Four years lost nearly 5 billion yuan, Latharbeel defeated, the Chinese version of ZARA regretted hi

Author:Those things on the Internet Time:2022.06.14

In the past year, major industries have undergone major changes.

In the field of fast fashion, for a long time in the past, in the European and American brands ZARA, C & A, Japanese and Korean brands UNIQLO, H & M, domestic brands, Matsbonway, Peacebird, etc. There are fewer and fewer stores, and the sales curve is like a falling meteor. Even in the hottest stage of the entrepreneurial entrepreneurship of consumer companies, few people have set foot in the field of clothing

Who would have thought that even if La Xiabeel, who held the size of Wandian, came to the edge of the "delisting".

Lathar Bell received the "Regulatory Work letter on the termination of the relevant matters related to listing" by the Shanghai Stock Exchange's supervision of the Shanghai Stock Exchange. According to this document, the Lathamberg has touched the termination of the listing conditions and opened on March 31st. Starting trading in the city means that Lahabeel intends to terminate listing.

Latharbeel had a number of 9,269 stores at its peak, and then dropped to 300 in three years. In 2018, La Xiabeel issued a loss of 160 million yuan. In the next three years, La Xiabeel's losses further expanded and frequently issued a "delisting risk" warning.

In 2021, La Xiabeel was applied for bankruptcy settlement by four creditors, and now it is about to return to the market. So how did La Xiabeel fall from the scale of Wandian? What are the business methods of Lambeel, known as the "Chinese version of ZARA"? Regardless of the final reason for retirement?

Farmers, come to the edge of the cliff

On March 31, 2022, La Xiabeel released the 2021 financial report. The company's revenue was 430 million yuan, a decrease of 76.36%year -on -year, and a loss of 821 million yuan. This is the fourth year of La Xiabeel's continuous losses. In the past few years, news about Lathambell's bankruptcy was very arrogant on social media.

Have you ever thought that La Xiabeel was once a national brand of Wandian.

In 1992, Xing Jiaxing, who was born in Nanping, Fujian, was just 20 years old. In an accident, Xing Jiaxing signed up for the clothing design of the vocational training school. In the following four years, Xing Jiaxing worked at Fuzhou Sophie Fashion Co., Ltd., and then resigned to study for further studies.

At this time, the development of Fujian's clothing industry was in full swing, and brands such as Anta, Pike, and Seven Wolf gradually emerged.

In 1998, 27 -year -old Xing Jiaxing was preparing to start a business. This year La Chabel and several Taiwanese bosses co -founded La Chapelle.

Since the founding of La Xiabeel, there are many "gamblers" style, that is to open a shop crazy.

According to the data of Tianyancha, in the ten years after the founding, La Xiabeel opened more than 600 stores. In 2010 alone, La Xiabeel opened more than 300 new stores.

Under the blessing of capital, in 2011, the number of La Xiabeel stores was as high as 1841, and in 2012, it applied for A -share listing and was rejected.

Latharbeel continued to advance high, and enriched its brand over 20 with "multi -brand, direct business", and increased the number of stores to 5,384 after getting Goldman Sachs's 300 million investment in 2013.

In 2014, La Xiabeel's IPO in the Hong Kong Stock Exchange. In 2017, after two failures of the A -share listing, La Xiabeel succeeded in the third IPO and became the first domestic "A -share+H -share" clothing company. The market value is as high as 12 billion yuan. In this year, the number of La Xiabeel stores reached 9,448, which realized its highlight moment.

The chairman of the flowing water is trapped in capital operation

Expansion, acquisition, investment ...

Lathar Bel will use the raised funds to be used almost to store expansion and brand expansion, trying to create a "Chinese version of ZARA". After a while, at the end of 2017, the share price of Rhaxbe's A shares came to the highest point of 30.62 yuan, and before the suspension, it was stopped. , Latham Bell's stock price was 1.05 yuan, a decrease of 97%.

In 2018, Lathar Bell's revenue exceeded 10 billion.

But behind the revenue of 10 billion yuan is due to the personnel management, rent costs, and hasty stores brought about by the rapid expansion, and the stores of the store, Latharbeel ushered in the first loss under the revenue of 10 billion yuan. The net profit was -1.6 was -1.6. 100 million yuan.

From 2019 to 2021, La Xiabeel continued to lose money, and under the influence of the epidemic, the losses further expanded, with losses of 2.166 billion yuan, 1.841 billion yuan, and 821 million yuan, respectively. In these four years, the cumulative loss was 4.987 billion.

In the later period of loss, Latham Bell had to sell assets and "break the arm".

According to Tianyan check data, since 2019, La Xiabeel has closed a total of 4,391 stores, accounting for 47.37%of the number of domestic stores. In addition, La Xiabeel has also sold its brands, office buildings, and warehouses. At the end of 2019, La Xiabeel's debt ratio was as high as 85.59%, and the actual controller Xing Jiaxing's stock was also frozen.

Two years later, in February 2020, the founder Xing Jiaxing submitted a resignation report and nominated Lu Ersui to take over. After the negotiation failed, Xing Jiaxing nominated Duan Xuefeng. Duan Xuefeng is extremely good at capital operation.

Seven months later, Xing Jiaxing proposed to dismiss Chairman Duan Xuefeng's position, and in January 2021, Duan Xuefeng resigned. Zhang Ying was elected as the new chairman. One month later, Zhang Ying resigned, and the veteran of La Xiabeel took over.

In March 2021, Xing Jiaxing's shares lifted the ban. Wensheng Assets took over the stock of Latharbeel, the largest shareholder of Latharbeel, with a shareholding of nearly 20%. In May of the same year, Wu Jin also submitted his resignation, and Wen Sheng Asset Zhang Xin was "upper". Under the frequent changes in personnel, La Xiabeel has become more difficult in the company's operations and capital and debt, and the debt problem has not been resolved.

3. Where can the brand's injury find the antidote?

At present, Lathar Bell's cumulative involving unsuccessful cases involved a case of approximately 463 million yuan, and the amount of the case involved in the decisive lawsuit was approximately 1.97 billion yuan.

Its 145 bank accounts were also frozen, with a freezing amount of about 109 million yuan, and the equity of 17 subsidiaries was also frozen, with a total equity of about 1.076 billion yuan.

La Xiabeel said that the company will reorganize the company's credit and financing capabilities through business optimization and reorganization with the help of Wen Sheng, Haitong and other resources.

For many years of capital, Latharbeel ignored an important factor, that is, the brand itself.

As early as the beginning of expansion, Lambeel, like many fast fashion brand stores at home and abroad, paid attention to the "fast" of product styles, focusing on basic and fashionable trends, and did not shape the brand.

With the gradual growth of generations, the pursuit of brand and trend culture has greeted Anta, Li Ning, Huili and other brands to rejuvenate the second spring. While emphasizing fashion, it will shape the brand culture and trend culture. Online marketing, seeking endorsements and introducing elements of the sub -cultural circle, many tide brands also have a foothold.

The fast fashion brand did not have too many brands in the early years, and often buried the focus on the word "fast", just like the domestic brand Metusbon Wei had missed to varying degrees.

Foreign fashion brands are also facing such an embarrassing situation.

Earlier this year, Bershka, Pull & Bear, and Stradivarius, who belonged to the Zara parent company Inditex Group, announced that they would close all physical stores in China before mid -2021.

Under the pressure of the epidemic, GAP's Old Navy could not bear the pressure to leave the Chinese market. C & A sold Chinese business. SuperDry abandoned the Chinese market and Mango suspended the Chinese market opening plan. In August 2021, Urban Outfitters, the American fast fashion brand, announced the closure of Tmall stores.

Even HM and Uniqlo ushered in obvious performance.

Of course, the above brands are not entirely the enterprise itself, but under the fast -fashion environment, we will often have this hidden danger to heavy marketing, heavy channels, and light brands and light -developed Lathamel.

During the extensive development, the brand's supply chain and product operation will often be overwhelmed by the income brought by channel expansion. In the end, we ushered in evil results.

Today, Laxibell's debt is not offset, but fortunately, it still retains the financing channel of Hong Kong stocks and will not directly affect the company's operations. But in the rapidly changing brand iteration tide, how much time is there a lacking sense of Lambeel?

According to Tianyancha, Latharbert's global fast fashion boss Zara stores was 1975 (as of Q3, 2021), H & M was 4,721 (as of the end of February 2022), and Uniqlo was about 2,260 (as of 2020).

Even if it is called "Chinese version of ZARA", La Xiabel wants to solve the debt crisis to catch up with ZARA, which is even more distant.

What's more, Zara is now trapped.

Reference materials:

Data source: Lathabel Report, Sky Eye Inspection

Picture source: network, official website

Reference article:

Internet style list: Fast fashion is cold, Lathar Bels are under pressure

Future consumption: 600,000 people are in the live room, wait

Lishi Business Review: Who is the encircling of ZARA?

- END -

Bay Area Time: Drone who does not require a flying in time with time race

Run with time, keep your green code on time!Have you ever seen a nucleic acid with a drone without a flying hand? Source: Shenzhen Satellite TV

What is taurine? What is it?what's the effect?

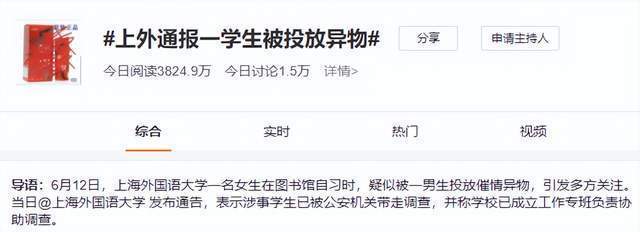

On June 12, a a girl coffee cup of Shanghai Foreign Language University was put on...