Oil prices are about to drop!

Author:China Youth Network Time:2022.06.28

The new round of refined oil price adjustment window is opened. According to the information of the National Development and Reform Commission, according to the recent changes in oil prices in the international market, in accordance with the current mechanism of oil prices of refined oil products, from 24:00 on June 28, 2022, domestic auto and diesel prices have been reduced by 320 yuan and 310 yuan per ton, respectively.

This price adjustment is the second time that domestic oil prices have been reduced. After the price adjustment, refined oil products have shown the pattern of "ten rises and two declines and zero stranded" within the year. According to estimates, after the price adjustment is equivalent to the price increase, 92#gasoline is reduced by 0.25 yuan per liter, 0#diesel is reduced by 0.26 yuan per liter, calculated at an ordinary private car with a fuel tank capacity of 50L. about. Xu Wenwen, an refined oil analyst in Longzhong Information, said that for the 7L-8L models of 100 kilometers in the urban area, the average cost of a hundred kilometers per driving is about 2 yuan; for large-scale logistics and transportation vehicles with a full load of 50 tons, the average The cost of fuel per 100 kilometers is reduced by about 10.4 yuan. Jin Lianchuang analyst Ma Jiancai said that the current domestic retail 92#gasoline price range is 9.25-9.4 yuan/liter. After the expected redeemed of the retail price is expected, in addition to individual regions, the domestic 92#gasoline price level is mostly 9.0-9.1 yuan The price of/liter, 0#diesel prices are mostly at 8.75-8.85 yuan/liter, which is still a relatively high level.

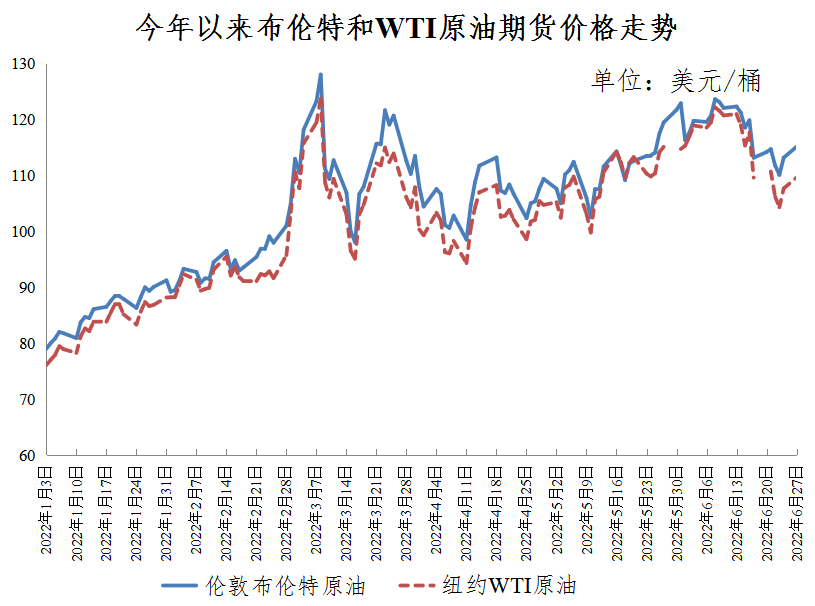

The monitoring of the National Development and Reform Commission's price monitoring center shows that the international oil price of the refined oil price adjustment cycle (June 14th -June 27th) has fallen down. Essence During the price adjustment cycle, factors such as concerns, Fed's radical interest rate hikes and other factors have promoted the decline in international oil prices. First, the market's concerns about economic recession and the need for suppression of demand. Second, many European and American countries have raised interest rates one after another, especially the Fed's radical interest rate hikes have caused recent commodity prices to generally decline. In addition, the U.S. government tried to demand large -scale production in US shale oil companies, and through media shouting, hoping that oil companies would take measures to reduce oil prices, and also increased the downward pressure of crude oil prices.

According to the analysis of the National Development and Reform Commission's Price Monitoring Center, from the later period, crude oil prices still face many uncertainty. On the one hand, the market's concerns about the global economic recession still exist. At the same time, the current international oil price is at a high level, and the inhibitory effect on demand will gradually be reflected. On the other hand, the current production capacity of OPEC has limited production capacity. At present, in addition to Saudi Arabia, Iraq, and Kuwait, most member states have basically reached the limit of oil production, and it takes time to relieve Iranian sanctions and release Venezuela's crude oil production capacity. Recently, the Seven -way Group meeting plans to impose more sanctions on Russia, which will have an important impact on the supply of future global crude oil markets. In the later period of the price adjustment cycle, international oil prices have rebounded. It is expected that international oil prices will remain at a high level in the short term.

Li Yan, an analyst of the Oil Oil Oil, said that based on the current international crude oil price level, the next round of refined oil price adjustment will show a slight downward trend. At present, the pressure on Russia's sanctions on Russia and the peak of summer travel in the United States have brought good support, but the Fed said that it will continue to raise interest rates and the market's concerns about economic and demand. The probability of price adjustment is high.

、 Source: Guangming.com, Economic Daily

Editor -in -chief: Zhang Yanyun

华 Audit: Zeng Fanhua

┃ Review: Wang Hai

© China Youth Network WeChat

- END -

The 10th increase of oil prices during the year, and Hengyang citizens will target the electric vehicle market

Hengyang News Network News reporter Zhu Min reported that domestic oil prices will...

The planned total investment exceeds $ 500 million!Six foreign -funded projects are signed!

BleakFrom June 19th to 20th, the 3rd multinational company leader Qingdao Summit w...