The academic education in the transformation: more flowers or scattered sand?

Author:Blue Whale Finance Time:2022.09.06

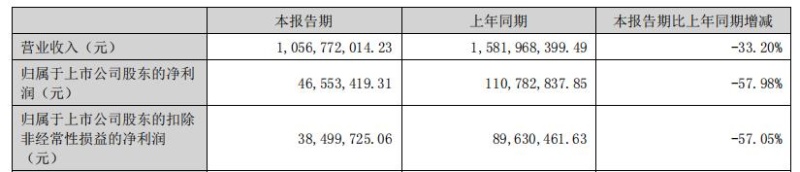

Recently, Xueba Education announced the semi -annual results of 2022. In the first half of the year, revenue achieved a revenue of 1.057 billion yuan, a year -on -year decrease of 33.2%, and the net profit attributable to the mother was 46.5534 million yuan, a decrease of more than 50%year -on -year.

Within a year of returning, Jin Xin encountered the "double reduction" policy. How about the education of the big school of life for half a year?

"Dark moment"

"The K9 training business accounts for 40%of the overall revenue of the large academic academic. It is huge in the short -term clearance or pressing the pause keys in a short time. Until the dark moment. "Talking about the influence of industry policy changes, Jin Xin described this in the media interview.

Earlier, Xueda Education has issued an announcement saying that it is planned to stop the online disciplinary education training business during the compulsory education stage from January 1 this year. The semi -annual report shows that the company has stopped the K9 discipline education business. Affected by the changes in industry policies and the repeated epidemic, the company achieved revenue of 1.057 billion yuan in the first half of the year, a year -on -year decrease of 33.2%. During the period, the net profit of mother -in -law was 46.5534 million yuan, a decrease of 57.98%year -on -year.

The company's ability to maintain positive profits is mainly due to effective control of cost. During the reporting period, the sales costs, management costs, financial expenses, and research and development costs of Xueda Education were 57.71 million yuan, 149 million yuan, 35.1213 million yuan, and 12.539 million yuan, a year -on -year decrease of 53.76%, 28.87%, 26.49%, 46.16%, and 46.16%. Essence The company's operating costs also decreased from 1.049 billion yuan in the same period last year to 29.97%to 734 million yuan. According to the financial report, the company strictly controls the operating costs of the enterprise in the first half of the year, reduces costs, reduces unnecessary expenses, and maintains the stability of cash flow.

However, despite the effective control of expenses, cash flows are inevitable. Affected by changes in industry policies, the reduction of pre -collection of education business has led to the net cash flow generated by operating activities in the first half of the year was 5.8045 million yuan, a year -on -year decrease of 93.12%. As of June 30, 2022, the company's cash and cash equivalent balance was 787 million yuan, compared with 867 million yuan at the end of 2021. From this point of view, even if the cost reduction measures are taken, the cash end still takes a lot of pressure.

It is even more noteworthy that as of the end of the reporting period, the company's short -term borrowing and contract liabilities were 1.17 billion yuan and 448 million yuan, respectively. The two items increased by more than 50 % of the total assets. Moreover, the company's cash cannot completely cover short -term borrowing and contract liabilities, which undoubtedly brings more risks to operations.

The revenue profit is doubled and the cash flow is under pressure, which cannot completely cover short -term loan and contract liabilities ... The pressure of operation is transmitted to various sectors of education.

"Giant Elephant" turn around

In the predicament, the study of the University of Education is fighting the "combination boxing" of self -rescue.

After the "double reduction" policy landed, the company announced a strategic cooperation almost every month. In September 2021, Xue University of Education and Wuling Technology signed the "joint venture agreement". The two parties will jointly invest in the business operation and comprehensive management platform in the field of picture book. In October, Xue University of Education and Dane Education announced a long -term in -depth business strategic partnership. The two sides will carry out in -depth cooperation in non -disciplinary business including adult vocational education and adolescent programming. In November, Xueda Education signed a strategic cooperation agreement with Grape Smart Science, and will cooperate around the fields of artificial intelligence and smart education.

Compared with scattered projects last year, this year's study of education seems to have clarified the specific direction of transformation. The semi -annual report pointed out that in addition to consolidating traditional businesses, the company is actively deploying four areas: vocational education, quality education, cultural services, and education informatization.

Specifically, in terms of traditional businesses, the study of education has retained some high school business. By September 2021, the revenue of high school and the proportion of education and training business revenue will be about 60%. The semi -annual report revealed that the full -time training business, including the repetition of the college entrance examination, has become one of the traditional advantages of the University of Education. As of the end of the reporting period, the company has deployed nearly 40 full -time training bases nationwide.

In the media interview, Jin Xin said that the entry point for learning the transformation of the University is the new college entrance examination, making corresponding reconciliation plans for students, and at the same time, focusing on expanding and re -reading, college upgrades, postgraduate entrance examinations and other businesses. Last year, the repeat volume of the college entrance examination was not large. This year, the re -reading business should account for more than ten % of the overall revenue.

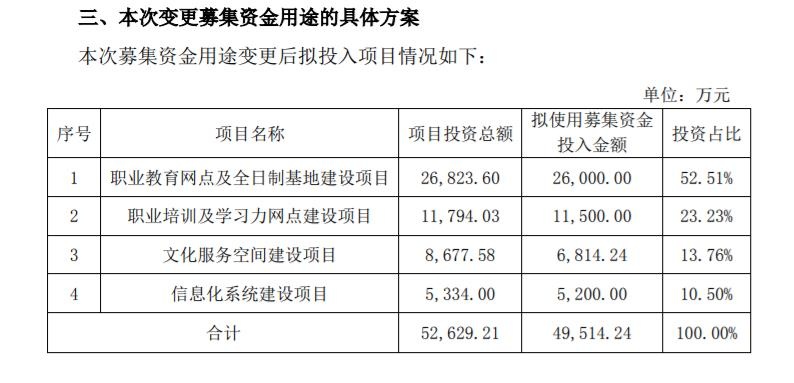

In the new expansion of business direction, the study of education is obviously very optimistic about the development potential of vocational education. In February last year, the company had not publicly issued 822 million yuan in raised funds, and as of June 30, 2022, the balance still deposited 495 million yuan. Recently, Xueda Education announced a plan to change the use of funds raised. It plans to transfer funds that were originally used for K12 business to vocational education outlets and full -time base construction projects. Among them, projects related to vocational education accounted for more than 75%.

The change announcement states that the company plans to deploy vocational colleges through cooperation, custody, school running, etc., steadily developing vocational undergraduate education, and intending to launch vocational education and college entrance examination training, college upgrade training, joint school running and training bases. Essence The semi -annual report revealed that there have been vocational education college entrance examination training at present, and cooperation with education and secondary vocational schools to set up vocational education education majors, vocational education and education majors, and art education major. Study projects.

However, the semi -annual report did not disclose the specific revenue number of the vocational education business. At present, although the company is very optimistic about the development prospects of vocational education, the sector is still in the early stage of investment. Essence Recently, Xueda Education has also announced that it is planned to invest 300 million yuan in cash to set up a wholly -owned vocational education platform company. The business scope includes vocational education and full -time education. With the company's cash and cash equivalent only 787 million yuan, a large number of investment vocational education may further exacerbate the tension of cash flow. Regarding the transformation of education in education, there are also cultural service directions that have attracted attention. It is mainly to lay picture books reading halls and read cultural spaces in major cities across the country, and provide users with services such as book borrowing and coffee light food. In June last year, Xueda Education announced the establishment of a wholly -owned subsidiary Beijing Zhuoqi Coffee Co., Ltd., and "Xueda Education Transformation and Selling Coffee" immediately triggered a lot of discussions. In January of this year, the first pan -crowd cultural space "Sentence Bookstore" was opened in Shenzhen, and the picture book reading museum has also landed in Beijing.

However, due to the impact of the epidemic, even if many bookstores try to transform to cultural service space, it is still closed for physical bookstores, including a highly popular and financing of more than 200 million yuan. The bookstore closes Shenzhen stores and so on. "2020-2021 China physical Bookstore Industry Report" shows that in 2020, about 1,573 physical bookstores in China were closed. The profit model of offline reading is still an industry problem. The well -known online celebrity bookstore is still in business dilemma, not to mention that the "new entry" such as the University of Education seems to be optimistic.

The change announcement shows that the overall construction period of the two projects related to vocational education is 3 years, with a total annual revenue of 1.126 billion yuan and an annual net profit of 83.2 million yuan. The annual revenue of cultural service projects is estimated to be 303 million yuan, and the annual net profit is 17.828 million yuan. In contrast, even if the impact of the epidemic has declined, the teaching and training business of the great education in 2020 still achieves revenue of 2.394 billion yuan and net profit of 177 million yuan.

It can be seen that even if the transformation project is built and landed in accordance with the plan, the revenue and profits it brought by it are expected to be compared with the volume of the teaching and training business. Moreover, it takes time to transform to the ground. There is still a problem that cannot be ignored in learning to study at the moment -a billion debt is to be repaid, which is like Damoris's sword high.

Huge debt

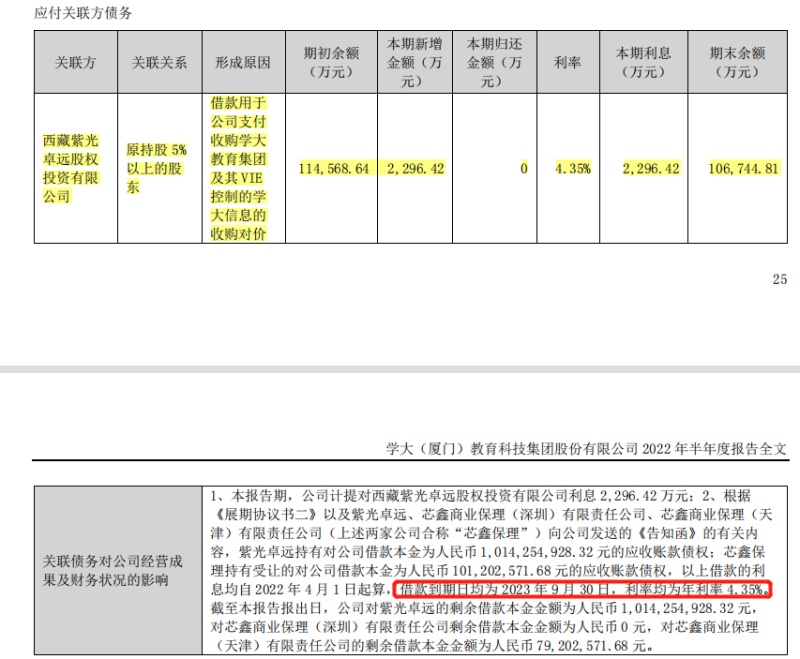

As of June 30, 2022, Ziguang Zhuoyuan held the creditor's receivable claims with a principal of learning from the education of the University of Studies, from April 1, 2022 to September 30, 2023. It is 4.35%. During the reporting period, the company's interest in Ziguang Zhuoyuan was 22.9642 million yuan, accounting for nearly 50 % of the net profit.

In fact, this borrowing is a problem left over the history of studying the University of Education. Xueba Education was listed on the NYSE in 2010, and in 2015, it accepted the privatization invitations of Yinrun Investment and opened the road to returning to A shares. However, after the privatization was successfully completed, the capital market fluctuated, and the original targeted additional issuance plan failed. In desperation, Ziguang Science terminated the fixed increase plan and borrowed 2.35 billion yuan from Ziguang Zhuoyuan.

The 230 billion yuan debt overlay interest of about 80 million yuan per year, which is obviously an unbearable burden for academic education with an annual profit of only about 100 million yuan. In order to solve the problem of debt, Ziguang University has planned asset reorganization and selling major education for the sale, but finally ended.

It wasn't until March 2021 that Ziguang Dai Dingda increased successfully and raised 822 million yuan. At the same time, Jin Xin returned to the great education of the great master of learning, and it seemed that there was a trace of turning. Using the funds raised, the company invested 247 million yuan to repay the debt, which relieved the debt pressure to a certain extent. At that time, many brokers believed that they were trapped in debt pressure and the profitability of studying great education was weak. After the repayment of the loan, the asset -liability ratio of Ziguang science will be reduced from 96.56%to 81.14%. The company's profit prospects are more optimistic.

However, in less than a year, the "double reduction" policy landed, and the business of nearly 40 % of the business stopped operations, and the pressure brought to the company's performance has not yet slowed down. In 2021, the net loss of the University of Xue University of Education was 536 million yuan. As of June 30, 2022, the Education Education also carried 1.618 billion yuan in contract liabilities and short -term borrowings. Each year, the interest on Ziguangzhuoyuan was repaid nearly 50 million yuan. Under the current profit, it is undoubtedly a lot of expenses.

In an interview with the media, Jin Xin stated that it would be expected to see more obvious scale benefits until the second half of 2023 or 2024. The effectiveness of vocational education was very slow. After a period of time, the employment was more long. There is still one year before the deadline for repayment of 1.067 billion yuan. It is expected to continue the exhibition period. The debt repayment pressure is still difficult to eliminate in the short term. It is yet to be observed whether the transformation can be successfully completed.

The transformation is still climbing and huge debts still over the body ... The transformation of learning from education is destined not to be flat.

- END -

In 2022, the Summer Camp of the "British Talent" was held at Dalian University of Technology

From August 20th to 21st, the summer camp of the British Talent Plan of Liaoning P...

The Ministry of Education "Looking back" found that 4614 institutions of off -campus training problems were disposed of

Cover news reporter Su YuOn August 11, the cover reporter learned from the Ministry of Education that the Ministry of Education deployed the three -month national compulsory education stage look back