The market value has evaporated by 45 billion yuan, and the gross profit margin has fallen by more than 35 percentage points in 3 years. How many opportunities are there under the giant ring?

Author:Blue Whale Finance Time:2022.07.04

Picture source: Oriental IC

Recently, the days of excellent are not good. Following the resignation of the chief operating officer Hua Kun, the first quarterly report released by You was engraved, and its revenue and net profit were both declined. At present, the stock price has also fallen by 90 %, and the market value evaporates exceeded 45 billion yuan.

Behind the lower performance is the strategy of reducing the price of products to expand the market. After the price of the product declined, the gross profit margin of its products also began to decline sharply, a decrease of 35 percentage points in the past three years.

Today, the competition in the cloud computing market is becoming increasingly fierce, and the large share of the public cloud market has been occupied by giants such as Alibaba Cloud, Huawei Cloud, Tencent Cloud, and Tianyi Cloud. I am afraid that there are few opportunities for excellent opportunities.

The market value evaporates exceeds 45 billion yuan, and the co -founder resigned

In March 2012, Ji Xinhua, Mo Xianfeng and Hua Kun jointly founded the excellent engraving. Before that, all three had worked in Tencent. With the development of the cloud computing market, in January 2020, it was engraved to the Science and Technology Board, becoming the first domestic public cloud science and technology innovation board listed company, with a limelight time.

The prospectus published by the excellent showed that Ji Xinhua, Mo Xianfeng, and Hua Kun will hold a total of 23.1197%of the company and 60.0578%of the voting rights after the issuance is completed. The three are also the actual controller of the company.

In January 2020, You was carved with the aura of "the first share of the domestic cloud computing science and technology board", which has attracted much attention from the market. Immediately, the stock price rose sharply, up to 125.9 yuan/share, and the highest market value exceeded 53 billion yuan. However, after several shocks, its stock price showed significantly, a significant decline, a minimum of 11.82 yuan/share. Today, its stock price has fallen to more than 90 %, and the corresponding market value has evaporated by more than 45 billion yuan.

According to statistics, since March 2021, excellent is engraved on March 6, March 24, May 12, September 7, September 28, 2022, February 25th, 6th, 6th, 6th, 6th, 6, 6, 6, 6, 6, 6, 6 On the 22nd, the announcement of the shareholders or directors of the director of the supervisor was issued, and the total reduction of 28.11%of the total stocks was reduced to reduce holdings.

The decline in stock prices and the pain period for shareholders' reduction of holdings have not passed, and the excellent is facing the dilemma of executive departure. In April of this year, You was engaged in an announcement saying that the company's chief operating officer Hua Yan submitted a written resignation report and applied for resignation from the company's chief operating officer position. After his resignation, he was still a director of the company.

As of the announcement date, Hua Kun directly held 5.17%of the shares, and indirectly held the company's 0.51%of the shares of the company through the Jiaxing Yunxian Enterprise Management Partnership (Limited Partnership). The announcement said that Hua's resignation will not adversely affect daily operations.

As one of the co -founders of the excellent engraved, why did Hua Kun resign as an important job for 10 years? The announcement only gives "personal reasons", that is, a stroke, but whether there is other hidden feelings behind this, the outside world is unknown.

After listing, the performance "changed face", and the net profit of Q1 in 2022 both declined

At the beginning of the listing, it was carved as a neutral third -party cloud computing service provider. Many people in the industry said that the industry has invested huge in the early stage and is often in a state of losses. It may be profitable when occupying enough market share.

Observing its prospectus and annual reports carefully, it can be found that excellence has experienced the few profitable situations of cloud computing companies from 2017-2019.

The excellent carving has achieved a profit in 2017, but this profitable situation has not lasted long. The net profit engraved in 2019 has fallen sharply in 2019, and after listing, the performance "changes the face". There is a dilemma of losses again.

In the 2020 annual report, the excellent interpretation said that the current domestic cloud computing industry is still in the rapid development stage. Since the company's listing, the business volume has been expanded, and some Internet segmented industry head customers have been introduced. Fast growth and accumulation of scale effects. Due to the impact of the rapid increase in the proportion of low gross profit business income, the price decrease, and the upgrade of the server, the overall gross profit margin of the main business decreased. In addition, the company has increased research and development investment and increased fixed asset investment.

The preferred is that the common role of the above factors in the future may have a continuous impact on its operating performance, causing the risk of continuous losses in the short term.

As the estimated estimated, the amount of losses was further expanded in 2021. According to the financial report data, in the first quarter of 2022, the net profit of the excellent mother -in -law was negative, and even the revenue began to decline, a year -on -year decrease of 25.73%.

The gross profit margin fell more than 35 percentage points in 3 years

A number of people in the industry analyzed reporters that one of the reasons for the loss of losses after being engraved to the market is that they have adopted the price reduction method and launched a price war with the cloud computing giant to seize the cloud market.

The excellent financial report shows that in 2019, it began to reduce the unit price of public cloud products, which is also the main reason for the sharp decline in net profit returning to the mother in the same year.

This is more intuitively reflected in the financial report that the gross profit margin has fallen. In 2019, the gross profit margin has dropped sharply by 10.44 percentage points. Since then, it has continued to decline. In 2021 It is 39.48%.

2020 is the largest year -on -year -old gross profit margin decline. The excellent engraved in this year's financial report explained that the decline in gross profit margin was reduced to the unit price of public cloud products in response to market competition, as well as according to the market according to the market, and the market was based on the market. Environment, business development expectations and operating equipment update plans, due to continuous procurement and deployment of operating equipment, and deploying and supporting the procurement data center resources. However, this seems to be difficult to reverse the current situation. In the annual financial report of 2021, the excellent products admit that the main product price has shown a decline in the overall decline since 2018, and the price reduction is large. It is still relatively fierce. The main cloud computing manufacturers have the possibility of continuous competitive prices to achieve a short -term market share. In the face of fierce market competition, the excellence may be engraved in the next few years.

In this regard, people in the industry told reporters from Blue Whale Finance that large manufacturers such as Ali and Tencent have other businesses to support the pressure of the price war period, but for the excellent engraving of the cloud business as the main business. It is not advisable to sacrifice gross margin to expand market share.

The market share is getting smaller and smaller?

The existing products include a series of cloud computing products such as IaaS, PaaS, big data circulation platform, and AI service platform. According to business, its products are divided into public clouds, mixed clouds, private clouds and other products. Among them, the public cloud accounted for a large revenue, and the financial report in 2021 showed that the proportion of the public cloud accounted for 75.6%of the main revenue.

According to IDC data, the shares of the public cloud IaaS market decreased from 4.9%in 2015 to 3.4%in 2018. This may be the reason why you are rushing to expand the market in 2019.

But on the other hand, the Chairman and CEO Ji Xinhua said in an exclusive interview with the media after listing, "The competition in the cloud computing industry is relatively fierce. We are a cloud computing company that competes with the Ali and Tencent giants. Optimistic about the cloud computing industry, but there is still some worry about how to compete with the giant. "

According to IDC data, in the second half of 2021, the top five market share in the Chinese public cloud IaaS market totaling 76.8%, and the top five manufacturers were not included. The reporter noticed that after 2018, there was no public information on the market, indicating what the share of the shopping mall in the cloud computing market was in what position.

According to IDC analysis, in the second half of 2021, China's public cloud market growth returned to rationality, but also contained new opportunities. So, how much is the opportunity to leave for you?

- END -

49 -year -old Luo Yonghao, quietly bid farewell to the Internet!

Luo Yonghao, the first net celebrity, just retired from the net!From Lao Luo quote...

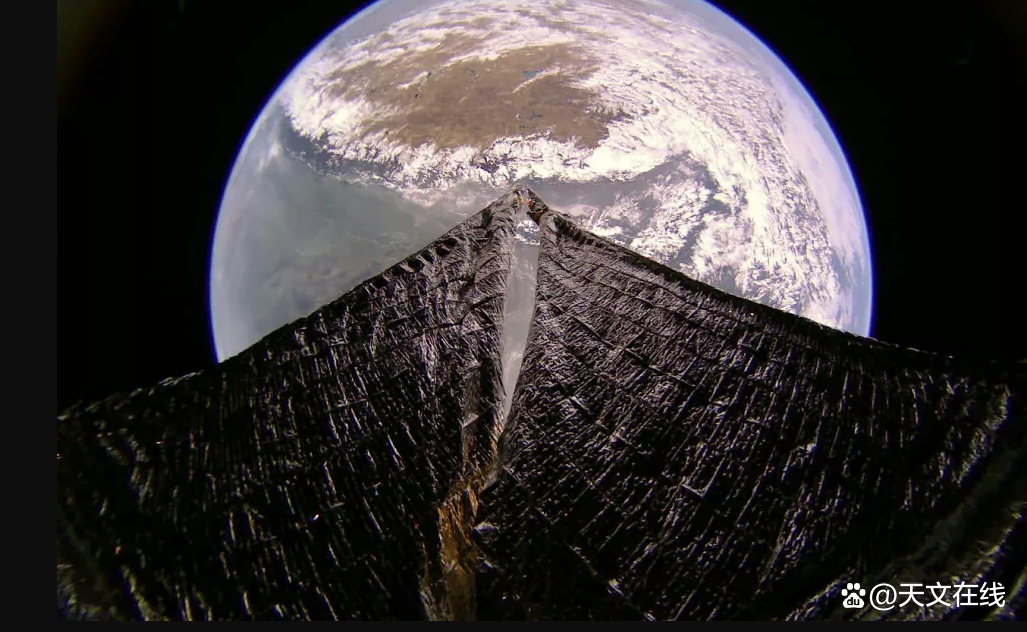

set sail!What kind of task will be there in Guangfan No. 2?This is the sun and earth in its eyes

The prototype of this solar ship was built by the planet society to experiment wit...