What is the top five in the world in the world? What is India's confidence?Can you hold it?

Author:Daily Economic News Time:2022.09.04

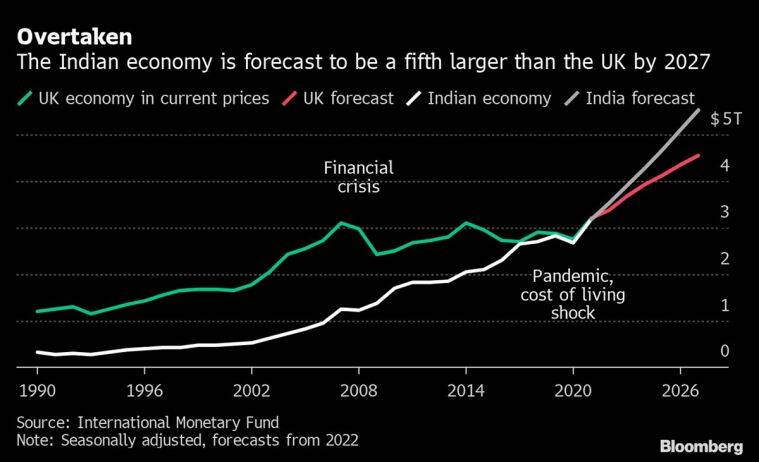

According to the results of the Bloomberg Comprehensive International Monetary Fund (IMF) data and the historical exchange rate calculation results on Bloomberg terminal machines, India has surpassed the United Kingdom and has become the fifth largest economy in the world. IMF expects that India's economic scale will be about 20%larger than Britain in 2027.

The US Human Resources Consulting Safeguard Global believes that the large -scale economic growth in India must largely attribute to globalization. Since the 1990s, the country's GDP has grown at index speed and is expected to reach an amazing $ 4.5 trillion by 2026.

However, international financial institutions, including Goldman Sachs and Morgan Stanley, have maintained their cautious views on the economic prospects of India. They believe that although India is currently under economic growth, it still faces multiple pressures. Essence

India surpasses the United Kingdom and break into the top five worldwide

IMF data shows that after correction, India's nominal GDP in the first quarter of 2022 was US $ 854.7 billion, while British data was $ 816 billion in the same period. In addition, according to the preliminary statistics released by the National Bureau of Statistics, the British GDP shrinks by 0.1%from the previous quarter in the second quarter of this year.

The agency predicts that the GDP scale of India will still exceed Britain in 2022, second only to the United States, China, Japan, and Germany. According to analysis, India's economic scale will be about 20%larger than Britain in 2027. You know, 10 years ago, India's GDP ranked only 11th in the world and ranked fifth in Britain.

Picture source: Bloomberg

The decline in British GDP is also an unpopular result for the new British Prime Minister who is about to be announced. Bloomberg reports that members of the British Conservative Party will choose a new Prime Minister on Monday (September 5th) on Monday (September 5th). It is expected that British Foreign Minister Leeds Tellas will eventually defeat the former Financial Minister Sonak.

For the new British Prime Minister, the challenge in front of it is very specific. Britain is currently facing the fastest inflation in 40 years, and there is no signs of alleviation at all. The Bank of England believes that inflation may continue until 2024. At the same time, the slowdown in economic growth, coupled with the rise in natural gas prices, has led to the continued deterioration of the economic prospects of Britain and Europe. It is expected that the British economy will begin to fall into recession from the fourth quarter of this year.

At the same time, the performance of the pound to India's rupee is not as good as the US dollar. Since the beginning of this year, the exchange rate of the pound to India has fallen by nearly 9%.

Picture source: Google Finance

In contrast, the Indian stock market also recorded a strong rebound in the third quarter. India's weight in the MSCI emerging market index has risen to the second place, second only to China.

India Mumbai Sensex Index has recorded a strong rebound since the third quarter (Picture Source: Bloomberg Society)

The US Human Resources Consulting Safeguard Global believes that the large -scale economic growth in India must largely attribute to globalization, that is, the transformation and changes began in the 1990s. Since then, the country's GDP has increased at index speed, leaving from US $ 270 billion in 1991 to US $ 2.87 trillion in 2019, and is expected to reach an amazing $ 4.5 trillion by 2026.

In its report, the agency pointed out that "the reduction of export subsidies and import barriers has promoted free trade, and the Indian market that has not been developed has attracted the attention of the international community like a magnet. Finance and agriculture. "

Experts: Insufficient growth motivation, multiple challenges to be solved

Data show that the actual GDP of the first fiscal quarter of the fiscal year 2022 ~ 2023 (corresponding to the year 2022 to June) increased by 13.5%year -on -year, the fastest growth rate in one year, and it is still the fastest economic growth rate in the world. The economy, but the increase is lower than the 16.2%expected by the Bank of India and the market expectations of 15.2%.

Some views point out that although India surpasses Britain to become the fifth largest economy in the world, due to the disparity population gap between the two countries (1.4 billion India and 68 million Britain), the two countries have GDP per capita (India 2,500 US dollars, and 47,000 in the UK. The US dollar) There is still a considerable gap.

After the actual GDP data of India's first fiscal quarter, Reuters also splashed cold water to India in the report. It quoted a number of international economists as saying that India's "global GDP growth rate is the fastest economy" may It is "a short -lived", because the country is tired of responding to the unemployment rate and inflation rate, and domestic consumption cannot continue to provide motivation for economic growth.

Goldman Sachs also reduced the expectations of India's annual growth, reducing India's GDP growth in 2022 from 7.6%to 7%, and at the same time, the GDP growth expected to be currently expected to be reduced by 20 basis points on the basis of 7.2%. Morgan Stanley also said that India ’s fiscal year is expected to have a risk of 40 basis points.

Kunal Kundu, an Indian economist in French Industrial Bank, believes that due to the high unemployment rate and the actual salary at a low level, India's domestic consumption may not be enough to further promote economic growth. He said that India's economic growth is not enough to accommodate about 12 million people entering the labor market each year.

"Daily Economic News" reporter noticed that since the beginning of this year, India's inflation rate has been at the top 6%of the central bank's tolerance, and the Indian central bank has also vowed to take more measures to suppress inflation. On August 5th, Mumbai time, the Indian central bank exceeded 50 basis points to 5.4%. This was the third interest rate hike for the Bank of India's fiscal year (April 2022 to March 2023). After the May and June expected interest rate hikes, the Indian Central Bank has accumulated a total of 140 basis points in the past three months. Market analysis believes that the six members of the monetary policy committee agreed to raise interest rates this time, reflecting the determination of the Indian central bank to remove looseness. Indian Bank of India's governor Shaktikanta DAS said in his speech on August 5 that the core inflation of India is still at a high level and inflation pressure is wide. It is expected that inflation may continue to be higher than the central bank's 2%-6%of inflation targets.

DAS emphasizes that continuous high inflation may undermine market inflation expectations and damage India's mid -term economic growth. The Central Bank of India will be vigilant and maintain the stability of the rupee. India's rupee exchange rate has fallen by 7%this year. With the continued upward of inflation, foreign funds flow from the Indian stock market to nearly $ 30 billion, setting a historical record; in the case of rising oil and commodity prices, people are worried about the deterioration of the deficit of the country in the country, which has caused the Indian rupee to suffer. Create.

Indian rupee's exchange rate for the US dollar in the past year (Picture Source: British Caiqing)

In addition to the tightening of monetary policy, India is also facing the pressure of rising energy and commodity prices, which may further cause consumer demand and corporate investment.

Daily Economic News

- END -

Indian media hype China is security in Pakistan, Chinese experts: hype is not necessary

[Global Times Special Reporter Cheng Yijun] India's Sunday Guardie reported on the...

Biden won a "major victory"

According to several US media reports, the US President Biden and the US Democrati...