House prices were announced in July 70!Hangzhou, Hefei, and Chengdu new houses rose obviously

Author:China Urban News Time:2022.08.15

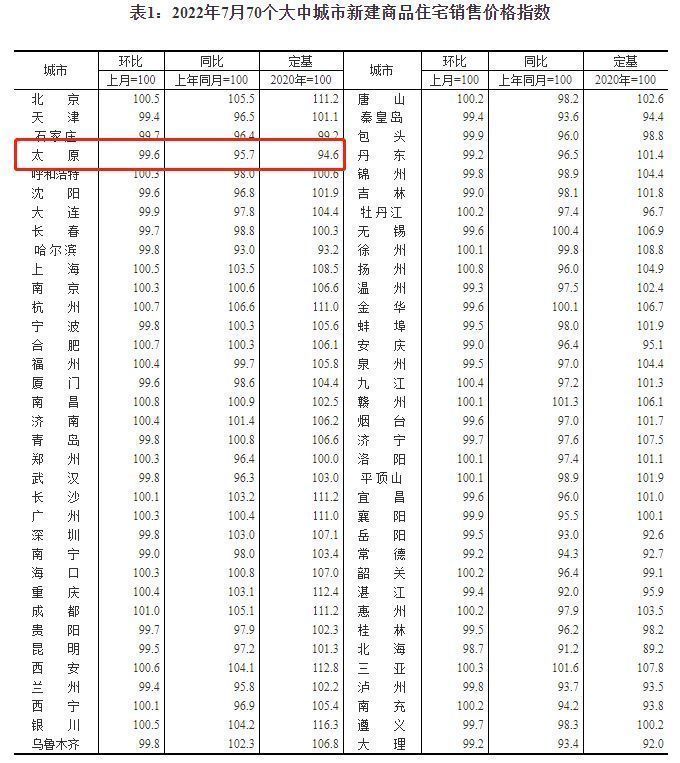

On August 15th, the National Bureau of Statistics released the "Change of the Sales Price of 70 Greater and Medium -Cities in the 70 large and medium -sized cities in July 2022". It shows that in July 2022, the number of commercial housing prices in 70 large and medium cities decreased slightly. The sales prices of commercial housing in first -tier cities rose slightly and decreased year -on -year, and the overall decline in second- and third -tier cities showed a decline and a year -on -year decline.

58 Zhang Bo analyzed the dean of the Square Institute of Anju House Real Estate. The market is in a state of slow recovery. The effectiveness of policies in various places is still differentiated. From the regional point of view, the policy of many hot cities in the Yangtze River Delta, the Greater Bay Area and the middle reaches of the Yangtze River in the Yangtze River The frequency of relaxation is accelerated, and the effect of increased market heat is more obvious.

According to the data released by the National Bureau of Statistics, from the perspective of the year -on -month perspective, the sales prices of commercial housing in first -tier cities rose slightly, and the overall trend of second- and third -tier cities showed a downward trend. In July, of the 70 large and medium cities, the sales prices of new commercial housing and second -hand housing decreased by 40 and 51 cities, respectively, increased by 2 and 3 respectively.

In July, the sales price of new commercial housing in first -tier cities rose 0.3%month -on -month, and the increase of 0.2 percentage points from the previous month; the sales price of second -hand residential houses rose 0.2%month -on -month, an increase of 0.1 percentage points from the previous month. The sales price of new commercial housing in second -tier cities rose 0.1%from the previous month to the same as the previous month; the sales price of second -hand residential houses decreased by 0.2%month -on -month, and the decrease was 0.1 percentage points from the previous month. The sales prices of new commercial housing and second -hand housing in third -tier cities decreased by 0.3%month -on -month, and the decline was the same as last month.

From the above data, what are the characteristics of new houses and second -hand housing in various cities? What are the main reasons for rising and falling?

"The first -tier cities are still the" leader of the sheep 'in the market. The price of the first and second -hand houses shows an upward trend. Corresponding to this, it still maintains more caution at the policy relaxation level in the north. The recovery is directly related, not only the performance of house prices is stable, but also from the transaction amount of commercial housing and the performance of the soil shooting market. "Zhang Bo told the China City Daily reporter that from the perspective of the new house, the rising monthly rising monthly monthly rising is more obvious. The average increase in the north is 0.5%, which has a certain relationship with the market supply structure. The monthly increase of 0.8%in Shanghai in second -hand houses has performed the most obvious, and it also shows that the rhythm of rapid recovery of the market after the epidemic is still continuing.

In terms of sales prices in second -tier cities, Zhang Bo analyzed that the differentiation of second -tier cities is still continuing. From the perspective of market differentiation, the new first -tier performance is more obvious compared to the third and fourth -tier performance. At the same time The modes of relaxation in steps, especially the adjustment of the level of purchase and down payment ratio, will be more conservative. From the perspective of new house prices, Hangzhou, Hefei, and Chengdu have risen more obvious, especially in Chengdu's single -monthly new houses and second -hand housing rose by 1%and 1.3%, respectively. It shows that the policies are more powerful in the release of local effects. It is expected that the popularity of hotspots in second -tier cities will become the second share of the market's continuous recovery.

Next, will this year's Jin Jiuyin Ten Performance? What are the trend of new houses and second -hand houses and transactions?

Previously, on July 28, the Political Bureau of the Central Committee of the Communist Party of China held a meeting to analyze the current economic situation and deploy economic work in the second half of the year. The meeting pointed out that it is necessary to stabilize the real estate market, adhere to the positioning of houses for living, not for speculation, because the city has used a good policy box to support rigid and improved housing demand, compact local government responsibilities, guarantee payment Lou, stabilize people's livelihood.

Zhang Bo believes that the above meeting clearly points to "stable real estate", and mentioned that the policy toolbox should be "well used". Therefore, for most hot cities, the market promotion of market boosts will be obvious. Increasing, the direction of policy relaxation will also develop from inclusive to targeted people, especially for support for improving sexual needs.

"In this context, the recovery of the market in September and October is still worth looking forward to. The first -tier cities and the second line of hotspots will become the" core force 'for the increase in market heat, which drives the stable house price and the market is stable. "Zhang Bo said, it is worth noting that This round of warming cycle is long, and more market potential needs to be released in the future to boost the property market.

■ Reporter of China City Daily: Zhang Ahuan, Zhu Lina

- END -

Henan first real estate fancy promotion: 5 yuan/jin, garlic change?

Recently, the real estate of Henan Jianye has launched the garlic change promotion...

House prices in July 70!Taiyuan's new house price fell 0.4%month -on -month second -hand house price ring fell 0.3%

Note:1. Scope of survey: city jurisdictions in each city excluding counties.2. Inv...