Jinan's first -hand housing "transferred" industry in the country: the seller gets money and the buyer gets the house faster

Author:Poster news Time:2022.08.17

Volkswagen · Poster Journalist Zhang Cing Lu Le Jinan Report

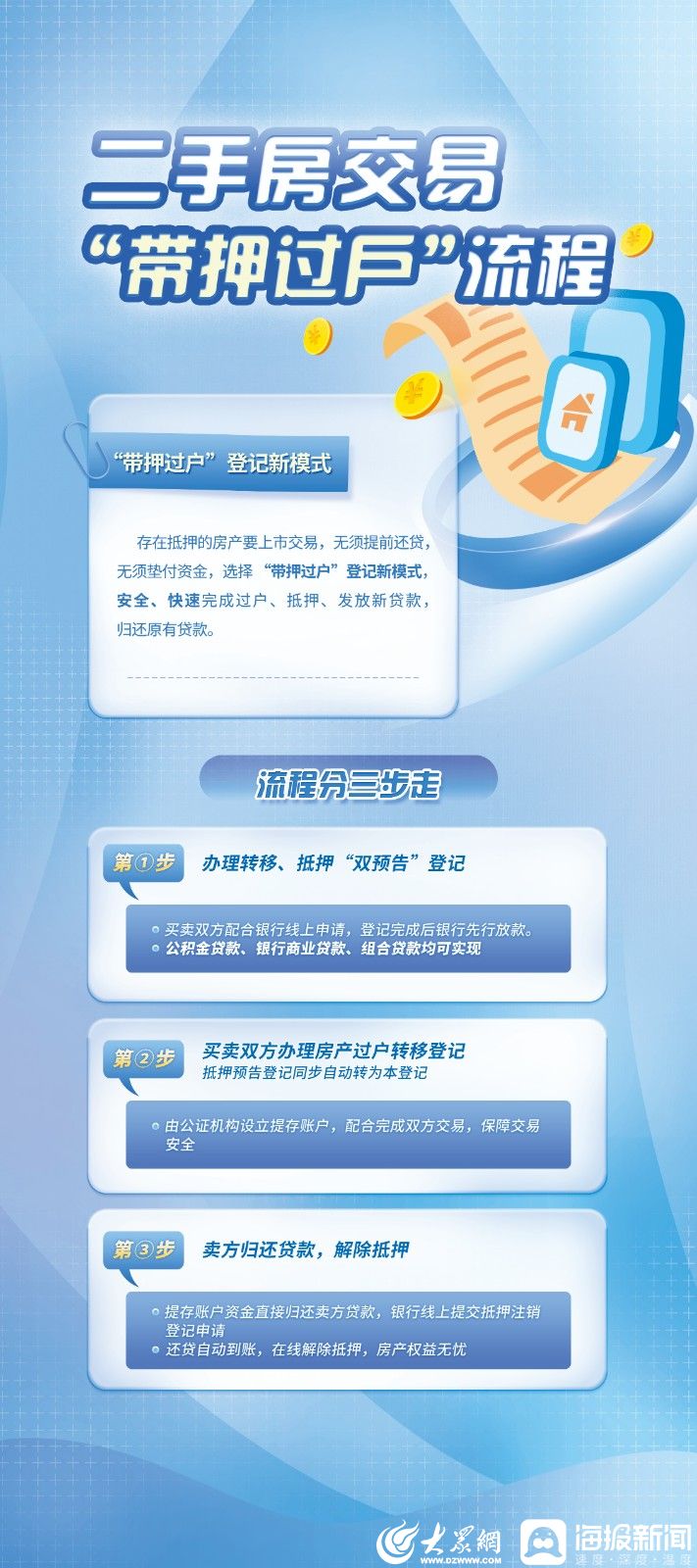

There is no need to repay the loan in advance, no need to pay the funds, and the second -hand housing "takes the transfer" in Jinan to officially land. On August 17, the reporter learned at the press conference held by the Jinan Municipal Party Committee and Municipal Government that the Jinan Natural Resources and Planning Bureau collaborate with the Jinan Housing Provident Fund Center, banks, notarization and other institutions to innovate and launch second -hand housing to "take the transfer of transfer" registration. For the mortgaged real estate, if you want to go public, you can complete the transfer, mortgage, and issuing new loans without returning the original mortgage, improving the quality of transaction, and reducing transaction costs.

So, in the process of second -hand housing transactions, what is the past process of buying a mortgage house for loans? In the traditional model of second -hand housing transactions, no bank is willing to bear the risk of the seller's timely repayment after being "transferred to the transfer" without guaranteeing the security of funds. However, the seller's mortgage was lifted and the second -hand house was transferred. The buyer mortgaged three registration links. It was indispensable during the transaction of second -hand housing, and the order was clear. The bank guarantees its own "security lock", but it has also become a stumbling block for second -hand housing in the market.

"Under the original traditional model, it is quite troublesome to carry the mortgage real estate. It is necessary to terminate the mortgage home repayment and then transfer." Zhang Chunxia, deputy minister of the Real Estate Registration Center of Jinan City, told reporters that the second -hand housing "belt with The new model of the registration of the households has broken the original conventional practice and puts the lifting mortgage in the final link.

"First apply for transfer and lending, wait for all procedures to complete, and finally lift the mortgage. Although we see that it is just a small adjustment, in fact, this adjustment greatly reduces the transaction cost and fully resolves the transaction risk." Zhang Chunxia told reporters.

The traditional model requires that it can be transferred before the transfer can be transferred. The removal must be repaid. It is not possible to be unblocked if it is not repaid. If the buyer needs to buy a house, you must apply for the transfer and mortgage before the bank can lend the loan. In this case, it is impossible for the seller to use the buyer's money to repay the loan, so it must raise the bridge funds, so an additional large amount of expenditure has been added. In particular, when the buyer's loan was delayed, the cost of occupying the bridge for a long time has also increased significantly. The model of "transferred the transfer" is to use the buyer's bank loan to repay the seller's bank loan, without having to raise the bridge funds and reduce the transaction cost.

At the same time, in the traditional model, the buyer's bank is approved first, and then the loan is released after the transfer is registered. In the process, the buyer will inevitably have any problems in the preparation of credit reporting and loan registration materials. Pay a lot of funds to the seller through other ways. At the same time, because the house is completed first, in the process, the risk of the seller is huge, and it is likely that the house wealth is short. In the past, there were often such cases. Both buyers and sellers were under great pressure, and some transactions would be canceled due to such risks. There is also a situation that under the traditional process, there are many links and long time. In the process, once any part of the buyer and the seller have economic disputes, the court seizes the house and will have an adverse impact on the entire transaction. The new model does not need to be solved first. The buyer can get the house to get the house to get the house. If there is a problem with the household, the house can be returned to the original road, which guarantees the interests of the two parties to the greatest extent and minimizes the risk.

The reporter learned that the Jinan Natural Resources and Planning Bureau and the Municipal Housing Provident Fund Center issued the "Notice on Promoting the" Double Trailer Registration "on the Promotion of Stop Housing Transaction Provident Fund Loans" to promote the transfer and mortgage "dual trailer and pre -transfer registration" for the transfer of stock housing and mortgage. Model, adjust the process of adjusting the provident fund loan lending process, and the process adjustment that must be officially transferred after the transfer is required to be adjusted to the preview registration, which provides policy guarantee for the implementation of the implementation of new processes of "new loans to old loans" and "transit".

In order to further provide convenience to both parties and financial institutions, the Jinan Natural Resources and Planning Bureau Real Estate Registration Center expands the online application system. "Just. At the same time, actively extend the registration port to real estate development enterprises and housing brokerage agencies, further simplify the processing process, shorten the processing time, and make people profit -making enterprises. Safety escort.

In the new process of "transferred" launched by Jinan, a notarized "deposit account" was also introduced. Before the transaction is not completed, all funds are supervised by the account to ensure the safety of funds. Once the risk of the transaction or the accident occurs, the transaction fails, the funds are returned, and the capital disputes are avoided. Through the "transfer of transfer" in the "deposit account" mode, "zero risks" can be achieved. More importantly, with the official escort method of notarization, so that both buyers and sellers can feel at ease, and do not have to worry about the capital risks brought by various "fund supervision" models in the society.

The reporter learned that at present, the "bringing transfer" has been successfully piloted in many banks such as CCB, ICBC, and Bank of Beijing. Seamless connection of each link.

At the same time, the new model of "transferred transfer" shortens the time limit, improves efficiency, and becomes cumbersome to simple. In the past, citizens handled second -hand housing transactions. After signing the contract, the buyer must submit a loan application to the bank. After the loan approval is approved, the seller must first set up a loan of the original bank to apply for the mortgage and register before applying for transfer registration and mortgage registration. After the registration is completed, the buyer's bank loan, the seller can finally get the remaining house purchase funds. The two parties must not only travel between the registration agency and the bank many times, but the time cycle required will be long. More than one month. After the implementation of the "transfer", "enter a window, submit a set of materials, and handle a business". The buyers and sellers do not need to run legs, transfer and mortgage "dual notice registration" can complete online application, transfer registration and mortgage registration through banks Can be handled simultaneously, the mortgage forecast registration is automatically converted to this registration. The seller can get the house purchase payment on the day or the next day when the transfer registration is handled to settle the original bank loan. On the one hand, the number of legs running for the masses is reduced. On the other hand, the time limit is compressed to 1-3 working days. The simple process will further stimulate the transaction desire of the second-hand housing of the masses and inject motivation to the market.

Zhang Chunxia told reporters that since February 2022, the overall "transferred transfer" flow chart and operation methods have been designed. It lasted for nearly half a year. Essence At present, the Bank of Beijing, Construction Bank, and Industrial and Commercial Bank of China have been handled into multiple "transferred" business, including peers, cross -bank, and provident fund loans. At present, a total of 17 second -hand houses have been handled by the "transfer" business, involving the total amount of deposit payments of 810.755 million

Liu Lianheng, general manager of Jinan Real Estate Customer Customer Division, told reporters that the second -hand housing "takes the transfer" has shortened the cycle of second -hand housing transactions, increased more selectivity of both buyers and sellers, reducing the cost of second -hand housing in the market. The second -hand housing market in Jinan will have a certain role in promoting and injecting a certain vitality into the market. "Being good is for both parties. For sellers, they can quickly get the deserved houses instead of paying more time and money costs. For buyers, they can get their own house as soon as possible as soon as possible."

- END -

You can "buy" 300,000 yuan to Hangzhou E talent?Scam or gray industry chain?

Our reporter Quan Linxun Li Panji Ji Wenlei Zhou XuhuiDirectly settled, rented house subsidies, and tilted houses in buying houses ... In recent years, Hangzhou has introduced a series of heavy prefer

Heavy!Wenzhou Middle School Affiliated Middle School Construction Project fully launched the bidding

Recently, the construction project (04-D-12 plot of the core area of the south...