Xingye Auto Parts: Spelling the realities of the purchase amount of 20 million yuan in the purchase of patents or "supporting the facade"

Author:Jin Ziyan Time:2022.09.16

"Golden Syllabus" Southern Capital Center Weixun/Author Sanshi Nanjiang/Risk Control

In the process of development, industry prosperity often affects the development of enterprises. Looking back at the past two years, in the first half of 2020 and 2021, the domestic truck industry has shown an overall explosive growth, and related parts and components have strong demand. However, since the second half of 2021, the market demand of the truck industry has gradually slowed down.

Facing the situation of downstream "cooling", Rizhao Xingye Automobile Accessories Co., Ltd. (hereinafter referred to as "Xingye Auto Parts") is difficult to cover up the dilemma of decline, and its net profit has grown negatively in 2021. In addition, Xingye Auto Parts asset -liability ratio is higher than the average of the peers, and the interest expenditure of interest expenses in 2021 exceeds 30 % of the profit. It is worth noting that Xingye Auto Parts purchases more than 20 million yuan from a "zero" supplier, and its transaction authenticity may be tortured. Not only that, the number of patents in Xingye's auto parts is aligned, and it is suspected of "assault" application patent on the eve of listing.

First, the downstream cooling net profit increases negatively, and the interest expenditure "devour" exceeding 30 % of net profit

Business income and net profit are important factor for investors to judge the operating conditions of listed companies. However, in 2021, the growth rate of the operating income of Xingye's auto parts slowed down, and the net profit increased negatively.

1.1 The sales volume of downstream trucks is now "negatively growing", and the net profit of Xingye Auto Parts has negatively increased within three years.

According to the prospectus (hereinafter referred to as the "prospectus") and the signing date of the prospectus (hereinafter referred to as the "prospectus") on June 22, 2022 (hereinafter referred to as the "2021 Version of the Fair") Business business is the research and development, production and sales of trucks and body parts.

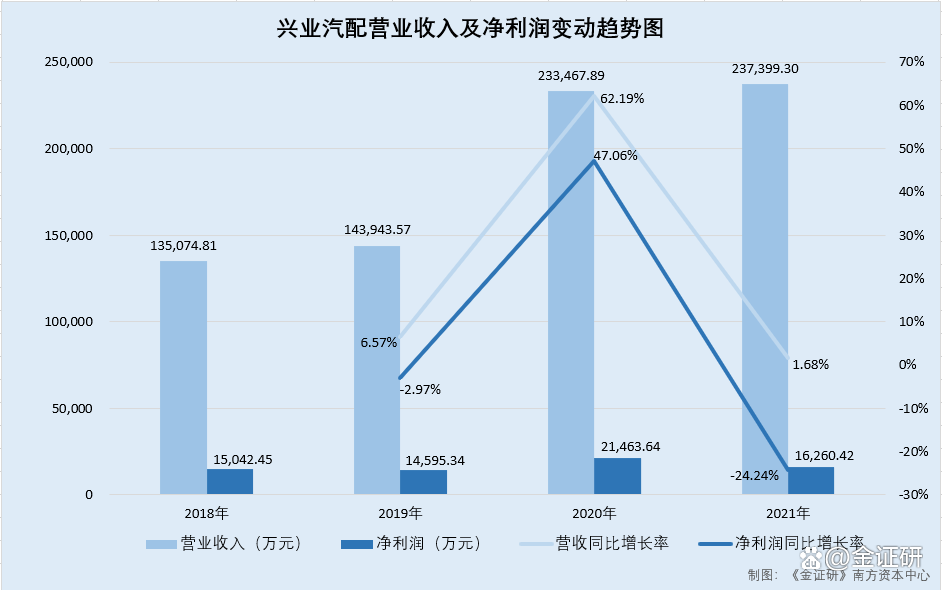

From 2018 to 2021, the operating income of Xingye Auto Parts was 1.351 billion yuan, 1.439 billion yuan, 2.335 billion yuan, and 2.374 billion yuan, and net profit was 150 million yuan, 146 million yuan, 215 million yuan, and 163 million yuan.

According to the Calculation of the Southern Capital Center of "Golden Syllabus", from 2019 to 2021, the operating income of Xingye Auto Parts increased by 6.57%, 62.19%, and 1.68%year-on-year, respectively, and the net profit increased by -2.97%, 47.06%, and -24.24%year-on-year.

According to the prospectus, in response to this, Xingye Auto Parts said that the national VI emission standards were officially implemented. From July 1, 2021, vehicles below the National VI standard will not be able to produce and sell. In the first half of 2020 and 2021, the domestic truck industry showed overall explosive growth, and related parts and components demand was strong. Beginning in the second half of 2021, market demand gradually slowed down.

That is to say, the downstream customers of Xingye Auto Parts are mainly truck manufacturers.

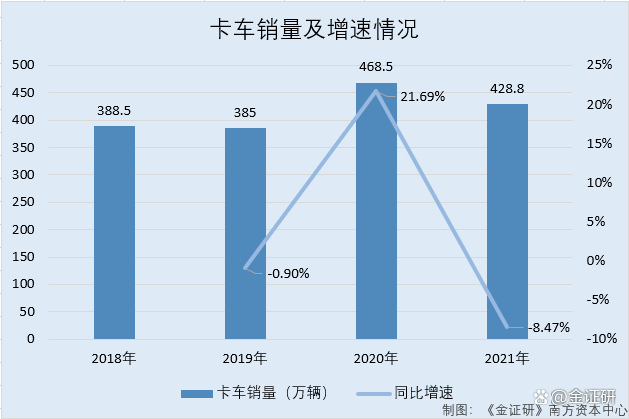

According to the prospectus, from 2018 to 2021, domestic truck sales were 3.885 million, 3.85 million, 4.685 million, and 4.288 million. From 2019 to 2021, the year-on-year growth rate of truck sales was -0.9%, 21.69%, and -8.47%, respectively.

According to the study of the Southern Capital Center of "Jin Securities", in 2021, the sales of domestic trucks increased negatively, and the downstream industries or "encountered cold".

In this context, in 2021, the total of 936 million yuan in the receipts and accounts receivables of Xingye Auto Parts, accounting for more than 30 % of the operating income during the same period.

1.2 From 2018-2021, the proportion of account receivables and receivables of Xingye Auto Parts accounted for higher comparison on the same value

According to the prospectus and the 2021 version of the prospectus, at the end of each issue of 2018-2021, the receivables of Xingye Auto Parts were 473 million yuan, 209 million yuan, 529 million yuan, and 325 million yuan. 277 million yuan, 378 million yuan, 611 million yuan.

According to the research and calculations of the Southern Capital Center of "Jin Securities", at the end of each issue of 2018-2021, the total receivables and accounts receivables of Xingye Auto Parts were 625 million yuan, 486 million yuan, 907 million yuan, and 936 million yuan, accounting for accounting The proportion of operating income during the same period was 46.24%, 33.8%, 38.87%, and 39.43%, respectively.

According to the prospectus, Xingye Auto Parts has selected Hefei Changqing Machinery Co., Ltd. (hereinafter referred to as "Changqing Co., Ltd."), Suzhou Jinhongshun Automobile Parts Co., Ltd. (hereinafter referred to as "Jin Hongshun"), Changchun Yingli Automobile Industry Co., Ltd. (hereinafter referred to as "Yingli Motors"), Wuxi Zhenhua Automobile Components Co., Ltd. (hereinafter referred to as "Wuxi Zhenhua"), Yantai Yatong Precision Machinery Co., Ltd. (hereinafter referred to as "Yatong Jingong") as comparable companies in the same industry.

According to the annual report of Changqing's 2018-2021, from 2018 to 2021, Changqing's operating income was 1.874 billion yuan, 1.834 billion yuan, 2.297 billion yuan, and 3.09 billion yuan. At the end of the same period, the receivables receivables of Changqing shares were 85 million yuan, 144 million yuan, 134 million yuan, and 42 million yuan, respectively; accounts receivables were 228 million yuan, 228 million yuan, 348 million yuan, and 571 million yuan.

According to the research and calculations of the Southern Capital Center of "Jin Securities", at the end of each issue of 2018-2021, the total receivables and accounts receivables of Changqing shares were 313 million yuan, 372 million yuan, 483 million yuan, and 614 million yuan, respectively. The proportion of operating income was 16.72%, 20.3%, 21.02%, and 20.4%, respectively. According to Jin Hongshun's 2018-2021 annual report, from 2018 to 2021, Jin Hongshun's operating income was 1.07 billion yuan, 768 million yuan, 470 million yuan, and 515 million yuan. At the end of the same period, Jin Hong's receipt of the bills was 82 million yuan, 27 million yuan, 114 million yuan, and 118 million yuan, respectively; accounts receivables were 227 million yuan, 225 million yuan, 154 million yuan, and 161 million yuan.

According to the research and calculations of the Southern Capital Center of "Jin Securities", at the end of each issue of 2018-2021, Jin Hongshun's receivables and accounts receivables were 309 million yuan, 253 million yuan, 168 million yuan, and 179 million yuan, respectively, accounting The proportion of operating income was 28.89%, 32.98%, 35.86%, and 34.74%.

According to Yingli Motor's 2018-2021 annual report, from 2018 to 2021, Yingli Motor's operating income was 4.669 billion yuan, 4.812 billion yuan, 5.02 billion yuan, and 4.595 billion yuan. At the end of the same period, Yingli Automobile's receivables were 244 million yuan, 200 million yuan, 200 million yuan, and 200 million yuan, respectively; accounts receivables were 860 million yuan, 760 million yuan, 668 million yuan, and 859 million yuan.

According to the research and calculations of the Southern Capital Center of "Jin Securities", at the end of each issue of 2018-2021, Yingli Automobile's receivables and accounts receivables were 1.104 billion yuan, 760 million yuan, 668 million yuan, and 859 million yuan, respectively, respectively, respectively, respectively, respectively, respectively, respectively. The proportion of operating income is 23.64%, 15.8%, 13.31%, and 18.69%.

According to Wuxi Zhenhua's 2018-2021 annual report, from 2018 to 2021, Wuxi Zhenhua's operating income was 1.527 million yuan, 1.569 billion yuan, 1.417 billion yuan, and 1.582 billion yuan. At the end of the same period, Wuxi Zhenhua's receivables were RMB 21.514 million, 13.012 million yuan, 667,900 yuan, and 11.82 million yuan, respectively; accounts receivables were 463 million yuan, 610 million yuan, 755 million yuan, and 748 million yuan.

According to the research and calculations of the Southern Capital Center of "Jin Securities", at the end of each issue of 2018-2021, Wuxi Zhenhua's receivables and accounts receivables were 484 million yuan, 611 million yuan, 755 million yuan, and 749 million yuan. The proportion of operating income is 31.7%, 38.96%, 53.3%, and 47.36%, respectively.

According to the prospectus signed by Yatong Seiko on November 1, 2021 (hereinafter referred to as the "Yatong Seiko Prospectus"), from 2018 to 2020, Yatong Seiko's operating income was 858 million yuan, 1.07 billion yuan, and 1315 billion yuan, respectively. Essence At the end of the same period, Yatong Seiko's receivables were 109 million yuan, 67 million yuan, and 178 million yuan, respectively; accounts receivable were 239 million yuan, 355 million yuan, and 477 million yuan, respectively.

Among them, Yatong Seiko is a listed company, and has not disclosed financial data in 2021.

According to the research and calculations of the Southern Capital Center of "Jin Securities", from 2018-2020, Yatong Seiko's receivables and accounts receivables were 349 million yuan, 422 million yuan, and 654 million yuan, respectively, accounting for 40.63 operating income of 40.63, respectively. %, 41.88%, 49.75%.

According to the research and calculation of the Southern Capital Center of "Jin Securities", from 2018-2021, the average value of the comparison company receivables and accounts receivables of the same industry in the industry of Xingye Auto Parts is 28.31%, 29.98%, 34.65%, and 30.3. %.

It can be seen that the proportion of the total amount of the bills receivable and account receivables of Xingye Auto Parts accounts for the average level of comparable companies in the same industry during the same period of the same industry, or it constitutes the sales.

It is worth mentioning that the liability ratio of Xingye Auto Parts assets is higher than those of peers.

1.3 Xingye Auto Parts asset -liability ratio is higher than the peers, and the interest expenditure in 2021 "devour" over 30 % of the profit

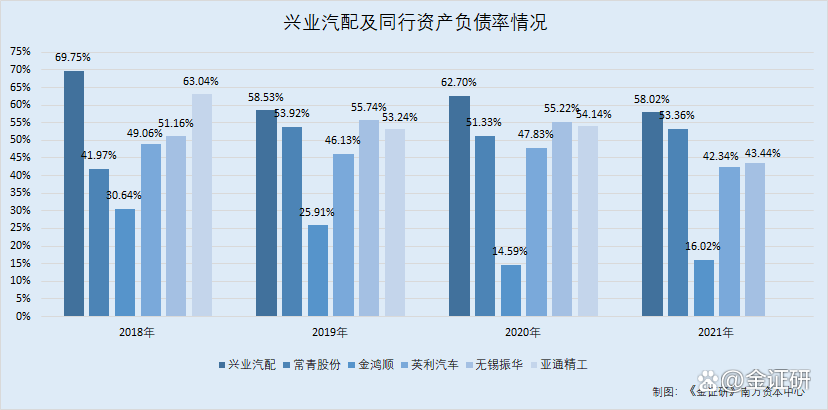

According to the prospectus and the 2021 version of the prospectus, from the end of 2018-2021, the asset-liability ratio of Xingye Auto Parts was 69.75%, 58.53%, 62.7%, and 58.02%.

At the end of 2018-2021, the asset-liability ratios of Xingye Automobile Comparison Changqing shares were 41.97%, 53.92%, 51.33%, and 53.36%; Jin Hongshun's asset-liability ratio was 30.64%, 25.91%, 14.59%, 16.02%; Yingli Motor's asset -liability ratio was 49.06%, 46.13%, 47.83%, and 42.34%, respectively; Wuxi Zhenhua's asset -liability ratio was 51.16%, 55.74%, 55.22%, and 43.44%.

At the end of 2018 to 2020, the asset-liability ratio of Yantong Precision of Xingye SAICs was 63.04%, 53.24%, and 54.14%, respectively.

It can be seen that from 2018 to 2021, the asset-liability ratio of Xingye Auto Parts is higher than those of peers. It is worth noting that as of the end of 2021, the short -term borrowing of Xingye's auto parts was 760 million yuan and the currency funds were only 26 million yuan.

According to the prospectus and the 2021 version of the prospectus, at the end of 2018-2021, the short-term borrowings of Xingye Auto Parts were RMB 53,90,68,400, RMB 44,40.56 million, 78,745,600 yuan, and 759.690 million yuan.

At the end of 2018-2021, the monetary funds of Xingye Auto Parts were RMB 66,998,100, 38.4067 million yuan, 75.7673 million yuan, and 25.8829 million yuan; during the same period, the balance of cash and cash at the end of the Xingye Auto Parts was 37.497 million yuan, 26.66 million yuan, and 7,180.28888 10,000 yuan, 13.9892 million yuan.

It can be seen that at the end of each year of 2018 to 2021, the short-term borrowing of Xingye's auto parts exceeded 500 million yuan, and the currency cash at the same time was not over 100 million yuan.

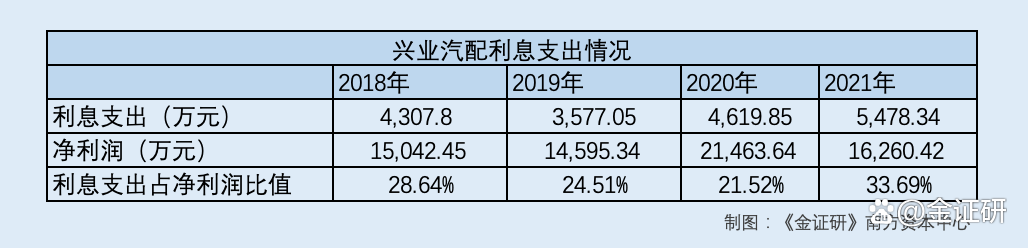

In addition, at the end of 2021, the interest expenditure of Xingye's auto parts exceeded 50 million yuan, accounting for more than 30 % of net profit.

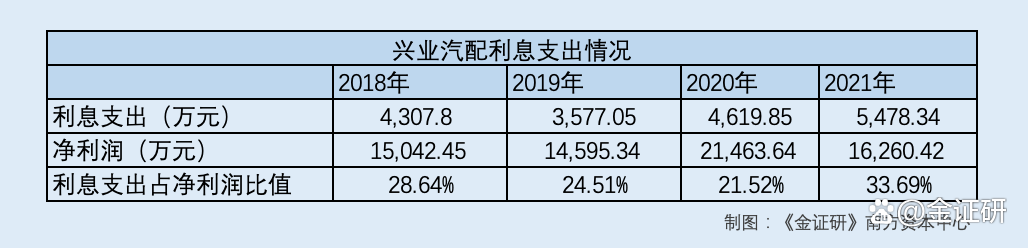

According to the prospectus and the 2021 version of the prospectus, from 2018-2021, the interest expenditure expenditures of Xingye Auto Parts were 43.078 million yuan, 35,770,500 yuan, 46.1985 million yuan, and 54.783 million yuan, accounting for 28.64%, 24.51%, respectively, 24.51%, respectively. 21.52%, 33.69%.

In short, in 2021, the interest expenses of Xingye's auto parts accounted for more than 30 % of the net profit. During the same period, the short -term borrowing of Xingye Auto Parts at the end of the year was 760 million yuan, and monetary funds were only 26 million yuan. At the same time, from 2018 to 2021, the asset-liability ratio of Xingye Auto Parts was higher than that of comparable companies in the same industry. At this point, Xingye's auto parts may face short -term debt repayment pressure.

Second, zero suppliers support more than 20 million yuan in procure

Under normal circumstances, the number of social security payments may reflect the true scale of the allocation of corporate personnel. Among the partners of Xingye's auto parts, the "zero" supplier appeared.

2.1 In 2018, the supplier Weifang Baohong and Xingye Auto Parts transactions exceeded 20 million yuan

According to the 2021 version of the prospectus, Weifang Baohong Materials Co., Ltd. (hereinafter referred to as "Weifang Baohong") is the fifth largest supplier of Xingye Auto Parts in 2018. In 2018, Weifang Baohong and Xingye's auto parts transaction amount was 20,692,600 yuan, accounting for 1.98%of the current purchasing volume.

2.2 Weifang Baohong 2016-2019 Social Security payments are all 0 people, canceled in May 2020

According to data from the Market Supervision and Administration Bureau, Weifang Baohong was established on July 22, 2006 and was canceled in May 2020. Weifang Baohong's business scope is steel, hardware, building materials, cold boards, hot plates, stainless steel, non -ferrous metal.

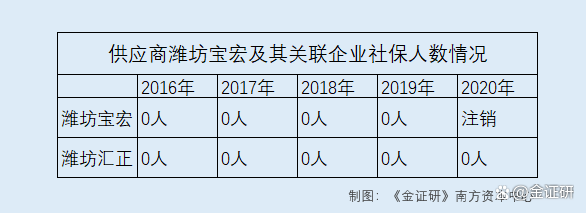

According to data from the Market Supervision and Administration Bureau, from 2016 to 2019, the number of social security payments of Weifang Baohong was 0.

2.3 Weifang Baohong's actual controller name is only one share company.

According to data from the Market Supervision and Administration Bureau, Weifang Baohong only had a record of shareholders in October 2019. The former shareholders were changed to Tang Shanjiang and Tang Haitao. After the change, it was Tang Shanjiang.

According to public information, as of August 31, 2022, Tang Haitao had no other companies. Tang Shanjiang also held Weifang Huizheng Economic Trade Co., Ltd. (hereinafter referred to as "Weifang Huizheng").

According to data from the Market Supervision and Administration Bureau, Weifang Huizheng was established in 2016. From 2016-2020, the number of people in Weifang Huizheng Social Security was 0.

That is to say, Weifang Baohong may not have related parties to pay social security.

This means that from 2016-2020, the number of suppliers of Xingye Auto Parts Weifang Baohong Social Security paid 0 people, and Xingye Auto Parts had more than 20 million yuan in transaction authenticity. In 2020, Weifang Baohong had mysteriously canceled it.

3. Supplier Quality Management System Certification Certificate has been revoked, and it still has hundreds of millions of yuan with Xingye Auto Parts.

Quality management system certification certificate is one of the signs recognized by enterprise products. During the transaction of the supplier of Xingye Auto Parts and Xingye Auto Parts, there is a situation where the quality management system certification certificate has been revoked.

3.1 Prospects show that Xingye Auto Parts has strict standards and requirements for product quality

According to the prospectus, automobile parts supplier requires refined management from raw material procurement, product production to sales. Only through good and continuous systematic management can automobile component suppliers better ensure product quality and timely supply to meet customer needs.

In addition, Xingye Auto Parts will conduct qualification review and regular inspection of the supplier by the procurement center to form a "qualified supplier list".

In addition, Xingye Auto Parts has established a complete quality management system in accordance with the requirements of IATF16949: 2016. From the procurement of raw materials, the production process of product production, to the final product distribution and customer feedback, all have made clear management regulations. There are quality manuals and management procedures for definition, and corresponding professionals ensure that the entire process is effectively running under the control of the quality system.

It can be seen that Xingye Auto Parts claims to have strict requirements for product quality, and conduct qualification review and regular inspections of suppliers.

However, one of the top five suppliers of Xingye Auto Parts has expired during the transaction period.

3.2 2018-2021, Xingye Auto Parts and Shandong Pudong Development Cumulative transactions of 148 million yuan

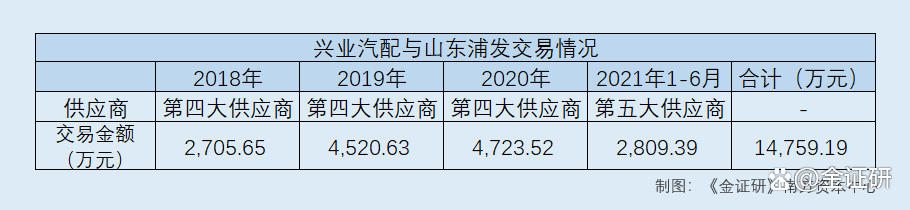

According to the 2021 prospectus and prospectus, from 2018-2020 and January to June 2021, Shandong Pudong Iron and Steel Co., Ltd. (hereinafter referred to as "Shandong Pudong") is the fourth largest, fourth, fourth, fourth, fourth, fourth largest, and largest of Xingye. The five major suppliers; during the same period, the transactions of Xingye Automobile Parts and Shandong Pudong Development were 27.0565 million yuan, 45.206 million yuan, 47.235 million yuan, and 28.939 million yuan, respectively.

According to the Southern Capital Center of "Jin Securities", from January to June 2020 and 2021, the cumulative transactions of Xingye Auto Parts and Shandong Pudong developed a total of 148 million yuan.

However, a quality management system certification certificate in Shandong Pudong was canceled in 2019.

3.3 During the period with Xingye's auto parts, Shandong Pudong's Quality Management System Certificate was suspended first and then was revoked

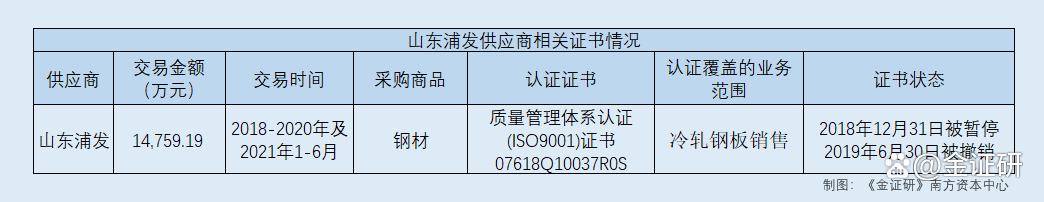

In addition, according to the national certification information public service platform, Shandong Pudong has a certificate number 07618Q10037R0s. The certified project is the quality management system certification (ISO9001). The business scope of the certificate certification is cold -rolled steel plate sales. The date of the certificate is January 4, 2018, and the date of the certificate is January 3, 2021.

At the same time, the historical trajectory of the certification of 07618Q10037R0S shows that on December 31, 2018, the status of the certificate was changed from effective change to suspension. On June 30, 2019, the certificate was changed from suspension to revocation.

That is to say, during the period of Shandong Pudong and Xingye's auto parts, Shandong Pudong's Quality Management System Certification (ISO9001) certificate was suspended and revoked.

3.4 The Certificate of Quality Management System Certification Certificate is revoked.

According to the "Quality Management System Certification Rules" issued by the National Certification and Accreditation Supervision and Administration Commission on August 19, 2016, the certificate of the certification organization was revoked, including the document that was canceled or revoked the legal status document, and the national quality supervision and inspection and quarantine were The General Administration includes the list of serious quality credit companies, the supervision and inspection of the implementation of the certification supervision department, or the inquiry and investigation of related matters with false materials or information, and refuse to accept the national product quality supervision and random inspection.

And the certificate of the certification organization also includes: quality and safety accidents such as major products and services, and the confirmation of the law enforcement supervision department is confirmed to be caused by the violation of the law, other severe violations of laws and regulations, and the period of suspension certificates for suspension certificates. If the problem that has been fully suspended has not been resolved or corrected, the quality management system does not operate or has no operating conditions, and the certification information obtained correctly in accordance with the relevant regulations, causing serious impacts or consequences, or the certification agency has already already been It is required to correction but not corrected for more than 2 months, and other certifications should be revoked.

It can be seen that the reasons for the withdrawal of the quality management system certification include the product quality is not up to standard. Shandong Pudong, one of the top five suppliers of Xingye Auto Parts, was suspended first during the transaction with Xingye Auto Parts and then was then revoked. In this context, Xingye Auto Parts and Shandong Pudong Development transactions are hundreds of millions of yuan, and their supplier selection mechanism may be tortured.

However, the issue of Xingye's auto parts has not ended.

Fourth, the number of patents is "aligned backward", "assault" application patent on the eve of listing

The new ones will go on the day, and the new ones will retire. Innovation ability is the inherent driving force for enterprise development, and one of the core factors to improve the competitiveness of the enterprise market. In contrast, Xingye's auto parts, as of June 22, 2022, the number of patents it owns "aligned backwards."

4.1 Xingye Auto Parts is identified as a high-tech enterprise, and a total of 286,000 yuan in patent subsidies from 2019-2021

According to the prospectus, Xingye Auto Parts said that in terms of production technology and technology, it has mastered the leading R & D and production technology in the segmentation of the truck industry.

In addition, Xingye Automobile Package was continuously rated as "high -tech enterprises" in 2015 and 2018, respectively.

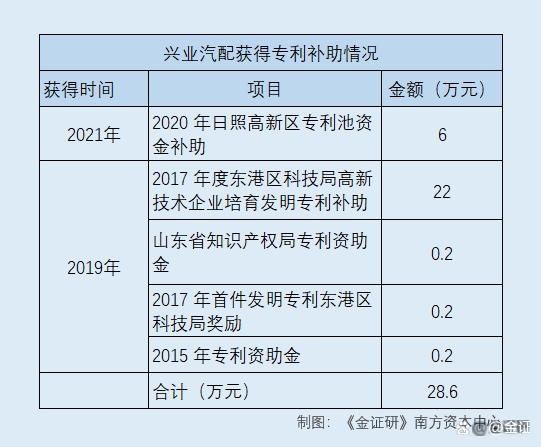

In 2019, Xingye Auto Parts received 220,000 yuan in the cultivation of high -tech enterprises in the Donggang District Science and Technology Bureau of Donggang District in 2017. During the same period, Xingye Auto Parts also received a patent funding of the Shandong Provincial Intellectual Property Office of RMB 2,000. In 2017, the first invention patent Donggang District Science and Technology Bureau rewarded 200,000 yuan, and the patent funding was 200,000 yuan in 2015. In 2021, Xingye Auto Parts received 60,000 yuan in funds for the Patent Pool Pond in the Rizhao High -tech Zone in 2020.

According to the study of the Southern Capital Center of "Golden Syllarsia", from 2019 to 2021, Xingye Auto Parts received a total of 286,000 yuan in patent subsidies.

It should be pointed out that the number of patents of Xingye's auto parts can be ranked behind in the same industry.

4.2 As of June 22, 2022, the total number of patents in Xingye's auto parts is "aligned backward"

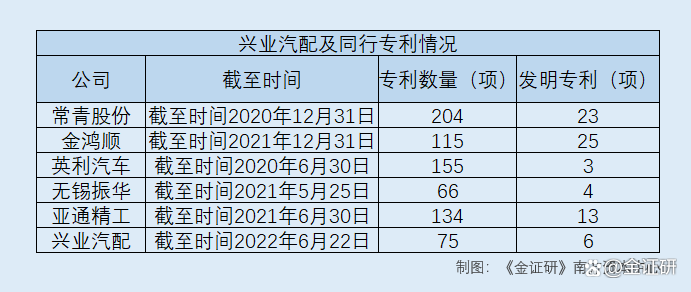

According to the prospectus, as of June 22, 2022, the promotion of the prospectus had 75 patent rights, including 6 invention patents, 67 practical new patents, and 2 appearance design patents.

According to the report of Changqing's 2020 annual report, as of December 31, 2020, Changqing shares have a total of 204 patent rights, of which 23 invention patents are invention. According to Jin Hongshun's 2021 annual report, as of December 31, 2021, Jin Hongshun had a total of 115 patent rights, of which 25 were invented.

According to Yingli Motor's signing date on April 1, 2021, as of June 30, 2020, Yingli Automobile has a total of 155 patent rights, of which 3 invention patents.

According to Wuxi Zhenhua's signing date on May 25, 2021, as of May 25, 2021, Wuxi Zhenhua has a total of 66 patent rights, including 4 invention patents.

According to Yatong Seiko ’s signing date on November 1, 2021, as of June 30, 2021, Yatong Seiko has 134 patent rights, of which 13 have invention patents.

It can be seen that as of June 22, 2022, in addition to Wuxi Zhenhua, the number of patents held by Xingye Auto Parts is lower than that of other comparison companies in the same industry.

Not only that, the number of patents applied for in 2019 and later in Xingye Auto Parts accounts for over 70 % of the total number of patents, and is suspected of "assault" application patent.

4.3 The number of patents applying for 2019 and later, accounting for a total of over 70 % of the total number of patents in the promo parts of Xingye.

According to data from the State Intellectual Property Office, as of August 31, 2022, there were 117 domestic patents applied for by Xingye Auto Parts. Among them, the number of patents applied for in Xingye's auto parts from 2010 to 2021 and 2022 were 3, 0, 8, 0, 2, 3, 4, 0, 13, 6, 6, 6, 6 , 77, 0, 1.

According to the prospectus, as of the date of signing the prospectus, on June 22, 2022, a total of 7 subsidiaries in the scope of the financial statements of Xingye Auto Parts were Chongqing Fuxing Automobile Accessories Co., Ltd. (hereinafter referred to as "Chongqing Fuxing") and Jinan Fuxing Automobile Accessories Co., Ltd., Jinan Fuxing Energy Equipment Technology Co., Ltd., Changsha Xingye Automobile Accessories Co., Ltd., Rizhao Xingye Metal New Material Co., Ltd., Shandong Xinge Machinery Co., Ltd., Rizhao Xingye Wheel Intelligent Manufacturing Technology Co., Ltd.

According to data from the State Intellectual Property Office, as of August 31, 2022, the number of domestic patents applied for by Chongqing, a subsidiary of Chongqing, was applied in 2021. In addition, the other six subsidiaries within the scope of the financial statements of Xingye Auto Parts did not apply for domestic patents.

That is to say, from 2010-2021 and January to August 2022, the total number of domestic patents applied for Xingye Auto Parts and its subsidiaries was 3, 0, 8, 0, 2, 3, and 4 items of 4, respectively. , 0, 13, 6, 77, 5, 1 item.

According to the public information of the Shandong Securities Regulatory Bureau, the time for the record for the promotion of the promotions of Xingye Auto Parts is September 26, 2019.

According to the calculation of the Southern Capital Center of the "Jin Si Yan", from August 31 from 2019 to August 31, the number of patents applied for by Xingye Auto Parts and subsidiaries was 89, accounting for 72.95%of the total number of patents applied for the patent of Xingye Auto Parts and subsidiaries. For Xingye's auto parts that opened the listing plan in 2019, it is suspected of "assault" application patent.

There is a long way to go. In the face of the above problems, how far can Xingye's auto parts go on the market? Unexpectedly.

- END -

Must see!The new road traffic logo is here

Road Traffic Logo and Line Part 2: Road Transportation Logo (GB 5768.2-2022) will ...

"Old Driver" help Xiaomi to build a car

Author | OujinThe Apple CAR, who has been dragging for many years, has not been ey...