How to buy both car insurance and save money?

Author:Tianshan.com Time:2022.09.20

Pomegranate/Xinjiang Daily reporter Ran Hu Ranhu

Recent Gao; the experience introduced by friends seems to be cheap but insufficient. Is there a solution for both beauty? "

With the improvement rate of private cars and the enhancement of people's insurance awareness, how to buy car insurance has become a knot of a car like Liu Huan. After all, in addition to buying a car, car insurance is one of the largest projects.

If you want to buy car insurance, you should fully understand the types of car insurance. "Motor vehicle insurance refers to a kind of property insurance that is liable for personal casualties or property losses caused by natural disasters or accidents due to natural disasters or accidents. It is divided into strong insurance (full name of motor vehicle traffic accident liability for compulsory insurance) and commercial vehicle insurance." Li Fei, a product manager of the Auto Insurance Department of Xinjiang Branch of China Ping An Property Insurance Co., Ltd., introduced.

"The owner must buy the strong insurance. The car can not be on the road without traffic insurance, nor can the annual inspection and annual review of the vehicle." Li Fei said, "Although the pricing of strong insurance is low, there are shortcomings: First, the target of the strong insurance compensation is limited to the other's vehicles and personnel out of danger. If the owner's own vehicle is damaged or the casualties on the vehicle, the strong insurance insurance will not pay. The second is that the insurance insurance insurance amount is very low, and the guarantee function is limited. "

He said that in the same insurance accident, the payment of the opponent's property was lost by 2,000 yuan; the other party's personnel were injured, and the medical expenses were paid up to 18,000 yuan. "Because of the low insurance insurance amount, commercial vehicle insurance, especially third party liability insurance, to supplement. The part with insufficient payment of the payment of the strong insurance compensation is paid by the commercial insurance." Li Fei said.

Jianqiang insurance is a unified standard in the country, and there is no purchase skills. However, commercial car insurance is diverse, and there are more "techniques". Commercial auto insurance mainly includes the main insurance such as third -party liability insurance, vehicle loss insurance, and vehicle personnel liability insurance, as well as additional insurance such as additional medical insurance medical expenses liability insurance.

"First of all, the third party liability insurance must be allocated. This is one of the most important commercial car insurance. If you accidentally hit others, vehicles, houses, etc., causing the other party's casualties or property losses. Compensation compensation can be understood as the "top version" of the traffic insurance. "Li Fei suggested that" the third party liability insurance insurance amount is best not to be less than 1 million yuan. First -tier cities can consider buying higher insurance amounts. "

When an accident, the compensation for the other party is basically enough to pay strong insurance and third party liability insurance; but if it is not the other party's full responsibility, the maintenance fee of your own vehicle must be packed at your own pocket. In this case, you need to buy a vehicle loss insurance. Li Fei explained: "The third party liability insurance is the contrary to the loss of the other party's loss. The vehicle loss insurance is the compensation of the owner's own loss. If the vehicle causes losses due to natural disasters or accidents, the insurance company can pay."

If the above two commercial car insurance is already equipped, the car personnel insurance needs to be considered next. "It guarantees the driver and the personnel on the vehicle. No matter who it is, as long as the insurance vehicle is accidentally accidentally, it can be paid. However, the insurance premiums are more expensive. Buy personal accident insurance to replace. "

After understanding the type of car insurance, Li Fei provided three basic solutions for auto insurance for everyone to choose according to their own actual situation:

Option 1: Jianqiang insurance+third party liability insurance, suitable for old drivers with limited budget or low vehicle value.

Option 2: Jianqiang insurance+third party liability insurance+vehicle loss insurance, suitable for novice drivers like Liu Huan or more expensive car owners.

Option 3: Jianqiang insurance+third party liability insurance+vehicle loss insurance+vehicle personnel liability insurance, suitable for the owners who often carry relatives and friends or business operations.

"Generally speaking, the higher the insurance insurance amount, the more comprehensive the protection, the more expensive the premium." Li Fei concluded, "The car insurance protection of each insurance company is basically the same. When choosing ","

Li Fei reminded the owner to buy car insurance to choose insurance companies with more service outlets. If the accident occurs, the road rescue of the insurance company with many outlets is more timely, and the claims services are more thoughtful.

"If there is no risk for a period of time, the auto insurance rate will be greatly discounted; on the contrary, the number of risks will not only be discounted, but the premiums will rise in the following year. Therefore, if you drive carefully, travel safely is the secret to save money." Li Fei added.

- END -

[Security Book of Defense] Traveling in heavy rain, these techniques can help

Happy SummerSpend a safeSummer Safety GuideRecently, high temperatures,Welcome to ...

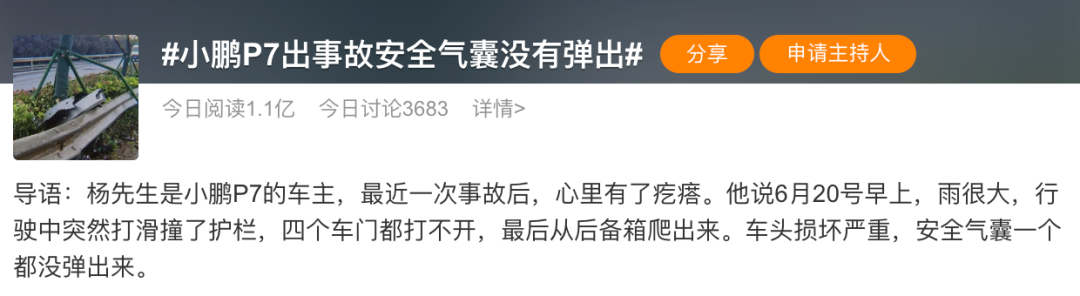

There were accidents in the well -known brand cars, but the airbags did not pop up. The official response: The impact has not reached

Yesterday, Xiaopeng Automobile was also celebrating the list of new forces in June...