Yaoming was equipped with 63.7 billion in 3 years, but only spent 2.148 billion "fire saving"?

Author:Yaizhi.com Time:2022.09.27

Yaoming was equipped with 63.7 billion in 3 years, but only spent 2.148 billion "fire saving"?

Source: Gazette Society/Kris.

On September 26, Yaoming Bio announced that the company has decided to use the purchase of repurchase, and plans to repurchase shares (equivalent to RMB 2.148 billion) at a total price of no more than 300 million US dollars from time to time.

The repurchase was authorized as early as June of this year's shareholders 'annual conference. The company was approved to buy up to about 426 million shares, accounting for 10%of the total number of shares issued on the day of the shareholders' anniversary conference.

The Bioming Biological Biological Biological Biological Biological Biological Biological Biological Biological Biological Biological Biological Biological Biological Biological Biological Biological Biological Prosper's inherent value or actual business prospects of the company's repurchase of shares provided a good opportunity for the company to repurchase shares.

Since July 2021, Yaoming biological stock price has fallen from a maximum of HK $ 148 to the current level of HK $ 48. The decline in this round has been close to 70%, back to the third quarter of 2020.

However, in the past three years, the number of shares of Yaoming Biological Sales has reached 9 times, and the scale of the distribution of sales exceeds 63.7 billion Hong Kong dollars. Morgan Stanley has played a more important role in it.

In

The amount of repurchase this time seems to be more like a "cup of water" for the huge scale of sale in the past, but it is optimistic that at least has a trace of confidence in the market.

01

Why do Yaoming creatures kill valuations?

The price -earnings ratio of Yaoming Bio has returned to the current 40 -fold increase from over 300 times in mid -2021. It is essentially the change in the external environment that has made the market's expectations from the company's expectations to decline.

From the perspective of rearview mirrors, the turning point of all is the release of the new version of the CDE version of the clinical guidance. The logic of long -term prosperity of the upstream demand end of the CXO has begun to crack. The turning of domestic pharmaceutical companies' R & D strategy has influenced the growth of R & D expenditure. This is also from the "brother enterprise". Yaoming Kant's DDSU business growth level is concentrated.

"In recent years, Yaoming Bio accounted for no more than 25%of domestic revenue. What are the fear?"

The market performance proves that once the logic of the high valuation industry is loose, or there is negative news, it is easy to cause the "Domino card" because of the fugitive of the organization.

1. The difficulty of market share is increasing: Yaoming creatures once hovered in 5,000-600 billion. We all know that from 1 to 10 far more than 0 to 1. Yaoming creatures wanted to get from 500 billion to trillion at that time. Obviously, they needed need The resonance of the fund, fundamentals, and news surfaces. At that time, the news surface had cracks, and the capital surface (not sufficient transaction volume) also had a certain difference, and the fundamentals (the third and 3 billion levels of profit scale in the world) It does not seem to support this logic.

With the course of the 500 billion to trillion-dollar market value of Ningde Times, the company's average daily transaction volume will be more than 20 billion (the peak value of the Pharmaceutical Bio-Top grid is only 30-5 billion areas), and it has stabilized the global power battery boss worldwide. Status (deducting a net profit of non -13 billion levels in 2021), and the new energy track is at a thriving stage.

2. The uncertainty of the new crown income is eliminated: Whether it is Kant or a creature, the new crown orders undertaken during the epidemic are not a small number. With the release of epidemic prevention policies around the world, the new crown mildness or even asymptotic, plus the new crown, plus new crowns, plus new crowns The increase in vaccine vaccination rate and overcapacity of various vaccine manufacturers will inevitably cause the impact of the income model for biopharmaceuticals (neutralized antibodies, vaccines) CDMO.

In the first half of 2022, Yaoming's new crown revenue reached 2 billion, and the annual expected annual expected revenue ratio was close to 20%. By 2023, the revenue of the new crown will drop to about 1 billion. The annual growth rate fell to 30-40%.

3. The competitiveness brought by geopolitics weakens: The Department of Pharmaceuticals puts its attention to Singapore. In addition to increasing overseas production capacity, the core purpose also avoids geopolitical factors that affect business. The increase in overseas production capacity will inevitably increase the overall operating costs in the medium and long period. If more customers do not consider the cost of the cost, they may affect the profitability of Yaoming creatures and weaken their other overseas CDMO manufacturer's price advantage.

In addition, it is worth noting that new entrants such as Biotech to CDMO and raw material pharmaceutical companies have transformed CDMO. Although it fails to pose a threat to the main core orders, it will inevitably have advantages in the schedule of time. The risk of overcapacity does exist.

02

Where is the bottom?

200 billion Hong Kong dollars, is it the "bottom" of Yaoming creatures?

The bottom is from the market, not predicted. We can still get a lot of inspiration from the historical trend of the global CDMO brother Lonza.

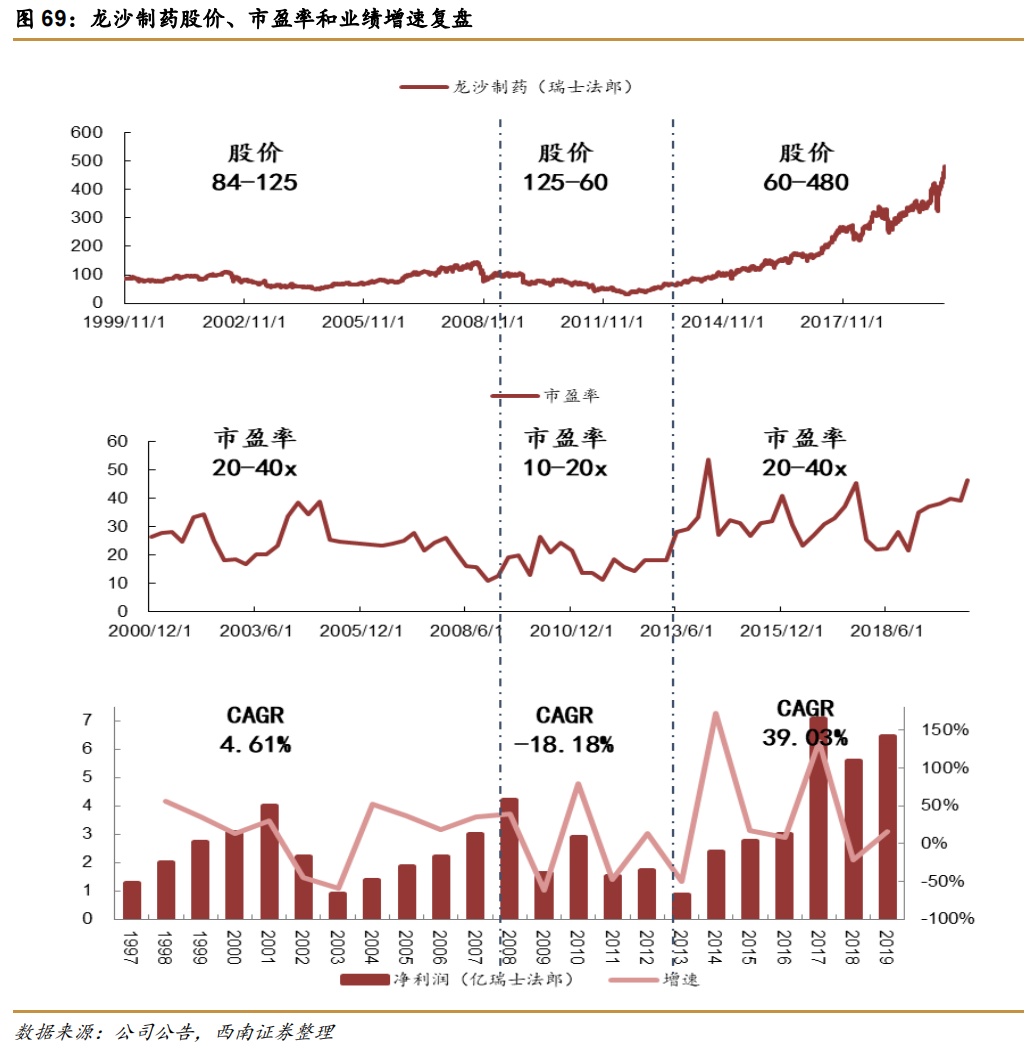

The development of Longsha Pharmaceutical (Lonza) can be divided into three stages (as shown below). In the first stage, the company was already a small analysis CDMO leader at that time. The compound annual compound growth rate of net profit from 1997 to 2007 was 4.61%(the price-earnings ratio 20-40 times the interval); in the second stage, due to the stricter economic downward and industry supervision, and the company did not stop the expansion of production capacity, the performance growth rate slowed down. 2008- 2008- In 2012, the price-earnings ratio was 10-20 times the interval; in the third stage, the company ushered in the vigorous development of the pharmaceutical industry and its performance increased rapidly. In 2013-2019, the compound growth rate of net profit was nearly 40%, and the price-earnings ratio was 20-40 times the interval.

Affected by the global environment (at the same time the company's performance declined in 2021), Longsha also opened a round of decline in early 2021. The current market value is about 238.9 billion yuan, corresponding to the price -earnings ratio of 12.57 times. Of course, the current stage of Yaoming Bio is very different from Longsha. Tracking the guidance of the exchanges of the management of 2021, the company has maintained an optimistic attitude of maintaining a growth rate of about 40%in the next few years. The stage is a bit similar, even better than Longsha.

Based on the extreme analysis of Hong Kong stocks, due to the growth rate of the net profit expected by pharmaceutical biology in 2023, the expected growth rate of the new crown was 30-40%, then the most pessimistic may be at the market value of about 170 billion Hong Kong dollars (30 times the dynamic price-earnings ratio in 2022). There are funds to recognize its cost -effective advantage.

03

The stock price has plummeted, and the Department of Pharmaceuticals still "win" in industrial investment

Although the stock price of Yaoming creatures has plummeted, it cannot cover up the investment vision and strength of Yaoming creatures.

Yaoming Biological Industry Fund is a wholly -owned investment platform of Yaoming Bio. According to incomplete statistics, the known Yaoming Biological Industry Fund has invested 10 projects, including 6 innovative pharmaceutical companies and 4 upstream of the biopharmaceutical industry.

For these 10 projects alone, we can see three different "show operations".

1. Investment binding customers

Take Beihai Kang, a Hong Kong stock listed company, as an example. The Yaoming Biological Industry Fund invested more than $ 5 million in the company's Series C. In fact, Beihai Kangcheng's transaction amount to Yaoming Bio far exceeded the investment amount.

Beihai Kangcheng not only purchases CMC, CDMO and other related services from Yaoming Biology, but also gives the authorized Yao Ming creatures in the company's pipelines. In the future, it will be required to pay milestones and dividends. Beihai Kangcheng's prospectus shows that the company and Yaoming Bio have a cumulative transaction value in the past three years, which is close to 100 million.

2. Acquisition with peers and growing upstream

Yaoming creatures know how to use their own advantages to invest and acquire them.

In October 2019, Yaoming Bio officially controlled Bolger (50.1%), and the total acquisition price was about 300 million yuan. Boglon is the main supplier of domestic purifying fillers. The company is one of the few companies in China that can produce agarose and micro -balls (not more than 3). The production capacity and sales are ranked first.

In March 2021, Yaoming Biological acquisition of CDMO Suqiao Biological, which further enlarged the company's scarce production capacity at that time after the acquisition. This transformation comes.

In addition, Doning Biological, a biological consumable head company invested by Yaoming Biological Industry Fund, has launched the Hong Kong IPO. The intelligent production solution of biopharmaceuticals is highly collaborated with Yaoming biological business. It does not rule out the possibility of continuing investment or future mergers and acquisitions.

3. Use your own status to empower the investing enterprise

In terms of "stock trading", the most classic World War I of the Yaoming Biological Industry Fund is Morimon International.

In June 2021, the issue price of the IPO of Monatsu International Hong Kong Stocks was about 2.48 Hong Kong dollars, and Yaoming Bio, as the cornerstone investor, invested 6 million US dollars. At present, Monsuya International's stock price is HK $ 8.26. It is assumed that Yaoming creatures have not reduced their holdings, and the floating profit is about 2.33 times.

After the listing of Monatsu International has a lot of potential associations with Yaoming creatures. Pulfulous creatures have purchased a disposable reactor of Sonong International since 2016. Yaoming Bio is not only the company's long -term purchasing customers, but also serves as Samsatsu. "Effective" endorsement PR.

It is expected that Yaoming creatures will give more "new classic investment cases" in the future.

Conclusion: As the stock price gradually returns to a reasonable area, Yaoming creatures may give more sincerity, and the company's stock price stops and stabilizes, and it is not far away.

Disclaimer: This article is the content of Yaozhi.com, and the copyright of the pictures and text belongs to the original author. The purpose of reprinting is to pass more information, which does not represent the viewpoint of this platform. If the content, copyright and other issues are involved in the work, please leave a message on this platform, and we will delete it as soon as possible.

- END -

A letter from Surabaya County to the county's child supervisor and chief director of the county

Children's supervisors and chiefs:The Mid -Autumn Festival is approaching, and it is time to reunite again. Due to the severe and complicated situation of the prevention and control of the epidemic, i...

Chengdu High -tech, Jinjiang, Longquai, and New Capital issued the latest notice

In the early morning of September 3rd, the Xindu High -tech Zone's new crown pneum...