The latest performance of 16 multinational pharmaceutical companies is released: K medicine is tightly cultivated Merlot, Bojian ADUHELM sales ...

Author:Yaizhi.com Time:2022.08.16

The latest performance of 16 multinational pharmaceutical companies is released: K medicine is tightly cultivated Merlot, Bojian aduhelm sales ...

Source: Bo Ya/药

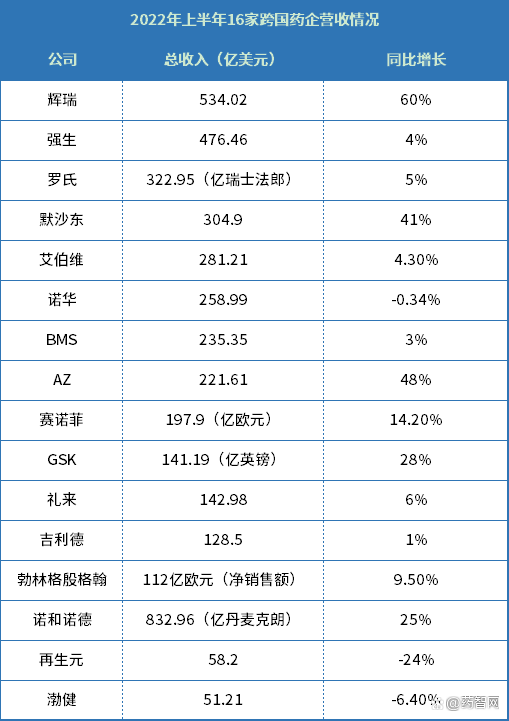

Recently, many multinational pharmaceutical companies announced their revenue performance in the first half of 2022. As of now, according to the total revenue, the global TOP10 pharmaceutical companies include Pfizer, Johnson & Johnson, Roche, Merck, Albervi, Novartis, BMS, AZ, Sanofi, GSK. Among them, Pfizer ranked first with a revenue of US $ 53.402 billion, an increase of 60%year -on -year. The main product of its performance was new vaccine and new crown drugs.

The first half of the first half of Nuo -Nuo, Nuo, Nuo, and Bo Jian has been disclosed one after another. On the whole, most MNC pharmaceutical companies have achieved positive growth, or they are the same as that of the same period, and there are also negative growth, such as Nuohua, Regenerative Yuan, and Bo Jian.

Pfizer first, Johnson & Johnson and Novarty's net profit fell more than 20%

According to statistics, according to the total income, the top 10 of the global pharmaceutical companies in the first half of 2021 is: Johnson & Johnson, Roche, Pfizer, Albervi, Novartis, Beltay Schimibao, Merhado, GlaxoSmith, Sanofi, and Takeda.

Among them, Johnson & John ranked first with a total revenue of US $ 45.633 billion, and Roche's total revenue followed closely at 33.922 billion US dollars. Pfizer ranked third with total revenue of US $ 33.559 billion.

With the normalization of the epidemic, it has a heavy new crown vaccine and drugs, which has become one of the key factors for the total revenue of MNCs.

In the first half of last year, Pfizer's revenue was "dazzling" in the first half of the year. It also mainly relied on the new crown vaccine BNT162B2, and the business business of mature products. In the first half of this year, Pfizer smiled again with the help of the new crown vaccine and drugs — Pfizer MRNA vaccine Comingaty and the new crown oral medication PaxLovid strongly increased, contributed more than half of sales. Among them, the total sales of COMIRNATY were US $ 22075 billion (+95%), and the new crown oral medication PaxLovid revenue was US $ 9.585 billion.

It is worth noting that Pfizer's new crown oral medication Paxlovid overtakes Molnupiravi, the new crown oral drug of Merck. In the first quarter of this year, Molnupiravi achieved a revenue of 3.2 billion US dollars, and PaxLovid only achieved $ 1.5 billion in sales revenue. The market performance of Murisha East New Crown Oral Drugs leader. With the end of Q2, Molnupiravi in Merckon has achieved a total of $ 4.4 billion in sales in the first half of this year, which is not as good as Pfizer's new crown oral medicine.

In the first half of this year, the total revenue ranked second in Johnson & Johnson. Its new crown vaccine contributed a new growth force and achieved revenue of US $ 1.01 billion in the first half of the year.

However, although the revenue on the other side is at the forefront, there are also hidden concerns for Johnson & Johnson and Novartis. The specific manifestation is that Nuohua's net sales revenue in the first half of the year reached US $ 25.312 billion, which was basically the same as the previous year; net profit was US $ 3.916 billion, a year -on -year decrease of 20.97%; operating income was 25.899 billion US dollars, a year -on -year decrease of 0.34%; Johnson & Johnson 2022 was in 2022. The total revenue of half a year was 47.446 billion US dollars, a year -on -year increase of 4%, and net profit was 9.963 billion US dollars, a year -on -year decrease of 20.1%. The net profit of Johnson & Johnson and Novartis has decreased by more than 20%year -on -year.

The gap between "OK" is widening, and the commercialization of Bojian ADUHELM is weak

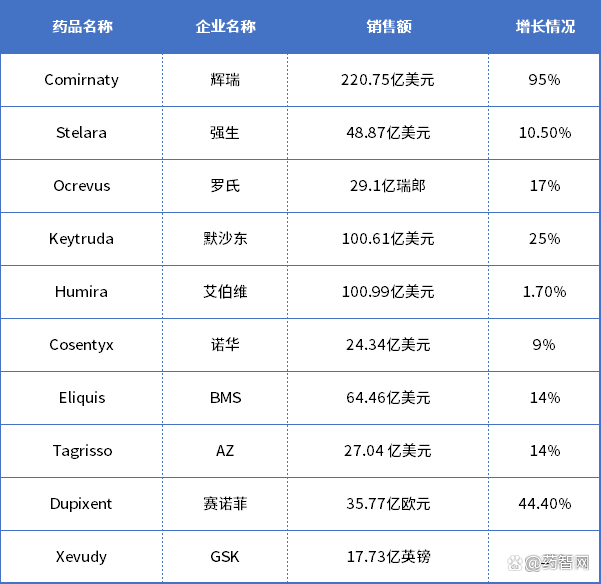

Behind the growth of most multinational pharmaceutical companies, there must be a "sales champion" product. For example, Pfizer's Comingaty, Stelra of Johnson & Johnson, Ocrevus of Roche, Keytruda in Merhado, Merlotyle of Abervis, Cosentyx of Novartis, BMS's Eliquis, AZ's Tagrisso, Dupixent's Xevudy of GSK, and GSK's Xevudy. The corresponding sales were US $ 22075 billion, US $ 4.887 billion, 2.91 billion in Swiss francs, US $ 10.61 billion, US $ 1.099 billion, US $ 2.434 billion, US $ 6.446 billion, US $ 2.704 billion, 3.577 billion euros, and 1.773 billion pounds. The details of growth are as follows:

Data source: Enterprise Half -year Report

Among them, the sales performance of O, and the generation of "Medicine King" Xiu Meile has always been the focus of the industry.

Merhadon's PD-1 drug Keytruda (commonly known as "K drug") increased by nearly 30%year-on-year, and achieved a revenue of US $ 10.61 billion in the first half of the year, supporting the revenue of nearly one-third of Merck east, and continued. Earlier, some institutions predicted that in 2022, K medicine will exceed the $ 20 billion mark, and K medicine has also been called the seed player of the king of the medicine king; 3.986 billion US dollars, a year -on -year increase of 10%. In contrast, the sales gap between O and K drugs are getting bigger and bigger.

Albervi's global sales of Xiu Meile in the first half of the year were US $ 10.099 billion, a slightly increased by 2.7%, but contributed more than one -third of the revenue to Albervi. The gap between the K -drug and Merlot in the "Endeter" is constantly shortening.

In addition, Roche's "three-driving carriage", Bo Jian's ADuhelm, Nosna sodium, renewable new crown antibody Regen-COV, Geely's new crown drug VEKLURY, etc., all were "hot" drugs. Roche's pharmaceutical business revenue in the first half of the year was 21.6 billion Swiss franc (US $ 235.63), a decrease of 3%. The reason for the decline in pharmaceutical business is the influence of biological drugs and epidemic. In the first half of this year, Roche's anti -cancer drugs "three driving carriages" Bevarzumab, Tuskuzab, and Lifenab's sales fell 40%, 35%, and 41%, respectively. Roche's former ace product revenue has declined, and the company's new generation of star products are rising.

ADuhelm, the Alzhemo drug, which has received much attention, has only revenue of US $ 2.9 million in H1 in 2022. Since its listing in June 2021, a total of $ 5.9 million has been revenue. The commercial road of this product can be said to be very bumpy.

In the first half of this year, the sales of spinal muscle atrophy (SMA) drugs SPINRAZA (sodium Nosna) were US $ 904 million, a year -on -year decrease of 11.37%. Among them, the US market fell 6%, and other markets fell 17%. The reason for the decline may be related to factors such as market competition and decrease in price.

In 2022, H1 revenue for H1 a total of US $ 5.82 billion, a year -on -year decrease of 24%. The decline in the performance of the new crown antibody Regen-Cov is the main reason for the decline in revenue in the first half of the regenerative yuan, a year-on-year decrease of 84%. In the second quarter, REGEN-COV revenue only about 22.8 million US dollars, a year-on-year decrease of 99%.

The main reason for the decline in the sales of the new crown antibody is due to its failure to the OMICRON variant, and the US market suspended sales. Clinicaltrics.gov official website shows that 4 Regen-COV-related cocktail therapy clinical trials have recently terminated.

On the other hand, Geely's new crown drug VEKLURY (Rydevil) 's sales also fell 46%to US $ 445 million in Q2 in 2022. The main reason for the decline in income is that the related infection rate and severity of COVID-19 brought about the severity of COVID-19 The treatment rate is declining, and at the same time due to the alternative of vaccine and COVID-19.

It is not difficult to see that the new crown therapeutic drugs are updated quickly, not all products can become Pfizer's Comingaty and Paxlovid.

Chinese performance pk, a few happy and happy sorrows

While multinational pharmaceutical companies disclosed the performance of H1 in 2022, the sales "transcripts" in China's sales were also exposed. Several people were happy, and they followed the new layout and adjustment to welcome changes.

Among them, the performance of Novartis, Johnson & Johnson, Merck, Novo, and Norders showed a growth trend year -on -year. The revenue growth rate of Sanofi China's revenue has achieved the same as the United States.

In the first half of 2022, the sales revenue of Novartis China was 1.6 billion U.S. dollars, a year -on -year+11%, mainly driven by the Costecyx (Cosentyx); in addition, in the first half of 2022, Johnson & Johnson China ushered in double -digit growth.

In the first half of this year, Merck's pharmaceutical business revenue was US $ 26.863 billion, an increase of 45%year -on -year. Among them, China is close to $ 2.5 billion, a year -on -year increase of 51%.

The revenue of Meridodong Pharmaceuticals still relies on the strong sales growth of K drug, Gardasil/Gardasil 9 and new crown drug Lagevrio. The three drugs contributed $ 17.6 billion, accounting for 57.8%of operating income. It is particularly mentioned that although the sales revenue of Gardasil/Gardasil 9 in the United States has begun to decline, thanks to the strong growth of the international market, especially the Chinese market, the revenue of US $ 3.133 billion was achieved in the first half of the year, an increase of 48%year -on -year.

In March of this year, Meridon has adjusted China's architecture, set up two new positions of data protection officers and chief transformation officers, and merged digital interaction with transformation and commercial operation departments to establish a new department of business. The department merged and established a new business excellence department.

Nuo and Nord's total revenue in the first half of the year was 83.296 billion Dan Ying Kron ($ 11.378 billion), a year -on -year increase of 25%. Among them, China ’s revenue of 8.407 billion Dan Ying Crown (US $ 1.148 billion), an increase of 4%year -on -year, accounting for 10%of Nuo and Nord's global revenue.

Sanofi China revenue was US $ 1.699 billion, but the growth rate (+12.3%) had achieved the growth rate (+12.4%) with the United States (+12.4%), exceeding its global growth rate (+8.4%). Mainly benefited from the growth of Dupixent and the recovery of Poliviger (clopidogrera) from the impact of volume procurement.

However, there are also declines, such as Robe, AZ, etc., BMS products are facing fierce competition in China. After the decline in the performance of Merko, Albervi urgently needs to find a substitute ...

In the first half of this year, due to the fierce competition of biological drugs, and the impact of the new crown epidemic measures, Roche's overall sales revenue in China fell by 7%. The Roche Group's global CEO SEVERIN SCHWAN pointed out that the Chinese market has returned to normal. In fact, the Group already has a strong beginning in the third quarter. the trend of. In the first half of 2022, affected by the purchase of volume, medical insurance negotiations, and epidemic conditions, AZ China revenue was US $ 3.057 billion, accounting for 14%of total revenue, a year-on-year-5%. However, it also contributed half of the results of Astraikang's emerging market.

The United States is still the main source of Lilly's revenue. In the first half of 2022, sales of USD 9109 billion, an increase of 19%. However, the sales of Lilly in Europe, Japan, and China have declined, down 14%, 30%, and 14%, respectively. Among them, it is worth noting that the Lili Lili and Cinda's Civi Lisan was affected by the intensified domestic competition and the price reduction of medical insurance. In the first half of this year, it revenue only 159 million US dollars, a year -on -year decrease of 26%.

On the other hand, BMS products are facing fierce competition in China, including OPDIVO and anticoagulant drugs Eliquis. BMS said that it will increase investment in R & D and accelerate the listing of new products in the future.

It is reported that Albervi has accelerated the research and development of Chinese products. After the medicine king HUMIRA, it also urgently needed substitutes. As a alternate product of Humira, it is difficult for Skyrizi and RinvoQ to reproduce HUMIRA's glory. In addition, the Chinese market in 2022 Abervi has expanded new businesses through various means. Albervi also plans to sell women's health business to focus on the development of new drugs.

According to the "Medical World", in the Chinese market, Pfizer also announced new organizational adjustment: in three aspects: Biopharma, Global Product Development (GPD), and Business Innovation (CBIO), the business will be even more Surrounded by COVID-19 related products. It is understood that the new architecture changes will take effect before September 1, 2022.

Article Reference: Public information such as corporate financial reports.

Note: The above statistics are MNCs that have been disclosed by the financial report as of the time before the press release, for reference only.

Disclaimer: This article is the content of Yaozhi.com, and the copyright of the pictures and text belongs to the original author. The purpose of reprinting is to pass more information, which does not represent the viewpoint of this platform. If the content, copyright and other issues are involved in the work, please leave a message on this platform, and we will delete it as soon as possible.

- END -

Nanyang aid cadres dedicated to the epidemic of the epidemic on the shoulder of the epidemic in Nanyang aid.

Wanha family, fighting side by side. The situation of the Xinjiang Hami epidemic prevention and control is severe. All cadres in Nanyang's aid in Harbin in Harbin regarded the epidemic, obeying the lo...

One new local diagnosis case is added, and the previously reported overseas input -related local native non -symptom -free infection was transferred to the confirmation

New Coronary pneumonia epidemic daily noticeAt 0-24 on July 5th, 1 new local diagn...