The transformation of all -in -law education, "This road is not connected"

Author:Blue Whale Finance Time:2022.09.14

Quantong Education, a company that debuted at the peak. It was only more than a year after listing, and the stock price rushed to 379.69 yuan, breaking the historical record of A shares at that time.

Highlight belongs to the past, and now the full -time education has long been dim. The "double reduction" has been on the ground for more than a year, and the transformation of Quantong Education seems to be hung up with a logo- "This road is unreasonable."

The performance of the landslide across the line

In the first half of the year, the performance of Quantong Education was almost fully declined.

During the reporting period, Quantong's education revenue was 245 million yuan, a decrease of 11.15%compared with 276 million yuan in the same period last year.

In terms of profits, its net profit in the first half of the year was 5.359 million yuan, a decrease of 30.79%compared to the 77.313 million yuan in the same period last year.

The financial report data shows that the non -recurring income of all -round education in the first half of the year is 15.054 million yuan, of which the equity investment disposal income (or the submissive part that includes the accrued asset impairment preparation) is 10.888 million yuan; government subsidies are 1.9145 million yuan; A total of 3.453 million yuan in equity incentives confirmed in the early stage.

After deducting the above -mentioned non -recurring gains and losses, the net loss of Quanyong Education in the first half of the year was 9.7030 million yuan, which was 642.53%year -on -year compared with the same period of the previous year.

From the perspective of expenses, due to labor costs, office expenses, transportation travel expenses, depreciation and amortization costs, all costs and costs in the first half of the year have decreased significantly.

In the first half of the year, the sales cost of Quantong Education was 11.9602 million yuan, a year -on -year decrease of 28.83%; management costs were 32.322 million yuan, a year -on -year decrease of 28.83%; financial expenses were 2.817 million yuan, a year -on -year decrease of 17.01%. R & D expenses increased year -on -year, an increase of 26.99%year -on -year to 16.38 million yuan.

Regarding business transformation, as early as 2021 reports, Quantong Education stated that in 2022, it will maintain the competitiveness of channels and service operations and actively seek the transformation method of basic business. Together with the operator to promote the optimization and service upgrade of education products, to meet the new needs of teachers and parents in the background of the Internet instant messaging. In the process of "dual reduction" policy advancement, it will take the "post -school service business" that will be deployed in advance as a key business to improve the level and quality of after -school service.

At the same time, Quanye Education will also explore from teachers' autonomous learning and integration of production and education. During the year, its "Quantong Ji Education" will continue to provide teachers 'training service solutions for teachers' training administrative departments at all levels, including training scheme design, curriculum resource integration, platform support services, training organization management and other services. It will also explore the self -selection mode of teachers and continue to provide the theme courses packs for teachers at all levels and levels of various disciplines.

In addition, Quanye Education will further expand the functions of the smart education platform, enrich platform resources and scenes, and create a smart -based environment and comprehensive information service platform.

From the perspective of sub -business, the continuing education business is still the business with the highest revenue contribution. During the reporting period, a total of 144 million yuan, a year -on -year increase of 0.1%, accounting for 58.9%of the total revenue; The revenue was 44.8252 million yuan, a year -on -year decrease of 34.33%, accounting for 18.3%of the total revenue; the revenue of the interactive upgrade business of home schools was 51.5861 million yuan, a year -on -year decrease of 18.82%, accounting for 21.06%of the total revenue.

Quanyong Education admits that the construction and operation of education informatization projects and the interactive upgrade business of home and school seem to have stirred their performance.

In the semi -annual report, Quanye Education explained that education information projects were affected by the time node of the bidding of customers, and there were irregular fluctuations. Among them, the relevant projects related to the education information platform have a complex process and a long period of time, and most of them are delivered in the second half of the year. Some educational information projects are also affected by different degrees of epidemic. The above reasons have led to the decrease of educational information project revenue by about 23 million yuan year -on -year. In addition, due to the changes in industry technological upgrades and customer needs, the income of home -school interaction upgrades has continued to decline year -on -year.

In addition to the decline in revenue profits, the cash flow of Quantong Education has also begun to reduce.

As of the end of the reporting period, the net cash flow generated by the full-time education fundraising activities was -122 million yuan, an increase of 39.94%from -87.836 million yuan in the same period last year. The main reason for the increase in related cash outflows is to repay bank loans. The repayment bank borrowing also reduced the money funds of Quantong Education by 37.45%, only 318 million yuan. As of the end of the reporting period, the balance of cash and cash equivalents in Quantong Education was 310 million yuan, a decrease of 5.16%year -on -year.

Endless risks

Summary of previous reports that since this year, Quantong Education has sold its company's equity many times.

In January of this year, Quanye Education announced that it intends to sell the equity of 24.24%of the Zhiyuan Holdings Co., Ltd. to M & S Glory Limited. The price of the assets sold at this time is RMB 22 million.

It is reported that before the transfer transaction, Quanye Education held 24.24%of the equity of Zhiyuan Holdings through its wholly -owned company Quanye Education Basic Investment Company. After the transfer is completed, it will no longer hold the equity of Zhiyuan.

Regarding the reason for the sale of Zhiyuan Holdings, Quanye Education stated that this move is based on the comprehensive consideration of the company's future development strategic planning and business layout, recover investment, reduce investment losses, and help achieve the company's strategic focus, enhance the company Sustainable development capabilities. In July of this year, its wholly -owned subsidiary Quantong Education Infrastructure Investment Management Co., Ltd. sold 51%of Tianjin Quanyong's equity held to Zhang Zhongyang, with a transaction price of 5.1 million yuan. According to the announcement, the transferee Fang Zhang Zhongyang worked in Tianjin Quanyong.

In the announcement, Quanye Education stated that as of the first half of 2022, Tianjin Quantong Pure Assets was 5.4635 million yuan, a net loss of 2.27 million yuan in 2021, and a net loss of 1.23 million yuan in the first half of 2022. Quantong Education believes that it is difficult to achieve a large reversal in the short term of Tianjin Quantong business, so the company decided to sell 51%of Tianjin Quanyong's equity to reduce investment losses.

How much risk does investment loss bring to Quanye education? At the beginning of the semi -annual report, Quantong Education listed a number of risks it faced, among which the risk of goodwill impairment ranks first.

Quanyong Education stated that as of the end of the reporting period, the company's good book value was 97.752 million yuan, accounting for 14.58%of the net assets attributable to shareholders of listed companies at the end of the reporting period. The goodwill brought by Xi, Hebei Huangdian, Quantong Ji religion, Hangzhou Sixun and other companies. In the future, if the relevant subsidiaries of mergers and acquisitions cannot achieve the income better, there will be a risk of goodwill impairment, which will adversely affect the company's operating performance.

At the same time, Quanye Education is also facing the risk of higher accounts receivable.

In the end of the reporting period, the company's revenue account balance was 196 million yuan, accounting for 18.59%of the total assets at the end of the period. The company's education informatization project business involves multiple links such as hardware procurement, software development and testing, hardware installation and system integration, project delivery acceptance, and some customer payment approval processes from contract signing to project acceptance.

In this regard, Quanye Education stated that the nature of the business has led to the company's account receivable turnover speed slower and the balance of accounts receivable is large. If the customer breaks the contract by changes in the macroeconomic environment in the future, the balance of accounts receivable will make the company face a certain risk of bad debt, and it may directly affect the company's capital turnover speed and operating performance.

In addition, Quanye Education also stated that due to scientific and technological and national policies, the company's education information service industry is evolving. With the continuous application of innovative technologies such as AI, virtual reality technology, 5G, and cloud computing; the relevant industry policies introduced by the country densely pointed out the new direction for the development of the industry, and also put forward new requirements for the company's development.

In the future, if the company fails to accurately grasp the development trend of the industry and information technology in the fierce industry competition pattern, and the degree of matching of iterative products and the market will hinder the company's healthy development.

In addition, with the intensification of competition in the industry, Quantong Education is still facing the risk of core personnel loss. If the loss of key talents will cause the company's ability to coordinate resources and solve problems, affect the smooth operation of the company's business process, and to a certain extent affects the stability of the company's business and the sustainability of development.

Revenue profits have continued to decline, and the transformation business drags the performance; investment losses have continued to increase, and the risk of personnel loss has increased ... To break the dilemma of development, the full -scale education is still far away.

- END -

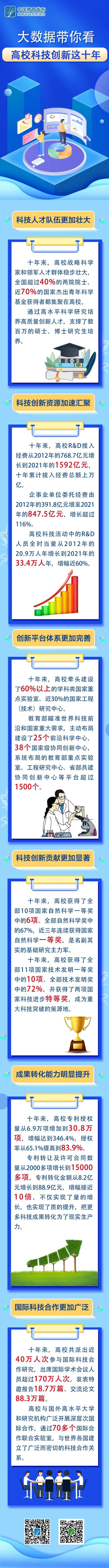

Big data takes you to see the ten years of the reform and development of scientific and technological innovation in colleges and universities | Education in the "1+1" session of the "1+1" in the past ten years · Data said

Education This 10 years | Data StoryThe Ten Years of Education 1 series of the Min...

Beijing University of Technology's second batch of public recruitment in 2022!

Beijing industry universityThe second batch of teachers and other professional and...