Will the unbearable killing will be more powerful?

Author:Yaizhi.com Time:2022.09.26

Source: Archimedes Biotech

We are all living hard.

This week, the market was super dark. The flood is happening around. The destructive results of the Fed's radical interest rate hikes and the soaring US dollar indexes are still on the way. All companies in the competition field are facing the test of survival. To a certain extent, it can be understood that China Mobile, China Telecom, Sinopec, China Oil, and China Shenhua rebel against the trend. High score is the appearance, the oligopoly monopoly, and the system is in the system.

In the past four years, the pharmaceutical industry has actually undergone a large -scale survival pressure test, which has no more test than the collection. Even in the economic recession, the treatment needs are rigid.

The original intention of collecting collection is to save expenses for medical insurance, without excessive interpretation as an forced innovation. We don't have to praise the suffering, but most of the enterprises involved in the collection of collection have relied on the toughness and the industry's just need, and most of them have slowed down and rebuild their blood capacity. Jackiers can't kill, what are the terrible?

However, a small number of enterprises are still struggling, and their lessons are worth reflecting.

01

Coronary

The coronary bracket is the worst battle for the collection.

In 2019, the wind and daylife, minimally invasive medical cardiovascular intervention income of US $ 265 million and net profit of US $ 111 million, is the most powerful business sector, which provides a source for nurturing and innovative layout.

In November 2020, the coronary bracket set was adopted, with an average decrease of 93%. The minimally invasive medical product Firebird 2 was priced at 590 yuan, and the FireKingfisher was offer for 750 yuan.

Since then, it has been implanted with a 590 yuan coronary bracket for 30,000 yuan. It always feels weird.

In the first half of this year, the income of minimally invasive medical cardiovascular intervention has shrunk to $ 60.22 million, with a loss of 4.33 million US dollars. After losing the ability of hematopoiesis, the crazy dismantling company is listed to allow the capital market to nurture its innovative layout. In other words, after the coronary bracket business was severely damaged, minimally invasive medical treatment did not rebuild the blood -making ability, but threw the consequences of collecting collection to the secondary market.

In the first half of this year, minimally invasive medical cash reserves decreased by 343 million US dollars, with R & D expenses of US $ 186 million. The former was 1.8 times that of the latter, and expenditure control was poor. The growth rate of sales costs and management expenses is greater than the growth rate of revenue, and the efficiency is low.

The winter has arrived, and it is getting more and more difficult for the capital market to reach out to the capital market.

At the time, the Lepu Medical Coronary Scholar was bid for 645 yuan. The appointment of his appointment had to finish with tears. In the first half of this year, the conventional business of the medical device sector (except for new crown testing) revenue increased by 43.29%year -on -year, of which the coronary innovation product (drug balloon, degradable stent, cutting balloon) increased by 61%year -on -year, and the proportion of coronary revenue increased to reached to the increase of revenue to the revenue 69%, the proportion of traditional metal drug stent revenue accounted for 12%.

Innovation has not been delayed. R & D investment is 570 million yuan, an increase of 27.3%year -on -year, accounting for 10.6%of the revenue, covering coronary, peripheral, structural heart disease, pace -electrical physiological, heart failure, neural regulation, health management fields, in the future, in the future, in the future, in the future Four years are expected to be listed on 22 heavy products, with an average of more than 5 models per year.

The EXCROSSAL product of Lanfan Medical subsidiary Jiwei Medical has the lowest price at 469 yuan/branch, covering more than 2,300 hospitals across the country. In the first half of this year, it sold more than 200,000. The domestic market share further increased to 23%.

The performance fell, and the income of cardiovascular and cerebrovascular products fell from 1.737 billion yuan in 2019 to 710 million yuan in 2021.

In the first half of this year, the income of cardiovascular and cerebrovascular products in the first half of this year increased by 3.4%year -on -year, and the gross profit margin also turned up. Among them, the revenue of the catheter aortal valve replacement system (TAVR) revenue increased by about 110%year -on -year. The coronary bracket of polymer drugs began to contribute performance. Innovative medical device "Beautiful Mosh coating coronary arterial balloon ducting catheter" has been recently approved.

The coronary bracket renewal rules have improved the margin, and the maximum effective declaration price is 798 yuan, which is the highest high -ranking price of the collection in that year. Compared with the respective bid price, there is room for improvement. 35.25%, 645 yuan+23.72%), plus 50 yuan with service fee, can cross the profit and loss balance line as a whole.

The 798 yuan ceiling is still too low.

02

insulin

This week, some investors asked Gan Li Yaowe to care about the health of the 74 -year -old chairman Gan Zhongru.

The degree of deterioration of insulin competition is far less than that of coronary brackets and generic drugs, but Gan Li Pharmaceutical has reduced prices in the collection and finally eats bitter fruits.

In November last year, the average decrease in insulin collection was 48%, and Ganli Pharmaceutical reported that he had super low -cost deterrent opponents and shocked himself. The company's 6 insulin products all won the bidding level, of which 4 were bids in Group A, which means that the decline was huge. Submarine insulin (30r) was off -price at 17.89 yuan/branch, a decrease of 64%, and the door winter insulin reported 19.98 yuan/branch. , Decreased by 72%, accounting for the product with the largest proportion of revenue -glycry insulin injection (Changxiulin) 48.71 yuan/branch, a decrease of 63%, obtaining nearly 13 million basic bands.

Old opponent Tonghua Tonghua glycotium glycotium insulin quotation was 77.98 yuan/branch, a decrease of 41%. Foreign company Sanofigan's insulin quotation was 69 yuan/branch, a decrease of 48%, and the basic band was 12.12 million. According to this data, the total revenue was 836 million yuan. On the day of Jizhi, Gan Li Pharmaceutical announced the high -profile "recruiting thousands of sales elites to the country", proud of obtaining the first year of the first year of the agreement, 35.377 million, covering a total of more than 21,000 medical institutions, of which nearly 10,000 new access medical institutions. In the first half of this year, the sales volume of preparations increased by 23.2%year -on -year, of which the sales volume of non -Changxiulin series products increased by 123.0%year -on -year.

However, in the first half of this year, revenue was 835 million yuan, a year -on -year decrease of 43.4%, and net profit loss was 198 million yuan, a year -on -year decrease of 153.0%, of which Q2 lost 311 million yuan.

What is the significance of getting more market share when the market has shrunk sharply?

Tonghua Dongbao adopts a steady -and -stable collection strategy, and the price of winning products has decreased by 41%on average to retreat. In the first half of this year, the sales of similar insulin similar substances increased by more than 100%year -on -year, but the revenue of biological products was 1.167 billion yuan, a year -on -year decrease of 18.9%.

However, the impact of the collection and the control of Tonghua has not suffered a loss. In the first half of this year, the non -net profit was 440 million yuan, a year -on -year decrease of 32.7%, of which Q2 net profit was 52.07 million yuan.

The impact of insulin collection requires digestion over 2 years.

03

Orthopedic joint

After experiencing the maximum declines of 93%and 87%, Chunli Medical and Aikang Medical Stable rebounded, and orthopedics became the most powerful medical device segmentation track.

The endogenous growth of the joint business has gradually recovered. The worst expectations of collecting collection have been reflected, and marginal improvement has occurred.

In the first half of this year, Aikang Medical revenue was 531 million yuan, an increase of 18.7%year -on -year, and net profit was 126 million yuan, an increase of 13.1%year -on -year. The income of hip joints (including 3D printing products) revenue was 328 million yuan, an increase of 15.87%year -on -year. The revenue of knee joints (including 3D printing products) revenue was 128 million yuan, an increase of 16.56%year -on -year. The annual revenue growth rate of the joint sector is expected to exceed 40%, and the annual sales have hit 200,000 units.

ICOS customized products/services are expected to achieve a compound growth rate of 100%income in the next two years. The digital platforms are expected to be listed in the next 1-2 years, of which the heavy hip joint navigation system is expected to receive a registration certificate within the year. A total of 5 varieties (2 varieties have been registered in 2 varieties, and 3 varieties are under research). SBG artificial bone is expected to be registered during the year.

Aikang Medical Management Line Exchanges said that conservative expected revenue this year returned to the level of 2020, and the net profit margin returned to more than 15%.

Chunli Medical's joint product revenue was 524 million yuan in the first half of this year, a year -on -year increase of 13%. It is expected that the growth rate will be further increased next year after the stable price. R & D costs rose to 12.7%, accelerating the development of new materials and joint surgery robots, sports medicine, PRP, and new oral pipelines. Get the first 3D printing bone beam, that is, the bone beam hip acetabular pad registration certificate, at the same time obtains the knee joint prosthesis registration certificate, fills the domestic gap, and makes the company's knee joint prosthesis the best abrasion resistance in domestic wear resistance. Essence

The net profit of Weigao Orthopedics in the first half of this year was 398 million yuan, an increase of 7.8%year -on -year, and the income of joint products was 295 million yuan, an increase of 13.39%year -on -year. It was the fastest -growing business sector.

However, orthopedic spine collection is about to begin, and if the average decrease of more than 80%, it will also constitute a great impact. The revenue of Vehir Orthopedic spine products accounts for 45.8%.

Chunli Medical and Aikang Medical only have a stable revenue. The net profit margin and gross profit margin are lower than before the collection. The growth rate of Aikang Medical's net profit is faster than Chunli Medical, because it is because of compressed research and development costs.

The net profit growth rate of Weigao Orthopedics has signs of recovery. The root cause is to compress sales costs, management costs, and R & D expenses.

The dawn is in front, the road is blocked.

04

Traditional pharmaceutical company

The direction of the incident is always unexpected, and the collection has not made imitation pharmaceutical companies clearly clear.

Faced with the cold of medical insurance control fees, it is not traditional pharmaceutical companies, but new -generation pharmaceutical companies.

Standing in the depth of history, we found that comprehensive operational capabilities, especially commercialization capabilities, are also important moats. By 2025, the national and provincial drugs will have more than 500 procurement varieties. At present, about 60%have been completed. For products, the collection will still be cruel, but the traditional pharmaceutical company's rebuilding business line and product line will be reduced by the influence, the risks of decentralization of multi -line business, and a significant recovery of hematopoietic capacity.

The most prominent representative is East China Pharmaceutical. This year's Q2 revenue was 9.265 billion yuan, an increase of 11.9%year -on -year, and the non -net profit was 573 million yuan, an increase of 15.1%year -on -year. The international medical beauty and synthetic biology will start the company's second growth curve.

The dilemma of Colom Pharmaceutical reverses. In the first three quarters of this year, the expected net profit is 1.315 billion yuan to 1342 billion yuan, a year-on-year increase of 55%-70%, of which Q3 net profit is 447 million yuan to 574 million yuan, a year-on-year increase of 26%-61 %. Innovative output innovation, in the first half of the year, through the authorized MSD macromolecules project to confirm the revenue of 370 million yuan, increase the net profit of 160 million yuan, and received 35 million US dollars in September, increasing net profit of 129 million yuan.

As soon as the biology of Sichuan -Ning biological was washed, the price of the raw materials was high, and the profit increased. Chuanning Biological has established the Shanghai Research Institute, relying on mature biological fermentation technology and enzyme technology platforms. Based on the synthetic biology and enzyme engineering research, it is Development of degradable materials.

Among the three traditional BIGPHARMAs, the stone medicine group has the fastest transformation to promote innovative drugs to the efficiency of imitation pharmaceuticals. Ming Fule, which is used to treat the indications of cerebral infarction indications, is expected to be approved next year to strengthen the central nervous system product matrix. ), Ilidekang and JMT103 (RANKL) are expected to be listed in 2022-2023. Hengrui Medicine has the largest body and the slowest turn. The pessimistic price has been fully included. It is expected that the performance will gradually stabilize at the end of this year or early next year, and the dilemma reverses. Chinese biopharmaceutical transformation is also slow, but cash reserves are 26.4 billion yuan, which may achieve non -linear reversal through mergers and acquisitions. The main problem is that family management is immature and layman.

Traditional and third -tier traditional pharmaceutical companies also generally grow steadily and choose two randoms.

The large varieties of Puli Pharmaceuticals have been destroyed. In the first half of the year, revenue increased by 27.7%year -on -year, and net profit increased by 27.8%year -on -year, as stable as an old dog. The large varieties of Voldemol and nitrate sodium injection are approved, bringing new growth momentum. Innovative fields focus on boron medium capture therapy (BNCT) boron drugs, mRNA drugs, and SIRNA drugs.

The net profit of Xianxian Pharmaceutical Q2 is obvious. In the first half of the year, the revenue of respiratory preparations was 310 million yuan, an increase of 40%year-on-year. It was difficult to collect in 1-2 years, and the market competition pattern was good. The income of anesthesia muscle pine preparations was 305 million yuan, a year -on -year decrease of 5%. Among them, the fifth batch of national collection of the bid in the bid in Shuoquan ammonium incecut, the sales decreased by about 66 million yuan year -on -year, a year -on -year decrease of 88%. Seven national collection in the liquid is expected to land in November, which will affect the income end. The income of preparations accounts for 60%, and multi -line development is generally stable.

If the murder is not killed, it may not be more powerful, but for pharmaceutical companies, the collection of collection is the biggest pressure. This can be survived. What else can not stand up. There is no problem to survive.

At present, the pharmaceutical PE valuation in the case of the case of the case has reached a new low of ten years. From the perspective of the medium and long line, the valuation bottom+configuration bottom+policy improvement+the four major factors with the environment of the environment still has the value of persistence.

Since July, in the industrial chain of the capital allocation sector, medical devices have ranked second in the market with a net inflow of 5.43 billion yuan, second only to lithium battery materials. In addition, ETF (159883), the largest A -share scale, has increased by 187 million since September, and this year's ETF share growth rate has reached 79%. It is really difficult to buy at the lowest point, but most people can do it in the bottom range. In actual operations, try to combine your own funds as much as possible, take a batch of approval methods to enter the venue, and use long -term adherence to the reversal of the industry.

Disclaimer: This article is the content of Yaozhi.com, and the copyright of the pictures and text belongs to the original author. The purpose of reprinting is to pass more information, which does not represent the viewpoint of this platform. If the content, copyright and other issues are involved in the work, please leave a message on this platform, and we will delete it as soon as possible.

- END -

Is the Chongqing Monkey Case and the German virus highly homologous monkey acne infection?What are the way monkey acne spread?

Chongqing discovered a case of input monkey acne casesAccording to the official we...

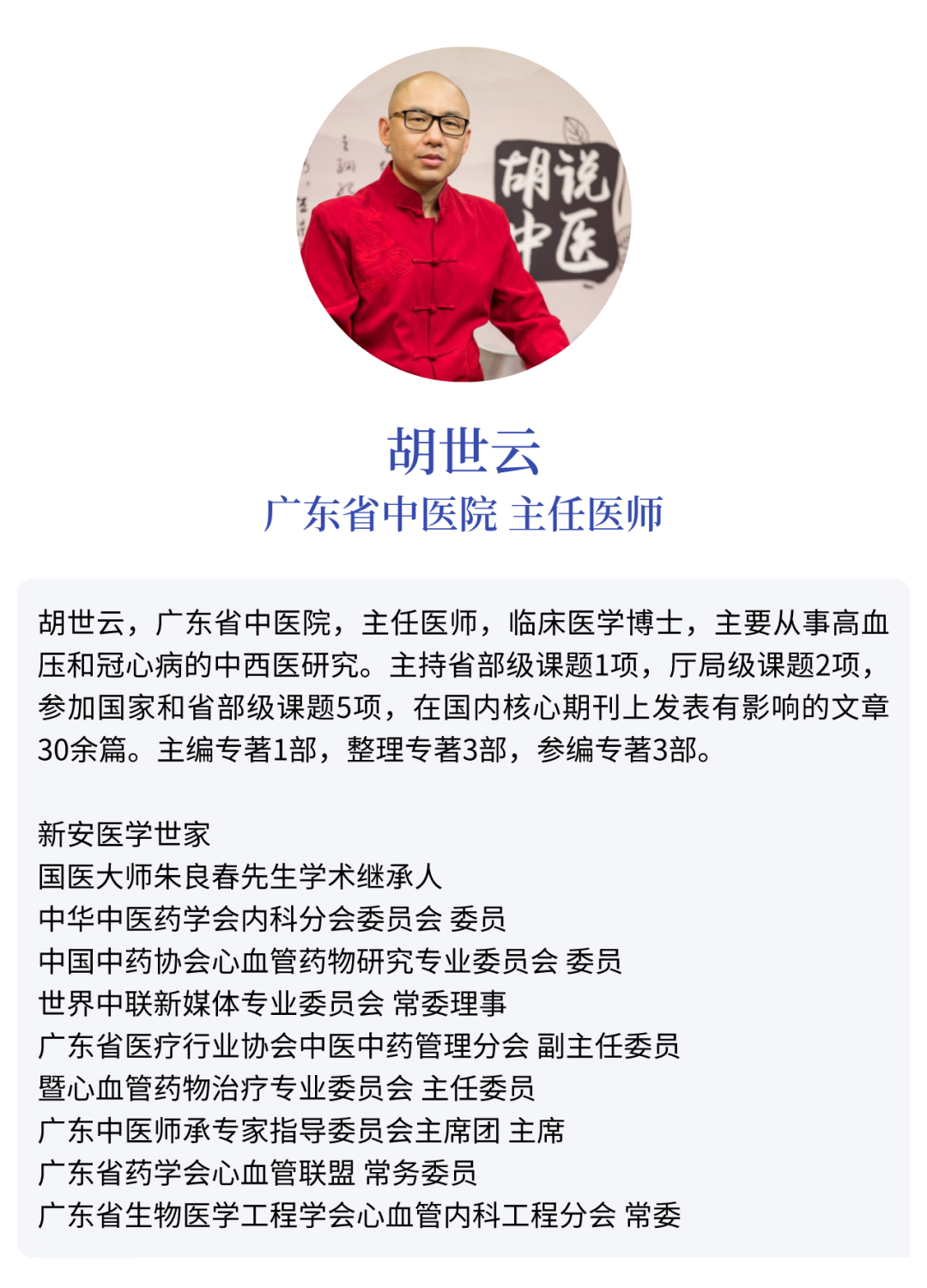

Dr. Hu said that Chinese medicine | Chicken's internal organs can also be used as medicine?Take you to know -chicken inner gold

Chicken in the chicken is also one of the elimination medicines. The chicken inner...