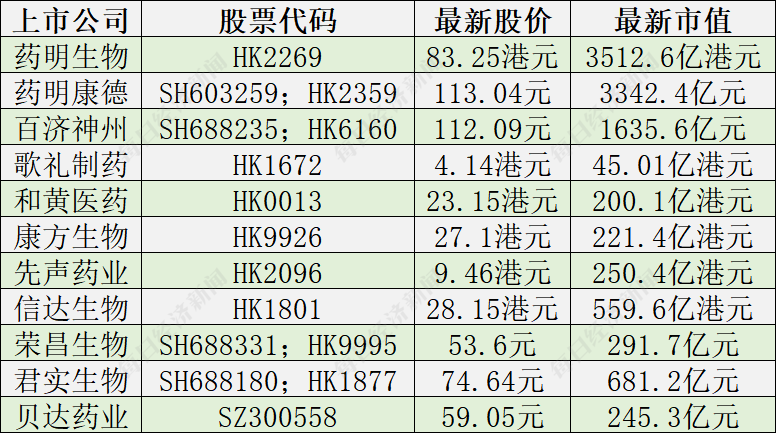

CRO leading news may be lifted, and the stock price of innovative pharmaceutical companies continues to warm up the industry: pseudo -innovation enterprises will gradually clear

Author:Daily Economic News Time:2022.07.06

Today (July 6), the biomedical sector of Hong Kong stocks rose 9.40%, the Ge Li Pharmaceuticals rose 6.98%, and the increase in Yellow Medicine, Kangfang Biology, and Xianyin Pharmaceuticals increased by more than 5%.

Yesterday, the innovative medicine CRO (pharmaceutical research and development outsourcing company) pharmaceutical biology rose 6.51%, and there was market news that it was expected to be removed from the "Unverified List (UVL)". Yaoming Biological executives confirmed to the reporter of "Daily Economic News" that Wuxi subsidiaries have been checked and Shanghai subsidiaries are waiting for inspection.

This means that the "sealing" pharmaceutical biological stock price for 5 months may be lifted. The "rise" of the innovative medicine sector seems to be a positive response to the news.

On July 6, He Shan, director of Investment Research, told the reporter of "Daily Economic News" through WeChat that if Yaoming creatures were successfully removed from UVL, it would form a great benefit to the innovative pharmaceutical industry.

Innovative drugs are good for policies, and the stock price is heating back

In the spring when the epidemic raid, facing the frustration of drugs to the sea, the cold winter of domestic innovative drug companies lasted for nearly half a year, and finally recovered with the unblocking of Shanghai on June 1. After the news that Yaoming creatures are expected to delete from the "unknown list", the market confidence seems to have a more concrete carrier.

On February 8th, Yaoming Biological disclosed that the US Department of Commerce included Wuxi Yaoming Biotechnology Co., Ltd. and Shanghai Yaoming Biotechnology Co., Ltd. in the "unattended list".

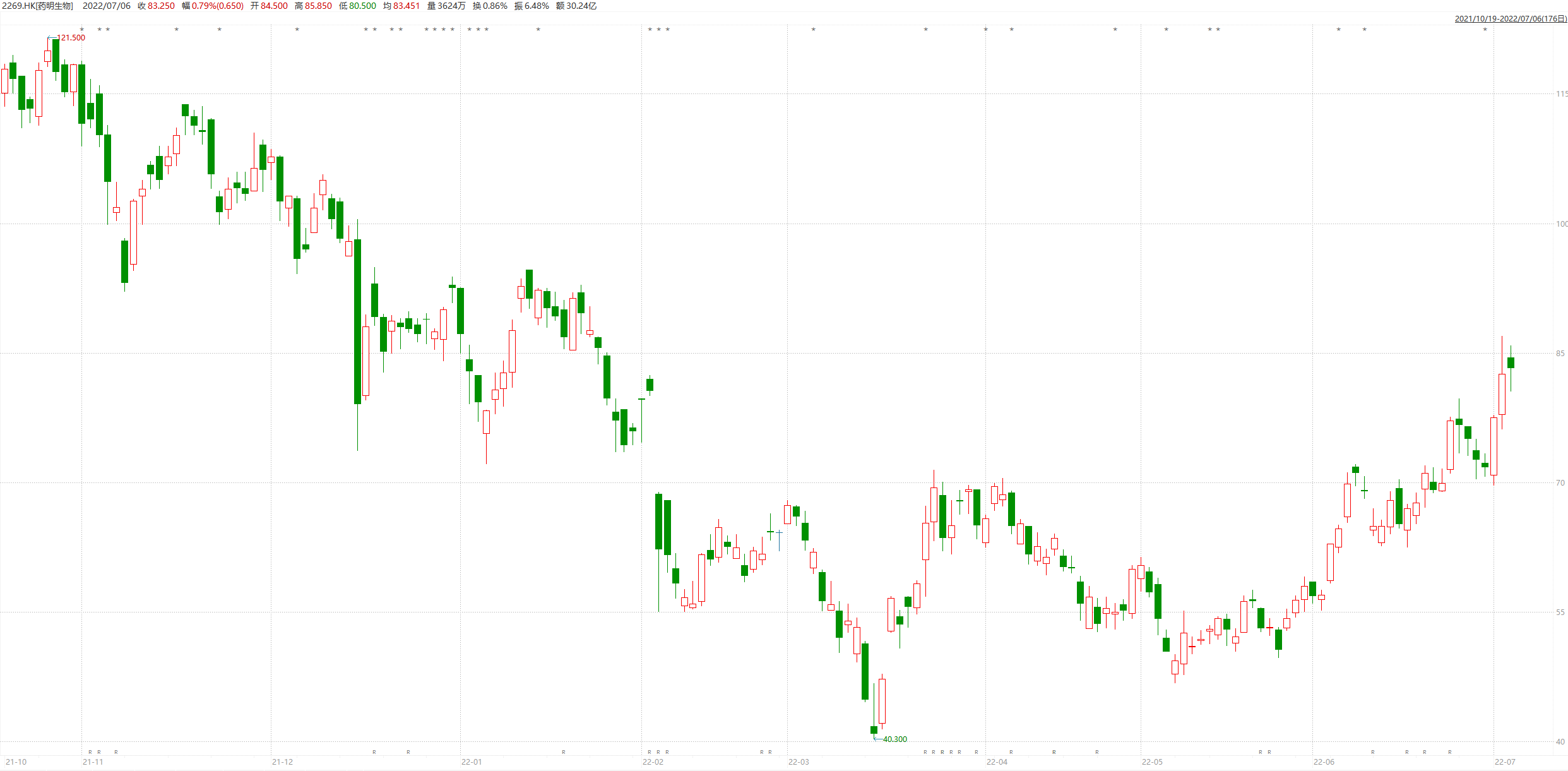

Although at the conference call in February, Chen Zhisheng, CEO of Yaoming Bio, repeatedly emphasized that UVL is different from the so -called "entity list" or "black list" The controlled products have been affected, but then Yaoming's biological stock price has been lower for 4 consecutive months. Affected by this news, the stock price of many innovative drug chain companies fell into a downturn.

Since June, Yaoming's biological stock price has gradually strengthened

Image source: Wind screenshot

In fact, since July last year, the Drug Review Center of the State Drug Administration (CDE) released the "Principles of Clinical R & D Guidance (Draft for Soliciting Opinions), a clinical value -oriented anti -tumor drug clinical R & D guideline (draft) After rolling, reducing price reduction, and being frustrated in the sea, it has gradually left the valuation bubble to enter the precipitation period.

Recently, the favorable policy level is frequently considered a precursor to the recovery of the industry's environment. In May of this year, the National Development and Reform Commission issued the "Fourteen Five -Year Plan" Biological Economic Development Plan ", pointing out that" conforming to the new trend of the cure "cure" to the center of health, and developing a biomedicine for the health of the people's lives "; On June 20 this year, the CDE released the "Single -arm Clinical Test to Support the Applicive Technical Guidance Principles (Draft for Soliciting Opinions) for supporting the application of anti -tumor drugs", and proposed that in the future Choosing one -arm test as a key clinical trial for drug listing is of great significance for reducing the number of test persons, shortening the time of new drugs, and saving costs.

Before market rumors of the good news of Yaoming creatures, the stock price of biological innovation pharmaceutical companies represented by Biota Bio, Rongchang Bio, and Kangfang Bio has picked up in June.

In the same month, the domestic PD-1 manufacturer Junshi Biological and Beida Pharmaceutical issued a fixed increase announcement. The total amount of funds raised by the former was not more than 3.969 billion yuan, of which 3.671 billion yuan of fundraising was used for innovative drug research and development projects. The company's headquarters and R & D base projects; the latter intends to raise funds from the actual controller of not more than 1 billion yuan, and the raised funds raised will be used for "Beida Pharmaceutical (Lazhou) Innovation Pharmaceutical Industrialization Base Project" and supplementary mobile funds.

Industry insiders: The development of new crown drugs has narrowed, and differentiated new drugs have better development

In the past six months, the popularity of the new crown drugs represented by the new crown oral medication remained high, and it also attracted some market attention that was originally developed by innovative drugs.

Taking Junshi Bio as an example, its PD-1 drug Tripley Midarity (product name "Takiyi") newly added indications for the listing application was approved in May. /Patients for recurrence or distant metastatic esophageal squamous carcinoma. This means that the company is steadily promoting the strategy of expanding PD-1 products from childhood to large adaptive expansion, and it is expected to improve the company's bottom position in 2021 in the sales revenue of PD-1 antibody drugs. But this news has not stirred much water in the capital market.

The domestic new crown candidate oral drug VV116 has become the focus of the market's attractive attention, and the company has therefore become one of the few innovative drug companies that have risen in February to April this year.

While the new crown drug attracts market attention, the research and development process of domestic innovative drug companies is also "low -key".

According to the "Medicine Guanlan" related WeChat public account of Yaoming Kangde, according to incomplete statistics, more than 30 new drugs (excluding new indications, biological drugs, Chinese medicine, and vaccine products) were first approved by the State Drug Administration for the first half of the year. Listing. Among them, more than a dozen new drugs were approved by accelerating priority review procedures. From the perspective of treatment, these new drugs are mostly anti -tumor products.

The reporter noticed that diversity and differentiation are the direction of the future of innovative drugs.Taking the domestic innovative drug company Baiji Shenzhou as an example, it developed the main field of anti -tumor field, but took the first step in the field of inflammation and immunology at the end of last year.In addition, in addition to tumors, the focus of the R & D of Cinda Bio and Junshi Biological includes autoimmune diseases and metabolic diseases.He Shan believes that the innovative pharmaceutical industry is currently in the "supply-side reform" stage. The ME-TOO pseudo-innovation enterprises will gradually clear up, and the powerful heads can come out.With the ease of the new crown epidemic situation, the space of the new crown drugs will become smaller and smaller in the future, differentiated, and non -tumor drugs will develop better.

(Cover picture source: Photo.com -500668961)

Daily Economic News

- END -

The lump that does not hurt or itchy is lymphatic cancer!Don't care about these 8 categories!

Suddenly, there is a lump on the neck, will you be nervous? This may be an early w...

As of 24:00 on June 18, 2022, the latest situation of Henan Province's new coronary virus pneumonia epidemic

As of 24:00 on June 18, 2022, the latest situation of Henan Province's new coronary virus pneumonia epidemicAt 0-24 on June 18, there were no new local diagnosis, asymptomatic infections, and suspecte...