The lowest record in 37 years!This old world is troublesome!

Author:Global Times Time:2022.09.24

Author: Geng Zhi

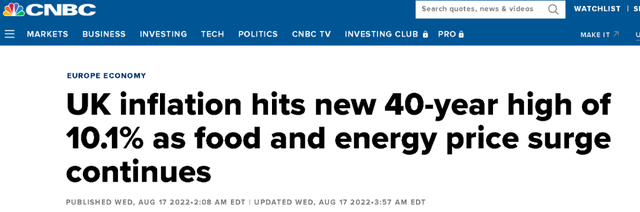

According to many British media reports, the British economy is facing the biggest dilemma in the past 40 years -the economic growth rate has continued to slow down, the worst of the Seventh Kingdom Group, and its inflation rate has continued to refresh the past since May this year. The highest record in 40 years has now exceeded 10%.

Many British media lamented therefore that Britain had entered its economic recession.

However, the British government's newly announced economic stimulus plan has failed to cause the market's excitement. Instead, it also further crack down on investors' confidence, and even fell the British exchange rate to the lowest point in 37 years!

Judging from the British "Guardian", BBC and Reuters, under the multiple blows of the new crown epidemic, the conflict between the Russian and Ukraine, and the Brexit, the British economy has been going downhill in the past two years, not only the economic increase has increased, not only the economic increase has increased. The speed is slow, the worst of the Seventh Kingdom Group (G7), and in May this year, it has set the highest inflation rate since 1982, and it has now exceeded 10%.

Although Kwasi KWARTENG, the new British New Treasury Minister, announced on September 23, Beijing time on September 23, the British government's new economic stimulus plan can be reported according to the BBC and the Guardian. The major tax reduction has been the most important economic stimulus plan for the most beneficiary of the main beneficiary in half a century. The wealthy and big enterprises have not only failed to win the recognition of the market, but also further exacerbated investors' concerns- In addition to the decline in the British stock market, the exchange rate of the British pound against the US dollar has fallen to a new low in 37 years, approaching the point where £ 1 is against 1.11 US dollars, and intuitively reflects how much investors lack confidence in Britain ...

Judging from the analysis given by the two British media above, the reason why the market responds to the British government's economic stimulus plan is so negative because this large -scale tax reduction plan seems to be the main strategy of Kwandon's stimulation of the British economy. But if it is only relying on tax cuts to stimulate the economy, the British government will inevitably borrow a lot to support this plan, and at the same time, some people can take over the British government's debt.

(Report from BBC)

However, the problem is that the debt problem of Britain itself is already very serious. Not only is the government's debt serious, the previous more than 10 years have always maintained 1%or lower interest rates that the Britain has always maintained it, which has led to the public due to low loan costs to buy them. In fact, the houses and cars that cannot be afforded at all have led to the debt level of the entire UK to a very dangerous level.

The serious debt issue has even forced the former British Prime Minister Boris Johnson to repay the debt by increasing taxes to the enterprise, and the British "civil servants" are not optimistic because they are not optimistic about the loan repayment ability. It is impossible to borrow money from the mainstream loan channels. I have to seek the help of the "buy and then pay" loan company full of controversial and "routine loan" to borrow money.

At the same time, under the impact of a series of incidents such as the conflict between Russia and Ukraine, Brexit and epidemic, Britain's inflation rate has continued to refresh the new high since 1982, forcing the Bank of England to have to curb inflation through interest rate hikes. Conventional means to control. As of now, the Bank of England, as the Bank of England, has raised interest rates 7 times this year, and the last time is September 22. The current interest rate in the UK is 2.25%.

Then, when a serious debt problem meets the problem of severe inflation, the British economy is in a vicious circle: to avoid economic recession, it is necessary to stimulate the economy, but this will inevitably exacerbate inflation. Rating interest rates can be greatly aggravated for Britain, which will greatly increase debt burden, and then combat economic development ...

The British "New Politician Weekly" focused on a article on September 22, which focused on this issue, pointing out that the British are the most vulnerable to interest rate hikes. Although the United Kingdom does not want to inflation, it is not ready to face it to face it to face The consequences of interest rate hikes.

Under such a tricky situation, the new British Treasury Secretary Kwate now decides to reduce taxes to enterprises and individuals. If you want to stimulate economic development practices, it is tantamount to "oiling on the fire".

Many financial experts interviewed by BBC and the Guardian pointed out that although this approach may stimulate economic growth to a certain extent, it will inevitably bring a lot of uncertainty to the market, including the government further Liabilities, inflation further intensified, interest rates further pushed high, and finally further aggravated the entire British debt burden, and who these debts took over, and so on.

In the end, it is worth mentioning that in addition to a new low of the dollar, the pound also seems to have reached a record low in terms of renminbi. Some foreign exchange trading websites show that on the evening of September 23, the exchange rate of the British pound against the RMB had fallen below 7.8, that is, pounds 1 pound can be exchanged for RMB 7.79.

This is also a very negative news for British who are struggling with inflation and high prices.

- END -

The average price index of 100 stocks in London stock market "Financial Times" fell

Xinhua News Agency News: The average price index of 100 stocks in the London stock...

The collapse of the Mumbai building in India has caused 3 deaths and 11 injuries

Jimu Journalist Hu LiAccording to the India Express report, on the evening of June...