There are many places in Henan: Motorcycles insured for strong insurance is so difficult

Author:Xinhuanet Time:2022.08.26

Xinhua News Agency, Zhengzhou, August 25th. Question: There are many places in Henan: Motorcycles insured and strong insurance

Xinhua News Agency "Xinhua View Point" reporter Chen Chunyuan

The insurance company refuses to protect the insurance delay and bundle sales, and the motorcycle owner tossed back and forth ... Henan motorcycle owners have strongly reflected the difficulty of insured in traffic insurance.

A few days ago, the inspection team visited a number of insurance institutions in Zhengzhou, Jiaozuo City, Henan Province, and found that high -paying models represented by motorcycles were really difficult to buy strong insurance. Life and road traffic safety has affected. The lack of social responsibility of the insurance company and the losing management of regulatory agencies are loose and soft, and they need to "make up" as soon as possible.

Three moves of insurance companies: rejection, delay, bundling sales

In 2006, my country officially implemented a compulsory insurance system for the traffic accident responsibility of motor vehicle traffic. It stipulates that motor vehicles must insure strong insurance, and motorcycles are no exception. However, the inspection team found in an unannounced visit to Henan Province that some insurance companies' demand for strong insurance for motorcycles was relatively indifferent.

—— Disguise rejection. According to laws and regulations such as the Road Traffic Safety Law and the "Regulations on the Liability of Motor Vehicle Traffic Accidents", insurance companies shall not refuse to undergo a motorcycle for strong insurance for various reasons. Although the state has clearly stipulated, insurance companies often refuse insurance through disguised rejection. In a insurance company in Jiaozuo City, the reporter consulted the insurance personnel on the grounds of insured multiple motorcycles. The answer was that the company's leadership signed to handle it. The company's daily processing volume was limited. Only one was done last month. The reporter's investigation found that there were nearly 10,000 motorcycles in Jiaozuo alone, and the demand for the insurement of strong insurance insurance was huge. In January, a month could not meet the needs of the owner.

Supervisory found that many insurance companies in Zhengzhou, Jiaozuo City and other places may refuse on reasons such as no motorcycle traffic insurance business, salesman without permission acceptance, and system failure. Outside the car owner, if the car is foreign, the owner is required to have a local household registration, work certificate or social security certificate.

——The delay. The method of delay in the insurance company is different: it is required to apply for the next day on the grounds that the full -time staff of the motorcycle traffic insurance business is not or the system is not open; The original reason is delayed; repeatedly guided car owners to other insurance agencies to ask other insurance institutions to see and compare; More than 15 days.

Insurance companies often have various harsh conditions and tedious procedures when they are underwritten. The most common way is to require motorcycles to drive to the insurance institution business hall for on -site vehicles, and to go through tedious procedures; some also need to issue a "wonderful certificate certificate ", Intended to let the owner" know the difficulties ".

—— Binding sales. In a insurance company in Jiaozuo City, the inspector found that a car owner was consulting the motorcycle to pay strong insurance premiums. According to his motorcycle displacement, the insurance premium was 400 yuan, but the insurance company reported twice the high price.

"800 yuan! Paido ride -to -ship tax plus accident insurance is 400 yuan plus 40 yuan plus 360 yuan." Insurance personnel said uncomfortably.

"Isn't it possible to buy a strong insurance?" The owner asked.

Insurance staff said that if you add money, you may not be able to guarantee it, and you must report to it and approval.

The inspection found that when many insurance institutions accepted the strong insurance, they clearly proposed that the insurers needed to purchase home property insurance and accident insurance at the same time. In Jiaozuo City, PICC Property Insurance requires a 200 yuan accident insurance, and the land property insurance needs to be sold at 360 yuan accident insurance.

Limits of interest driving supervision

As the first insurance type that is enforced by the law, the traffic insurance has played an important role in ensuring the social contradictions caused by the social contradictions of the victims of road traffic accidents and the treatment of economic disputes caused by the economic disputes of the accident. According to data from the China Banking Regulatory Commission, in 2021, 323 million motor vehicles participating in the country's traffic insurance participating in the country were 176.3 billion yuan for the property and personal health losses caused by traffic accidents.

The inspection found that not only motorcycles, operating trucks, taxis and other high compensation models have always been a "boss difficulty" issue in the country, and the problem of strong risks in Henan Province is particularly prominent. There are 9 insurance companies involved.

Some of the interviewed motorcycles in Zhengzhou City complained that they were not insured in accordance with regulations. They must not only be punished by the traffic management department. If a traffic accident occurs during this period, it will also bring a huge economic burden on both parties involved. Social contradictions.

People in the insurance industry said that motorcycles have low premiums and high insurance rates, which puts great pressure on insurance institutions' operations, and has become a business of "one more order and one more." In addition, high compensation models have a small profit business profit and small assessment contribution, which also affects the enthusiasm of the first -tier insurance personnel.

The inspection found that high -paying models such as motorcycles are difficult to pay for strong insurance, although some insurance institutions lack a sense of social responsibility, focus on "economic accounts" and other reasons, but more importantly, the insurance regulatory authorities are missing, management, management, management, management Lost in loose and soft.

The "Regulations on the Liability for Motor Vehicle Traffic Accidents" clearly stipulate the underwriting responsibilities of relevant insurance institutions, define violations, and clearly list relevant punishment measures. Regarding the occurrence of rejection, procrastination, and binding sales, the regulatory agency should be fined 50,000 to 300,000 yuan. The inspection team believes that after receiving many complaints on the difficulty of making strong motorcycles in recent years, the Henan Banking Insurance Regulatory Department knows that it is difficult to violate the law of insurance institutions in insurance institutions. On -site inspections were conducted on the facts of violations of laws and regulations, and it was not investigated and rectified in this regard. For many years, it has never made administrative penalties specifically for this situation. The supervision was obviously absent and indirectly condoned the illegal and illegal behaviors of the insurance institution.

Fresh the insurance channel as soon as possible to solve the people's concerns

The inspection team feeded the investigation unannounced visits to the Henan Banking Insurance Bureau. The relevant person in charge of the Henan Banking Insurance Regulatory Bureau said that in recent years, Henan Banking Insurance Supervision Department has adopted a variety of measures for the difficulty in governing high -paying models such as motorcycles, including multiple documents and transmission, sharing information with relevant departments, and joint industries. The association co -supervisory and establishing a system of responsible persons of insurance institutions, but still frequently difficulty in insurance, is very distressed, indicating that the supervision coverage is insufficient, and there is obvious loopholes in the work.

The inspection team suggested that the regulatory authorities should fulfill their duties and increase their supervision. Local regulatory agencies should attach great importance to the difficulties of motorcycles, trucks, and refrigerated cars reflected by the masses. Investigate, seriously investigate and deal with insurance institutions in accordance with laws and regulations to refuse to fulfill the legal underwriting obligations and play an effective warning role; the national bank insurance regulatory authorities shall target the insurance institutions that have appeared in many places for allegedly refusing insurance and delaying the inheritance. Remediation, in -depth analysis of the insured institution's assessment mechanism behind the problem is unreasonable and unscientific, and the supervision measures of local regulatory agencies are not accurate in time, and other reasons, etc., will further study and improve the pricing mechanism of the traffic insurance, solve the strong insurance rejection, delay underwriting, bundle the binding of the strong insurance insurance, delay underwriting, delay underwriting, bundle binding Sales and other issues have truly implemented the people -centered development concept to the specific actions to ensure the safety of the lives and property of the people.

The Henan Banking Insurance Bureau stated that the insurance company involved in the inspection found as soon as possible will conduct serious investigations and investigations and investigate the entire province. In the next step, the problem of the maintenance of motorcycle owners will be urgently arranged to ensure that the owners of the majority of the owners will Vital interests. At the same time, the insurance company focuses on whether there are restricted assessments and binding sales such as lower -level institutions, and strengthen daily monitoring, optimize services, and promote the establishment of online intensive insurance insurance platforms as soon as possible to remove the unreasonable obstacles of insurance institutions for the establishment of the masses.

- END -

[Civilization Creation] Civilization crossing the road safety companionship

The beauty of the city is orderly. Motor vehicle gifts allow pedestrians and pedes...

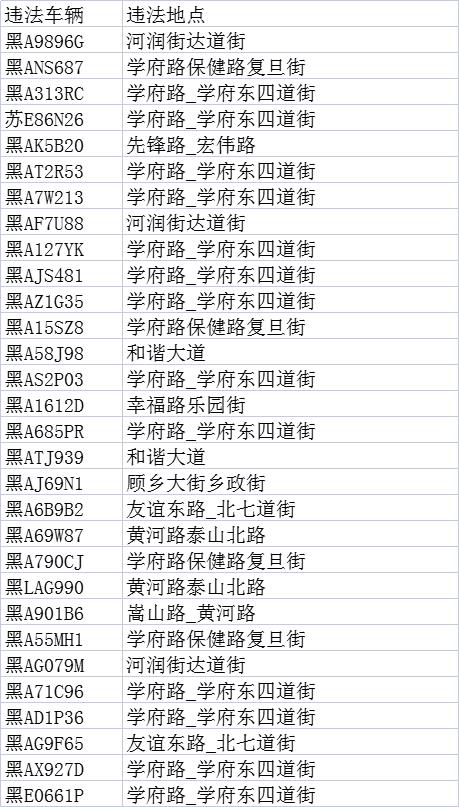

Let's let pedestrians!These motor vehicles are exposed

In order to carry out the creation of civilized cities, further enhance the awaren...