How can the "fruit" swallow in inflation, can the United States less bitter?

Author:Look at the think tank Time:2022.08.22

US President Biden signed the "Inflation Act" in the White House on the 16th. According to the bill, the federal government will invest about 370 billion US dollars in the climate and clean energy field; invest in the field of medical care about $ 64 billion to reduce the price of prescription drugs and strengthen medical security. The bill includes levy 15%of the minimum tax on some large enterprises, and is committed to creating nearly $ 740 billion in fiscal revenue in the next ten years.

The Democratic Party quoted the analysis of the Congress tax and budget office that the bill would reduce the federal deficit more than $ 300 billion. Although the Democratic Party claims that the bill can alleviate inflation and reduce deficit, critics believe that the substantial effect of inhibit inflation is not significant.

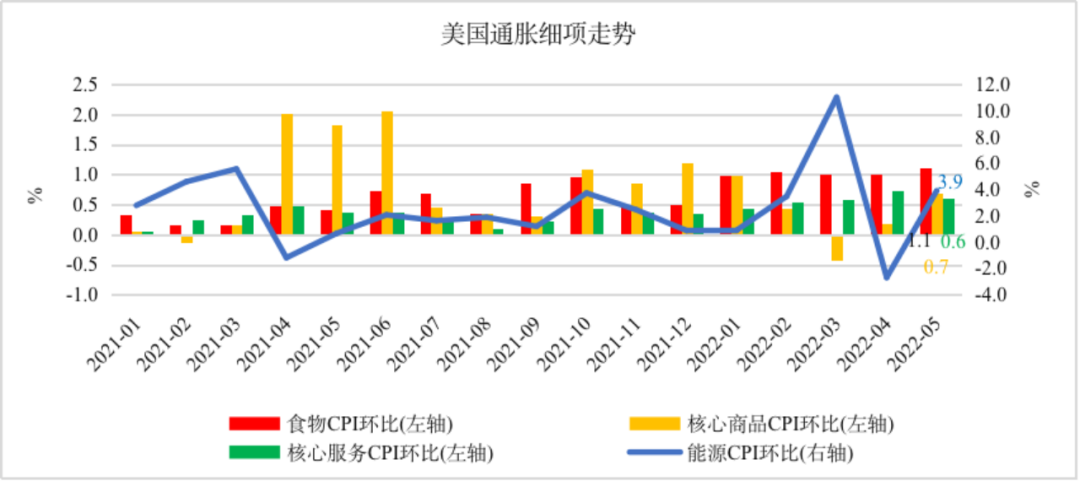

American inflation has been accelerating since a year before a year. Since March this year, consumer price index (CPI) has increased by more than 8%year -on -year. According to data released by the US Department of Labor on the 10th, CPI rose 8.5%year -on -year. In this context, the purchasing power of the United States is restricted.

At a White House press conference in January this year, the US President Biden was forced to inflation by a reporter. Half a year later, inflation is the number one issue that Biden could not avoid the president.

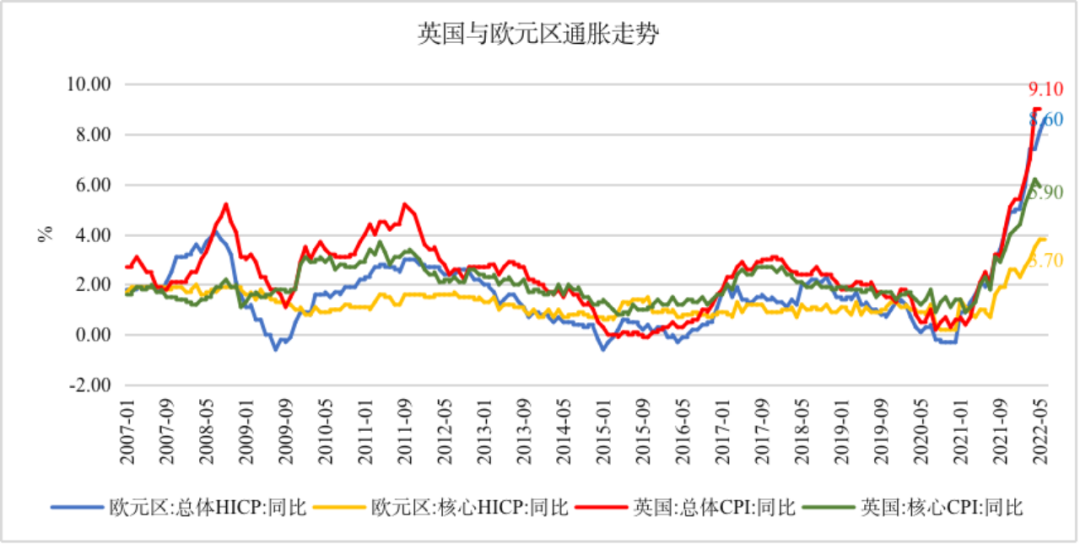

Europe is also troubled by inflation. The British CPI in May rose 9.1%year -on -year, and the core CPI rose 5.9%year -on -year; the reconciling consumer price index (HICP) in the euro zone rose 8.6%year -on -year, and the core HICP rose 3.7%year -on -year.

According to data from the International Clenging Bank, as of April 2022, the level of economic inflation in the world in the world exceeded 5%. Almost all developed economies inflation levels exceeded the central bank's goals, and more than half of the emerging market economy exceeding half of the emerging market economy Body inflation is higher than 7%.

Inflation has become one of the most urgent issues in the world.

So, how did inflation "cause" be planted? How can this "fruit" swallow?

Text | Zhang Yugui President of the School of International Finance and Trade, Shanghai Foreign Studies University, professor of economics

Master of Finance of the School of Finance, School of International Finance and Trade, Shanghai University of Foreign Languages

Edit | Pu Haiyan Watch Think Tank

This article is an original article on the lookout think tank. If you need to reprint, please indicate the source of the Source of the Source of the Think Tank (ZHCZYJ) and the author's information, otherwise it will strictly investigate the legal responsibility.

1

Inflation is fierce than the tiger

If the Nobel Prize winner Milton Friedman is alive, he will definitely speak loudly: the United States must control currency issuance! Because in his eyes, inflation is mainly currency at any time and anywhere.

On June 10, 2022, New York, USA, customers were shopping in supermarkets. Figure | IC Photo

According to a report from the US Department of Labor, the US Consumer Price Index (CPI) in June increased by 9.1%year -on -year, the largest increase since November 1981. The market expectations increased by 8.8%, and the previous value was 8.6%. Without the price of food and energy with a large volatility, the core CPI in the United States in June increased by 5.9%year -on -year, with an expected 5.7%, and the previous value was 6%. The market estimates that the Fed will accelerate the pace of radical interest rate hikes to curb inflation expectations, and at the same time, it has also aggravated investors' concerns about the decline of the US economy.

Data source: US Labor Statistics Bureau

Data source: European Central Bank, British National Bureau of Statistics

Former Fed Chairman Arthur Burns said that the poor were undoubtedly the most important victims under inflation. In the consumer basket measured by the cold price index, the actual consumption structure of different income groups is systematic. Taking the United States as an example, low -elastic necessities of low -income families account for 77%of their income, while high -income families account for only 31%of their income.

In these necessities consumption, because the living conditions of low -income families are often relatively dilapidated, more energy heating is needed to maintain the necessary living guarantee. High -income people can offset the impact of inflation by reducing the purchase of luxury goods and replacing the original high -end breakfast with cheap bread. But for low -income families, it may have been buying cheap future foods. This means that low -income people have retreat in front of inflation.

What's more terrible is that the price of essentials such as food and energy is an important factor that constitutes the general inflation of the United States and Western countries since 2021 to the present. Related studies have shown that the actual inflation pressure of low -income groups should be nearly 3%higher than those who have higher inflation pressure. Mid -high -income families can also maintain the quality of life or preserve the purchasing power of the currency in their hands through financial means such as credit, investment anti -inflation products, but these tools are expected for low -income groups. Support it.

Full information is an indispensable prerequisite for economic research and economic policies. When governance inflation has become the top priority of the Western and Western politicians, even if the Federal Reserve raises interest rates, or even starts to start a hard hike, but the effect is still not significant, the complexity of the cause of the inflation in this round is particularly worthy of careful investigation.

As the Fed's chairman Powell acknowledged, there are many factors in the current overall inflation that are not controlled by the Fed, such as cost -promoting inflation caused by Western sanctions on Russia and supply chain disconnection. The Federal Reserve's monetary policy is really possible to act as an inflation that causes overheated demand by the currency over issuance. As for the inflationary factor outside the economy, the Fed cannot be controlled. 2

Two -wheel effect -wage inflation spiral and debt inflation spiral

Like many variables in the economy, inflation has the characteristics of strong self -reinforcement and self -actuality, that is, long -term low inflation environment usually makes low inflation deep ingrains, and high inflation environment may make inflation and anchors more and more uncontrollable. Essence On the one hand, inflation expectations are expected, and on the other hand, it is also the spiral of inflation and other economic variables. Therefore, the initial neglect will greatly raise the cost of inflation.

The hallucinations brought by wage growth

When inflation is at high for a long time, the workers will adjust their expectations for future inflation, so as to consider the erosion of actual wages and require higher compensation. Because wage expenses are also an important part of the production cost of enterprises, raised salary will guide enterprises to pay for prices to pass the cost of salary costs to consumers, and finally formed a two -wheeled effect of wages and inflation circulation.

The two-wheel effect of triggering wages-inflation originally required extremely strict conditions. Because for workers, as long as the cost of re -re -aring salary and the cost of establishing a new contract is higher than the cost of living, wages will not be required, and they are willing to tolerate the rise in relative prices of some goods or services.

For the United States, the long -term low inflation environment has greatly reduced the correlation between various categories of goods and services. The change in the price of a single product generally will not spill on other goods and have a great impact on the lives of the workers. Change is often ignored. However, because the US Western policy makers ignore the inflation in the early stage, the starting conditions for wages and inflation spirals are basically available:

Taking the United States as an example, on the one hand, the consumer survey of the University of Michigan shows that workers have paid enough attention to inflation, and believe that inflation will be higher than 5%in one year. The motivation for re -bargaining for salary is already available;

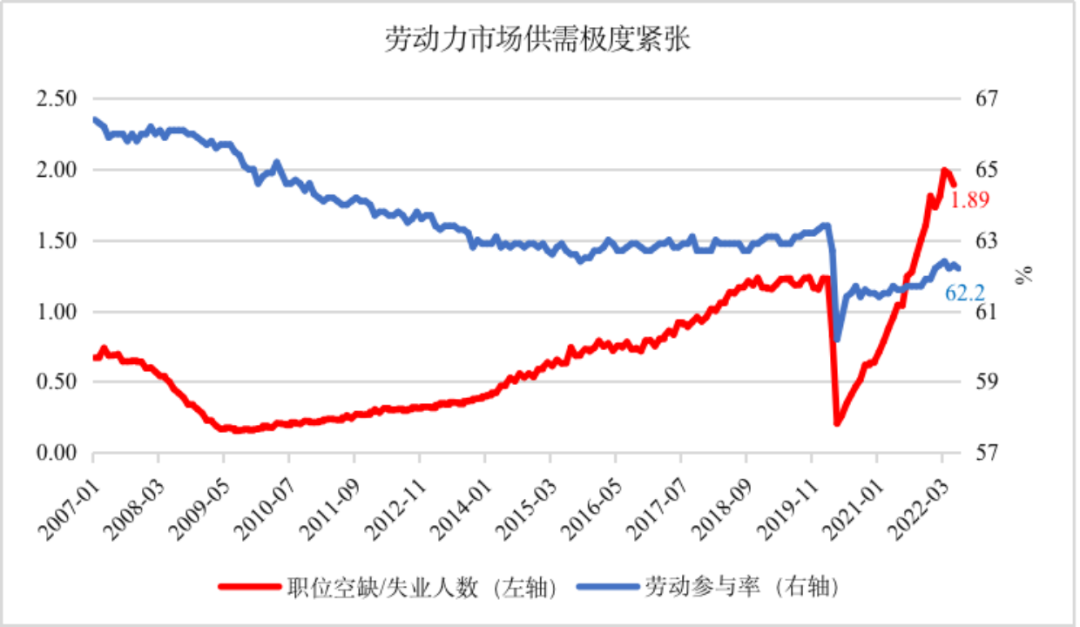

On the other hand, the current labor market is extremely tight. The labor demand expressed by the vacancy/unemployment number of jobs has almost reached the vacancies corresponding to the two positions corresponding to each unemployment population, but the participation rate of labor supply has returned slowly. The rising wages of supply and demand have been launched, and the labor force has also obtained the ability to re -bargain on wages.

Data source: Michigan University

Data source: San Louis Federal Reserve

The Federal Reserve's policy judgment in the past year is that the supply and demand of the labor market is not matched as the relative price of other goods rising. Because the constraints of the supply always relieve itself, people who leave the labor market always return, and the rise in wages can always make the labor market re -clear.

However, Fed officials may ignore important structural factors. Since Promoting Ronwalke led the Fed to repel inflation, the Eastern European drama changes in the 1990s, the disintegration of the Soviet Union, and China's emerging market economy were integrated into the global trading system, making approximately 1.7 billion people join the global labor market. The higher number of labor has reduced the willingness and ability of bargaining, so that wages are not sensitive to changes in prices, and inflation is expected to be structurally reduced.

With the aging of the global population and the "anti -globalization" restricting the flow of labor, the inadequate control of the new crown pneumonia in the United States in the United States has taken the initiative to withdraw from the market, and the structural factors that have lowered inflation have reversed.

The debt platform is high -built salary

Since the international financial crisis broke out in September 2008, almost 14 years have passed. The global economy has achieved a certain degree of recovery and growth, but the hidden deep -level contradiction has not been fundamentally resolved. And due to excessive water injection, the systemic economic risks caused by too much water are getting worse.

Some major economies will implement irresponsible economic policies while hoping that other countries will pay for their own economic policies. Although the market vitality of micro -subjects based on technological progress and financial innovation has performed in some countries and regions, in general, major economies have fallen into a vicious circle of "debt without debt".

According to data from the International Monetary Fund (IMF), as of the end of 2020, the total global debt reached 226 trillion US dollars, accounting for 256%of GDP, and the historical peak in World War II. Among them, the debt growth of developed economies is particularly significant, and its public debt accounts for GDP from about 70%in 2007 to 124%in 2020. During the same period, the growth rate of private debt was relatively mild, from 164%of GDP to 178%.

The "Global debt monitoring" report released by the International Financial Association (IIF) shows that the total global debt exceeded 3 million US dollars in 2021, reaching 3.33 trillion US dollars, a record high. More than 80 % of the debt of the newly increased from emerging market countries, the debt of emerging market countries increased by 8.5 trillion US dollars compared with 2020, exceeding $ 95 trillion. The report shows that the proportion of debt in emerging market countries is about 248%, an increase of more than 20 percentage points from the epidemic.

Of course, due to the differences in statistical caliber, the gap between IMF and IIF's respective statistics on the scale of global debt is large, but both developed countries and emerging economies have a substantial expansion of debt scale. This is an indisputable fact. According to the previous autumn economic forecasting report released by the European Commission, last year, the finance deficit of the euro zone accounted for 7.1%of GDP, and public debt accounted for 100%of GDP. The scale of US federal government debt exceeded the $ 3 trillion mark, of which the new coronary pneumonia's epidemic increased by nearly $ 7 trillion in two years since the outbreak.

For developed economies, the liquidity shrinkage and high interest rates brought by inflation and policy steering will naturally lead to higher debt repayment pressure and asset re -pricing, thereby testing the toughness of the private sector's balance sheet and profit statement, and then dragging down to increase growth Essence

Although emerging markets and low -income countries are less than developing their debt levels, they are even more difficult to face. At the end of 2020, the debt of public and private sectors issued by these countries and regions also reached a record high.

During the loose period, their high returns are in the face of cheap liquidity. The credit risk is reduced, and the financial environment after capital flow is more loose. Once the situation reverses, its domestic and foreign currency debt will be challenged by the cycle of capital outflow and exchange rate fluctuations. The depreciation of capital flow and the depreciation of the local currency promotes each other, and then conducts inflation through exchange rates. The rising inflation and inflation expectations will trigger the next round of capital outflow, and the financial environment will be tightened.

In fact, Latin America and some countries in Eastern Europe have experienced sovereign debt yields and inflation. As long as the inflation momentum of the United States and Western countries will continue, the calibration of its monetary policy will continue. At present, a mild but fragile balance may be broken by the appreciation and tightening liquidity of the US dollar at any time, and as weaker inflation anchor is out of control.

The British "Financial Times" recently said anxiously that the bad inflation data in the United States in June reminds many people in the United States and around the world, especially the most vulnerable people and the most vulnerable developing countries, and will be very difficult in the future.

3

Two macro -control -functional finance and super conventional monetary policy

Compared with the decline in the general economic cycle or the recession induced by the financial crisis, the new coronary pneumonia epidemic has its speciality. The demand side of the sealing measures is naturally liberated, thereby quickly rebounding. The fiscal and monetary policy of heaven during the epidemic greatly stimulated the rebound of demand.

There is no upper limit in fiscal policy

After the epidemic, compared with the fact that the epidemic prevention measures are limited to the spread and spread of epidemic prevention measures, the United States seems to be more enthusiastic about the signing of the bill to win more votes and seats. In the past two years, the two parties rushed to introduce the "New Crown Virus Aid, Relief and Economic Security Act" (Cares), the "American Rescue Plan Act" (ARP), and the "Infrastructure Investment and Employment Act" (Iija) The amount of remedy exceeds the scale of more than 5 trillion US dollars to ensure the basic life of private sector during the epidemic. But these reliefs are obviously not free.

In the autumn of 1981, Sakinte and Wallace, who were in stagflation, stood at the perspective of modern fiscalism. When government departments implemented responsible fiscal policies, inflation is a pure monetary phenomenon. Level; Conversely, when the irresponsible financial authorities implement the unrestrained non -Li Jiatu policy, the government’s cross -period budget balance requires that the currency authorities will collect higher inflation taxes in the future. Inflation.

For the warning of the two rational expectations of the representative of the school, the US government has already left it behind.

Two studies of San Francisco Fed and San Louis Federal Reserve show that by the fourth quarter of 2021, unrestrained fiscal stimuli will push inflation by about 3%, and the value of U.S. Treasury bonds caused by inflation will be re -distributed in the U.S. government and creditor's rights. It is equivalent to levying an additional 6.5%inflation tax to U.S. debt holders. This part of the tax burden fell on the shoulder of the US debt holder.

The first thing that is the Federal Reserve of the US debt through various unconventional monetary policies in the epidemic. When the Fed completed TAPER in March 2022, U.S. debt accounted for nearly 65%of the Fed asset scale. The actual value of the Fed's asset end is transmitted to the asset side of the private sector through the cash, reserve and reverse repurchase tools of the liabilities.

Outside the Federal Reserve, 62%of the remaining US bonds were directly or indirectly held by the US family sector, and eventually bears most of the inflation tax burden. Another 38%of U.S. bonds are held by foreign departments, and the same actual value reduces the inflation tax burden to all parts of the world.

Related data show that the US personal savings rate, which has increased to more than 30%due to the restrictions and consumption of the epidemic period, has dropped significantly to about 5%, even lower than the average level before the epidemic. The family savings rates in the European Union and the euro zone also dropped from 25%of the epidemic high to about 13%at the end of 2021, and the decline will continue in 2022.

In addition, the relief measures in these fiscal policies may also delay the speed of labor return. A lower labor participation rate makes the labor market more tense and boosted inflation.

In other words, although the unconventional fiscal policy is the same as monetary policy, it does reserve kinetic energy for recovery to a certain extent and avoids the deeper economic decline, but it is difficult to blame the current inflation that is gradually getting out of control. The Economic Annual Report of the International Clearance Bank pointed out that the part of these fiscal stimulus measures to support household income did increase the nominal GDP in 2021, but had little impact on the actual GDP. For ordinary people, the honeymoon period signed with the government's auspicious bill has passed, and inflation that comes to fight with it is obstructive and long. There is no basis for monetary policy

The central banks of various countries that implement the inflation target system and the current inflation evolution obviously cannot be removed.

More than two years ago, when the new crown pneumonia's epidemic spread globally and caused a break in the supply chain industry chain bureau, when the US economy faced large -scale stops, the stock market was fused, and the footsteps of the Great Depression were getting closer, the Fed opened unlimited quantitative looseness (QE QE (QE ) The "helicopter sprinkle money" model and reduced the interest rate of federal funds to 0-0.25%, causing the Federal Reserve's balance sheet to expand sharply. And everyone who is familiar with currency finance knows that the problem of easy to play and difficult to collect the unlimited QE can not find the optimal solution in the real world.

But even so, the currency authorities such as the Federal Reserve and other developed countries do not have to go to such a poverty -stricken technique on inflation. Its performance is a disaster.

From the first time that the overall CPI of the United States exceeded 2%of the policy goals in March 2021, the main Federal Reserve officials repeatedly emphasized that inflation is temporary, and its joy is short -term. It wasn't until the Federal Public Marketing Committee (FOMC) meeting in November 2021 that Fed Chairman Powell first admitted the durability of inflation for the first time.

Considering the well -known external stagnation of monetary policy, this is not rigorous, and this absurdity has continued to this day.

Inflation forecasts are constantly being repaired in each economic forecast announced by the FOMC meeting, and the rate hikes move forward again and again. The so -called forward -looking guidance cannot be talked about at all. Even in the meeting in May 2022, the Federal Reserve rejected the consideration of 75 basis points in interest rate hikes, but hurriedly raised the 75 basis points after seeing Pentium's inflation data in June.

On the one hand, the Fed is still emphasizing that its toolbox is not caught in the face of supply shocks and fiscal factors, but on the other hand, it is believed that inflation will achieve soft landing without affecting growth and employment. These kinds of them have greatly damaged the reputation of the Fed itself, and even the determination to repeat the anti -anti -inflation determination has been widely questioned, and the anchoring industry that inflation expects has been shaken.

In contrast, the central bank of developed countries did not show some of the more clever skills of some emerging market central banks that started interest rate hikes in 2021.

4

Two hegemonic actions -trade protectionism and marginal wars strategies

If the demand -side policy during the epidemic period is putting on a stable employment and guaranteeing people's livelihood, there is still a staged rationality, and the policy scale and exit problems can be attributed to the technical category. Western cocoons are binding.

The cost -promoting inflation encountered by the United States is largely caused by the "neighbor" policy adopted by the United States. This is why the Fed feels helpless. The report of the UN Secretary -General's Global Crisis response to the food, energy and financial systems released earlier that the food, energy and financial systems pointed out that the food, energy and financial channels have begun to interact to form a vicious circle. And everyone who is concerned about the current international political and economic situation knows that at least part of the United States has the key to resolve the key issues such as Russia and Ukraine.

Protectism as a cocoon

Since the Industrial Revolution, developed countries have not needed to peel off in underdeveloped regions through free trade. Since the end of World War II, the United States has been the biggest beneficiary of free trade as a guarantor for the global trading system.

However, the Trump administration, as the "crystallization" of the flood of American populism, pursues unilateralism in order to maximize its short -term interests, disregard the facts and sciences. The wave of "against globalization".

In fact, the academic community has already reached a consensus, and the actual damage of the trade protection acts represented by tariffs is not good for themselves. Importers passing the tariff costs of goods to consumers in downstream not only raised the price of imported goods, but also increased the price of domestic products that compete with them. The tariffs on upstream raw materials are disturbed to the overall supply chain, increasing the cost of downstream investment products, and the final trade tariff will also increase the price of non -trading products through the general equilibrium effect, so that the inflation overflows to all parts of the economy. Widely damage consumers, exporters and even importers themselves.

Studies from Peter Sen International Economic Research Institute showed that the United States' 232 tariffs imposed on all trading partners, 301 tariffs imposed on China, wood product tariffs on Canada, and Chinese tariffs on US tariffs raised the US trade weighted average tariff The tax rate is 2.5%, which helps its CPI inflation level 1.3%. If all the above -mentioned trade wars are stopped by 50%of all tariffs, CPI 1.5%can be reduced at one time.

When IMF President Cristana Geurkaya recently talks with the United States, he once again calls on the United States to cancel all restricted tariffs on trading partners over the past five years. In recent years, WTO has also continuously ruled that the United States has defeated in tariff countermeasures. These all show the negative attitudes of international multilateral mechanisms to unilateralism, and express the general demands of the international community to maintain multilateral governance mechanisms in order to effectively resolve inflation, growth, and international conflicts. Explosion the Russian and Ukraine conflict to boost inflation

Before the outbreak of the Russian and Ukraine conflict, the United States was even more concerned about the situation in Ukraine than any party. In particular, the American military -worker complex and their spokesperson that are accustomed to randomness and the blood of civilian blood in both hands and spokespersons are used to rendering Russian threats through the propaganda machines controlled by it. Then set the time window for the outbreak of the conflict, for fear that there are any signs of shaking the handheld words in Russia and Ukraine, and live off a super -drum player image. Finally, in early 2022, the United States continuously "previewed" Russia and Ukraine to ignite the war.

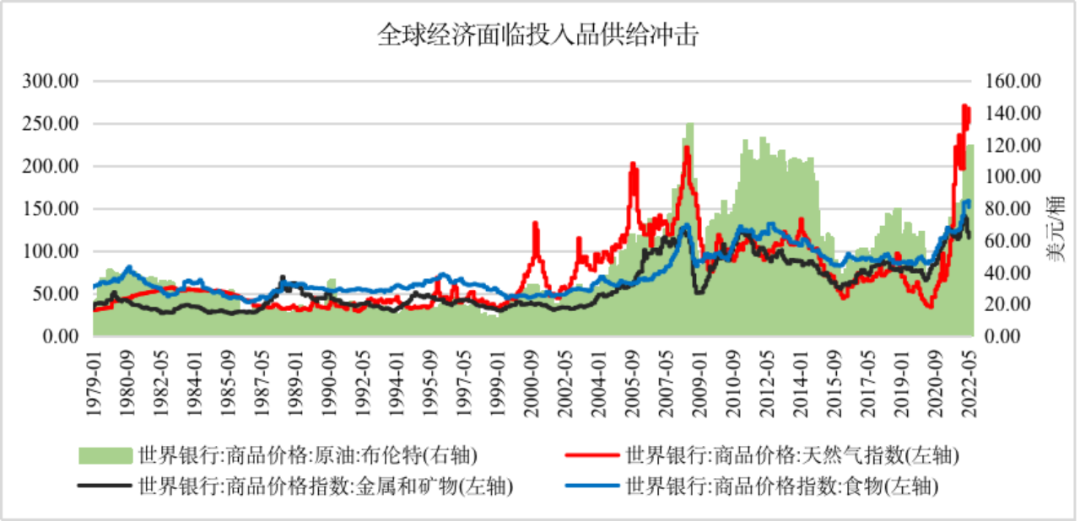

Since the outbreak of the epidemic, the price of commodities such as international energy, food, and basic raw materials has maintained the rise for a long time under the influence of supply chains and extreme weather. After the outbreak of Russia and Ukraine's conflict, the interruption of the supply chain intensified, and the grain and energy crisis intensified. For example, Russia and Ukraine, also an important producer of commodities, mainly produced oil, natural gas, agricultural products, chemical fertilizers and metals necessary for the production and consumption of various economies in the world.

Research from the International Clearance Bank shows that historically, oil prices rose 30%or agricultural product prices will increase by 10%, and global inflation will increase by about 1%the following year. The high investment (any resources used in the production process, INPUT) price has impacted the global economy. These supply chain bottlenecks that occur in the upstream of production will spread to all corners of the economy as the value chain spreads.

EU member states have initiated "comprehensive" sanctions on Russia, including all coal and sea -transport crude oil, but they dare not start with pipeline crude oil and natural gas. Even so, the impact of the supply is enough to make them more straightforward. Since last year, energy prices have contributed more than half of the euro zone inflation. As of January 2022, Russia's supply accounted for 40%of the EU natural gas consumption. In June, Russia once reduced natural gas supply to Germany by nearly 60%through the "Beixi No. 1" pipeline, which attracted the virtue of the German side. Torture in Europe's energy inflation.

Some Western countries have re -sacrificed the old handle of fiscal expenditure to families trapped in energy prices, or taking the opportunity to increase military expenditure to strengthen NATO's military existence in Europe. Rather than on the occasion of various occasions, and repeatedly emphasize how the Russian -Ukraine conflict is a "humanitarian disaster", the United States and Western countries are not as good as the fire to the ground. Self -rescue.

Data source: World Bank

5

How to say goodbye to inflation

The best time window for anti -inflation is first before inflation occurs, followed by the next time after inflation occurs.

In the late 1970s and early 1980s, Fed Chairman Walc to contain inflation, which put the US GDP growth rate from 5.5%in 1978 to 1982-1.8%. In the first 10 years of the oil crisis, the average increase of 5.5%in the first 10 years dropped to 2.5%in the next ten years. Even if you review longer history, it is extremely difficult to find a "perfect landing" example of maintaining economic growth and low employment under such high inflation and financial fragility.

Nowadays, the global economic slowdown is almost inevitable, but historical experience also fully shows that the deep -rooted inflation of root inflation will be much higher than the short -term pain that controls inflation. Late, the greater the cost of governance.

For the Federal Reserve, the priority is to return to the origin of the dual mission. It is a top priority to clarify inflation. It should establish a more clear policy response function to communicate with the market and reshape its reputation. The current Fed's performance is suffering, and the persistence of the so -called "soft landing" narrative has greatly restrained the hands and feet. At least according to the current interest rate hike path, the actual interest rate will continue to be negative for a long time, and there is still a distance from substantial tightening.

In addition, the central bank of developed countries should strengthen global exchanges and communication on its policy path, and reduce the impact of its policy uncertainty on the spillover of emerging markets.

Take a step back, anti -anti -inflation is not only the task of central banks. Non -traditional functional fiscal harmless theory has been almost evidenced, and the American and Western governments should recognize the fact. The era of low inflation has passed. It should be dropped for decades of dependence on the "loose policy stimulating the economy without paying the price", and returns to the goal of the macro policy to settle the economic cycle.

In fact, the current inflation crisis is not 啻 to promote these countries to withdraw from conventional currency and fiscal policies, and rebuild the security boundary of the security to cope with the precious opportunities of the next potential recession.

Although inflation is largely currency phenomenon, it is inseparable from the economic imbalance of a country. In a sense, a phenomenal expression of monetary policy is abused during the transition period when a country has the exhaustion of growth and new growth momentum has not yet emerged. The so -called monetary policy is the central bank's opium. It can be an angel or a devil. Any rational economic growth cannot be driven by a single round of monetary policy for a long time. In the final analysis, the endogenous progress of technology and the continuous improvement of human capital are the ultimate driving force for a country and the entire world economic growth.

In this sense, in the West, in the United States to avoid repeating the same mistakes of the previous round of financial crisis response, we cannot simply rely on the high and high fighting of monetary policy. The well -being of the people's livelihood to prevent credit expansion from being used to purchase a large number of stocks or mainly invests in large enterprises.

At the same time, while maintaining moderate flexibility of policies, countries should increase investment in technology research and development and industrialization, effectively enhance the competitiveness of the manufacturing industry, and switch the economic growth model to endogenous orbit.

Uncle Ku Welfare

Uncle Ku's book is always there! Bo Ji Tianjuan provided Uncle Ku with 15 "Before Decisions of You" and presented enthusiastic readers. The insights of senior Internet people, focusing on the core method of achieving self -growth. The author is good at insight, and summarizes some truths and methods based on his own life experience and social experience, and gives all the inspirations to all readers who feel confused and anxious in life. Be a long -termist and believe in the power bit by bit. Please comment under the article that the top 3 (more than 30) who likes the highest likes will get a book.

- END -

Pelosiqi people's affairs

【Special attention】In the United States, this hegemonic country has gradually risen and has the upper power in power, but it is the narrow politicians such as Pelosi, such as Perlis, who have a part...

This country discovered "more than ten tons of human ashes"

According to the Agence France -Presse, Polish Jobado reported on the 13th that th...