The new energy vehicle industry is hot, but upstream and downstream companies say "don't make money"?

Author:China News Weekly Time:2022.08.06

New Energy Vehicle Industry Well Spray

But from the entire car manufacturer to the battery company

They are all shouting "work for others"

Where did the profit go?

"At present, the cost of power battery accounts for 60%of the total cost of automobiles. Aren't we working for Ningde Times now?" Recently, Zeng Qinghong, chairman of GAC Group, complained at the 2022 World Power Battery Conference. Auto companies are in a state of losing money.

Image source: 2022 World Power Battery Conference

To say that money was made by power battery companies, Ningde Times did not agree. "Although our company has not lost money this year, it is basically struggling at the edge of a little profitable. It is very painful. Wherever the profit goes, everyone can imagine." Facing Zeng Qinghong's question, Wu Kai, chief scientist in Ningde Times, responded.

According to the financial report data, in the first quarter of this year, Ningde Times revenue was 48.6 billion yuan, an increase of 153%year -on -year; net profit was nearly 1.5 billion yuan, a decrease of 23%. This is the first quarter performance of the company's first quarter after the third quarter of 2020. The relevant person in charge of Ningde Times told China News Weekly: "Since 2021, the main battery raw materials have risen significantly. Especially lithium carbonate, due to human speculation and other factors, the price has accelerated since the end of last year, and the year has increased by more than 10 a year. Double. This caused a lot of pressure on the cost of the company's product, which led to a decline in the company's net profit in the first quarter, and also affected the overall profit of the battery industry as a whole. "

In recent years, the new energy vehicle market has made progress all the way, but from vehicle companies to key parts and component companies have even complained about "not making money". So, where is the profit going?

Only to make a profit

In the first half of 2022, despite the impact of the epidemic, the sales volume of new energy vehicles completed 2.6 million units, an increase of 115%year -on -year, and the penetration rate was as high as 21.6%. This year's sales are expected to exceed 6 million units. In the first half of this year, the sales volume of China's automobile industry fell 6.6%year -on -year to 12.057 million units.

The increase in new energy vehicles is unique in the entire automotive industry. But in fact, in the field of new energy vehicles, only Tesla and BYD are in a state of making money in the new energy vehicle field; the profitability of the power battery field is not optimistic. In an interview with China News Weekly, Cui Dongshu, Secretary -General of the Federation, also said that in China, my country's new energy vehicles have achieved curve overtaking, but there are still shortcomings to make up. "Lithium, cobalt, nickel and other resource shortages, the current status of low profits of downstream companies also needs to be improved."

Taking BYD, the largest sales volume in China as an example. In the first half of the year, BYD sold more than 641,000 units or even more than 564,000 Tesla. But from the perspective of profitability, BYD is still a large gap compared to Tesla's profitability. According to the performance forecast, BYD's net profit in the first half of the year was about 2.8 billion to 3.6 billion yuan. Based on GAAP net profit calculation, Tesla made a total of 5.578 billion US dollars in the first half of the year, equivalent to about 37.66 billion yuan, which is equivalent to earning 200 million yuan a day.

For most new energy vehicle companies, performance is far less than BYD, and even in a state of loss. For example, BAIC New Energy's listed company BAIC Langu's performance loss announcement in the first half of 2022 shows that a net loss of 1.8 billion to 2.2 billion yuan in the first half of 2022 is expected to be 1.8 billion yuan. Among the new forces of car building, the total revenue in the first quarter of 2022 was 9.56 billion yuan, but the net loss was 10.9 million yuan; Xiaopeng lost 1.731 billion yuan in the first quarter; Weilai achieved revenue of 9.911 billion yuan in the first quarter of 2022, However, the net loss reached 1.783 billion yuan, an increase of 295.56%year -on -year.

Facing the current situation of making money, the ideal car CEO Li Xiangxiang said on Weibo that "the increase in battery costs in the second quarter is very outrageous." The price was announced immediately. "

In the power battery industry, it is not just a test of profit decline in Ningde Times. Guoxuan Hi -Tech's net profit in the first quarter of this year was 32.2 million yuan, a year -on -year decrease of more than 30%; Xinwangda's net profit in the first quarter was 94.92 million yuan, a year -on -year decrease of 26%. "At present, the power battery industry is so hot, but the battery factory does not have a good profit." Some people with power battery companies told China News Weekly that since the second half of last year, the price of lithium carbonate has almost increased by more than 10 times, which has led to the battery The factory pressure is huge. "No profit, indicating that this industry is problematic."

Where did the money go?

Zeng Yuqun, chairman of Ningde Times, said at the 2022 World Power Battery Conference that the capital speculation of upstream raw materials has brought short -term distress to the power battery industry chain. Lithium carbonate, lithium hexovative lithium, and petroleum coke upstream materials have skyrocketed.

Guoxuan Hi -Tech also stated at an investor conference on May 6 that this year's profitability is still affected by the fluctuation of raw material prices. Xinwangda also mentioned at the performance briefing that raw material price increases are an industry issue and have formed a price linkage mechanism with downstream customers.

Since last year, the price of battery materials such as lithium, cobalt, nickel, and nickel has skyrocketed. According to data from Shanghai Steel Union, the price of battery -grade lithium carbonate once exceeded 500,000 yuan/ton in April this year, and the price of lithium carbonate in early 2021 was only 50,000 yuan/ton.

Why does the price of lithium carbonate soar all the way? Some analysts have shown that the currently proven lithium resource reserves of the world can produce 160TWH (hundreds of kilowatt -time) lithium batteries, and the lithium itself is not scarce. However, the excessive outbreak of the new energy vehicle market has stimulated the market demand of power batteries, and does not rule out the possibility of speculative hype of capital speculation. At the same time, the mining resources are long, the demand for funds is large, and the risks are high, and the real outbreak of the new energy vehicle market has only begun from the past two years. Under the influence of Russia and Ukraine's conflict, the accelerated transformation of energy in the world, especially European energy, has also caused a stronger demand for lithium resources in the energy storage market. As an energy metal, the importance of its importance is sought after after being fully understood, and it is not difficult to understand if there is no supply. Dongzhi Futures pointed out that the bottleneck of the current supply side of the lithium battery industry is still the upstream resource side, and the industry profits are accelerating to concentrate upstream. Such as Rongjie, Tianqi Lithium Industry, Ganfeng Lithium Industry, Shengxin Lithium and other mining companies to achieve excess profits; Tianqi Lithium industry has become a "pre -increase king's net profit and 110 times increase in net profit of more than 9.6 billion yuan. "; Rongjie, Tianhua Chaoeding, and Tibet's net profit increase also ranging from several times to dozens of times.

How to improve profitability?

In order to improve the profitability, Zeng Qinghong revealed that GAC Group is already making batteries and is still considering buying lithium mines to carry out the entire industrial chain layout. It is reported that GAC Ean is currently preparing the production line of power battery companies and power batteries to promote the industrialization layout of the self -developed and self -produced battery, and to achieve independent controllable power battery supply. In addition, Zeng Qinghong suggested to strengthen the supervision and guidance of the battery industry at the national level, improve the imbalance of supply and demand, and coordinate the price back to a reasonable range.

In order to cope with the rise in raw material prices, the theoretical of power battery recycling and disassembly is a good way. "Most of the materials in the battery can be repeatedly used. At present, the recovery rate of nickel cobalt manganese has reached 99.3%, and lithium has reached more than 90%." Zeng Yuqun said that the battery is different from oil, and after oil is used, it is used after the oil is used. No, most of the materials in the battery can be recycled.

"The price of upstream raw materials fluctuates a phased effect. Next, with the expansion of the resource end and the supply chain, the supply and demand situation will gradually improve, and the price is expected to fall to the rational level." Two years have also enhanced the investment and layout of the upstream supply chain, which will help further ensure the supply of raw materials and stabilize procurement prices. "

Zhang Yuping, deputy general manager of Greenmei Co., Ltd., said that if it continues to develop according to the current industry, lithium nickel and cobalt can only support decades. By recycling, by 2025, lithium nickel and cobalt can reach one -third of the demand that year. "Why do we do power battery recycling, which is to make a mine of 10 million tons."

Tianfeng Securities is expected to reach 380.3GWh in 2030 in 2030, and the CAGR is as high as 48.9%from 2021-2030, which is expected to present index growth in the future.

Picture source: CCTV Finance

The recycling price of power batteries has also risen all the way. Li Baohua, a professor at the Shenzhen Graduate School of Shenzhen University of Tsinghua University, said that when the price of lithium carbonate at battery -level is 37,000 yuan/ton, the lithium iron phosphate waste is 2,500 yuan/ton; at present, the price of battery -grade lithium carbonate is 500,000 yuan/ Tons, the price of lithium iron phosphate waste is 82,000 yuan/ton. This means that the price of raw materials has increased by 12.5 times, but the corresponding waste rises by 31.8 times.

However, it should also be seen that there are also many problems in my country's power battery recycling. Sun Fengchun, an academician of the Chinese Academy of Engineering, said that my country's power battery recycling faces three major challenges: the contradiction between the short -term supply and demand of raw materials is more prominent; the maturity of the market mechanism of power batteries is not high; and developed countries have set up "carbon barriers".

GGII (High Industry Research Institute) data shows that in 2021, the national lithium battery theory reached 512,000 tons, and the actual recycling of waste old lithium batteries was 299,000 tons, of which 258,000 tons of batteries used for regeneration were used. 10,000 tons.

At present, participants in the new energy vehicle industry chain actively explore the way out. For example, the OEM represented by the GAC Group was forced to "batteries" and layout battery raw materials. Battery manufacturers Ningde Times laid out the recycling and utilization of power batteries to improve the impact of continuous soaring raw material prices. "In the long run, in the context of the global promotion of 'double carbon' goals, the development of the new energy industry will not change due to these short -term fluctuations, and the prospects are still broad." The person in charge of Ningde Times said.

Author: Liu Shanshan

Edit: Zheng Yu

Operation editor: Xiao Ran

- END -

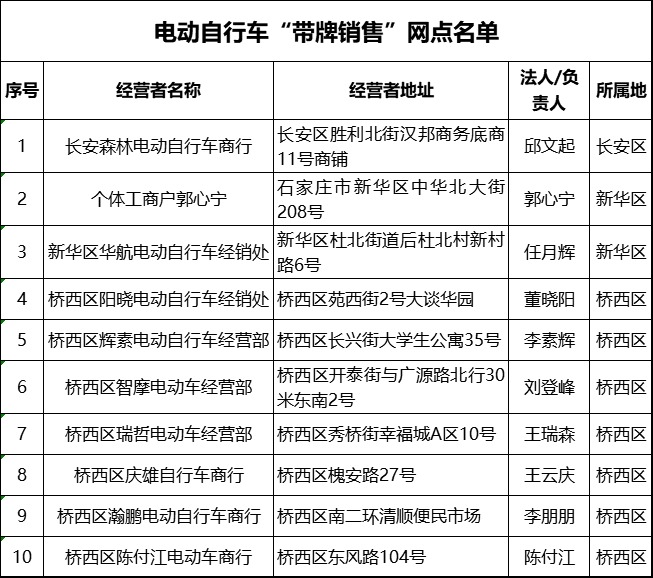

Shijiazhuang City Electric Bicycle "Card Sales" outlets (eighth batch)

Shijiazhuang City Electric Bicycle Bringing SalesOutlet publicationAccording to th...

The sales volume of electric vehicles is difficult to solve the loss!Will high costs overwhelm Wama Holdings?

Wima Holdings has a sum of the three -year new car delivery, which is not as good ...