $ 450,000 to US $ 435,000, but it still increased by 14.3%compared with the same period last year. At the beginning of the price reduction, the price reduction houses accounted for the proportion of housing sales rose to 19.4%last month, an increase of 8.4 percentage points from the same period last year, close to the level before the epidemic in 2017-2019. This indicator remained low during the epidemic, and in the hot sales of February 2020 and February 2021, the proportion of price reductions fell to 6%.

The US price reduction in August accounted for the proportion of housing sales (source: realTor.com)

According to the data of the real estate agency Redfin, as of the first round of August 28, the average transaction price of housing in the United States has been lower than the listing price for the first time since 17 months, which means that the situation of buyers' increase in price and grab the house is also changing.

The transaction speed slows down. Realtor.com reports that the average number of houses for sale in August increased by 5 days to 42 days from the same period last year. The average speed is about 64 days.

The number of listings decreased. The seller's confidence was frustrated, and the listing of listed houses decreased sharply by 13.4%year -on -year. On the other hand, the supply of houses increased significantly, and the housing inventory increased by 26.6%compared with the same period last year.

The enthusiasm of watching the house dropped sharply. According to Redfin's data, as of the end of August, the demand for home viewing and other house purchase services was 16%compared with the same period last year, and the amount of viewing decreased by 9%from the beginning of the year.

Danielle Hale, the chief economist of Realtor.com, said that the scarcity of inventory in the past two years has caused many buyers to have a sense of urgency to buy a house. "This mentality transition and the cost of superimposed loans have risen, making the bidding situation in August continued to ease, and the listing price trend also shows that buyers are holding their wallets."

Loan cost regaining the rise

From the middle of 2020 to the whole year of 2021, the U.S. -U.S. -opened house -buying model. However, as the Fed has accelerated the tightening of monetary policy this year, the popularity of a year and a half is abruptly stopped.

In terms of Mac to the First Financial reporter, "It is estimated that interest rates have increased by 1%, the purchasing power decreases by nearly 10%. At present, the interest rate of 30 -year mortgage loans has increased significantly compared with 3%in 2021. Residents can be reduced. , The U.S. property market is quickly cooling. "

According to the data of Freddie Mac, the interest rate of 30 -year mortgage loans in the United States soared in late June to 5.81%of the recent apex, hitting a new high since 2008. After that, it has been a short -term downturn for more than a month. Breaking the level of 5%and then regaining the rise.

In the case of Mike explained that in July, economic data showed that inflation seemed to show signs. The market expected that the Federal Reserve may transfer pigeons and suspended the pace of radical interest rate hikes. Therefore, the 30 -year fixed interest rate fell from a high level. However, Fed officials have continuously strengthened the eagle position in the near future. The annual conference of the Jackson Hall Central Bank is "gathered in group eagle". Chairman Powell emphasized at the meeting that the primary policy goal is to allow the inflation rate to return to 2%. History indicates that it is necessary to be right. The "premature" relaxation policy is vigilant, and restrictions may be adopted for a period of time.

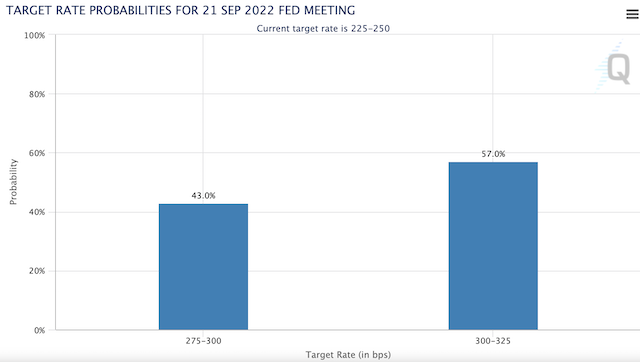

Since the beginning of this year, the Fed has raised interest rates 4 times in a row, with a cumulative interest rate hike of 225 basis points. According to the Fedwatch Tool (Fedwatch Tool), as of press time, the probability of 57%of the 75 basis points in September is 57%.

The Federal Reserve ’s interest rate hike probability (picture source: the official website of Zhishang Institute)

According to Mike, the current 30 -year mortgage loan profit has basically reacted the pace of interest rate hikes this year. If the rate of interest rate hikes at 75 basis points in September, it does not rule out that the above interest rates break through the previous high level 5.81%, but the upward space is not large.

The increase in house prices in the 20 cities of the United States slow

On August 30, local time, the SP CoreLogic Case-Shiller, which measures the average housing price of major cities in the United States, was released. In June, US house prices rose 18%year-on-year, lower than May 19.9%.The comprehensive house price index of 20 major cities rose 18.6%year -on -year, lower than the previous value of 20.5%.Craig Lazzar, managing director of the S & P Dow Jones Index, said, "The rise in house prices in the United States is slowing down, but it is worth mentioning that the deceleration and decline of house prices are completely two -cooked, and house prices are still rising strongly."

In the case of Mike also pointed out that although many indicators showed that the most enthusiastic period of the US property market had passed, it was still high in operation compared to the epidemic, and the conclusion that the property market was about to collapse.Looking forward to the trend of housing prices this year and next, he expects that the market will have a significant differentiation. In areas where population growth and employment support are not available, housing prices will experience significantly, and other regions are expected to be flat or slightly up.

- END -

21 depth 丨 Zhengzhou's "one stone and two birds" surprisingly, can "house ticket resettlement" stabilize the market?

The 21st Century Economic Herald reporter Kong Hailey and Wu Shuying reported that after the Zheng 18 was taken the lead in the first shot of the nationwide to optimize the property market regulatio

Real Estate Morning Post | Changchun City: Given a subsidy for buying a house for 200 yuan/㎡ for the farmers who enter the city

Today is August 12, 2022, Friday, Chengdu, cloudy, 26-37 ° C, today's limited number 5 and 0. Good morning everyone, come to today's real estate morning newspaper.Real estate industry information1. L...