The performance has fallen sharply, and Xingye Auto Parts has not caught up with good times | IPO observation

Author:City world Time:2022.09.27

In the past few years, the hottest industry is the new energy vehicle industry. The sales of related companies have not only increased, but the stock price has also risen sharply. Compared with new energy vehicles, the heavy truck car market is relatively lonely, and the industry sales have fallen sharply.

In this context, Xingye Auto Parts, the main business of truck parts, updated the prospectus in July 2022, and plans to list on the main board of the Shanghai Stock Exchange. Public information shows that Xingye Auto Parts was established in 2003. The main business is the production and sales of truck frames and body components.

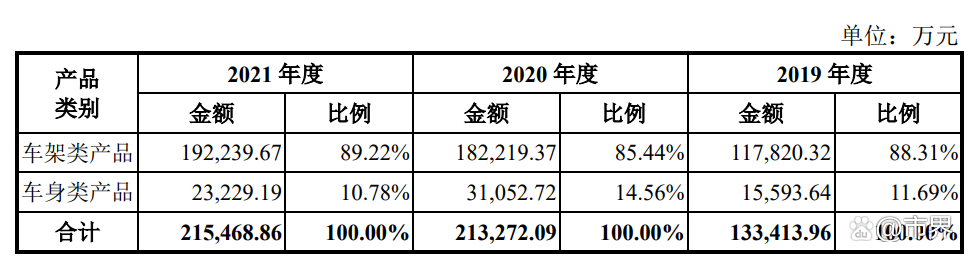

The company's main products are frame products, including frame assembly, vertical beams and frame parts. The products are mainly used in heavy trucks. In 2021, the company's frame products achieved sales revenue of 1.922 billion yuan, accounting for 89.22%of the company's main business revenue.

In the past 10 years, my country's economy has developed rapidly, and domestic heavy truck sales have also increased from 881,000 in 2011 to 1.619 million.

However, any industry is cyclical, and the heavy card industry is no exception. In 2021, the sales volume of the heavy truck industry fell for the first time since 2015. The heavy card sales of the year were 1.395 million units, a year -on -year decrease of 13.8%.

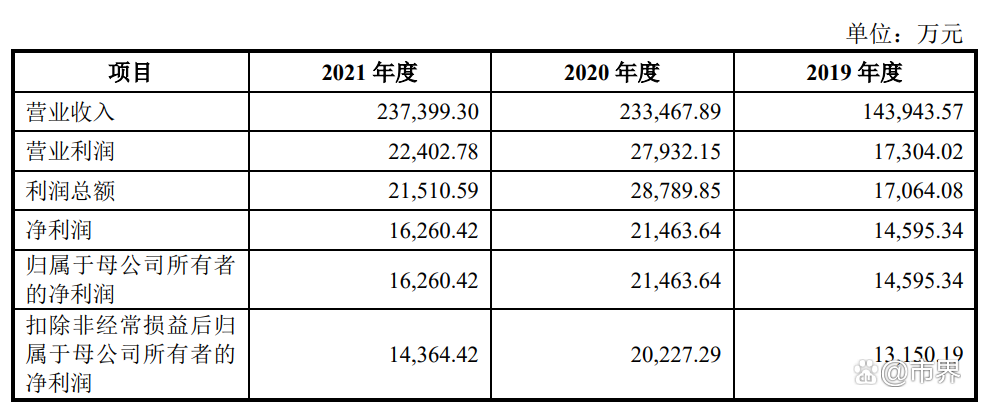

The industry is unsatisfactory, and the performance of Xingye's auto parts will naturally be affected. The prospectus shows that in 2021, the operating income of Xingye's auto parts was 2.373 billion yuan, which was only 1.6%from 2.334 billion yuan in 2020. In 2020, the company's revenue growth rate was 62.19%.

The rate of increasing the revenue of Xingye's auto parts has declined sharply, but it is still growing. Compared with revenue, the net profit of the home of Xingye's auto parts is a bit "cold". In 2021, the company realized net profit of 162 million yuan, a year -on -year decrease of 24.24%.

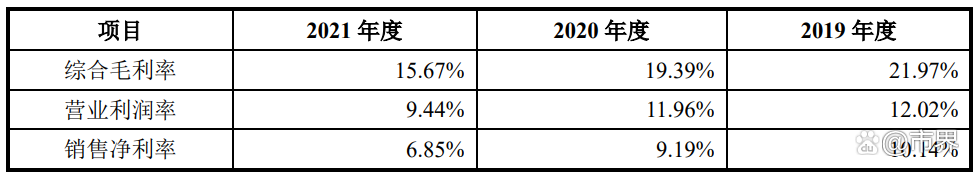

Regarding the decline in net profit returning to the mother, the explanation of Xingye's auto parts was that the rising raw material price increased the gross profit margin of the company, which led to a decline in net profit of the company. The prospectus shows that the raw materials of Xingye Auto Parts are mainly steel for steel in 2019-2021, respectively. In 2021, the price of steel rose by 34.56%, and the comprehensive gross profit margin of the company was 21.97%, 19.39%, and 15.67%, respectively during the same period.

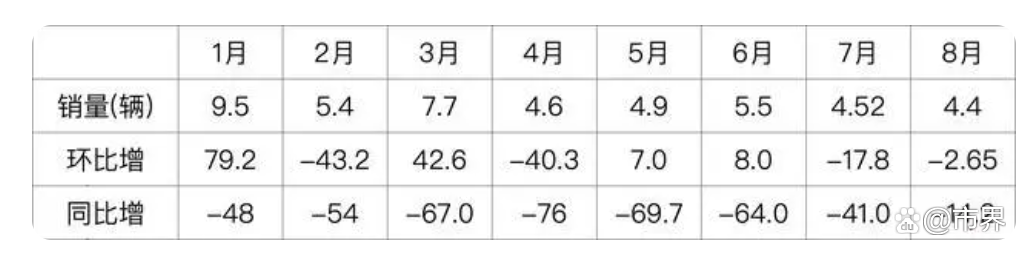

The rising price of raw materials has led to a significant decline in net profit attributable to mothers in 2021. From the perspective of raw materials, it is more friendly to Xingye's auto parts in 2022. Since the price of threads has seen it in 2021, the price decline is nearly 50%. Although the price of raw materials has plummeted, the company's life is not good. According to the China Automobile Association data, from January to August 2022, the domestic heavy truck sales were only 469,300 units, a decrease of 704,700 units from 1.174 million units in the same period in 2021, and sales decreased by more than 60%.

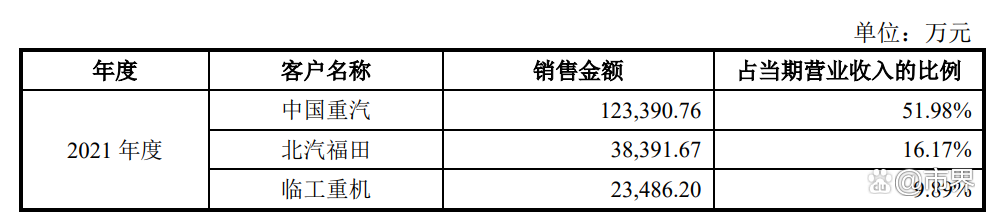

As the absolute leader of the heavy truck market, China Sinotruk has always been the largest customer of Xingye Auto Parts. In 2021, the sales of Xingye Auto Parts to China Sinotruk reached 1.233 billion yuan, accounting for 51.98%of the company's total revenue. In the first half of 2022, China ’s heavy vapor revenue and net profit attributable to their mother were 15.33 billion yuan and 320 million yuan, respectively, a year -on -year decrease of 61.67%and 68.34%.

From the perspective of industry sales and the largest customer performance, Xingye Auto Parts operating performance in 2022 is not optimistic. This point can also be seen at first sight in 2021. In 2021, all the products of Xingye Auto Parts have risen, and the sales of longitudinal beams, frame components, and body products have fallen sharply. The reason why the sales volume of the automotive frame assembly rose was because they signed a contract with customers such as Sinotruk and locked the sales of the year.

As of September 22, 2022, the IPO status of Xingye Auto Parts was displayed as pre -disclosure, and there were many processes such as feedback, preliminary review, and review meeting.

According to the new IPOs released by the Securities and Futures Commission in 2019, the net profit decline in net profit after the meeting does not exceed 30%. Essence

Companies with a decline of more than 30%but less than 50%need to provide a profit forecast report for the next year. The sponsors need to make a special analysis report on the changes in the operating performance of the issuer, and the continuous operating capabilities will be proposed, and the reason for the decline in operating performance will not affect the company's continuous operating capabilities. Only in line with the above requirements, the subsequent distribution can be arranged.

The decline is more than 50%, the IPO issuance is suspended.

According to the regulations of the CSRC, IPO companies need to update the prospectus every six months. The recent disclosure of the prospectus of Xingye Auto Parts is July 5, 2022, and the time to update the prospectus again should be January 4, 2023.

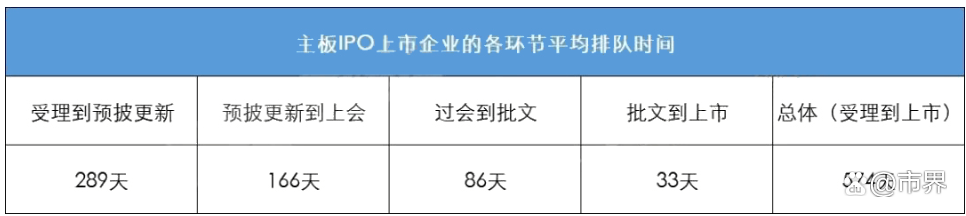

According to the official website of the CSRC, the pre -disclosure stage was only on July 5, 2022. According to the data disclosed by the Director of the Director, the average time from pre -disclosure to the official main board company is 166 days. Therefore, the time of Xingye's auto parts is likely to be at the end of 2022 or early 2023.

At that time, the latest financial data of Xingye Auto Parts should be the performance of the 2022 semi -annual report or the third quarterly report. According to the sales volume of the heavy truck industry and the semi -annual report disclosed by China Sinotruk, the net profit of Xingye's auto parts may also be significantly affected.Even if successful, according to the CSRC's disclosure of corporate profits, Xingye Auto Parts has faced major challenges.(Author: Duan Nannan)

- END -

Favorites | New Road Traffic Logos

Road Traffic Logo and Line Part 2: Road Transportation Logo (GB 5768.2-2022) will ...

Data outbound policy is frequent, how can intelligent connected car data be "security inspection"?

The automotive industry is one of the industries with a high degree of globalization. Many car companies set the R D center overseas to achieve the full use of global R D resources. Based on the c