Did the Rabble surge in the stock market led Putin to win?

Author:Leaf sandal Time:2022.06.22

On March 26, Biden gave a ruthless speech in Warsaw, Poland.

Today, $ 1 can be exchanged for 200 rubles, and the next step is to make the rubles into waste paper.

I believe that everyone still remembers the scene of Russian people queuing up to extract foreign currency when the Russian -Ukraine conflict broke out.

However, reality is always unexpected by most people.

Not only did the ruble become waste paper, but the exchange rate has long returned to the level before the conflict, and it is also hitting a new high continuously.

Russian ruble against the US dollar exchange rate (Source: Sina Finance)

As of June 21, the exchange rate of the ruble against the US dollar hit a new high, from the lowest point in March, which has almost tripled.

At the same time, the Russian stock market is about to recover.

Russian RTS index (Source: Oriental Fortune)

As shown in the figure above, the first big yin line of the Russian RTS index was on February 21 that Putin announced the independence of the two districts of Wudong, and the second big yin line was the official outbreak of military conflicts.

The second big yin line has long been recovered, and the recovery of the first big yin line is close at hand.

After the Fed's expected interest rate hike, the Russian stock market has recently become the most strong market in the world outside of A shares.

All of this, as if the smoke in Ukraine had already dispersed.

How did Russia reverse it all? What are the problems worth thinking about?

What did Russia do right?

Let's talk about Russia's "financial counterattack" under the hunting of Western sanctions.

On June 11, the United States paid a "huge sum" of 2 billion rubles to Russia.

Considering the ruthless words released by Biden at the beginning, this operation was a slamming face.

This cost is a ship ticket from the US Astronaut Vande Hai to the Russian "Alliance" spacecraft to the International Space Station because the United States and Russia had reached an aerospace cooperation agreement.

In the face of high space costs, the United States found that it was better to find a "ride" for Russia.

What's more interesting is that the United States should pay this amount in the name of the Aerospace Bureau (that is, NASA).

However, because the US Congress tried to oppose the use of rubles, it turned out that it used a private company called "US Torree Aviation Company" to pay Russia.

As if this realizes the so -called "political correctness" in the United States.

This scene is actually a microcosm of the entire Western financial sanctions on Russia.

Shouting to resist the ruble, but he couldn't get rid of the ruble.

Everyone also knows that in the face of Putin's tough attitude, some European countries have to use rubles to settle in Russian energy.

For Poland, the Netherlands and other countries that refuse to settle in rubles, Russia directly made them "break".

Recently, Russia's Deputy Prime Minister Novak mentioned that among Russia's natural gas supply to Europe, the proportion of natural gas paid through rubles has reached 90%to 95%.

In addition, the means of stable markets in Russia also include:

The central bank raised interest rates sharply to attract residents' savings (up to 20%, and at present, as interest rates have stabilized to 9.5%); restricting foreign exchange exchange, controlling liquidity, and enhancing the central bank's control; 100 million rubles purchase Russian stocks; restrictions are short to prevent foreign investors from leaving the market from the stock market and prohibiting shorts.

It is also under such a combination that Russian rubles and the stock market have performed today.

In addition, the Russian RTS Index's main weights have a lot of oil and natural gas companies. Under the strong performance of oil prices and gas prices, they have further stabilized the Russian stock market.

In general, in the face of continuous financial sanctions, Russia, which relies on energy, shows a strong disk control ability.

Throughout the world, there are no winners in the world

Although the exchange rate and the stock market have come up with a surprising transcript, this does not mean that Russia has won the "financial war".

These may reflect some of the phenomena of the economy, but we still have to look at the full picture of the economy.

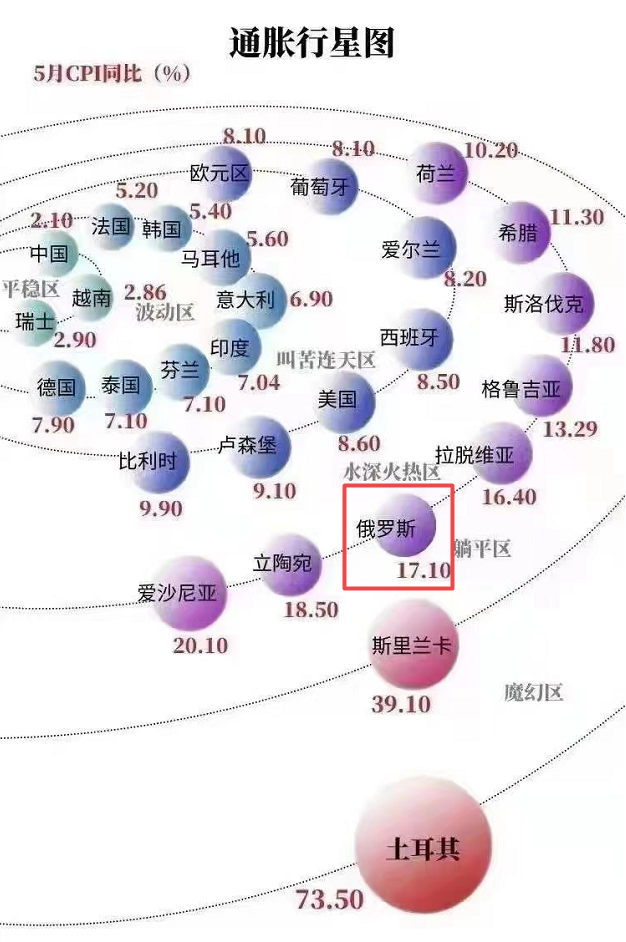

Recently, a "inflation planet map" is very hot, and we can also see the current situation of countries around the world.

Source: network (invading deletion)

17.1%, this is the inflation rate of Russia.

As shown in the figure, the inflation rate of this level is really hot.

At the same time, Russia's economic strength is also falling rapidly.

The Russian Bank recently said that the Russian economy is expected to shrink by 10%in 2022.

Inflation is high and economic atrophy. These two situations are undoubtedly the worst results at the same time, and the risk of stagnation rises suddenly.

Biden said proudly in the White House speech in April this year:

"In just one year, our sanctions may erase Russia's economic growth in the past 15 years."

Although the words about rubles have not been realized, I am afraid that this time it will be said to be said.

In addition, it is not good to rise blindly.

Excessive rise in currency exchange rates will destroy the country's export competitiveness, which has led Russia to discuss the goal of "optimal exchange rate" in the near future.

Russia's first deputy prime minister Belo Usov recently said that the authorities discussed the set goals of the rubles and given priority to economic growth. The "best" exchange rate was between 70 and 80 rubles per USD.

At present, the exchange rate of the US dollar against the ruble is around 1-55. Obviously, rubles need to cool down.

All signs show that the strong performance of Russia's rubles and stock markets does not show that Russia has won the "financial war".

However, looking at the global and looking at the inflation rate and economic environment of various countries, can we say who is the winner?The St. Petersburg International Economic Forum just ended last week. A total of more than 140 representatives from more than 140 countries and regions attended, and 14,000 participated. A total of 691 agreements were signed with a total amount of 5.639 trillion rubles (about 676.5 billion yuan).

Sanctions are under sanctions, and the cooperation is still cooperating.

The conflict of Russia and Ukraine has not subsided, but the global economy can no longer pay for it.

Under economic globalization, the consequences of sanctions will only be transmitted to each other. The end result is that there are no winners, and they lose all.

In addition to win -win cooperation, humans may have no choice.

(Disclaimer: This article is an objective analysis made by Ye Tan Finance based on public information, which does not constitute investment suggestions. Do not use this as a basis for investment.)

- END -

On the occasion of "Russia Day", Russia's latest polls: 85%of Russian interviewees th

[Global Times Comprehensive Report] On the occasion of Russia's Day (National Day) on June 12, the Russian polls conducted a survey to learn how many people thought they were patriotic. Russia's Free...

Japanese companies will vigorously promote insect foods: 蟋蟀 is more affordable than beef

Snacks such as biscuits and crickets produced by Japanese companies (Japan Economi...