Sports IP large households also sell blind boxes | Global Unicorn

Author:36 氪 Time:2022.06.29

Sports e -commerce companies have the head of hand in? FANATICS's ambitions are not only there.

Wen | Yao Lan

Edit | Qiao Yan

Cover Source | Sportico.com

How much is the maximum value of a retail company around a sports goods? The answer is billions of dollars.

If it plugs in NFT's wings, how much can it be worth it? The answer is nearly 30 billion US dollars.

The company is called Fanatics, and the founder Michael Rubin is a American Jewish. Starting from selling sportswear, sports equipment and other sports franchisees, taking the Internet wave, Fanatics grew up to the world's largest authorized sports goods retailers.

Since the first financing in 2012, FANATICS's valuation has risen from $ 1.5 billion to $ 27 billion, and the valuation has been over 18 times.

It is only one step away from sexy business to sexy business. After conquering the sports franchise industry, Fanatics "invaded" the star card industry with a total annual transaction of more than 10 billion US dollars, and began to get involved in the sports betting industry, and its ambition to build the "sports empire" has become increasingly revealed.

In 2021, FANATICS sales exceeded $ 3 billion, an increase of more than 30%year -on -year. According to people familiar with the company's business, FANATICS's income of about $ 6 billion in 2022, doubled year -on -year.

How does the sports retail giant FANATICS expand the business layout step by step? What is its new betting star card business with a huge potential business?

Sports goods dealers cross -border robbery

As early as high school, Rubin started a successful skiing equipment business in the basement of Philadelphia's parents' house.

After dropping out of the University of Veranova in his 20s, Rubin established a third -party software platform to serve e -commerce brands -GLOBAL SPORTS Incorpolet. By 2011, Rubin acquired Fanatics, which had operated more than 250 e -commerce websites at the time for US $ 171 million and US $ 106 million.

Fanatics was founded in 1995, headquartered in Florida. It was formerly known as a common physical retail store authorized by the NFL team Jacksonville American Tiger -FOTBALL FANATICS. It began to try online sales in 1997. In 2012, Rubin merged GSI's online sporting goods business, Fanatics, and Dream. Inc, another sports souvenir sales company they acquired, established the current FANATICS. Inc, and personally served as the company's chairman and CEO of executive execution official.

Michael Rubin, founder /Executive Chairman of FANATICS, Mike Coppola /Getty Images

In 2012, Fanatics completed a round of $ 150 million in financing. The venture capital giant Andreessen Horowitz (that is, A16Z in the field of Web3) and Insight Venture Partners participated in the investment, with a post -investment valuation of 1.5 billion US dollars.

A year later, Alibaba, who had not been listed in the United States, led a led by Temasek in Singapore to invest more than $ 170 million from the mobile Internet companies. In this round of financing, the valuation of FANATICS has once again increased to $ 3.1 billion.

In the past ten years, FANATICS's financing pace has never stopped, and the market value has turned over and over.

As of 2021, Fanatics ranked 36th among 1,000 North American e -commerce platforms with a sales of billions of dollars per year. There are more than 8,000 employees in 11 countries/regions around the world, and cooperate with more than 1,000 suppliers to operate e -commerce platforms and offline straight -camp stores of major professional sports allocated sports alliances such as NBA, NFL, MLS, NHL, and more than 150 Sales of home university sports associations and dozens of teams.

If there is no accident, FANATICS may continue to have a quiet life as "the world's largest surrounding retailers in sports goods", but the rush of star cards that come to the unexpected star has made it the most dazzling star in the capital market.

Figure | Sportico.com

In August 2021, FANATICS announced a strong break into the sports collection card industry and won the copyright of the exclusive star card of MLB, NBA, and NFL in a very short period of time. Breaking the situation of Panini, Topps, and Upper Deck.

Also in this month, Fanatics announced that it has received US $ 325 million in individuals and companies from MLB, SoftBank, ROC Nation, Jay-Z, Yinhu, etc., with a valuation of $ 18 billion.

What's even more surprising is that FANATICS's newly established sports collection card company Fanatics Trading Cards also issued any sports collection card products, which has won the favor of a number of top investment institutions, completing US $ 350 million in financing, and a post -investment valuation of 104 One hundred million U.S. dollars. In October, Candy Digital, another NFT startup of Fanatics, has announced a $ 100 million Series A financing of 100 million US dollars. The round of financing was led by Insight Partners and SoftBank VISION FUND 2, and the current valuation is $ 1.5 billion.

At the beginning of January this year, FANATICS acquired Star Card TOPPS at a price of $ 5 billion, which will broaden its market territory in the sports field. By March, Fanatics has completed a new round of financing of 1.5 billion US dollars, and the company's latest valuation will reach $ 27 billion, which is also the largest round of financing in Fanatics history.

Find your own foothold in the star card industry, so that FANATICS ushered in a dream moment for valuation takeoff.

Valuation take off: from star card to NFT

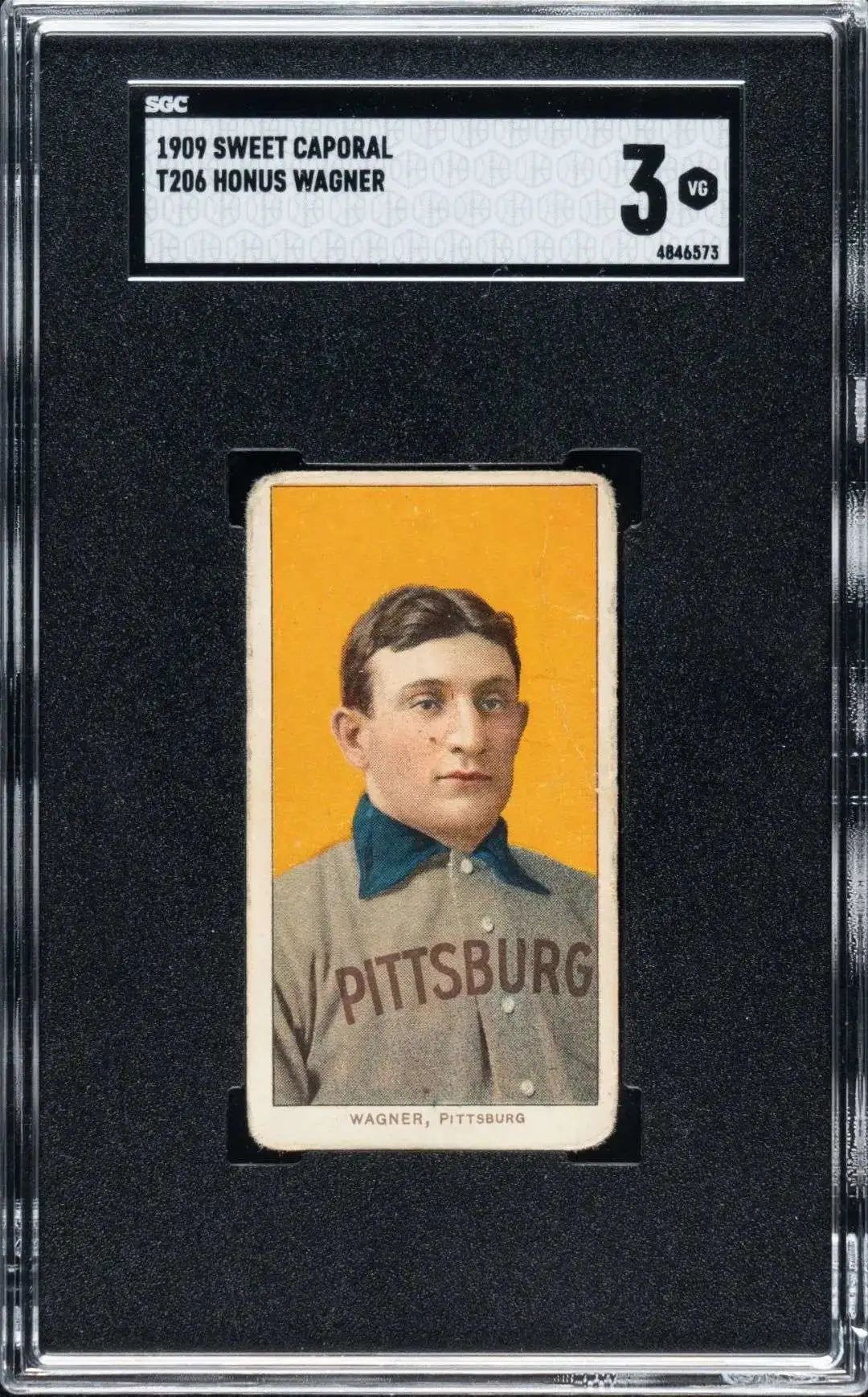

Just as every 80s in China have experienced the experience of being emptied by simply noodles -a sports collection card born in the late 19th century, it has been used as a gift by American tobacco and candy merchants to increase the sales of their products. After a long historical development, this card with various types of sports stars and showing stars related information has gradually become a unique IP derivative and collectible category that is deeply loved by sports fans.

Sports collection cards are divided into different types such as general cards, special cards, jersey cards, signature cards, and jersey signature cards. Among them, the most collectors are the star cards.

For example, in 2021, a signature star card of the NBA Lakers LeBron James was auctioned at a high price of $ 5.2 million, refreshing the transaction price of the basketball star card of the year.

高额回报的加持下,球星卡甚至演变成了一种类似股票的另类资产,诞生了著名的PWCC和Card ladder 50等价格指数——专业公司们通过分析卡片的价格波动规律撰写研究报告,为Investors provide a way to earn low -selling and high -selling earnings.

Taking the PWCC index as an example, it will select 100, 500, and 2500 card combinations from the current star cards available for transactions to form the PWCC100, 500, and 2500 index after calculation. From the perspective of investment value, since 2008, since 2008, since 2008, since 2008, since 2008, since 2008, since 2008, it has been since 2008. The overall return of PWCC500 exceeds 800%, and the return rate of PWCC2500 is also above 500%, which is much higher than the return rate of 230%of the S & P index during the same period.

In 2021, the star card and NFT joined by NFT are tantamount to a bucket of gasoline on the hot market.

Compared with the traditional physical star card, the production margin cost, preservation, and maintenance cost of the digital star card is obviously lower, and the circulation, uniqueness and entertainment are enhanced. In addition, public transactions online are more conducive to the marketization of card value. According to Deloitte's global forecast, the NFT of sports media in 2022 will generate more than $ 2 billion in transactions, which is about twice as much as 2021.

At present, the star card has formed a complete, mature, and huge industrial chain overseas, especially the development of North America is the most prosperous: publishers obtain IP copyrights from the sports alliance and the individual of the stars, based on the authorization of IP production, issuing sports collection cards, and then again, and then通过多样的渠道触达一级消费者, 形成一级市场;下游消费者因购买目的不同(收藏用、投资用等),有些会产生再次交易卡片的需求, 二级交易市场应运而生;而The emergence of midstream rating agencies can provide third -party reference for the value of the card market, which not only enhances the financial asset property of the sports collection card, but also increases the liquidity of the sports collection card market.

At present, the most expensive star card, with a total transaction price of more than $ 6.6 million, picture | Robert Edwards Auctions

Because the star card IP is exclusively authorized, the upstream copyright link is at the absolute highlands of the industrial value chain, so the competitive barriers of the star card publisher are the number of IP authorization, which belongs to "the IP who gets the world."

As a niche industry, the upstream of the star card has a clearer boundary, which is basically three -pointers from Panini, TOPPS, and Upper Deck. However, after FANATICs entered the game, it adopted a radical growth strategy to quickly grasp the initiative and lead the industry to towards the industry towards towards the industry. Integrated business model development.

As mentioned at the beginning, FANATICS took only a very short time from Panini, who was in an absolute leading position, and grabbed the copyright of heavy IPs such as MLB and NBA. The five major star cards of MLBPA and FIFA are fully authorized by the company.

The reason is that in addition to capital assistance, the success of Fanatics is to change the rules of the game.

FANATICS re -negotiated the cooperation method with major sports alliances, no longer relying on agreement binding as before, but to form interest binding in the form of the sports event alliance. Sports alliances such as NBA, NBPA, MLB, MLBPA will occupy a certain shares in Fanatics Trading Cards, a newly established Fanatics Trading Cards, which means has seen an increase. After the first battle, Fanatics stared at the "second child" of the three giants -Topps.

As a ballball star card giant, Topps has been monopolizing related businesses with Panini. However, under the fierce offensive of FANATICS money and disintegration, TOPPS quickly gave up resistance and was included in the latter at a price of $ 5 billion.

Two unions will undoubtedly allow Fanatics to have a more complete upstream and downstream resources -facing the frustrated boss Panini and the relatively weak old three UPPER Deck, holding most of the popular events, in front of the upper upstream Fanatics, leading to Rome The door seems to be open.

However, according to Bloomberg, FANATICS executives do not seem to intend to enter the field of the star card -the rating field, but will choose to sign an existing company as a partner.

Investors believe that downstream trading links will be the next goal of Fanatics. Rubin likes to deal with consumers directly, which means that Fanatics Trading Cards, a new company owned by Fanatics, is likely to create a new business model that integrates authorization, distribution, and transactions. In this model, FANATICS may have the best income performance, and the league can also obtain data on their own.

According to Bloomberg, Fantatics is undergoing a card demolition operation, that is, a number of players buy a box of star card jointly and distribute a box of star cards in a random distribution method, similar to the "group purchase+blind box" purchase method. In this way, the cost of the box can be shared, and the streaming media audience can also watch the entire packaging process and get the entertainment experience.

In addition to sports, FANATICS also expands other fields horizontally, trying to attract the attention of more people.

On March 8 this year, Josh Luber, co -founder of FANATICS, announced the launch of a new collection card brand focusing on popular culture, art and entertainment, ZeroCool, the first product from the well -known person Gary Vaynerchuk NFT project -VEVEEFRIENDS Trading Cards, This is the first time that the virtual NFT collection is brought to the real world.

After spending several years to study mathematical models and repeatedly discussed with economists, Zerocool finally chose the unique Blind Dutch Auction mode to determine the final price of the lot.

For example: 10 users bid, the top 4 may be $ 1,000, $ 900, $ 700, and $ 600, and the 10th place will issue $ 400. Then the final settlement price is $ 400. Essence

This bidding model is more changeable than the new brand itself, with three main functions:

First, it ensures that all users who purchase the product at the same time pay the same price; second, for the platform, this is a fair market price, "finding the right market price" is a high -level goal; Third, almost every user's actual payment price is lower than their bids, and they are glad that they can pay less, so this is a victory for all relevant people.

FANTATICS Collectives chief vision officer Josh Luber, picture | Fantatives

The attempt of the new model undoubtedly represents the greater ambitions of Fanatics -to make the collection card truly part of culture, and make it integrate into all parts of culture like sports shoes in the past ten years.

So, how does Fanatics make the collection card do this? Josh Luber believes that fans who cannot force the Travis Scott like to like basketball cards, but if Zerocool make Travis participating in the rapper card, it may win their favor. No one only likes one thing, and even sports card collectors may have other hobbies. The original intention of Zerocool was to make more new users outside the sports field exposed to the collection card.

The hidden concern of "high -speed operation machine"

In addition to collecting cards, digital collectibles, and NFT business, news shows that FANATICS has put the expansion eye to the sports gaming market to seek IPOs to achieve the as soon as next year.

At present, FANATICS has more than 80 million current target users, and the customer acquisition cost is allegedly $ 19/person, which is lower than the average level of gaming companies. Rubin once said to the media that more than half of Fanatics users participated in sports betting in 2020, and 82%of users also hoped to bet on Fanatics. In addition to the large user base, sufficient transaction volume is also convenient for platforms to master detailed user -related data. FANATICS has established one of the world's best fans databases. Each consumers have at least 16 data attributes. Detailed user portraits will help it provide personalized services to consumers and establish a new large -scale digital sports business.

In 2021, Fanatics has submitted a sports gaming license application to the New York State Gaming Commission, hoping to start a contest with DRAFTKINGINGS, Fanduel, CAESARS and MGM. According to foreign media reports, Wynnbet, a gaming company with a market value of $ 500 million, may become its next acquisition object.

According to a friend of Rubin, this is a great strategic story: to reach a suitable transaction with the appropriate alliance, establish an incredible execution model, and bring more value to the alliance than in the past. This is a one. Positive cycle value chain. "It's like a offending machine, the opposite of‘ complacent ’. It is constantly exercising, obtaining licenses and relationships, redefining the practice of searching, sales and retail.”

However, this "high -speed operating machine" is not uncomfortable.

According to Mildenhall, the former Aiwi Ying Chief Marketing Officer who just joined the board of directors of Fanatics: "Fanatics' brand capabilities cannot be compared with their business capabilities."

In Mildenhall's view, although Rubin is good at setting up business and establishing a company in the company, he does not know how to create brand logos. Most sports fans are only "blurred" for Fanatics.

Figure | Adobe/Designet by Mario Paulis

In addition to the unclear brand image, the key part of the FANATICS global business map -the business progress of the Chinese market is still in a vague state.

In March 2021, Fanatics announced that it cooperated with China Private Equity Corporation Gaozhi Capital Group to jointly establish a joint venture Fanatics China. The two parties held 50%of the equity of a joint venture, headquartered in Shanghai. The joint venture company will conduct localized sports product design, procurement, authorization and other businesses in China. According to CNBC, FANATICS is expected to "exceed $ 1 billion" in China's business in China.

However, after more than a year since the announcement of the two parties, FANATICS has not yet opened the official website of China or launched on e -commerce platforms such as Tmall, and has not announced any offline store information.

Although FANATICS, which holds many franchise rights, is full of confidence in the Chinese market that has continued to increase the consumption of sporting goods, it may not be easy to break out.

First of all, can American companies adapt to China's policies and market environments, such as Google, EABAY, Amazon, Uber and other industries and other industries. ; Finally, how to leverage the sports retail system and increase the contact of consumers. Sports brands such as Nike, Adidas, Anta, Li Ning, as well as the largest dealers in Nike and Adi China -Taobo Sports have opened direct -operated stores in major e -commerce companies, and offline retail stores have been laid for many years.

The progress of the Chinese market has stagnated, and there is no shortage of suspicion in the United States. A company executive of an anonymous interview with CNBC said he still did not believe in the price of FANATICS. In his opinion, private companies can easily conceal their income difficulties because the US Securities and Exchange Commission will not require them to report their income.

Facing the complex and changing international situation and the external doubts, Rubin believes that every industry has undergone fundamental changes, and he is still optimistic about the future. "I think sports is the greatest entertainment activity in the world, but we must make it closely related to people's lives and always feel fresh through innovation."

It is reported that FANATICS may move towards $ 100 billion. From the beginning, it is already large enough, fast enough, and decisive enough. Whether the road of growth can support such ambitions still needs time to verify.

Reference materials:

[1] FANATICS Reveals NFL WAS Biggest Backer in $ 1.5B Round Annound Last Month at $ 27b value, technology

[2] FANATICS SETS PORAN FOR TRADING-CARD Business, Starts New Brand, Bloomberg

[3] Fanatics wants to be a $100 billion company – here's how it plans to get there, CNBC[4] The dynamic career and life of Michael Rubin — billionaire team partner, friend of high-profile rappers, and criminal-justice reform advocate Insider

[5] FANATICS VALUED at $ 27B AFTER MICHAEL RUBIN ’s Latest Funding Round, New York Post

[6] Fanatics Searching for Brand Identity: Former Airbnb Marketing Office, New York Post

[7] How Josh Luber and Fanatics Are Making Trading Cards Cool Again, Forbes

[8] https://www.fanaticsinc.com/michael-rubin

[9] FANATICS to Buy Topps in $ 500M DEAL As Trading Card Biz Zooms Into2022, Sportic

[10] NFL, MLB and Players Unions Lead the Latest Roundting of Investment in Rapidly Growing Fanatics, CNBC, CNBC

[11] Jay-Z partners with fanatics in new york sports gambling bid, forbes

[12] Research on the sports collection card industry: assets with both collection and financial value, CITIC Construction Investment Securities

[13] A $ 6.2 billion American "catfish", entered the Chinese sports retail market, sports big business

[14] Sports e -commerce giant FANATICS valuation is nearly $ 30 billion, and the market has not landed for a long time, interface news

Let's "share

FANATICS's ambitions are more than that

- END -

Walking in front of the new bureau | "Three Top Ten" see Actions ②: "The top ten industries" see Qingdao

Create a pioneering city in modern industries, focusing on the development of 31 i...

Live Trailer | "Civil Aviation Wisdom" fifth cloud network integration to empower the digital construction of civil aviation

On June 30, the fifth online meeting of Civil Aviation Wisdom will meet you. This ...