Americans are angry: this matter must be banned!

Author:Global Times Time:2022.09.18

//

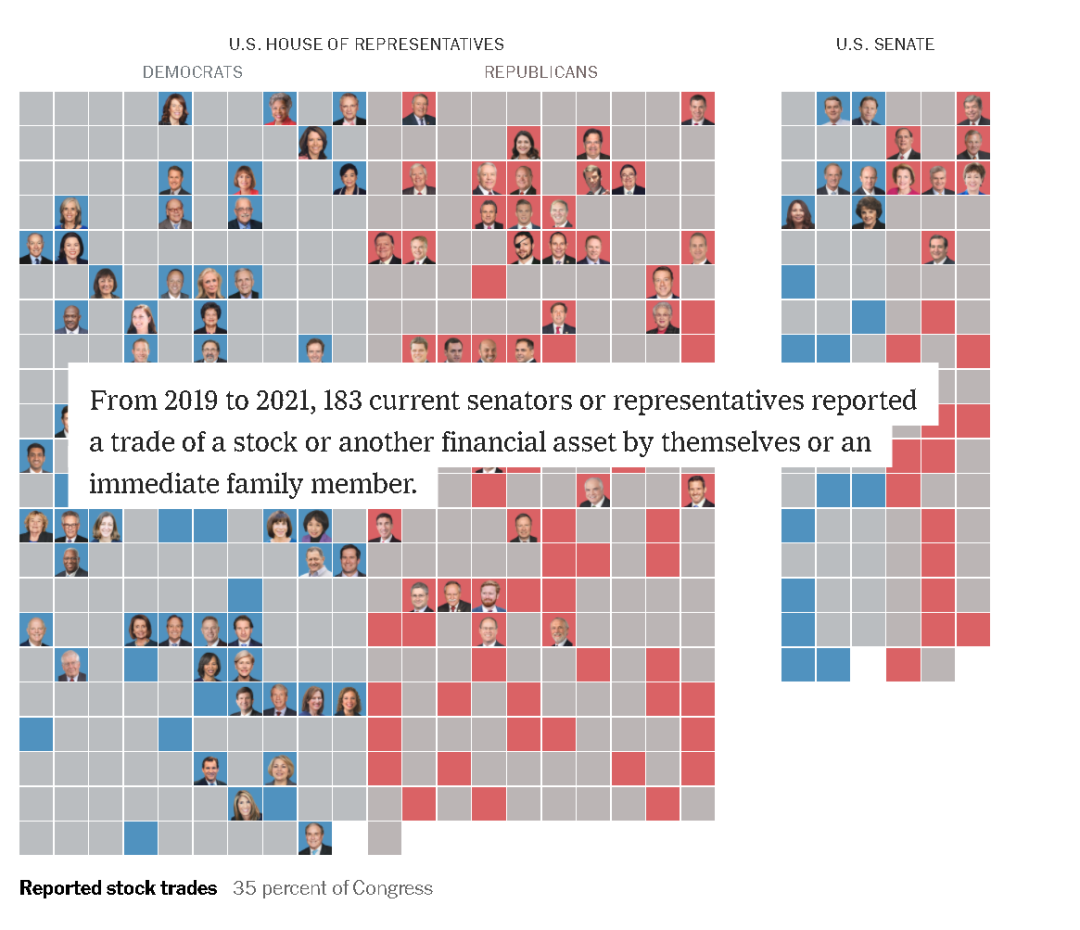

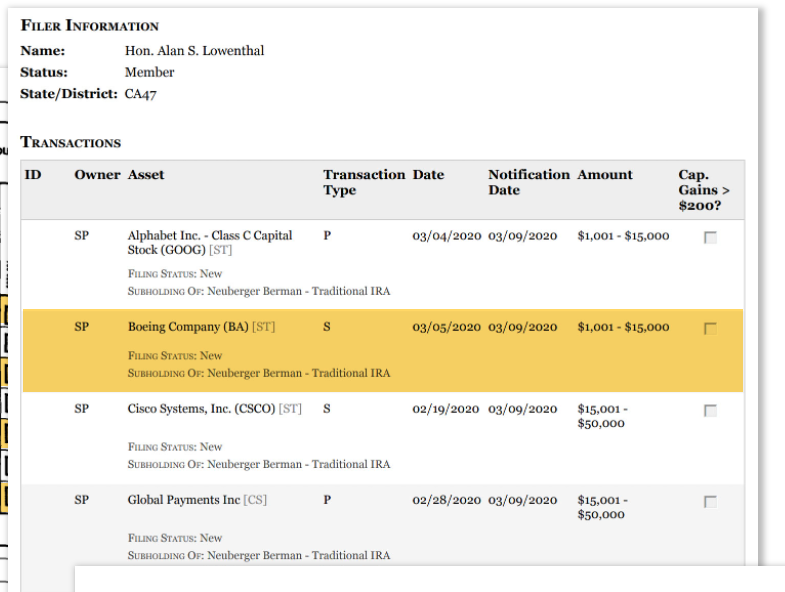

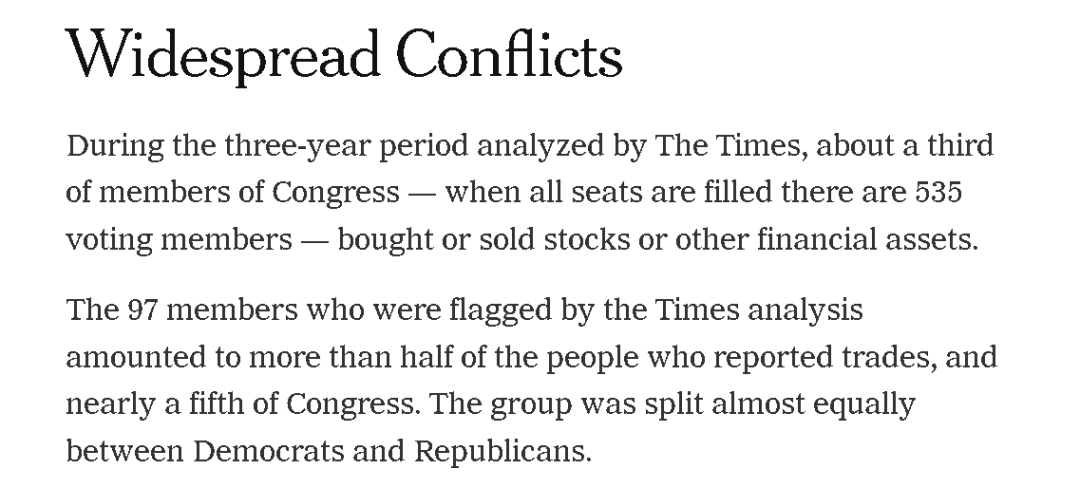

Recently, the New York Times disclosed an amazing situation in an in -depth report: In the three years from 2019 to 2021, nearly a hundred members of the US Congress appeared when they conducted stock securities transactions, and they appeared. It is suspected that the "conflict of interests" such as inside information is obtained in advance.

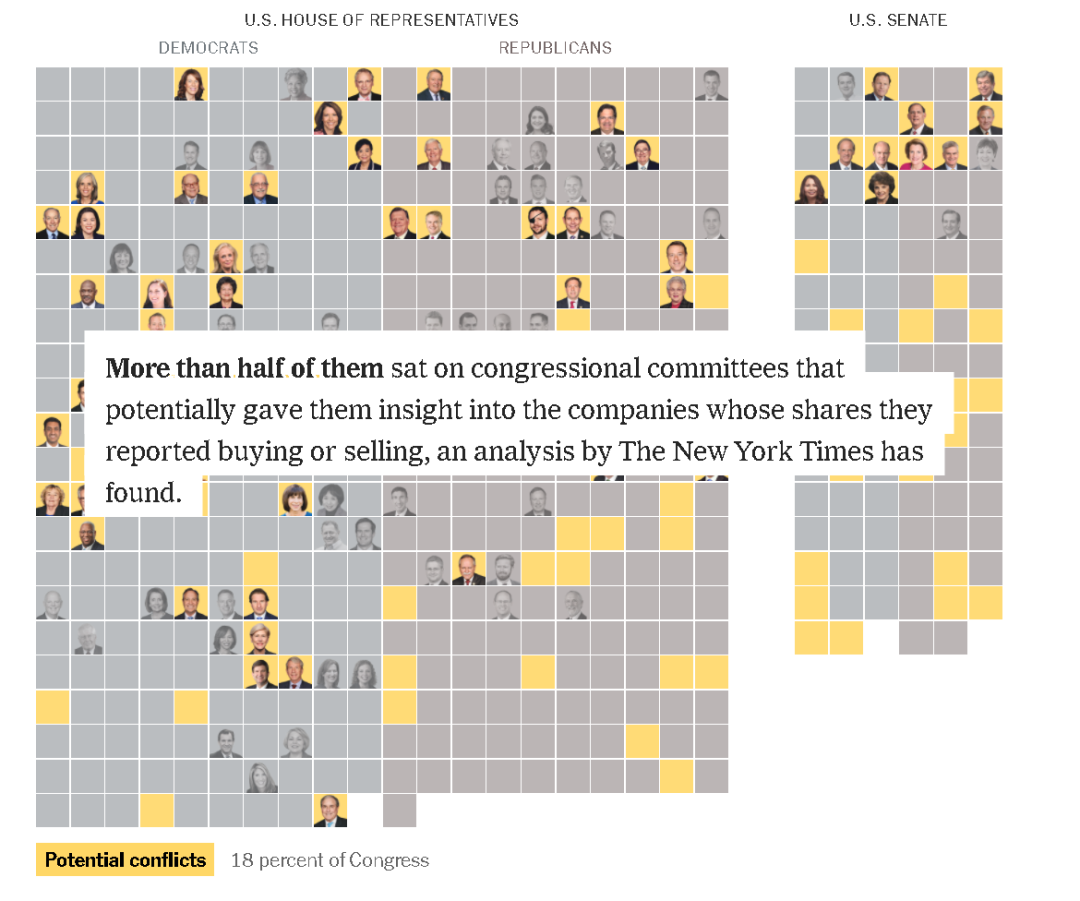

The New York Times found that the areas of the stock securities invested by half of these members of the Super League (and their direct relatives) not only coincided with the fields of legislation or regulatory committees they participated in Congress, but they also made stocks. At the time of securities transactions, it is often reunited with these committees to investigate or publish important information in related fields and enterprises.

At present, this in -depth report has aroused the anger of a large number of US netizens, and has demanded that the US Congress through legislation has completely prohibited all Congress members from conducting stock securities transactions.

According to the New York Times, US Congress members who have "conflicts of interest" with their own status and roles in stock securities transactions have a total of 97 people.

The newspaper locks these politicians through a big data website that tracks US parliament to conduct stock securities transactions and a evaluation standard. This big data website is compiled by a financial data company in Germany based on the transaction records of members disclosed by the US Congress.

(Screenshot comes from the New York Times, the same below)

Although the United States has legal regulations on the investment in the stock securities of parliamentarians, while allowing them to invest in this kind of investment, they are required to disclose their or direct relatives worth more than $ 1,000 in 45 days and not allow inside -view transactions, but " The New York Times pointed out that many members have a big problem when reporting the transaction information. For example, many members will only disclose the value category of their stock securities transactions. The information is often omitted. The newspaper also revealed that there were other US media surveys last year that many members did not disclose transactions in strict accordance with the requirements of the law. More than 70 members of parliament had had late reports or simply missed stock securities transactions.

Of the 97 members exposed by the New York Times, although these people seem to only account for less than one -fifth of the total of more than 500 members of the House of Representatives and Senate, from 2019 to 2021 There are only 183 members who have traded the stock securities transactions by themselves or the direct relatives, so the 97 people who have been exposed now have actually accounted for more than half of these people.

The New York Times also showed the severity of this problem through presented data on visual data and a large number of cases.

In terms of cases, from more than a dozen cases introduced by the newspaper, these cases have a commonality, that is, the field of stock securities that relevant members traded in transactions, not only with their high degree of the legislation or supervisory committee they participated in the Congress. The time to rearmed, and the time for them to invest in related investment in their or their direct family members often re -to be re -to investigate or publish important information in related fields and enterprises.

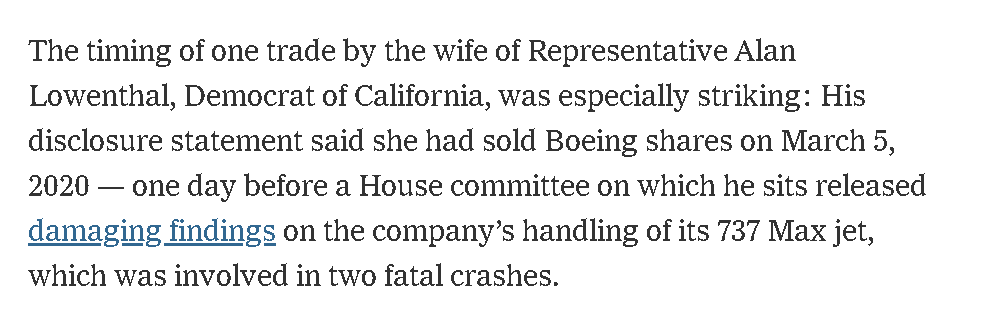

For example, a member of the Democratic Parliament from California from Congress House of Representatives participated in the House Council of the US Parliament's 737 MAX passenger plane in the United States Boeing in 2020. Two severe crash facing questions from the world. Coincidentally, just the day before the committee released a bad investigation report on Boeing on March 6, 2020, the wife's wife sold Boeing stocks.

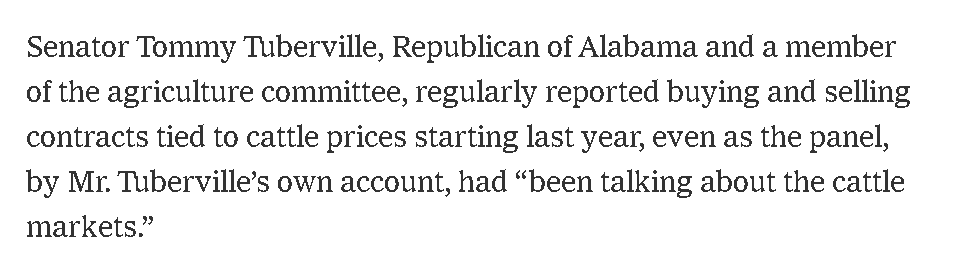

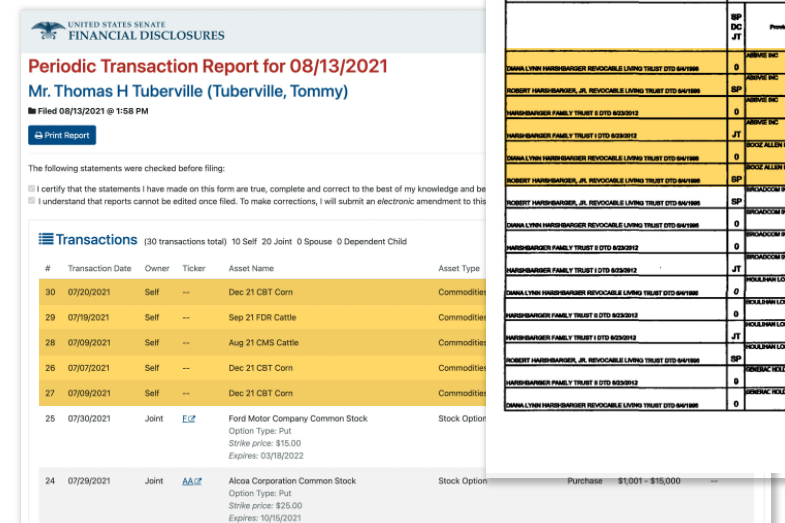

A Republican member of the Parliament Senate was found to have conducted many contract transactions related to the price of livestock in the financial market last year. The Senate Agricultural Committee he participated in the Senate Commission has even discussed the direction of the livestock market.

These two cases from the Republican and Democratic members also show that the situation of this "conflict of interest" is not limited to a certain party, but a problem of the common existence of the United States Congress.

In addition, it is worth noting that the New York Times did not include the Speaker of the House of Representatives and the "insider trading" of the "insider trading" of the US Congress. Focusing on the exposure, the public only mentioned that the public's husband Paul had obtained a series of success in the stock market in the middle of the article. However, as the Speaker, she can also contact the draft of many bills in advance, and can even determine which bill draft draft can be reviewed in the House of Representatives.

However, the 97 members and Pelosi have denied that they have used their powers to obtain inside information and use this illegal profit.

Judging from the report of the New York Times, most of their rhetoric is given by the response members of the members of the response, and these stock transactions are conducted through investment managers, not they operate, and even stock securities are not directly held by them. Well, they did not disclose any inside information to these investors in violation of regulations -such as the wife who sold Boeing stocks mentioned earlier; Investment behavior is well -deserved. For example, another member of the Boeing stocks who also sold Boeing shares during the Boeing was also said that he had seen the stock price of Boeing, and at the same time, he considers that he was also investigating Boeing Committee to stop loss and avoid suspicion. Perlis's spokesman said that she did not hold stocks, and she did not know and participated in her husband's investment in advance.

In addition, although so many problems existing in stock investment have been exposed, the New York Times is quite "restrained" when they are "qualitative" to them. While giving their response, they said that these actions were suspected of "conflict of interests" -the may be because the current evidence is not enough to make more serious allegations.

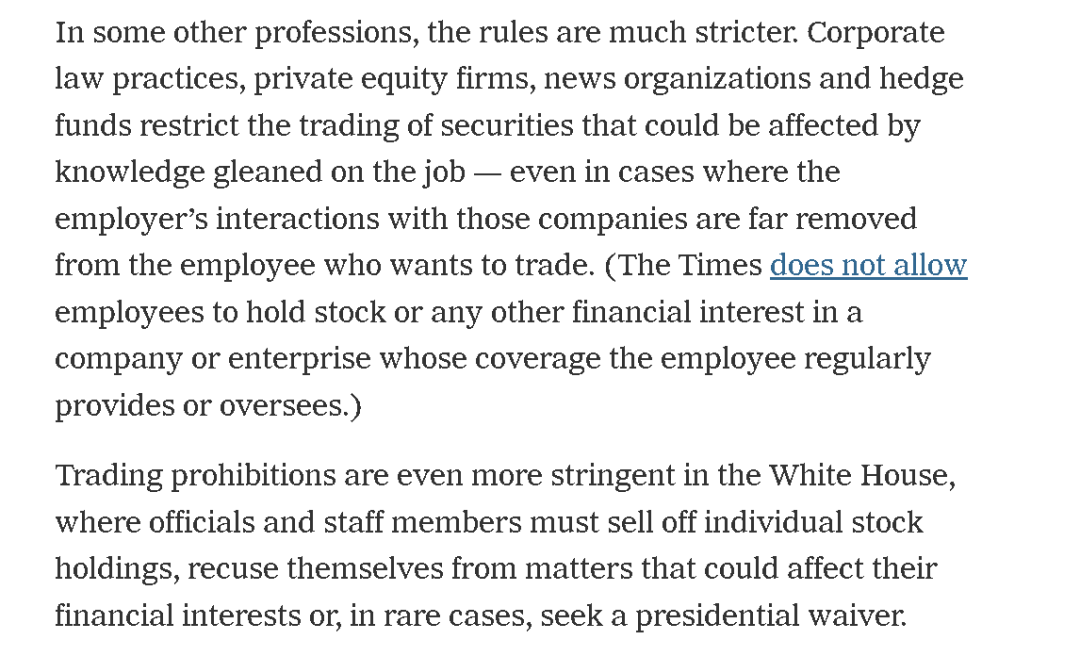

The final point of this article is that the US legal system still lacks this point in restricting parliamentarity in stock securities transactions. Because, according to the New York Times, the law that the United States now restricts membership in stock transactions is not only much weaker than the White House's restrictions on officials and staff in this regard, but even than many American companies and even news agencies from news agencies. Related restrictions must be weak.

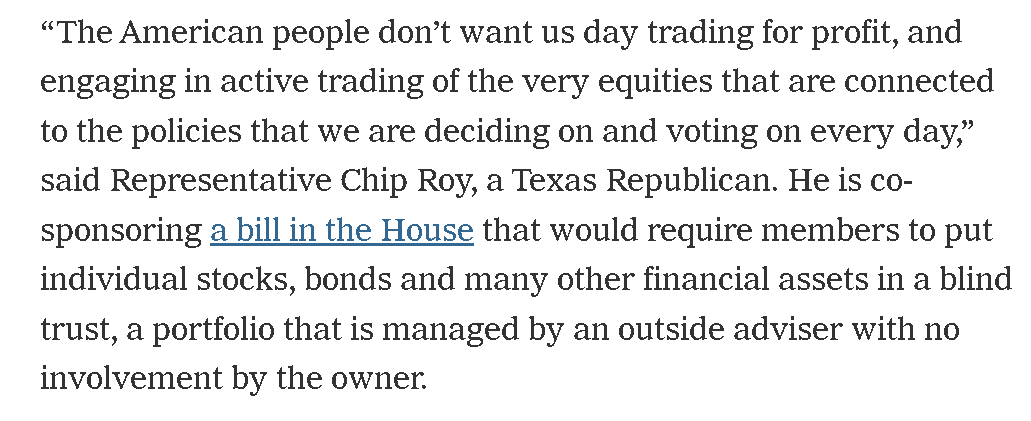

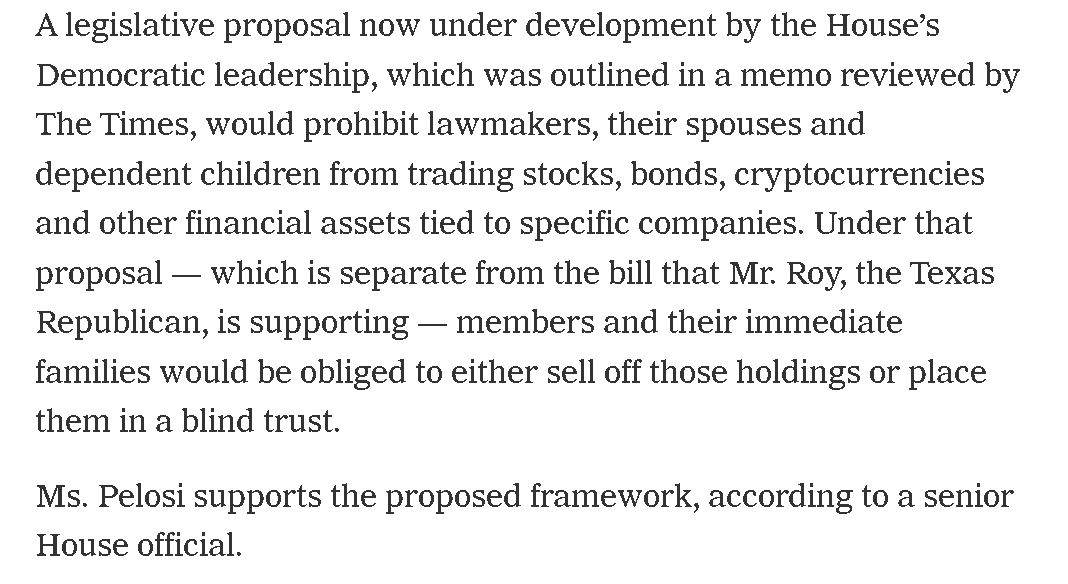

The newspaper also quoted the views of a number of members who believed that they should strengthen legal restrictions. Among them, some members believe that the members of the Congress should be required to give their stock investment to "confidential trusts" through legislation, that is, the client gives the property investment to the trustee to take care. People disclose the detailed situation of investment, and the client cannot affect or participate in investment. Public information shows that this kind of confidential trust services are popular at many officials in the West, because this trust can avoid official conflicts of interest in the New York Times when performing public duties to a certain extent. There are also legal suggestions made by members to prohibit members and their direct relatives from investing in stocks and financial investment in some specific enterprises. The existing investment must be sold or invested "confidential trust".

According to the introduction of the New York Times, this second proposal has received the support of some members including Pelosi -although Perlis initially opposed to further restricting members of the stock securities transactions. As for why she had such a transformation, the New York Times did not explain.

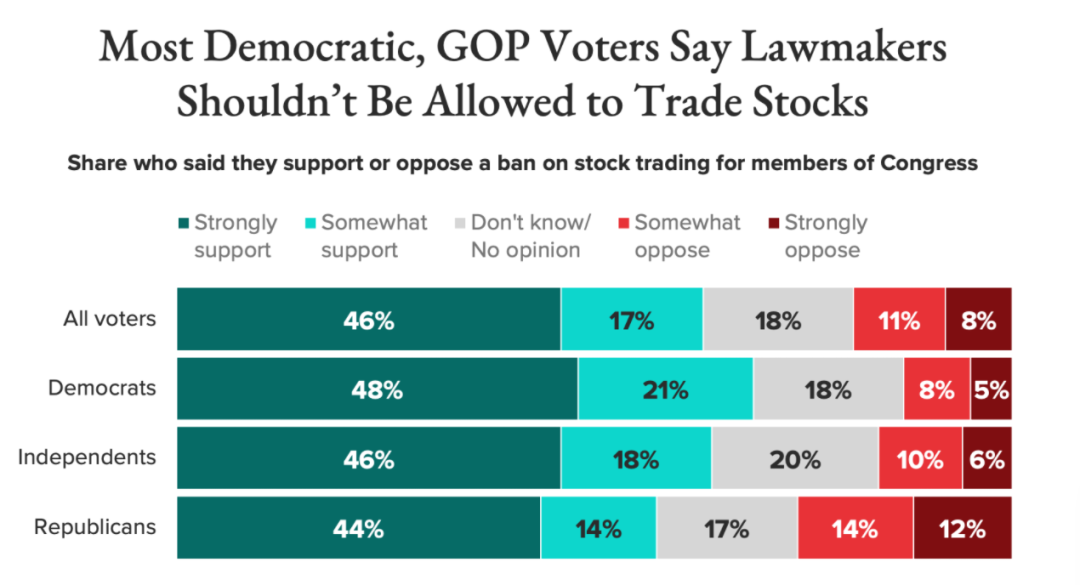

On social networks, many US netizens who are angry about the "conflict of interest" disclosed by the New York Times, and are advised to simply prohibit members of members from conducting stock securities transactions. The New York Times also mentioned a survey results from the US polls "Morning Consult" in January this year that most Americans support the prohibition of parliament members from conducting stock transactions, and this support is different from the party. Essence

This shows that whether it is further restrictions or simply prohibit members of parliament from conducting stock transactions. Through legislation, it is more consensus in the United States.

- END -

President Ukraine met with the leaders of the three kingdoms of Germany and France in Kyiv, and Russia voiced →

Leaders of Germany, France, and Italian have arrived in Ukraine KyrafuAccording to...

"Video" North Pole can wear short sleeves?Zhongdaji expert: The fierce ice melting of the high latitude ice cover is shocking

Text, video editing/Yangcheng Evening News all -media reporter Chen Liangtu, video...