The provident fund policy of 2 cities in Hebei has changed

Author:Hebei Daily Time:2022.06.08

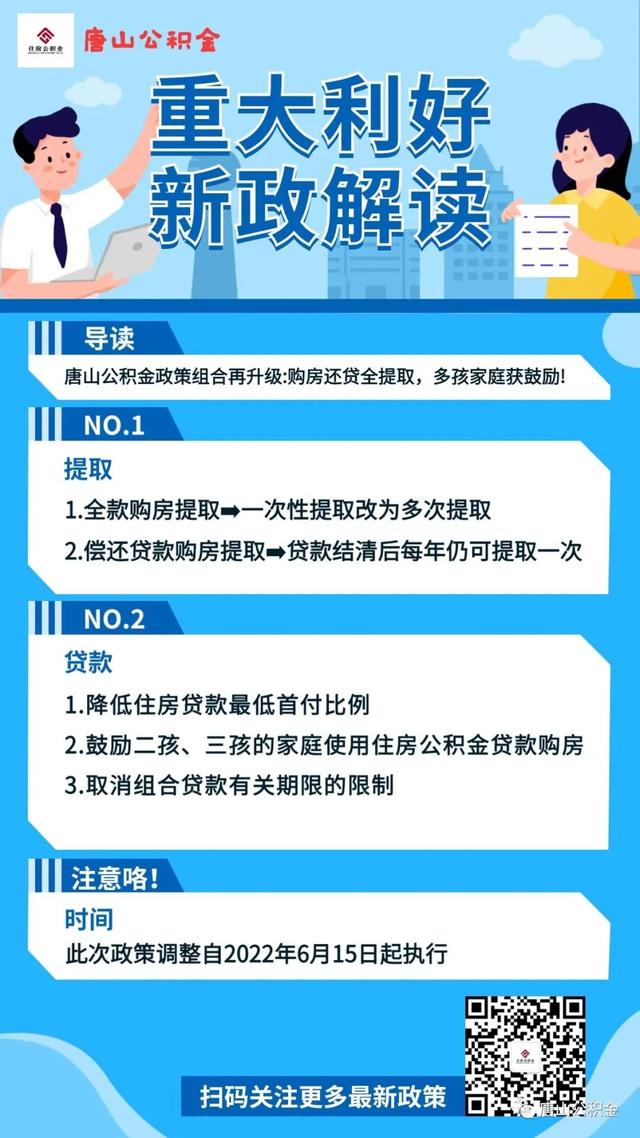

Tangshan

In order to better meet the first set of rigidity and improved housing needs of the employee Promote the virtuous circulation and healthy development of real estate in our city, reduce the pressure on the purchase of housing funds for the depositor, and further optimize the adjustment of the housing provident fund withdrawal and loan policy.

Full purchase and extraction → one -time extraction and multiple extraction [

[ 123]The full purchase of house extraction includes the full purchase of commercial house extraction and the full purchase of the existing house extraction. After June 1, 2022, employees and their spouses buy their first self -occupied housing or second -improved housing in the administrative area of \u200b\u200bTangshan City, and can withdraw the balance of the housing provident fund account of my and the spouse once a year. The total amount of extraction does not exceed the actual purchase expenditure.

Repair the loan purchase and purchase extraction → the loan can be extracted once a year

Repair the loan purchase of the loan purchase, including repayment Commercial loan extraction and repayment of housing provident fund loans withdrawal.

1. Repair commercial loan extraction Extract condition: After June 1, 2022, employees and their own If a spouse uses a commercial loan in the administrative area of \u200b\u200bTangshan City to purchase the first self -occupied housing or the second improved housing, the employee or the spouse housing provident fund account can be deposited by the loan repayment amount year. Storage balance, the total amount of extraction does not exceed the actual purchase expenditure.

Extract quota: ① Before the commercial loan is settled, the previous year's repayment can be extracted each year. ② After the commercial loan is settled, the payment of the previous year can be extracted each year.

2. Repair the withdrawal of the housing provident fund loan withdrawal

Venture of the loan repayment extraction condition: June 2022 After the 1st, the employee and their spouses use the housing provident fund loan in the administrative area of \u200b\u200bTangshan to purchase the first self -occupied housing or the second improved housing. The account storage balance is automatically deducted as the monthly loan amount. After the loan is settled, the storage balance can be extracted annually, and the total amount of extraction does not exceed the actual purchase expenditure.

Annual loan repayment and extraction conditions: If the non -proofing of the loan repayment business, the previous year's repayment amount can be extracted in the balance of the housing provident fund account of the employee or spouse, the loan can be withdrawn. After settlement, the storage balance can be extracted annually, and the total amount of extraction is not overPass the actual purchase expenditure.

Reduce the minimum down payment ratio of housing loans

Reduce the minimum down payment ratio of housing loans

Pay employees to buy the first purchase first The minimum down payment ratio of the housing provident fund loan is adjusted from not less than 30%to no less than 20%.

Encourage households using housing provident funds for two -child and three children to buy a house

Applicable object: conform to national fertility policy Family two children or three -child depositor employees

Loan quota: Any second child or three -child deposit employee family who conforms to the housing provident fund loan policy in our city applies for housing provident funds in our city to purchase housing provident funds When loan, the restrictions on the linked amount of the loan amount and the deposit balance can be eliminated. Under the premise of meeting the requirements of the loan repayment capacity, the two -child family can increase the maximum maximum increase of 100,000 yuan in the same condition. 10,000 yuan.Proof materials: When the two -child or three -child depositor employee family handles housing provident fund loan business, it is necessary to provide the \"Birth Medical Certificate\". The court judgment or civil mediation, divorce agreement, etc. of the custody right, other loan materials shall be implemented in accordance with the current \"Tangshan City Housing Provident Fund's Personal Housing Loan Management Measures\" (Tang Provident Fund [2019] No. 44).

Cancel the restriction of the relevant period of the combination loan

Cancellation of the housing provident fund loan period and commercial loan period requirements of the combination loan Somewhat consensus. When paying a portfolio loan, the borrowing date of the housing provident fund loan is still not more than 5 years after the borrower's legal retirement hours, and the commercial loan period shall be implemented in accordance with the provisions of commercial bank loans.

The policy adjustment will be implemented from June 15, 2022.

Qinhuangdao

The latest release of the Qinhuangdao Housing Provident Fund Management Center about the implementation of the city government \" The implementation rules of the implementation of the implementation of the city's economic operation \"↓↓↓

Qinhuangdao Housing Provident Fund Management Center The implementation rules of several policies and measures

According to the requirements of the municipal government's documents, the implementation time limit for the following policy measures is tentative to December 31, 2022.

Can the provident fund loan be loan more?

After the policy adjustment, the upper limit of the loan amount of employees alone was adjusted from 400,000 yuan to 600,000 yuan, and the upper limit of the household loan quota for double payment was adjusted from 600,000 yuan to 600,000 yuan to to to 600,000 yuan. 800,000 yuan. Loan procedures, required materials, and processing time limit are consistent with existing loan regulations.

Want to buy green energy -saving housing, is there a discount for provident fund loans?

There is a discount that when using a housing provident fund loan to purchase a two -star green building above the green building and is an ultra -low energy consumption building, it does not exceed the highest housing provident fund in our city. Under the premise of the loan quota and repayment capabilities, the loan quota rises by 10%. Except for other conditions in which the housing provident fund loan is met, the house purchased by the depositor shall be the ultra -low energy consumption green building above the two -star level of the relevant departments.

Loan procedures, required materials, and processing time limit are consistent with existing loan regulations.

The previous provident fund loan has been paid off. Has the second application for provident fund loan policy changes?

The depositor of the first personal housing provident fund loan was repaid, and those who apply for a housing provident fund loan to purchase self -occupied housing again will be the minimum down payment ratio from not less than 60% Adjust to not less than 30%. Loan procedures, required materials, and processing time limit are consistent with existing loan regulations.

Recently I have seen a set of second -hand houses. What are the new policies for applying for provident fund loans?

If you purchase a housing provident fund loan to purchase a housing provident fund loan, the limits of the longest housing age will be adjusted from not more than 25 years to no more than 30 years, and the age of the house and the age of the house The sum of the loan period does not exceed 45 years. Loan procedures, required materials, and processing time limit are consistent with existing loan regulations.

Can parents withdraw housing provident funds to support their children to buy a house?

The full amount of the depositors of our city purchased the newly built self -living housing in this city, and the parents of both husband and wife can apply for withdrawal of housing provident funds to support their children's purchase (only once). (1) Extraction conditions. The family of depositors in our city (the husband and wife will pay the provident fund in our city). After the implementation of this policy, the full number of newly built home housing (the date of the purchase of a house on the Internet), the buyer himself and the spouse will withdraw the housing Provident fundAt the same time, parents of both husband and wife can also apply for withdrawal of housing provident funds. Parents can only be extracted once in the name of their children.

(2) Extract quota. The total amount of the house withdrawal of this house shall not exceed the total price of the house (the amount of the purchase invoice is prevail).

(3) required materials. Extract the ID card, extract the bank card under the name, the buyer's ID card, parent -child relationship material, and children's related materials for children (refer to the current house purchase extraction materials and precautions).

The company affected by the epidemic is not good recently. Can I apply for a slow -to -pay housing provident fund?

Enterprises affected by the new crown pneumonia's epidemic can submit an application for a slowdown to the Municipal Housing Provident Fund Management Center in accordance with regulations. Slowly pay the housing provident fund, and pay the payment after the economic benefits improve. Employees who have paid the enterprise can withdraw and apply for housing provident fund loans normally, and are not affected by enterprises. (1) Application conditions. Enterprises that affect production and operations due to the epidemic situation have been losing money for two consecutive years and the average monthly salary level of the unit employee is lower than the minimum monthly wage standard for employees in our city in the previous year, and after discussion and approval by the employee representative meeting of the unit, they may apply for a slowdown in housing provident fund Essence

(2) The required materials

1. ]

2. Original resolution of the unit staff representative meeting;3. The depository provident fund is indeed difficult to proof, including the unit's financial statements or the original third -party audit report.

(3) handling process

1. Log in to the official website of the Qinhuangdao Housing Provident Fund Management Center to download and fill in the \"Application Form for Slowly Paying the Housing Provident Fund for Housing Provident Fund \";

2. The required material required by the units of provident fund management officers, and submit an application for a slow payment at the Municipal Provident Fund Center;

After the provident fund center is approved, the relevant procedures are completed;

4. After the economic benefits of the enterprise improve or expire, the payment is made in time.

I bought a house for a provident fund loan before, and the impact of the epidemic reduced income to reduce life. Can I enjoy what support policies?

Families that cause difficulties due to the impact of the new crown pneumonia, and cannot repay the housing provident fund loan normally.The center submits an application for repayment. After the review and identification, the loan will not be overdue, and it will not be submitted to the credit reporting department as an overdue record.

(1) Delayed repayment application conditions. If the borrower affected by the epidemic, if the family monthly income is less than 1,000 yuan after repayment of the provident fund loan, it may submit an application for repayment to the Municipal Provident Fund Center. (2) Application of the required materials for extended repayment

1. The borrower and joint borrower ID card, marriage certificate, hukou book book Original and photocopy;

2. The borrower and co -borrower extended the repayment application form (website download);

People and co -borrowers for more than one year's salary income bank details;

4. People's Bank of China Credit Report of the People's Bank of China.

(3) The extended repayment period does not exceed December 31, 2022, and the principal and interest owed to the loan owed in the loan must be paid before expiration.

Is this policy adjustment good for the renters?

Yes, the maximum limit of housing housing provident fund rented housing housing housing provident funds without housing employees has increased. The/year adjustment was adjusted to 12,000 yuan/year, and other districts and counties were adjusted from the original 8,000 yuan/year to 9,000 yuan/year.

Extracting conditions and required materials are consistent with existing rent extraction regulations.

Source | Tangshan Provident Fund, Qinhuangdao Release

- END -

The 7 old communities in Wuda District are being transformed!

Uda District has always adhered to the people -centered development ideas, mobiliz...

At the beginning of this fall, Nanchang will add 35 kindergartens in primary and secondary schools!

latest news!Nanchang will add new this year35 kindergarten in primary and secondar...