Stepping "backdoor listing", Baijiayun color geometry?

Author:Blue Whale Finance Time:2022.09.22

After reading Lang Lang and Zhizhi Education, the capital market is about to usher in another education listed company.

In July, Fuwei Film, a US listed company, announced that it had signed the "Intraged Agreement" with Baijiayun's substantive controlling shareholder on July 18. After the transaction is completed, Baijiayun will become a wholly -owned subsidiary. Baijiayun's existing shareholders will hold about 96.79%of the issued shares after the merger.

In August, the Baijiayun shareholders' association has passed the consolidation agreement 100%. The Fuxi Film plans to hold an interim shareholders meeting on September 19, 2022, Beijing time to review and vote the merger agreement.

If everything goes well, Baijiayun will soon become listed companies through the "backdoor" method.

Behind the curve listing, Baijiayun color geometry?

Stepping on the midwife

Baijiayun was established in 2017. It was mainly active in the educational track in the early days and provided audio and video SaaS services. It gradually extended to automotive, finance, medical care, electricity sales and other fields in the later period. From the perspective of the official website, its customers currently include large institutions such as BMW, Siemens, Hisense Group, Industrial and Commercial Bank of China, Apple, GAC Group, and Northeast Securities; they also include many schools, teaching and training institutions, such as Sichuan University, Beiwai, and Bei Normal University. , Media University, Shandong University, New Oriental Online, Studies University Education, Weimiao Business School, Huatu Education, etc.

According to Tianyancha, as of now, Baijiayun has completed a total of 6 rounds of financing, and the management has many well -known institutions such as CITIC Capital and Baidu. However, among the early investors, except for Jinpu Investment, other shareholders did not continue to invest in subsequent financing. In July last year, Baijiayun had just completed Series C financing. However, the amount of financing was not disclosed, it just claimed that it was valued at 3 billion yuan.

Established 5 years, obtained 6 rounds of financing, and will soon land on the capital market. The side shows the optimistic of capital for Baijiayun, and it also plays a certain role of demonstration and boosting the teaching and training institutions of transformed smart education.

Why is capital willing to bet on Baijiayun?

From the perspective of financing, Baijiayun completed B and B+round -round financing in 2020, with a financing amount exceeding 270 million yuan. For start -ups, the higher the financing round, the greater the difficulty of financing. However, Baijiayun's ability to raise the trend is that the important factor is to step on the outbreak of the epidemic.

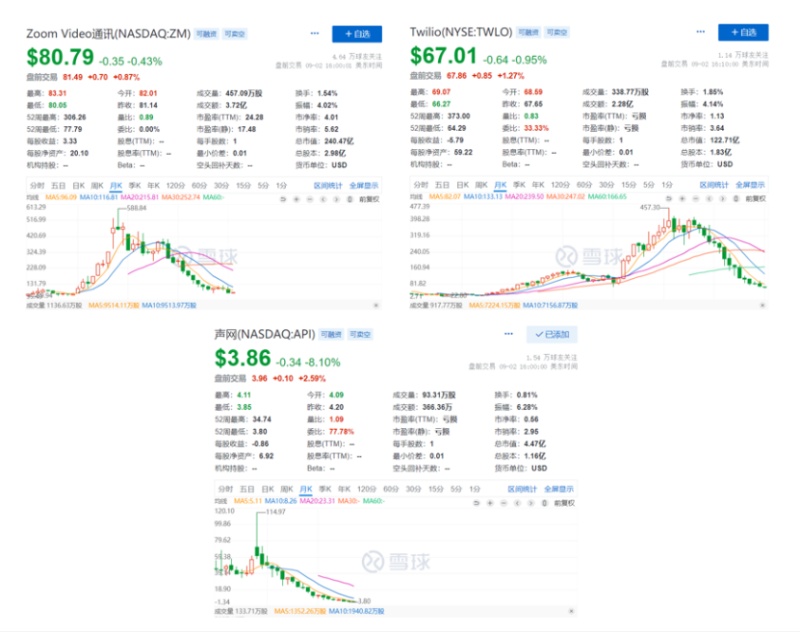

The epidemic accelerates online interaction, and the demand for real -time communication services such as video conferences, remote consultations, and online learning. At this time, audio and video service providers are generally attracted attention. In U.S. stocks, ZOOM, which provides video SaaS services, and Twilio's market value of Twilio, which provides audio PaaS services, has risen all the way, all of which have exceeded 100 billion yuan. In China, the real -time interactive cloud service company has logged in to US stocks, and the stock price rose by more than 150%on the first day. Baijiayun, as an important target on the track, is naturally favored by capital.

In addition to the promotion of the epidemic, the SaaS/PAAS service market has been growing. According to Ai Media data, from 2015 to 2021, the Chinese SaaS industry market has always maintained linear growth. In 2021, the scale is 32.26 billion yuan, and it is expected to reach 55.51 billion yuan in 2023. Data from Cedres showed that in 2021, the Chinese PAAS market size reached 3.41 billion US dollars, a growth rate of 56.4%.

The rapid growth of the industry has catalyzed the epidemic, allowing Baijiayun to get the dividend of the industry's development.

So, has Baijiayun grabbed this dividend?

Revenue increases by 80%, and the gross profit margin decreases by 12 percentage points

From the financial report, Baijiayun maintains a positive growth trend.

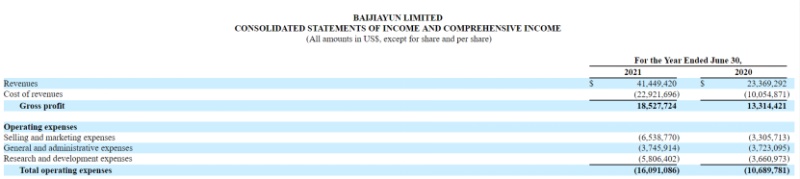

As of the fiscal year of June 30, 2021, Baijiayun's total revenue was approximately US $ 41.45 million, an increase of nearly 80%over about US $ 23.37 million in the previous fiscal year. From the second half of 2020 to the first half of 2021, the epidemic gradually subsided. Baijiayun can still achieve high -speed growth, reflecting a positive development trend.

When completing the round C financing, Li Gangjiang, the founder and chairman of Baijiayun, said that the company officially completed the transformation from product providers to technology providers in 2020 to achieve standardization and customization compatibility. PaaS standardization+SaaS scenario business layout has driven Baijiayun's explosive business growth.

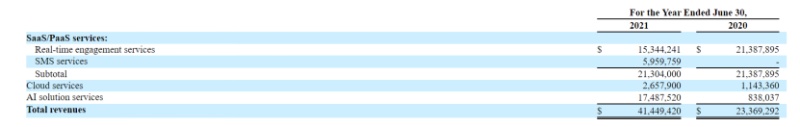

Judging from the performance disclosed by the announcement, the scene solution has indeed played a key role in its performance. By the end of the first half of 2021, Baijiayun's main business was mainly divided into three sections: SaaS/PaaS services, cloud -related services and AI solutions. Among them, SaaS/PaaS services include direct on -demand, BRTC, dual division, online school SaaS, etc., helping all types of enterprises to achieve online interaction. However, this part of the business did not grow, but declined. Among them, real -time interactive services fell from US $ 21.39 million to $ 15.34 million, a decrease of 28%.

Cloud services have a significant growth rate, from $ 1.14 million to $ 2.66 million. However, due to the limited scale of itself, it accounts for only 6.4%.

What really supports performance is the AI solution service. This business mainly combines artificial intelligence cutting -edge technology with actual scenarios, empowering multiple vertical fields, and provides a number of intelligent analysis capabilities such as face recognition/gesture recognition/head statistics. This business increased rapidly from $ 840,000 to 17.49 million, an increase of nearly 20 times. As a result, the decline of the traditional SaaS/PaaS service eventually brought the rapid growth of overall revenue.

But it should be seen that the business layout of the scene also brings a certain negative role. The operating cost of Baijiayun in the fiscal year in 2021 was $ 22.92 million, an increase of 128%year -on -year, and the growth rate was faster than the growth rate of revenue. This brings a decline in gross profit margin. The gross profit margin of Baijiayun in the fiscal year in 2020 still reached 57%. By the fiscal year in 2021, it fell to 45%, a decrease of 12 percentage points.

Product transformation needs to increase investment, and the expenditures of Baijiayun in the fiscal year in 2021 have increased significantly. Sales and marketing expenditures increased from $ 3.31 million to $ 6.54 million, an increase of 98%year -on -year; R & D expenditure increased from $ 3.66 million to $ 5.81 million, an increase of 59%.

However, because the overall expenditure is not large, Baijiayun can still maintain positive profit. The net profit was US $ 3.65 million, a slight decline from the US $ 3.7 million in the same period last year.

Thanks to the successive financing completed from 2020-2021, Baijiayun's cash and cash equivalents and restricted cash at the end of the clouds increased from US $ 1.02 million to $ 57.16 million, a significant increase of 55 times.

In summary, Baijiayun's current performance has shown a positive situation, revenue growth, and maintenance. However, due to the relatively small business scale, it is possible to face a longer review cycle and more uncertainty when it is listed in the form of submitting a prospectus. The listing of the "backdoor" curve may be the most suitable choice.

And what its development prospects still need to be observed.

Seek development in the gap

At present, although Baijiayun involves multiple sections in business, the total revenue of one year is equivalent to the one -quarter revenue of real -time interactive cloud service providers. To a certain extent, Baijiayun benefits from the growth of the industry. In the overall SaaS and PaaS industry, it still belongs to Changwei enterprises.

At present, the competition between PaaS and SaaS is fierce. The research report released by the research institution Canalys in the first quarter of 2022 shows that the "China Four Clouds" market share composed of Alibaba Cloud, Huawei Cloud, Tencent Cloud, and Baidu Smart Cloud accounted for total market share. It is 78.8%.

Currently, large factories are densely deployed PaaS and SaaS. Tencent said that in the field of video clouds and network security, it has increased resource investment, and on the SaaS side, it also stated that it is necessary to give priority to expanding the business scale of SaaS. After Alibaba Cloud was announced in early 2021, the SaaS and PaaS services were output through nails. Byte Cloud's office collaboration with SaaS products flying books, the development is even stronger.

In this case, Baijiayun is more like seeking development in the gap. It is difficult to become a large and complete company, and can only focus on small and beautiful long tail needs.

The initial needs of education companies made Baijiayun a lot of benefits during the epidemic, but the institutions after the "double reduction" were facing transformation. Baijiayun was destined to lose some customers. The trend was already shown in the performance of the downturn. At the same time, as other teaching and training institutions have also transformed smart education, it will also bring a certain impact on Baijiayun. In the fields of automobiles, finance, medical care, and electricity, Baijiayun needs to pay more investment to open up new customers.

When completing the C -round C financing, the relevant report mentioned that Baijiayun wanted to create the Chinese version of ZOOM and Twilio. But from 2020 to the present, Zoom and Twilio have stepped out of a parabolic line with an open opening. At present, ZOOM's stock price has returned to the level at the beginning of listing; Twilio's stock price has also fell back to the level of 2018-2019. At the beginning, the sound network of the benchmark ZOOM just refreshed the historical low of the stock price last month.

Since the beginning of this year, Baijiayun, who has been promising education, and now hopes for listing, has provided an important reference for the educational company in the transformation. Perhaps these companies have their own dilemma and struggle, but at least it also shows a line of route for other educational institutions.

- END -

Time · 2022 Teacher's Day | Zhu Shaoyuan: Signature under the candlelight

Text/Zhu ShaoyuanI have been signed in a continuous way. Every time I signature, I think of my junior high school Chinese teacher Zhou Anlu, and the situation of Teacher Zhou taught me in the candleli

Hong Kong media: Under the epidemic, elite graduates want to find a stable job

Hong Kong's South China Morning Post June 15 article, original title: For Chinese elite graduates, in the employment market affected by the epidemic, career stability is more important than dream la...