In the interrogation world on the altar, can Xiaokang shares get rid of dependence on Huawei?

Author:Drive China Time:2022.07.06

Produced | Bullet Fortune

Author | Hemer

Edit | Egg

Ask the M7 release of 2 hours of orders for a 2 -hour order, and asked the M5 order in June. From the seminar delivery of the first car, 4 months have delivered a total of 20,000 units ... This is a well -off shares (hereinafter referred to as "" hereinafter referred to as "" Well -off ") Half -year" car -making transcript "given to investors.

However, on the second day (July 5), the stock price of Xiaokang fell from 7 points to closing the market on the second day (July 5). Although there is no exaggerated trend from the daily limit to the daily limit, from the biggest decline of over 12 points a day, the secondary market does not seem to buy the arrival of the M7 in the interrogation industry.

On May 11th, "Bullet Fortune" published "Well -offs: A Gambling of a Three -Line Car Companies", thinking that Xiaokang is a lucky one in the story of Huawei's "thousands of money buying horse bones". At the same time, we also believe that "Huawei can help Xiaokang build a car today, and will help brands such as Changan, Great Wall, Geely and other brands tomorrow. There are currently some Hongmeng cockpits and electric drive systems in Xiaokang. The advantages of influence and channel outlets are the flaws of a well -off. "

What I never expected was that in less than a month, at least five car companies "hugged" Huawei's thighs, and in the second half of the year, at least five models on sale will be sold. Using Huawei's "car building" technology. If you have the accelerated transformation of the new forces of car involved in Huawei and the traditional car manufacturer, the prospects of well -off car building are even more doubtful.

1. From "one -branch" to "flowering all sides"

Most of the people in the industry praised the courage to make a car for the first time to build a car. However, if Xiaokang was confused by the current impressive sales and ignored its own shortcomings, it became a "stepping stone" to promote the development of the industry. Then It's a pity. In particular, Huawei has successively cooperated with friends and merchants of Xiaokang, and has a sense of "eating more fish" with friends and merchants of Xiaokang.

On June 14, the media reported that in addition to Jinkang New Energy, Huawei Zhichuan has successively finalized the business cooperation with brands such as Chery, JAC and Jihu.

On June 20, Fan Jingtao, deputy general manager of BAIC Langu, stated on the performance meeting on whether BAIC will enter the Huawei channel at the performance meeting that the cooperation between BAIC and Huawei has been actively promoted. Discovery.

On June 24, BAIC's first SUV model equipped with the Hongmeng vehicle machine system -BAIC Mikuki officially opened pre -sale. This fuel vehicle with the same model of Kirin 990A chip with Jihu and Wenjie Early.

On June 25, Changan, Huawei, and Ningde came together. The first smart high -end electric vehicle Avita 11, which was created based on the "CHN platform", was officially unveiled and determined the listing time on August 8.

On July 4th, Xiaokang and Huawei's third model. The luxury and smart large electric SUV asked M7 was officially released. At the press conference, Yu Chengdong promised to be delivered in August.

(Figure / Question World M7 Press Conference Live)

Judging from the determined news, in the second half of 2022, there will be more than 5 models that have Huawei "blood" and sold on sale.

From the perspective of product layout, it will cover the high -end sedan Fox Alpha S, the compact SUV BAIC Cube, the medium -sized SUV questioning industry M5, the large SUV question world M7 and Avita 11, and the subsequent release of the pure electric version of the question world. Model. From the perspective of power categories, it will cover fuel vehicles, extension, and pure electric models. From the perspective of price distribution, it will cover 10 to 400,000 lows, medium and high -end models.

From a stand -alone to flowering, Huawei has achieved quite good results.

But well in this car crane with Huawei, who is tied to Huawei in depth? Although in the market competition in the second half of 2022, Xiaokang will have two main power production models of M5 and M7, but obviously it is no longer the "who is giving me" in the first half of the year.

Not to mention whether Xiaokang will be "forced" by Chery and JAC. The two high -end models of Guangbei Steam Fox and Changan Avita may make Xiaokang feel pressure.

This is what we worry about -over -reliance on Huawei's well -off, which has been held on the market "altar", and ignores its own competitiveness and comparative advantages.

Of course, these are just the "Huawei" car construction pressure faced by Xiaokang.

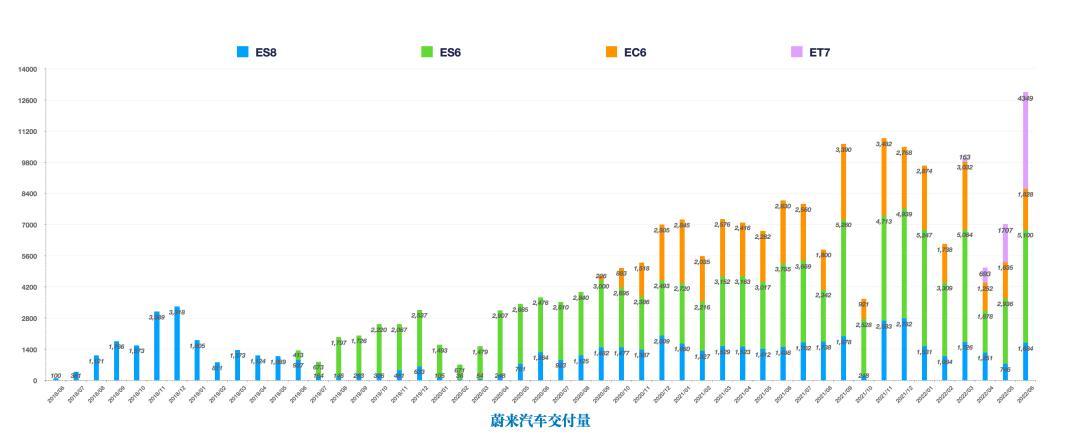

On June 15, Weilai's first large and medium -sized pure electric SUV model ES7 was officially unveiled. At this point, Weilai's products have covered the SUV models of medium, large and coupe, and two cars, becoming the most choosing brand in the new model of car manufacturing. At the same time, Weilai's sales data showed that as of May 31, 2022, Weilai's cumulative delivery reached 20,4936 vehicles, becoming the first new car company in the new vehicle construction for more than 200,000.

(Drawing / asymmetric transaction)

In addition, Ideally launched the second model "Ideal L9 MAX", known as "the best home SUV for 5 million", and finally priced at 459,800 yuan; combined with the Dongfeng Lan Tu dreamer released at the beginning of the month, BYD Tengshi D9 ... … Independent brand intelligent new energy has filled all the vacancies you can imagine below 500,000 yuan.

In particular, from the perspective of Weilai Automobile's layout and sales, the new forces of car manufacturing have entered a comprehensive overall layout from a single explosive model and precise users. The new car brand has also entered the comprehensive fighting of "competition on the same stage" from the differentiated play of "I can't", and the market competition has further intensified. But for a well -off, what is your own advantage? Where is differentiated and subsequent momentum? As of press time, the "Bullet Fortune" has not yet received a corresponding reply from Xiaokang.

2. Gao Geng or stop loss in time?

In this new energy vehicle melee in 2022, Xiaokang rely on a "dark horse" attitude to the car sales list with a "dark horse" posture, and it has also become a textbook style of Huawei's "buying horse bones". success case.

As far as Yu Huawei is concerned, the car manufacturing strategy of helping car companies is small and effective. As far as Xiaokang is concerned, the current situation of continuous losses and over -reliance on Huawei's technical support, combined with the brand image of Xiaokang and the shortcomings of sales channels, people are deeply worried about its long -term development.

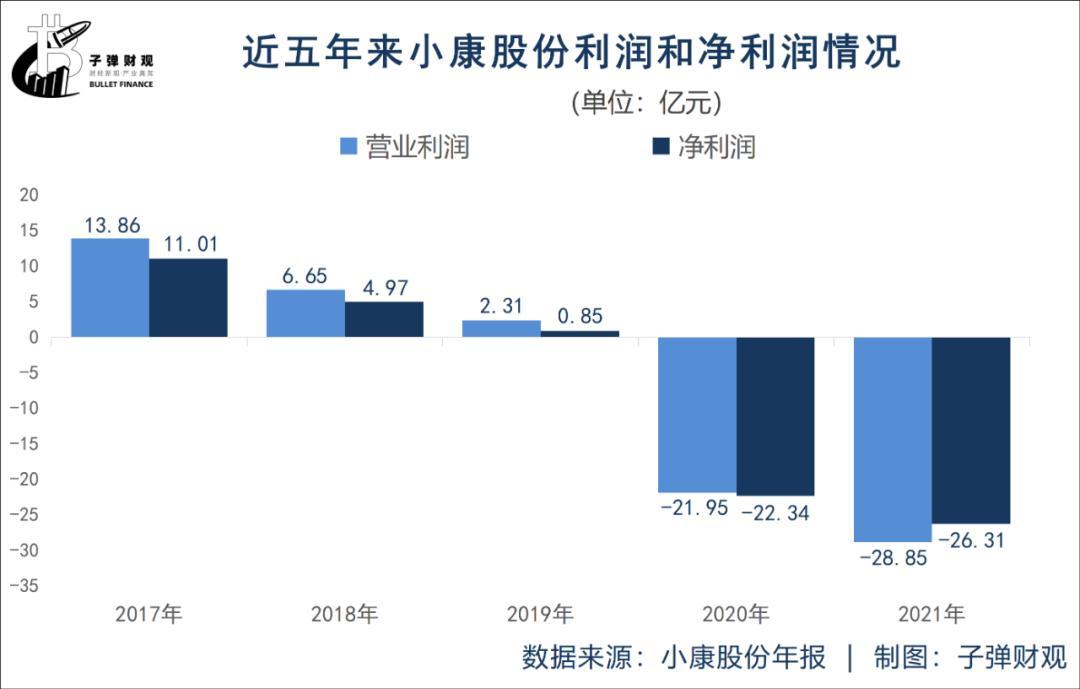

"Bullet Fortune" discovered that in recent years, with the overall decline in the sales performance of Xiaokang's shares, profitability has gradually decreased from gradually to huge losses.

In the past five years of financial report data, in the three years of 2017-2019, total operating income has fallen by 17.33%, but net profit has plummeted by 92.24%. Especially in 2020 and 2021, the operating income seems to have a sign of the bottom, but the amount of losses is further increased, and the cumulative net profit loss of two years reached 4.865 billion.

In the first quarter of 2022, the operating income of Xiaokang shares was 5.131 billion yuan, an increase of 56.03%year -on -year; net profit loss reached 1.124 billion yuan, an increase of 86.17%year -on -year. Operating income increased by over 50 %, but the amount of losses increased by more than 80 %, and the losses were further increased.

The two -year loss of 4.865 billion yuan means that the well -off shares have lost the cumulative net profit of the past 10 years in two years.

From the perspective of "Wei Xiaoli", in the past 2021, Weilai net profit lost 4.017 billion yuan, Xiaopeng net profit lost 4.863 billion yuan, and ideal net profit loss was 321 million yuan.

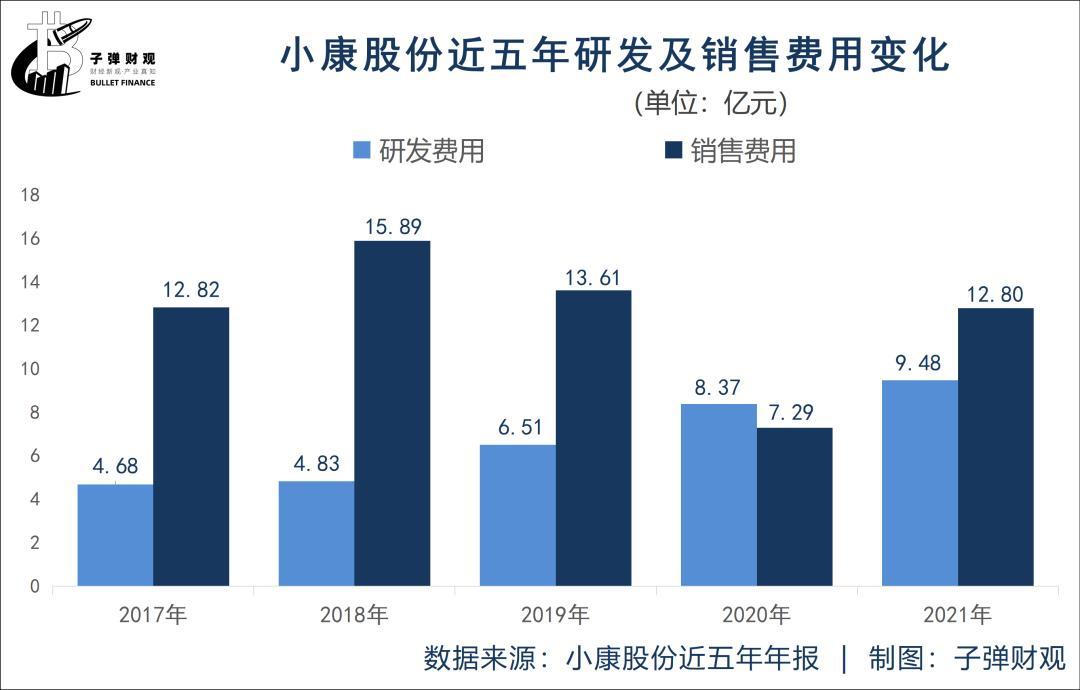

"Bullet Fortune" also noticed that in the past five years, with the overall decline in the operating income of Xiaokang, the sales costs have also shown the overall downward trend, but the research and development costs have increased significantly year by year.

This is also due to the high standard investment of Liangjiang Smart Factory, which is proud of Xiaokang, as well as the research and development and mass production of SF5 SF5, Wentian M5 and M7.

Of course, in terms of technical investment and accumulation, the amount of R & D expenses seems to be a bit too one -sided, and comprehensive revenue must be used to look at the proportion of R & D.

The "Bullet Fortune" compared to the annual report of Xiaokang shares and BYD's annual report found that the proportion of R & D expenses of Xiaokang exceeded 5%in the past two years, and exceeded BYD. However, considering that BYD is a large -scale car company with a revenue of 200 billion yuan, and the layout of the new energy vehicle has been nearly two decades, Xiaokang is still distressed when the revenue can return to 20 billion.

Behind these dozen times of revenue is the huge gap in R & D expenditure.

In addition, BYD is an old -fashioned company in the field of new energy vehicles. It seems that there are many models and the product lines are complicated, but most of the research and development results are used in cross. For example, a set of batteries, motors, electrical control, and vehicle machine systems can be used on different product lines and models, and most of them are basic technologies in the core field.

After the expansion of the output and development scale, the cost of R & D investment has been spread, and this will be that BYD's seemingly lower R & D expenses account for the proportion.

Compared to BYD, the road to Xiaokang's car building is more similar to new forces such as "Wei Xiaoli". For a well -off, high -end smart electric vehicle brands such as Selis and the questioning world have long been far away from mainstream models that won "cost -effective". Just like the AITO brand, Xiaokang and Huawei's car building is almost "starting from scratch."

As a new high -end smart electric vehicle brand, well -off in the past two years, only the R & D cost of less than 1.8 billion yuan has also lost over 4.8 billion yuan.

The reason why they can "spend small money to do big things" are because of Huawei's technical blessing. It is precisely because of Huawei that it has allowed Xiaokang to use less than one billion yuan in R & D investment and enjoy tens of billions of R & D results. And this is exactly what we worry about. Its basic skills are not solid, but they have been held on the "altar" by capital. It has also been further confirmed that the achievements I made today and the well -off their own investment are not equal.

3. Huawei's ambition and the pressure of well -off

The "Bullet Fortune" briefly sorted out the needs and concepts of the "car building" of Xiaokang and Huawei, and found that Huawei had a lot of ambitions in the field of car -making and various pressures faced by Xiaokang.

At present, Huawei insists on providing technical support to car companies with the posture of the supply chain, including but not limited to Huawei's power drive system, vehicle machine system, smart cockpit, and related ICT technology. And Xiaokang is a typical traditional car manufacturer. In recent years, it has tried to make a detonator of traditional car companies through breakthroughs in new energy tracks.

Huawei needs to use technology to exchange the trust chain market, and Xiaokang needs to pay for technology to seize market share. In recent years, Huawei has repeatedly stated that he has "not building a car". Therefore, the two can only be a "complementary" relationship. Even if the cooperation is deepened, it will not be on the joint venture model of well -off and Dongfeng. The reason why today ’s questioning industry has been valued by Huawei because of the first cooperation between Xiaokang and Huawei’ s SF5 models of the SF5 models of the SF5 models of the SF5 models of the SF5 models in lack of preparations -eager to see success and ignore the polishing of the product. The technology has not yet been sold yet. When you go to the product, you will turn over. This is undoubtedly "drinking" for Huawei.

In order to avoid repeating the mistakes of the first model, a new questioning world AITO brand appeared.

In order to regain the trust of the market, in addition to strengthening cooperation in R & D, design and manufacturing, the two parties to the car are also placed in Huawei's offline stores and online malls. It was completed by Yu Chengdong with Huawei terminal products.

From the perspective of the cooperation model, Huawei can understand as light asset operations and provide technical and brand support for the interrogation community. And well -off is a typical heavy asset operation, providing vehicle manufacturing and after -sales work for the interrogation community.

When Huawei stands on the role of supply chain, in order to create a fair and free market competitive environment, it will inevitably retreat behind the scenes. It is not only the production capacity and order pressure, but also the burden of brand packaging and channel construction. This is our biggest concern about well -off.

Just as Huawei's rotating chairman Xu Zhijun said at the Chongqing Auto Show: "China does not lack Huawei brand cars, but lacks automotive component suppliers who really have core technology."

What Huawei wants is the entire automotive industry, not just a well -off question.

*The title diagram in the article has been authorized, based on the RF protocol.

- END -

How to light up an electronic driving license for electric bicycles?The application strategy is here

On June 13, the electronic driving license of Wuhan Electric Bicycle entered the t...

Chongqing Auto Show | Brand new European Germany: "With me, control the interest of exploration."

On June 24, the day before the Chongqing Auto Show, Mitsubishi new Outlander made ...