"Profit Cow" Porsche was listed: selling a car to earn 120,000, one -third of them sold to China

Author:First financial Time:2022.09.29

29.09.2022

Number of this text: 1992, reading time for about 4 minutes

Guide: As soon as it was launched, it jumped to the world's fifth largest market value car company.

Author | First Finance Xiao Yisi

At 9:20 am on September 29th, Germany time, Porsche, which has attracted much attention, officially landed on the Frankfurt Stock Exchange. The listing price was set to 82.5 euros per share, with a total market value of 75 billion euros. This IPO is the second largest IPO in German history and the third largest IPO in European history.

Even if facing the environment where the overall valuation of the automotive manufacturing industry is unfavorable, Porsche will go all the way after the listing trading. As of 10:35 local time, Porsche's stock price has reached 86 euros/share, and the total market value has also increased to more than 77 billion euros (about RMB nearly 540 billion yuan), becoming the fifth largest market value car company in the world, ranking specially in specialty, ranking specialty, ranking in special specialty. After Sla, Toyota, BYD, Volkswagen.

How much is the fundamental "resistance"?

As early as 2018, it was reported that Porsche was going publicly, but the Volkswagen Group quickly rumored. After entering 2021, Volkswagen Group's rumors to go publicly on Porsche were even more prosperous, and some familiar with the matter said that the purpose was to transform electrification of the Volkswagen Group. On February 24 this year, Volkswagen Group finally stated publicly that the possibility of studying Porsche will be studied. At the beginning of September this year, Volkswagen Group confirmed that Porsche was planned to be listed on the Frankfurt Stock Exchange in Germany at the end of September or early October.

It is not uncommon for large -scale automobile groups to be listed on its high -quality assets independently to raise funds. For example, in 2015, Fiat Chrysler (FCA) launched its supercar brand Ferrari in the United States. The funds raised were used to help achieve a plan to turn losses, as well as brands such as Jeep and Maserati under the revitalization.

Affected by the sales of models, Ferrari has risen all the way since it was listed. On November 22 last year, the highest price was $ 277.25, which was 4.3 times higher than the issue price of $ 52. Although Ferrari's stock price has fallen this year, the closing price on September 28, Eastern Time, was $ 191.23, which is still nearly 2.7 times higher than the issuance price.

Compared with Ferrari, Porsche has no better than Ferrari. It is reported that Porsche shares performed very sought after the investor subscription stage.

"For a long time, Porsche has been one of the most profitable car manufacturers in the world." Sam Abuelsamid, an analyst at the US Energy Consulting company Guidehouse Insight, said, "For Volkswagen, the opportunity to sell some stocks and raise funds is difficult to meet. This is enough to ensure that Volkswagen has sufficient funds for electrification in the next many years. "

There are many car brands under the Volkswagen Group, including Bentley, Bugatti, Lamborghini, Dukadi and other ultra -luxury brands, and there are also relatively large sales of Audi and Volkswagen. But among them, Porsche can really be called the "profit dairy cow" of the Volkswagen Group. In 2021, although Porsche's delivery volume accounted for only about 1/30 of the total sales volume of Volkswagen Group, the profit contribution rate was as high as 1/4.

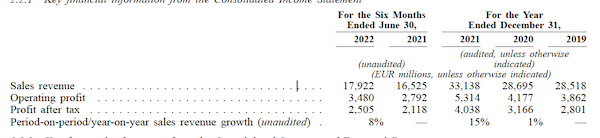

According to the latest announcement of the prospectus, in 2021, Porsche operating income and operating profit hit a record high. In fiscal 2021, Porsche revenue increased by 15.5%year -on -year to 33.1 billion euros; operating profit reached 5.3 billion euros, an increase of 27%year -on -year; after taxation profit of 4 billion euros; the return on sales was 16%, which was higher than 15%long -term long -term long -term long -term long -term long -term Strategic objectives.

In 2021, Porsche's sales in the world were 302,000, which means that Porsche's operating profit for each car for each car is as high as 17,600 euros (about 120,000 yuan), and the profit after tax is as high as 13,400 euros (about RMB exceeding the exceeding RMB exceeding over 93,000 yuan).

In the first half of this year, even if facing the energy crisis of the European region and severe car supply chain, Porsche financial indicators became more "anti -fight". Although Porsche fell 5%to 145,800 units year -on -year in the first half of the year, operating income increased by more than 8%to 17.9 billion euros year -on -year, and operating profit increased by nearly 25%year -on -year to 3.48 billion euros. 19.4%.

Prior to this IPO, Volkswagen Group held 100%equity of Porsche. After the IPO, Volkswagen Group will transfer 25%of Porsche equity, half of which are sold directly to new investors (no voting rights), and the other half is sold to the core shareholders of Volkswagen Group Porsche-Pijiey Porsche at a premium of 7.5%. Greek family.

Volkswagen Group previously stated that 12.5%of the total share capital of Porsche will bring the company's revenue of 8.7 billion to 9.4 billion euros. This funds will help them transform. The family, the family, has a 25%direct voting right after Porsche iPo.

One is sold to China for every 3 vehicles

Porsche's ability to make money is so strong, and the performance of 1/3 must be attracted to the Chinese market.

According to the prospectus disclosed by Porsche, in the past three and a half years, Porsche sold over 310,000 vehicles in the Chinese market, accounting for about 32.09%of the world's total sales. In 2021, Porsche delivered a total of 302,000 vehicles worldwide, of which the number of delivery in the Chinese market exceeded 95,000, accounting for 31.69%of the total global sales, an increase of 8%year -on -year. Yan Boyu, president and CEO of Porsche China, said that as of 2021, China has become the largest single market in the world for seven consecutive years.

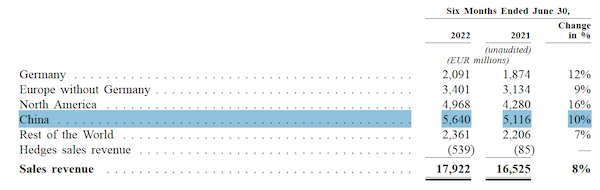

In the first half of this year, affected by the outbreak of the epidemic, the overall decline of the Chinese luxury car market exceeded 20%, and the proportion of sales in Porsche China's market also declined. A total of over 40,000 units were sold, a year -on -year decrease of 16%, accounting for a global sales proportion. To 27.4%.

However, according to the prospectus, in the first half of 2022, Porsche's sales revenue in the Chinese market did not have declined year -on -year, but increased by 10%to 5.64 billion euros (approximately RMB 39.2 billion), accounting for the proportion of global sales revenue Still over 30%(31.47%).

This also means that in the first half of this year, the average sales price of a domestic Porsche car increased. According to the calculation of the first financial reporter, the average price increased from about 730,000 yuan in the first half of last year to 980,000 yuan.

In addition to increasing the unit price of automobiles, Porsche's new buyers are gradually younger and feminine. The prospectus shows that in 2021, the average age of Porsche's new car buyers in China is less than 40 years old. As of 2022, the proportion of women's customers in Porsche, China was 50%, an increase of 3 percentage points compared with the 47%of the female owner in 2017.

- END -

360 Give up the capital increase, who is abandoned and who is abandoned

(Picture source: Oriental IC)Economic Observation Network reporter Zhou Ju, accomp...

Improving the proportion of application, improving the charging and replacing facilities ... Policy helps new energy vehicles to develop rapidly

Xinhua News Agency, Beijing, August 8th.Xinhua News Agency reporter Zhang XinxinIm...