Tomson's reform of reforms, the net profit has fallen sharply, is it difficult to accept by generations?

Author:Refer to the business Time:2022.08.22

Health products have created a few waves of wealth -making myths with their strong gold absorption. Old brand Tomson Bei Jian has become a dark horse that has risen rapidly in the Chinese health product industry.

"The deepest night, eating the most expensive health products", now health care products are no longer exclusive to middle -aged and elderly people. The market is becoming "younger". Tomson Bei Jian, a leading health product, is a bit uncomfortable.

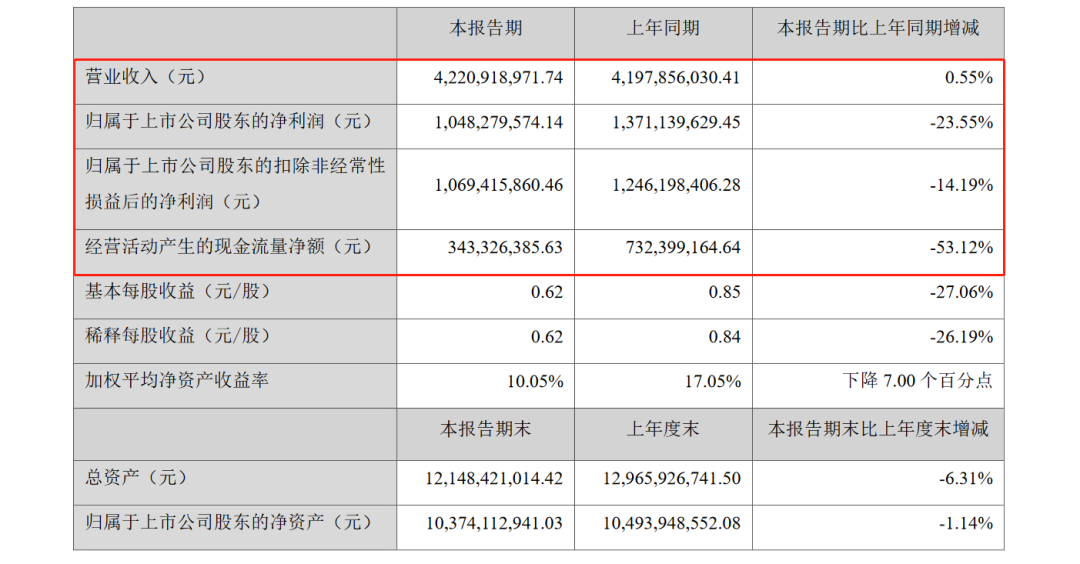

Judging from Tomson Beijian's semi -annual report data, the operating income in the first half of the year was 4.221 billion yuan, a slight increase of 0.55%year -on -year; the gross profit margin was 69.35%, which was among the best in A shares; It was 1.057 billion yuan, a year -on -year decrease of 23.55%, and the cash flow also decreased by 53%. This is not difficult to understand why Tomson Beijian's performance trailer announced the second day after the announcement was announced, the stock price fell 3.09%.

For the imperfect answer sheet that has declined significantly in this net profit, Tomson Biso gave up three major reasons in the announcement: first, the influence of the epidemic, the offline business continued to be under pressure; Third, it is affected by non -operating profit and loss.

Think of Tomson's financial report and the development trend in recent years can find that the epidemic is not the main influencing factor. Development strategies errors, decline in demand and channel reform are the main reasons for increasing income and increasing income.

From the perspective of market status, according to Euro Rui data, China's total retail scale of vitamin and dietary supplements (VDS) industry in 2021 was 189.2 billion yuan, with a growth rate of about 6.6%. It is expected that the scale of my country's health products industry will reach US $ 62.402 billion by 2025.

According to the logic of population aging acceleration and the continuous improvement of residents' awareness of health, the future prospect is not bad. Among them, Tomson Bicheng's share can reach more than 10%, ranking first.

In the past few years, Tomson Beijian has tried the "multi -brand" and "big items" strategy. In the first half of 2022, the growth of various brands of the company was as follows:

The main brand "Tomson Bei Jian" achieved revenue of 2.361 billion yuan, a year-on-year decrease of 7.91%; the joint care brand "Jianli Duo" achieved revenue of 733 million yuan, a year-on-year decrease of 13.83%; A year -on -year increase of 49.69%; LSG achieved operating income of 377 million yuan, an increase of 23.79%year -on -year.

It can be seen that the main driving force of its performance comes from LSG and LIFE-SPACE, and other brands of revenue are reduced. LSG is a brand acquired by the company in 2018. Because the acquisition of LSG brought the goodwill on the book, the company's total assets of 12.148 billion yuan, the goodwill accounted for 10.73%, the proportion was not low. Since the acquisition, since the acquisition From the perspective of performance, it did not bring too much profit growth to Tomson Beijian.

The changes in the objective market environment, the rationalization of consumers in the Z era and the joining of strong competitors, is also the reason for Tomson Bei Jian's stall.

The hotness of the health care products market has naturally attracted a number of new and old forces to join. Pharmaceutical companies such as Tongrentang, Act, Baiyunshan, and dairy companies such as Feihe, Beinmei have long been still in an attempt to split a share. This requires the brand to launch targeted products according to the specific situation of the post -epidemic era, such as enhanced health products that enhance autoimmune.

Under such a fierce competition environment, consumers' choices are more diverse. Tomson's development strategy is obviously insufficient. The brand aging does not think for progress.

The company's main products are nutritional health products, so brand building and marketing promotion are essential. During the reporting period, Tomson Beijian's sales expense scale was 1.349 billion, and the sales fee rate reached 31.97%, an increase of 8.75%year -on -year. 65.29 million yuan, R & D cost rate was only 1.55%, an increase of 0.35 percentage points year -on -year, which was seriously imbalance.

It can be seen that in the case of lack of product innovation, it has not been proposed to make new products with the trend of the times, and it is difficult for old brands to explode new vitality. Even if the sales costs are largely put on a large amount, it is difficult to attract a new generation of young consumers. Effect.

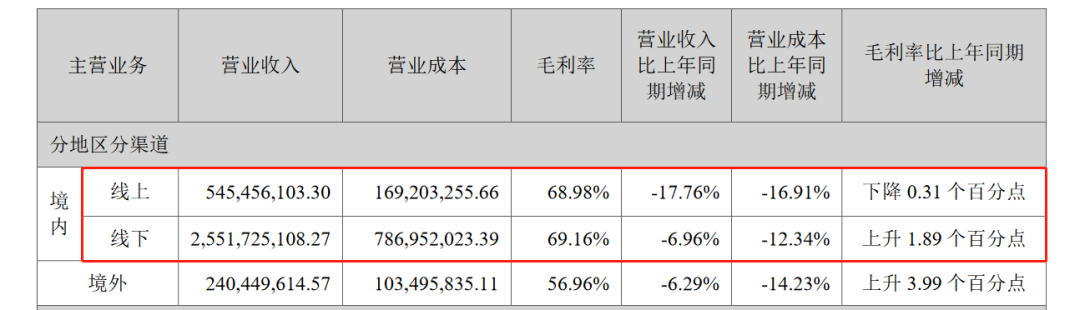

Another important factor for Tomson Beijian to fall into the predicament of growth is channel flaws.

Tomson Beijian's main force has always been offline sales channels, mainly selling in pharmacies, and online sales are relatively late, which has a great deviation from the times. Only in 2017 began to propose a "e -commerce branding" strategy. In 2020, It stabilizes the position of market share first.

However, according to Tomson's sales data in the first quarter of 2022, offline channel revenue accounted for about 76.9%of the overall income, a year -on -year decrease of 0.94%; and online channel revenue decreased by 10.65%year -on -year. This shows that Tomson's operating income is still mainly from offline, and it is still experiencing the pain of channel reform. How long will this process last, it is still difficult to say at the moment.

It is expensive, brand aging, and unsustainable products. It is not easy to turn the best transformation opportunity. It is not easy to turn around.

Fortunately, health care products have been sought after by consumers in recent years. As industry giants, Tomson Bichen still has the ability to absorb gold and wealth. However, up to 60%of the gross profit margin is really difficult to buy the young "Z era" group in the future. Tomson Beijian needs to work hard on research and development. Perhaps it is still possible to change and break through.

Reference materials:

Consumption titanium: "Tomson Beijian" Fine Thin "

Hydrogen Finance: "Tomson Beijian's net profit in the first half of the year has premedted over 30 %, and how long will channel reforms last?》 Mist through the financial report: Tomson Beijian 2022 Half -annual Report interpretation

- END -

After the intestinal polyps are removed, how long is it to review?Look at what the US guide says ...

For medical professionals for reading referenceRemember to collect this form!About...

Psychological Class 丨 The magical magic of Rosenteal effect

In 2022, the Chengdu Women's Federation fully implemented the Family Psychological...