Nanjing's "shot" drop -down house threshold two -suite down payment to a minimum down payment to 30 % to 30 %

Author:Securities daily Time:2022.08.15

Reporter Li Zheng

On August 12, Nanjing City, Jiangsu Province lowered the down payment ratio of commercial personal housing loans. Families with no houses and loans, and there were no mortgages. The down payment ratio was reduced from 50%to 30%. The down payment ratio of residential households has been reduced from a minimum of 80%to 60%. This means that after many adjustments during the year, the Nanjing property market is loosened again.

This new regulation has changed the policy of Nanjing's past "recognition of houses and recognizing loans". Earlier in Nanjing, there was a house, no home purchase loan record, or a loan recorder who had been settled in the name of the house, and then the purchase of a house was a two -suite, with a down payment ratio of 50%. The ratio is as high as 80%. Nowadays, the loan is settled before buying a house. The lowest down payment ratio can reach 30 %, which greatly reduces the threshold for buying a house.

Some market participants believe that the Nanjing property market has a large policy. It is expected that after multiple policies have been released and the effect of "combined fist" will improve the activeness of the property market in the area.

Reduce the threshold for buying a house again

According to a reporter from the Securities Daily, since this year, the Nanjing region has launched several new property market policies and has gone through multiple rounds of regulation. The purpose of only one is to reduce the threshold for house purchase.

This time, from the content of the screenshot of the Internet policy, the secretary of the market interest rate pricing self -discipline mechanism of market interest rate pricing in Jiangsu Province was released on August 12 (the resolution on adjusting Nanjing Differential Housing Credit Policy "(hereinafter referred to as the" Resolution "). The proportion of new commercial personal housing loans is issued to adjust.

The content of the "Resolution" shows that there are house purchase records in Nanjing City (excluding Lishui District and Gaochun District), but when applying for a loan, there are no houses with no housing residents, or one house, but a resident family or corresponding house purchase of houses. The residential family that has been settled in the loan has a down payment ratio of the commercial loan purchase of the house; the urban area (excluding Liuhe District, Laishui District, Gaochun District) has a house with 1 house, and the corresponding home purchase loan has not been settled. Apply again. The minimum down payment ratio of commercial personal housing loans is not less than 60%.

In response to the above content, the reporter of the Securities Daily asked for consultation with Ping An Bank, Construction Bank, Agricultural Bank of China, etc., and learned that the news was true, and some bank staff told reporters that they had received this notice. It will be implemented according to the above standards on the afternoon of August 12.

Li Yujia, chief researcher at the Guangdong Housing Policy Research Center, said in an interview with the Securities Daily that from the content of the "Resolution", the Nanjing property market loosening policy was strong.

Li Yujia introduced that reducing the down payment ratio or the adjustment of property market policies such as "recognition of housing and recognizing loans", launching more in weak second -tier cities and third- and fourth -tier cities. Essence This type of policy is to meet the demand for the reasonable loan purchase of residents. Adjusting "recognition of houses and recognizing loans" is a demand for improving house purchase. This demand is now in a leading position, which is more dominant in hot cities. more.

"Nanjing is a city with a long time. There are many people in their hands and a large demand for changing housing. In the past few years, there were more people who bought a house in the property market. The impact of loan ', with the gradual implementation of the policy, will help release this part of the demand, and the property market will further improve. "Li Yujia said.

Further promote the mild recovery of the property market

In fact, the previous easing policy has gradually developed.

At the end of April 2022, the content of the required material prompts required by the Nanjing Government Service Center for the purchase of a house purchase certificate was updated: non -city residents also need to provide: within 1 year from the date of applying for a house purchase certificate, a total of 6 months of personal income tax or social security in Nanjing Proof and other related materials. The policy before this is: within the first three years of the application for the purchase of a house purchase certificate, Nanjing has paid a total of 2 years of personal income tax or social security certificate.

On June 13, the purchase restriction policy was once again adjusted to 6 months of social security. The payment method does not distinguish, that is, the individual supplement and unit make up, and the threshold for buying a house will usher in a new round of reduction.

On July 25, Gaochun District, Nanjing City, Jiangsu Province issued the "Relevant Policies for Promoting the Healthy Development of the Real Estate Market (Trial)" (hereinafter referred to as the "Policies") proposed to be given to buyers to buy house purchase subsidies, guide commercial banks as rigid and improved models Housing groups provide commercial personal housing preferential interest rate loans.

In this regard, Li Yujia believes that during the year of Nanjing, the release policy of loosening the property market revealed that the demand of the Nanjing property market is still relatively weak. Buyers have insufficient confidence in buying a house. In this case, it is necessary to adjust the down payment or monthly supply, especially It is the down payment capacity of home buyers.

According to Li Yujia, in some hot cities, there are loan records, a house, or a set of house loans to buy two sets of two houses. The down payment is at least 50%, and the highest or even 80%can be reached. The impact is relatively large. At present, if such demand is needed, the proportion restrictions must be adjusted to a certain amount.

In fact, as Li Yujia said, the transaction situation of the Nanjing property market this year is indeed not optimistic.

According to the data released by Kernanjing, from January to June this June this time, the total supply of commercial housing in Nanjing was 3.703 million square meters, with a transaction of 4.6217 million square meters. Compared with the supply of 6.688 million square meters in the same period last year, the transaction was 7.695 million square meters.The overall supply and marketing data has fallen to a large degree of decline; as of the end of June, Nanjing's inventory has risen to 6.57 million square meters, a dewlocular cycle of 9.7 months, reaching a new high since 2015;46%year -on -year.Yan Yuejin, the research director of the Think Tank Center of the E -House Research Institute, told a reporter from the Securities Daily that the transaction data of the Nanjing property market was poor, indicating that the pressure of the property market was still not completely lifted."The market may have a small peak of transactions, and the positive signals may be more obvious, and it will further promote the mild recovery of the property market.

- END -

In July, Changsha second -hand housing transactions increased by 12% higher than the average month of this year

According to the sales data of Changsha real estate released on the 10th of the Hunan region of Ke Rui on the 10th, after the sprint of the middle of the year, the supply and demand of commercial hous

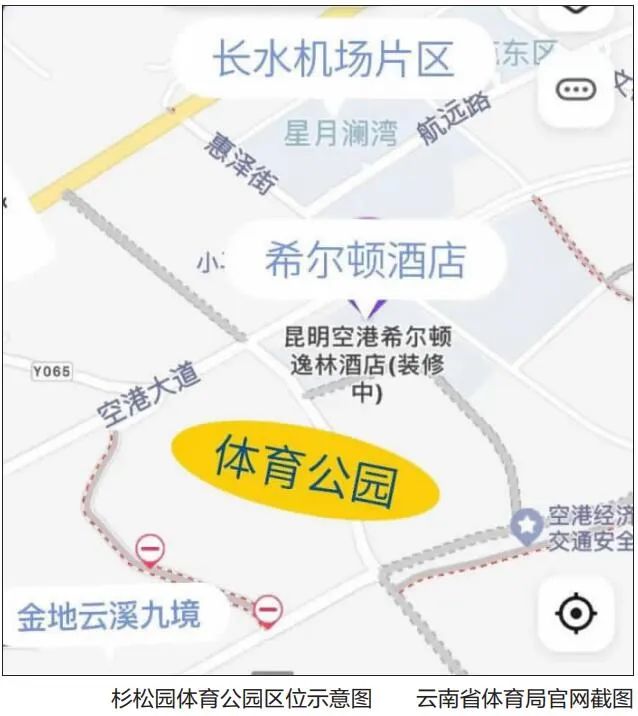

Kunming will add more public stadiums to see if there is any near your home?

In recent years, with the improvement of people's living standards, national fitne...