In the first half of the year, the market value of pharmaceutical listed companies has shrunk!Tiger Medicine and Changchun High -tech fell below 100 billion!Vaccine and ophthalmology are still booming!

Author:Pharmaceutical economy Time:2022.07.07

With the end of the first half of 2022, the medical sector of the capital market has also experienced huge fluctuations.

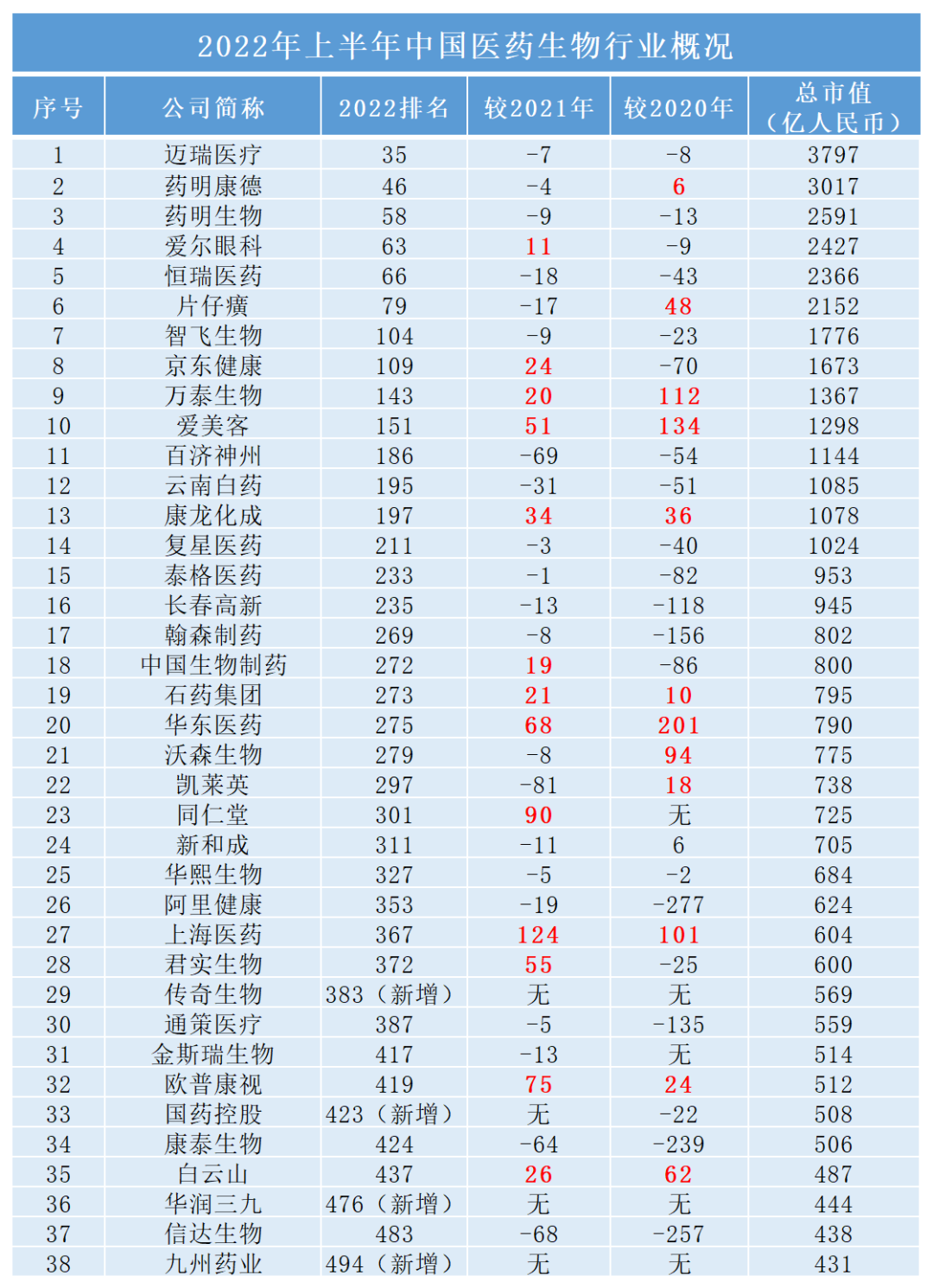

After sorting out, we can see that the total market value of all listed companies is TOP500 as the evaluation criteria. As of June 30, 2022, only 38 companies in the Chinese pharmaceutical company can be shortlisted, of which 14 companies above 100 billion are more than 100 billion yuan, ranking upward, ranking upward. There are only 13 leaps.

From the perspective of the market value, in the first half of this year, due to the limited market liquidity and the overweight policy of bidding and procurement in the industry, the stock price of pharmaceutical stocks continued to fall, and nearly 2/3 pharmaceutical companies in the list shrink their market value. Among them, Tiger Pharmaceutical and Changchun High -tech market value fell below 100 billion yuan, and the market value of Hengrui Pharmaceutical and Mai Rui Medical fell more than 80 billion yuan compared with the previous period.

Market analysis believes that since 2021, the Chinese pharmaceutical industry has begun to experience in -depth valuation recovery, with many factors such as procurement, medical insurance negotiations, research and development innovation, etc., and further accelerate market reshuffle. It is disclosed that it will become an important variable in the pharmaceutical capital market in the second half of the year.

As of June 30, 2022, the list selected TOP500

As of June 30, 2022, the list selected TOP500

Different cold and warm

Market changes are difficult to expect

In the first half of 2021 and 2022, domestic biomedical companies in the capital market continued to reduce, which profoundly changed the industry pattern. In the context of increasing medical insurance negotiations and intensive competition, the performance of mature drug companies has increased its performance and continued to expand the losses of innovative biotechnology companies; external factors such as China and the United States decoupled. Differentiated capital market trends.

As a leading company in medical equipment, Mai Rui Medical continues to take the first place in the field of medicine and biology, with a total market value of 379.7 billion yuan. In the first quarter of this year, Mai Rui medical performance was tested, superimposed on market reshuffle, continued to increase the layout of the IVD field, and was at key nodes of transformation and upgrading. Compared with 2021, Mai Rui's market value fell more than 80 billion yuan.

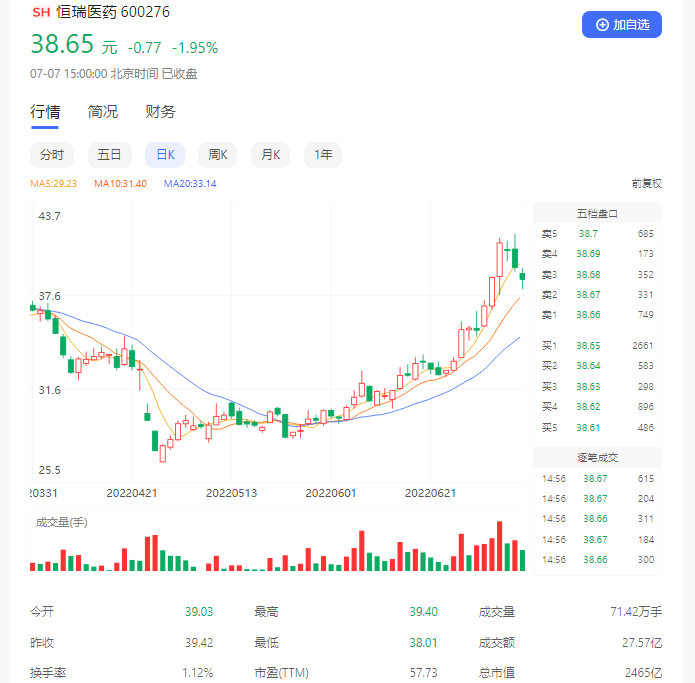

Since the beginning of this year, the capital market has reorganized the value of Chinese pharmaceutical innovation, and a large number of pharmaceutical innovation enterprises represented by Hengrui Pharmaceutical have declined. The market value of Hengrui Pharmaceuticals decreased by 27.05%compared with last year. However, with a series of actions such as innovative pharmaceutical products, management structure adjustment, overseas market innovation layout, Hengrui Pharmaceutical continued to refresh market investment expectations. On the trading day, the total market value of Hengrui Pharmaceutical increased by 47.5 billion yuan, and the stock price rose by 23.9%. Compared with the previous downturn, as of the close of July 7, Hengrui Pharmaceutical's market value was 246.5 billion yuan.

The three giants leading the Internet medical treatment are different. Jingdong's health has remained stable and rises slightly. Compared with 2021, the market value increases by 4.24%, and its market value is 167.3 billion yuan. Ali's health continues to decline, which is significantly reduced compared with 2021. Withdrawing from TOP500 in 2021, it has not returned so far.

In addition to the Yunnan Baiyao of the Chinese Medicine sector, the rest of the trend is good, and there is a good momentum, and there is a lot of reappearance of Chinese medicine. Tongrentang was shortlisted in 2021, with a market value of 72.5 billion yuan, an increase of 17.56%compared with last year; although Baiyunshan has decreased compared with last year, it has been promoted upward for two consecutive years, and currently ranks 437.

Benefiting from the growth of downstream demand at home and abroad, the domestic CXO industry chain has global competitive advantages, and the industry's prosperity has continued to rise. Yaoming Kant continued to rank the CXO industry's top chairs, ranking second in the field of pharmaceutical and biological, and currently market value of 301.7 billion yuan; followed by Kang Longhua into 13th place in the pharmaceutical and biological industry, the market value increased by 1.25% last year Essence

As the only domestic two -priced HPV vaccine in China, Wantai Biological and Watson Biological, Wantai Bio has benefited from the continuous influence of the new crown pneumonia. There are growth, currently 136.7 billion yuan; Watson creatures decreased by 13.33%compared with last year, only 77.5 billion yuan.

The medical beauty and ophthalmology industries that have not been affected by the epidemic and policy adjustment are also steadily growing.

The first market value of "Three Swordsmen in the Medical Beauty" is 129.8 billion yuan, an increase of 11.92%compared with 2021. On June 1 this year, Opangzhi announced that the Hefei Ophthalmology Hospital was issued by the Hefei Ophthalmology Hospital. "Registration and Approval of Preparations for Medical Institutions", the hospital can start to prepare and sell low -concentration Atto for children and adolescents. Within a month after the news was announced, Opangkang's stock price floated more than 20 %.

The Chinese medicine industry is dazzling

CDMO competition is fierce

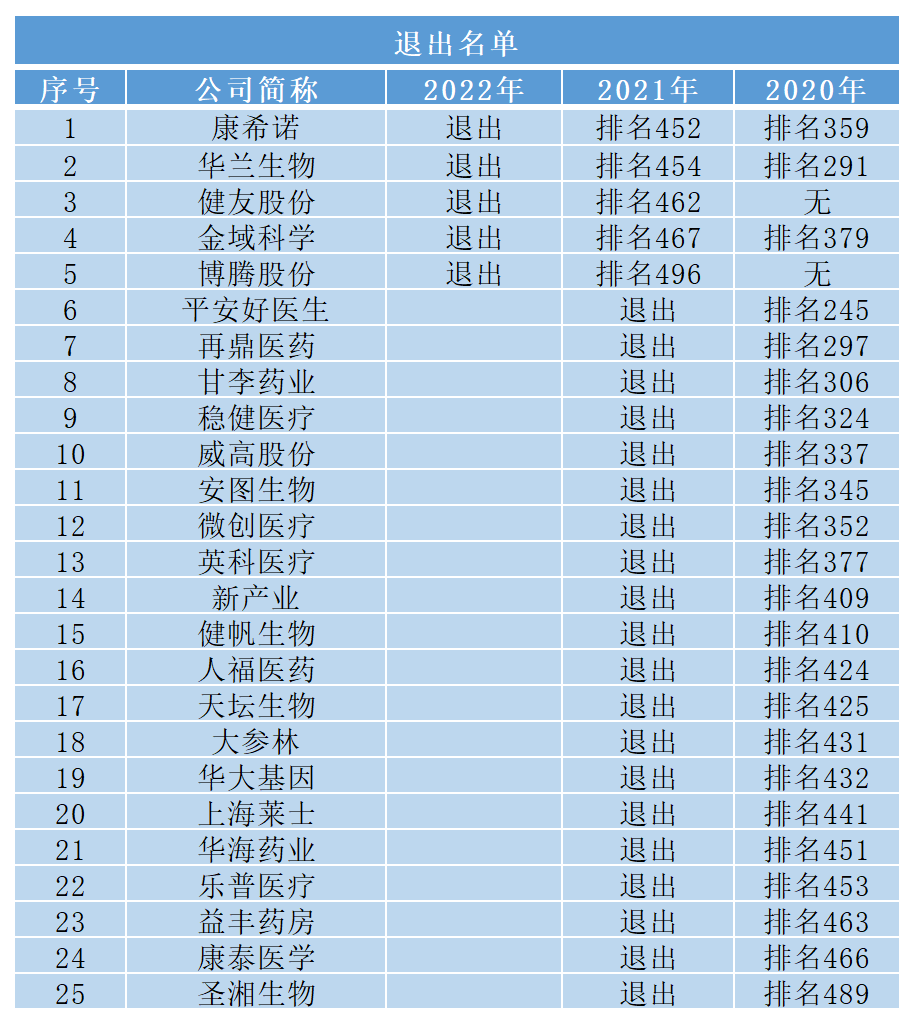

In the first half of 2022, 4 companies were newly shortlisted, namely legendary creatures, Chinese medicine holding, China Resources Sanjiu, and Kyushu Pharmaceutical. Domain science.

On February 28 this year, the legendary creature CARVYKTI (Sidaki Olun Sai) received the FDA (US Food and Drug Administration) listing approval, becoming China's first CAR-T product to successfully "go out to sea". Legendary creatures are shortlisted for TOP500, which is not surprising.

As one of the leaders of the Chinese medicine sector, China Resources Sanjiu was shortlisted for TOP500 in 2022, which once again confirmed that Chinese medicine companies can still release huge energy after many years of charging and transformation and upgrading. In the CDMO industry in the same place, Kyushu Pharmaceuticals entered the list and Botang retired. Based on the rapid development of global CDMO business demand, and a series of favorable policies such as the China Pharmaceutical Located License Organization (MAH) and the acceleration of new drug reviews, the CDMO industry has always been in good momentum.

So far, the domestic CDMO echelon has a pyramid layout. Among the front -line echelons, Yaoming's enterprises have the leader, and Kang Longcheng and Kaile are behind. Jiuzhou Pharmaceutical and Botan shares are in the quasi -line echelon. For CDMO companies, the most important of which is production capacity. Who can enter the front -line echelon in the first line of the two quasi -line echelons, we will wait and see.

As a BIOTECH "star" company, Kangshino has recently announced the termination of the "Promotional Service Agreement" signed with Pfizer, a multinational pharmaceutical company. Recently, it has been reduced by foreign capital group twice. The microcosm of the enterprise seems to be able to work harder as soon as possible to find the development path as soon as possible.

The vaccine track seems to be like an innovative medicine track, entering the stage of homogeneous competition. As one of the leaders, Kangtai Bio has fallen sharply, and the market value rate has fallen by 25.22%. The leading leaders of Zhifei Biological, Watson Biology, and Wantai Bio still maintain their original status, but not progress is to regress, and their risk of falling down is not low. At the same time, Hualan Bio has withdrawn from TOP500.

As a global heparin raw material leader, Jianyou shares, watching its recent dynamics, and had previously been regulated by the company's transfer to the company's company with a private name; secondly, it intentionally touched the CDMO business to broaden the company's business scope, but the original new drug research and development and listing of listing and market entrance There may be expected risks.

Earlier, the "poisoning" incident of Zhang Moudong, the head of the Zhengzhou Clinical Inspection Center in Henan in early 2022, was placed on the cusp of the wind. With the number of normalized nucleic acid testing, the "business" of 100 billion -scale nucleic acid testing has been reduced, and Jinyu Medicine, which is a leader of medical testing services, is also affected.

Edit: Yu Chenglin

- END -

Another batch of drugs price adjustment!

June 27thWuhan Medical Insurance Bureau issued noticeAccording to the unified requ...