The average price of commodity housing returns to 10,000 yuan, and the development of the development prosperity index is narrowed ... The downward situation of the industry is expected to be relieved

Author:Securities daily Time:2022.08.16

Our reporter Li Zheng on August 15th, the National Bureau of Statistics released statistics reports from January-July 2022-July (hereinafter referred to as "report"). From the perspective of the overall situation, although the downward pressure and risk issues in the real estate industry in my country during the reporting period are still severe, the development of the development prosperity index has narrowed for 4 consecutive months from the previous quarter. The average price of commodity housing in the country from January to July was 10036 yuan/ The average price of commercial housing from January to June was 9586.34 yuan/square meter, and positive signals have appeared. Some analysts pointed out that with the acceleration of future risk disposal work and the introduction and gradual implementation of the new policy of regulating the new policy in many places, the downside of the real estate industry is expected to improve in the fourth quarter. The decline pressure on development investment still shows that the national real estate development investment was 7946.2 billion yuan during the reporting period, a year -on -year decrease of 6.4%. Among them, residential investment was 6023.8 billion yuan, a year -on -year decrease of 5.8%. Specifically, the house construction area of real estate development enterprises was 859.194 million square meters, a year -on -year decrease of 3.7%. Yan Yuejin, the research director of the Think Tank Center of the E -House Research Institute, told a reporter from the Securities Daily that the national real estate development investment declined year -on -year, indicating that development investment is still under pressure to cool down. "However, although the pressure is currently under great pressure, it is expected that with the advancement of the policy of stabilizing the property market, especially the policy guarantee for the delivery of delivery, such data will have room for improvement." Yan Yuejin said. Li Yujia, chief researcher at the Guangdong Housing Policy Research Center, said in an interview with the Securities Daily that the decline in residential development investment (-5.8%) has expanded by 1.3 percentage points, showing that residential investment is even more affected by credit risk events. From a single month, in July, real estate development investment fell 12.3%, and the decline expanded for 5 consecutive months, mainly due to the influence of land purchase and continuous decline in new construction. According to Li Yujia, land purchase fees and construction engineering investment account for about 70%of the development investment. The two have fallen for 14 consecutive months and 12 months, and have shown a sharp decline of 35%-50%in recent months. It is bound to drag development investment. Moreover, due to the lag of land purchase fees into development investment, new construction continues to fall, and subsequent development investment data will still be dragged down. The data also showed that the real estate development enterprise in place was 8877 billion yuan during the reporting period, a year -on -year decrease of 25.4%. In this regard, Li Yujia analyzed that after the decline in the downside of the developer's in place narrowed for two consecutive months, it expanded again in July, mainly due to the frequent delivery of difficulties in the recent period, which has a negative impact on financial institutions. At the same time, the projects and enterprises of the early period of insurance conduct mergers and acquisitions, risk disposal, and asset restructuring. In addition, the decline in sales in July made the overall capital chain tight, and bank risks were concerned. What is slow to decline is deserved. It is worth noting that the real estate development prosperity index (hereinafter referred to as the "index") in July was 95.26. From the perspective of the timeline, the index was 96.64, 95.87, 95.59, and 95.39 from March to June, which can be seen that the decline is gradually narrowing. In this regard, Yan Yuejin believes that from the perspective of continuous narrowing of the index month -on -month, it is a positive signal for my country's real estate market, indicating that the overall recession of the prosperity is slowing down. "We have to see that the data is curbed compared to the deterioration of the previous period of time, and we must realize that whether the index is slowed down or not, it is at a level of below 100, indicating that the market pressure and not behind the market behind It is determined that it is still large, or some are behind expected, so you need to follow the aspects of improving the prosperity and improvement of the buyer as an important task. "Yan Yuejin said. In terms of sales, the sales area of commercial housing during the reporting period was 781.78 million square meters, a year -on -year decrease of 23.1%, of which the residential sales area decreased by 27.1%. The sales of commercial houses were 7576.3 billion yuan, a decrease of 28.8%, of which residential sales fell by 31.4%. Yan Yuejin said that according to the above data, the average national commercial residential price from January-July can be obtained from 10036 yuan/square meter, while this number from January-June is 9586.34 yuan/square meter. Its positive significance is that the average house price has returned to 10,000 yuan. It also shows that with the active release of the property market policy effect in the second quarter of this year, the phenomenon of over -cooling house prices has been reversed, and it has also promoted the adjustment of market expectations. Regarding the expectations of the future real estate development and sales, Li Yujia believes that the expected risk disposal will accelerate. If the impact of the supply side in the fourth quarter is relieved, the new policy policy is supplemented by the demand side. "), The situation where the real estate is going down is expected to be relieved.

Picture | Site Cool Hero Bao Map.com

Recommended reading

The central bank's small shrinkage sequel 400 billion yuan MLF exceeded the expected "interest rate cut" and is expected to drive this month's LPR reduction

Ministry of Transport: This year, strive to add about 100 billion yuan in rural road investment

- END -

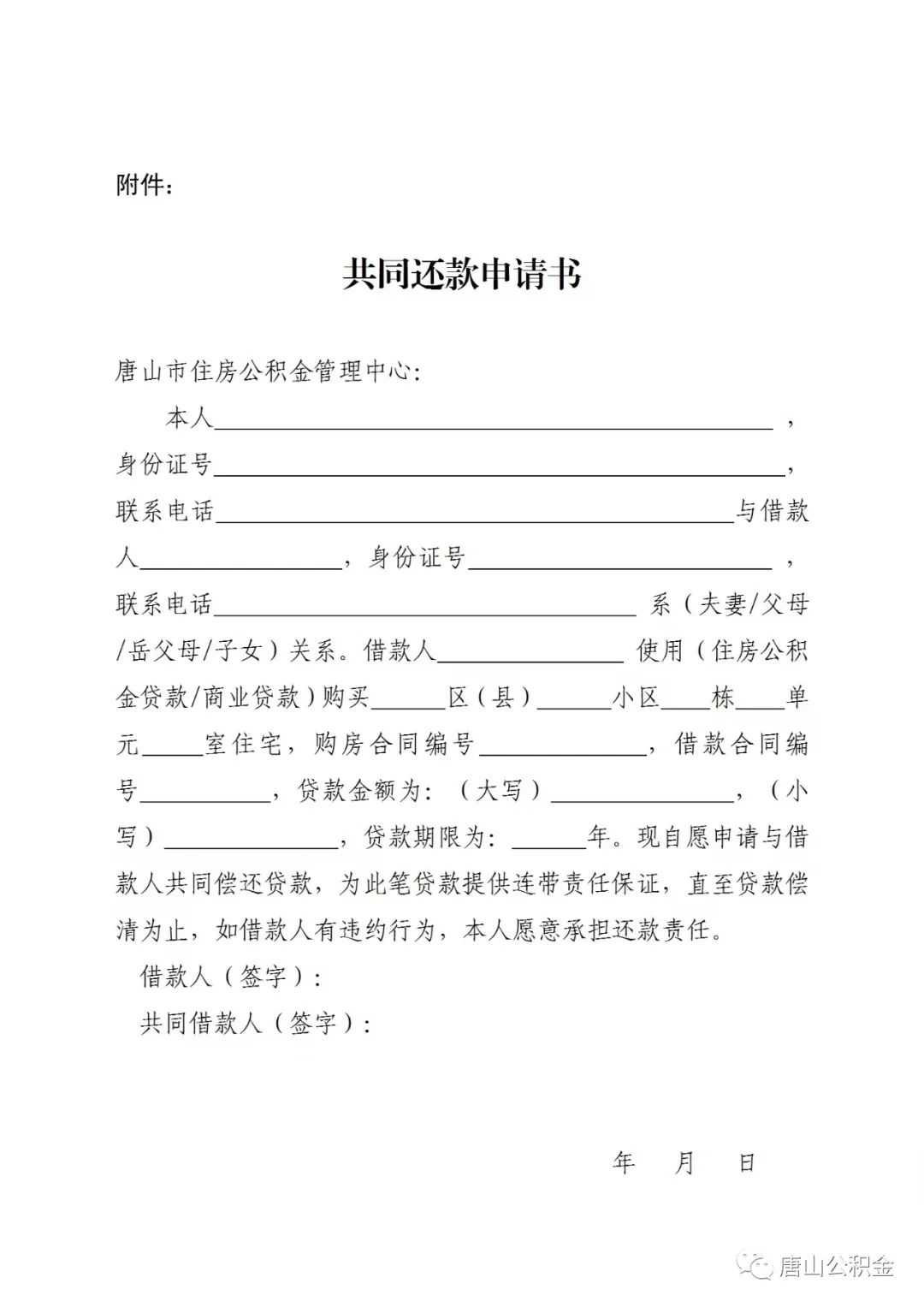

Tangshan: Buying a house and repayment, do not worry about the provident fund to launch the "one person to buy the whole family gang"

Beginning on July 15, 2022, Tangshan Housing Provident Fund Management Center purc...

Loans can be deducted directly in different places!All the housing provident fund loan repayment coordination mechanisms are established in Harbin and the province 13

The reporter learned from the Harbin Housing Provident Fund Management Center that...