The chip in the temperature measurement gun rich business | IPO observation

Author:36 氪 Time:2022.06.23

The gross profit margin is nearly 70 %, ranking among the best in A -share chip design companies.

Wen | Zheng Cancheng

Edit | Elegant

Source | 36 氪 South China (ID: south_36kr)

Cover Source | IC Photo

How scarcity is a European and American chip in the domestic market in 2003? 180 nanometer, 32 processing kernels, integrated 2.5 million devices to an integrated block of less than half a thumb, selling can be worth 1.1 billion.

This is "Hanxin No. 1" in the scientific research funding in that year. At that time, Chen Jin, who worked as an electronic engineer from the United States, packed itself with technology. It claims that its team has reached the international advanced level in less than 3 years. The story of being packaged by the "technical halo" was left in the market. With the stagnation of domestic chips at that time, it looked like Jinyu.

The veil of the real story is not so sexy. The "Hanxin No. 1" that has been held to get 1.1 billion R & D expenses is actually a "Motorola" chip logo. "".

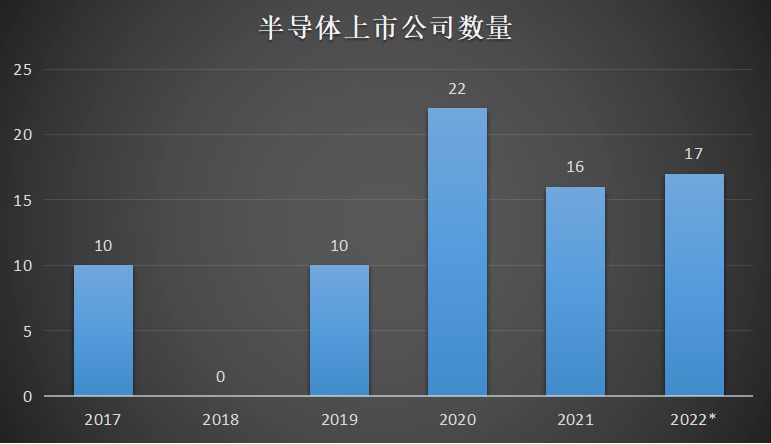

And pulling the time node to the present, the Chinese semiconductor industry has changed its technical precipitation and experience accumulation, which has also been reflected in the number of chip companies in the past two years. Wind data shows that in 2022, less than half, the number of semiconductor listed companies reached 17, and the number exceeded 2021. In addition, nearly 40 companies lined up in science and technology boards have nearly 20 in the field of semiconductor, accounting for nearly half.

Semiconductor listed company statistics, data sources: Wind, 36 氪 Map

So, a question worthy of being thrown out at the current point is that compared with the past stories, how should the real industrial value of chip companies be reflected? In terms of the secondary market, the head -of -chip head enterprise of the car plan is that the market value has exceeded 30 billion today, and the market value of CMOS image sensor chip head enterprise is nearly 20 billion. The two showed a state of adversity on the first day of the listing. In the case of the break from many companies in the science and technology board, the first day still increased by more than 10%, and then the stock price rose all the way through the 300 mark; the latter was the latter; the latter was the latter. From the beginning, it was high, and the increase in the first day of listing was close to 80%.

Companies that have been weighed by the capital market can directly display the fares, and companies in the process of listing can better explore their value shaping in the industrial chain. Among them, a typical representative is Jing Huawei. This company has only conducted a round Pre-IPO round of financing before listing, but it supports its long-term cash flow with high profits. Income can support the development of enterprises.

Recently, Jinghuawei submitted registration to the Shanghai Stock Exchange. The sponsor was Haitong Securities Co., Ltd., and it was planned to raise 750 million yuan. A typical chip company's investment and monetization in 20 years of development is implemented on the paper, which can be read from its prospectus.

Stable and steady, high -level fast running, springboard listing

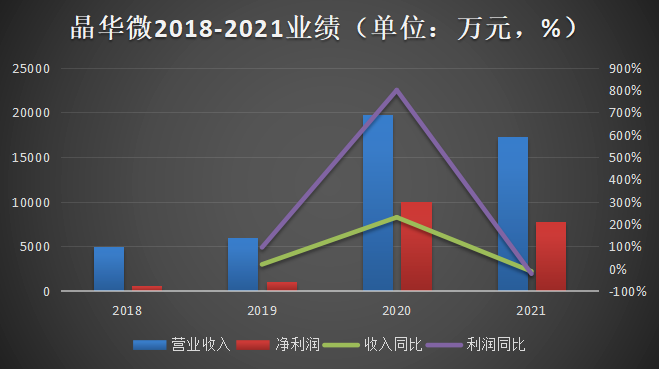

From 2018 to 2021, Jinghua's main business revenue was 50.177 million yuan, 59.733 million yuan, 197 million yuan, and 173 million yuan; net profit of home mother was 5.688 million yuan, 11.118 million yuan, 100 billion yuan and 77.3515 million yuan, respectively. Yuan. In other words, under the influence of the epidemic in 2020, net profit still turned more than 8 times. On average, in the two years after the epidemic, Jinghua's net profit fluctuated around 50%.

Jinghua Mi-Micro 2018-2021 performance, data source: Jinghua Mi-Micro-Share Book, 36 氪 Map

The promotion of epidemic is one of the reasons for the rapid development of Jinghuawei, but it is not the entire factor in the continuous growth of Jinghuawei.

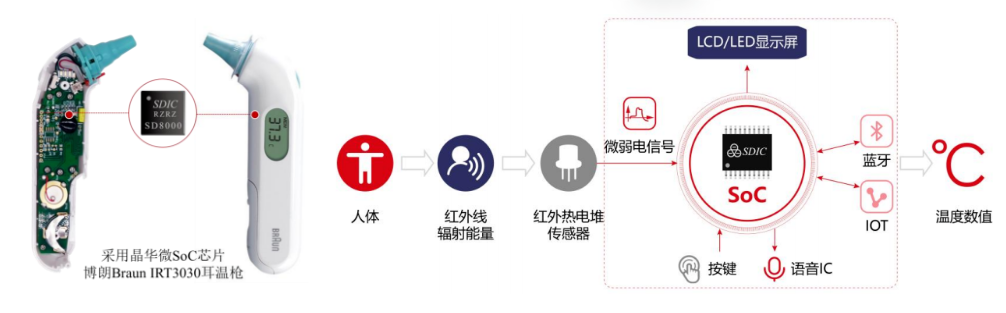

First of all, Jinghuawei's main product is a high -precision ADC -based signal processing SOC solution. SOC (chip -level system) refers to an integrated circuit that can achieve dedicated targets. For example, the just -needed temperature measurement products under the epidemic need to use infrared temperature measurement SOC chips. The role of this chip is to make the temperature value finally present on the temperature of the temperature measurement gun.

The internal structure of the ear temperature gun (left), the SOC solution schematic diagram (right), the source of the data: Jinghua Microemporant Book

Temperature measurement products are only one of the downstream applications. Jinghua Mi -micro chip can also be used in the fields of medical health, industrial control and instrumentation and intelligent perception. Among them, medical and health SOC chips and industrial control and instrument chips are the main sources of income, with a total proportion of over 95%from 2019-2021.

Jinghua Micro 2019-2021 Main business income composition, data source: Jinghuawei Fundamental Book, 36 氪 Map

Structural changes in downstream demand are the key to the rapid growth of Jinghuawei in the past two years. In 2020, the price of the front temperature gun soared under the impact of the epidemic. According to relevant cases, the supply and demand of the forehead gun during the epidemic period was extremely unbalanced, and the average price was more than doubled. It was once fired to nearly 400 yuan.

The rapidly changing supply and demand relationship failed to respond to the invisible hands as soon as possible, which also led to the rise and price of the upstream infrared temperature measurement signal processing chip. In 2019, the average unit price of only 1.3605 yuan was only 1.9716 yuan/piece in 2020, a year -on -year increase of 44.92%; sales rose from 8.2967 million in 2019 to 64.744 million in 2020. Therefore, if you look closely at Jing Huawei's revenue composition, you will find that in 2020 Jinghua's revenue has been more than three times, the main contribution comes from the infrared temperature measurement signal processing chip, from 11.28 million yuan in 2019 to 1.28 in 2020.28 in 2020 100 million yuan.

Being able to quickly grasp the epidemic dividend, on the one hand, is Jing Huawei's ability, but at the same time, there are resource accumulation and long -term betting to the industry. The prospectus shows that Jinghua's infrared temperature measurement signal processing chip accounted for a considerable part of the warmer gun field. According to statistics from the Ai Media Data Center, the demand for China's forehead gun in 2020 was 230 million units, with Jinghua micro -sales 64.744 million According to calculations, Jinghuawei's market share in this field reached 28.18%.

Being able to establish a stable cooperation relationship earlier is the tentacles that enter the field of warmade guns. As early as 2015, Jinghua Wei established a cooperative relationship with Berkang, the head of the warmer gun. In the following two years Sell a small amount of infrared temperature measurement signal processing chips. According to the prospectus, 70%of Belkang Medical Health SOC chips are provided by Jinghuawei. The infrared temperature gun produced by the former accounts for about one -third of the domestic market share.

However, there are also self -standing gestures. Among the top five customers in Jinghua, the customers related to the warmer gun occupy three. Dealer Kobo has become the largest customer of Jinghua Micro in 2020. In 2016, the static relationship with Jinghuawei to establish a cooperative relationship was the second largest customer; Jinghuawei and Xin Yilan established cooperation in 2020, and also ranked fourth in the top five customers.

Jinghua Mi -Micro's situation of the five major customers in 2020, information source: Jinghua Mi -Microemphenitation Book

The upstream technology has become more and more right to speak. Even in 2017, Berkang began to turn to dealers to indirectly purchase chips from Jinghua Micro. At that time, the SOC chip had begun to increase, and the thermometer electronic products gradually landed. The opportunity appeared in the formal effect of the "Water Capital Convention on Milivation", which clearly stipulated that the traditional mercury thermometer began to stop production in 2026.

In 2021, due to the effective control of the domestic epidemic, Jing Huawei's income of the processing chip of the infrared temperature measurement signal processing chip decreased to 30 million, and the overall revenue fell by about 13%to 173 million yuan.

Although the epidemic has briefly catalyzed the performance of 2020, excluding the epidemic affects Jinghua Wei, it still shows high growth. Regardless of the infrared temperature measurement business, the sales revenue of other chips in Jinghuawei was nearly 70 million yuan in 2020, an increase of about 44%compared with 2019. In 2021, it reached 143 million yuan, which doubled the performance from 2020.

Behind the eye -catching performance, on the one hand, the advent of the era of intelligent electronicization, mechanical instruments have gradually transformed into electronic instruments; on the other hand, Jinghua and Micro's long -term industrial cooperation relationship is made Time moves more and more.

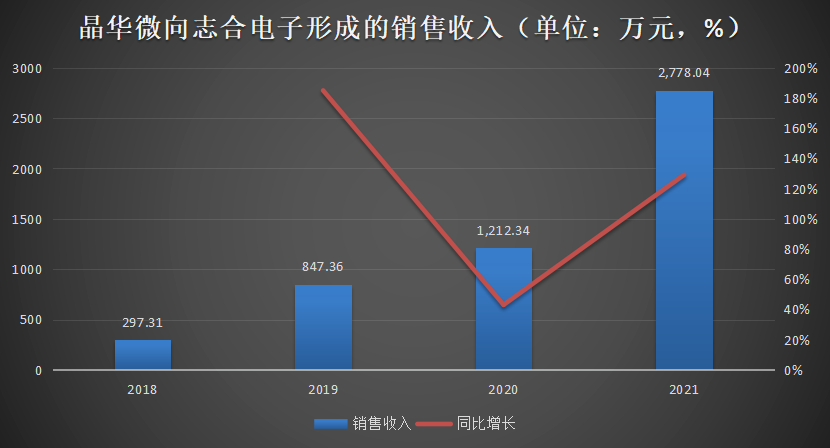

Jinghua Wei's sales revenue for some companies, data sources: Jinghua Mi -Micro -Share Book, 36 氪 Map

Specifically, in the field of intelligent health balance, in the general trend of consumption upgrade, the epidemic has further enhanced the health awareness of residents. Jing Huawei has already been deployed on the track. As early as 2014, it obtained the verification of Xiangshan Hengter in A -share listed company.

In the field of industrial control instruments, Jinghuawei established cooperative relationships with A -share listed company Ulid in 2016. Due to the changes in the external environment, the global supply chain stopped in the epidemic, and the chip demand in this field has also increased. In 2021, its sales revenue formed on Ulid was 11.838 million yuan, which was more than twice that of 2020.

Eat meat upstream, drink soup downstream

In 2000, the policy was to help the integrated circuit industry. The State Council issued the "Notice of the State Council on Printing and Distributing Several Policies of Encouraging the Software Industry and Integrated Circuit Industry" to encourage the development of the integrated circuit industry. In the same year, SMIC was established. In 2003, Tiejidian was established in Shanghai; Gekeway and Hisilicon, well -known semiconductor companies in China, were also established one after another. Jinghuawei was also born in such a era.

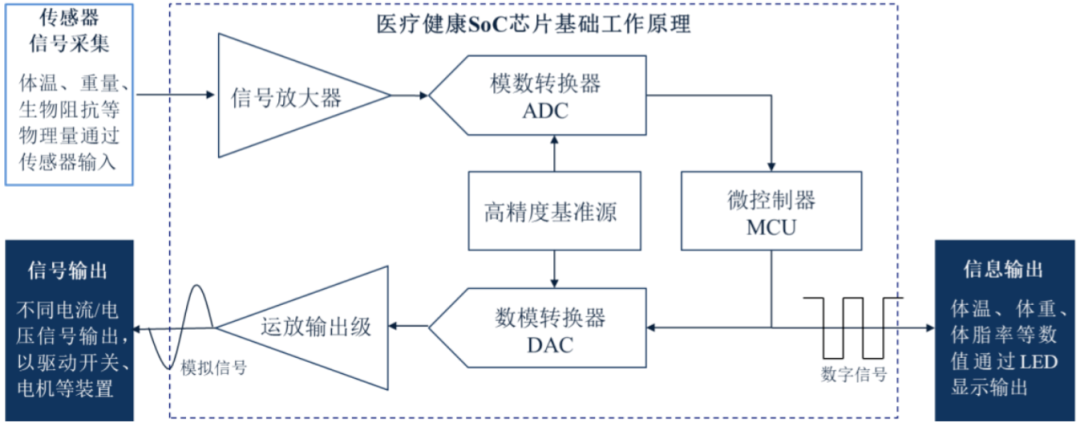

Looking back at the working principle of Jinghua Wei's main product SOC chip, today it can be found in textbooks: the physical quantities of most real worlds, such as body temperature, weight, etc., through the sensor collection, a built -in signal amplifier amplifier amplification , ADC (Analog to Digital Converter, mold/number converter) converts it into a more easy -to -process digital signal, and then handles this signal to microcontroller processing. The processing digital signal can be displayed through the LED screen, or the DAC (digital model converter) that is opposite to ADC function can be transformed into an analog signal to drive other devices.

Basic work principle of medical and health SOC chip, Source: Jinghua Micro Subsidiary Book

——It looks like a basic device that can commercialize technology. In 2005, it could not be bought in the market, and textbooks were blank.

In 2005, Jinghua Micro's core technical team led by Luo Weishao established Jinghuawei, becoming the first batch of chip design companies in China, hoping to introduce high -precision ADC and other core technologies to mainland China. Dr. Luo Weishao graduated from the University of Washington University in Electrical Engineering. He founded Jinghua Mi -Mi -micro -company Honeywell, Motorola, the United States, US Midunli, and Incontrol engineer in the United States. It is also because of this technical color that when Jing Huawei was founded, it broke through the industrial control Hart communication regulator chip. Its series of chips compatible with ADI, breaking the foreign monopoly of the industrial control industry to achieve domestic replacement.

In the context of the gradual commercialization of this technology, Jinghuawei has cultivated a downstream customer -Zhihe Electronics with its own power.

Prior to 2018, the electronic scale module in Zhejiang area was dominated by Weichun Electronics. In 2012, Jinghuawei cooperated with Weichun Electronics to supply it with intelligent health balance chips. In March of that year, three employees of Weichun Electronics Zheng Genhua, Lu Limin and Yang Minrong set up Zhihe Electronics. After the establishment, it established a cooperative relationship with Jinghuawei.

At the beginning of the establishment, Zhihe Electronics was still small, which provided financial support for Jinghuawei for the development of Zhihe Electronics. In 2018, the sales revenue formed by Jinghua Weixiang Zhihe Electronics was only 2.9731 million yuan. In May of the same year, Jinghua Mi -Micro -Xiang Zhihe Electronics provided 4.66 million yuan in loans for production and operation. In July of the same year, Jing Huawei also increased its capital to Zhihe Electronics 1.36 million yuan, accounting for 40%of the shares (in September 2020, returning to Zhihe Electronics Real Concerc).

Sales revenue formed by Jinghua Micro Xiang Zhihe Electronics, data source: Jinghua Micro Subjective Book, 36 氪 Map

In December 2018, Jinghua Micro terminated the cooperation with Electronics, the former partner Weichun Electronics. In the following three years, Jinghuawei and Zhihe Electronics cooperation became closer and closer. From 2019 to 2021, Zhihe Electronics ranked first in the top five customers of Jinghuawei, and ranked first in two years in 2019 and 2021.

After three years of development, Zhihe Electronics has become the main manufacturer of electronic scale modules and has established reputation in Zhejiang. In 2020, Zhihe Electronic's operating income reached 46.2888 million yuan, and net profit was 3.604 million yuan. Growth operating performance provides favorable conditions for the independent development of Zhihe Electronics. In December of the same year, it returned all of Jinghua Mi -Micro borrowing. In addition, Zhihe Electronics also has more choices in the market. According to the prospectus, Zhihe Electronics also purchases the same type of chips from Xinhai Technology, which does not form a dependence on Jinghua Wei.

Zhihe Electronics Revenue, net profit, data source: Jinghua Micro Fundamental Book, 36 氪 Map

In terms of the performance of this type of chip, the "digits" are important performance indicators used to measure such chips. For example, Jinghua's infrared temperature test chip focuses on high precision and low power consumption, specifically 24 -bit ADC and 8 -bit MCU. The realization of this performance may be considered behind Jinghuawei's team background today.

At present, the core technical team of Jinghua Micro is composed of 4 people: Luo Weishao, Zhao Shuanglong, Li Jian and Chen Jianzhang. Among them, the person in charge of the technical team Luo Weixo was the unanimous actor of Lu Hanquan and Luo Luoyi, the actual controller, and held 9.01%of the shares directly before listing;

Li Jian joined Jinghua Micro as the general manager of the Shanghai Branch in January last year. He has the dual background of industry and academics. He has engaged in research work in the National Key Laboratory of Special Integrated Circles and Systems, and has also served as a senior engineer in the Taiwan chip design company MSTAR. It is the first country in China to publish a paper in JSSC in JSSC. Researchers;

Zhao Shuanglong participated in the design and mass production of Jinghua Wei's high -precision digital temperature measurement chip, high -precision temperature control RTC chip. From the beginning of the Jinghua Mi -Mi -Mi -Ren simulated IC design engineer, it has been a director and deputy general manager of Jinghuawei so far It

Chen Jianzhang is also a core member of Jinghua Micro Technology Team. After graduating from undergraduate undergraduate at the age of 23, he joined Jinghuawei. The simulation IC design engineer was promoted to the IC design team leader and IC design manager to now serve as the supervisor and senior research and development of Jinghua Micro. manager.

In addition, in August 2015, Liang Guiwu, who had worked in Hong Kong, China Haowei Technology, Shouke Electronics and Mengke International, joined Jinghua Micro -Ren business director. Mengke International is still Taiwan's simulated IC Enterprise Tongkang Technology (6457 .Two) industrial partners.

The more irreplaceable the grinding, the higher the gross profit

From 2018-2021, Jinghua Micro comprehensive gross profit margin was 60.19%, 62.72%, 73.09%, and 68.61%, respectively, which is closer to the global simulation chip head enterprise Adeno and Texas instruments. One of the chip design companies with the highest gross profit margin.

The comparison of the gross profit margin level of Jinghuawei and comparable companies, data sources: Jinghua Mi -Micro Fundamental Book

Behind the high gross profit is the irreplaceability of Jinghua's core technology. First of all, compared with other domestic chip manufacturers, when Jinghuawei was established, it focused on high -precision ADC technology research and development products. Product performance can be higher than that of similar companies in the world. The right to speak on the chain to prevent it from developing the comprehensive gross profit margin in the field of low gross profit.

Secondly, compared with foreign manufacturers and Taiwanese manufacturers, due to external environmental factors, the supply chain has stabilized to become a new problem that mainland Chinese companies need to think about. As a local chip design manufacturer, Jinghuawei can jointly explore the development of new products with downstream customers.

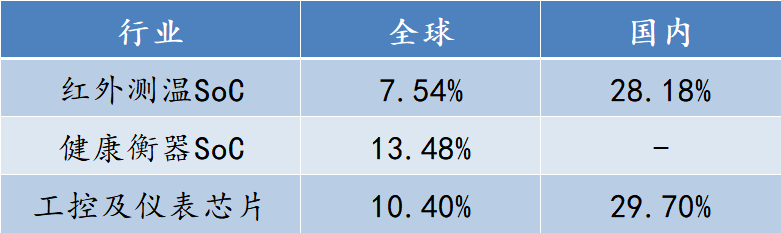

Jinghuawei has occupied a considerable share in the current focus. For example, in the field of infrared temperature measurement, according to the Ai Media Data Center, the global ear temperature gun demand in 2020 is 860 million units, 230 million domestic demand, and the sales volume of Jinghua's minimally infrared temperature test SOC chip is 64.744 million The domestic market share was 7.54%and 28.18%, respectively.

Jinghua micro -division industry market share, data source: Jinghua Mi -Minxuality Book, 36 氪

Looking at the remaining two industries, according to the prospectus, the market size of the global electronic weighing chip from 2020-2027 was about 1.394 billion yuan to 1.755 billion yuan; from 2018-2024, the market size of the global test and measurement instrument chip chip was about 43.65 From 100 million yuan to 5.487 billion yuan.

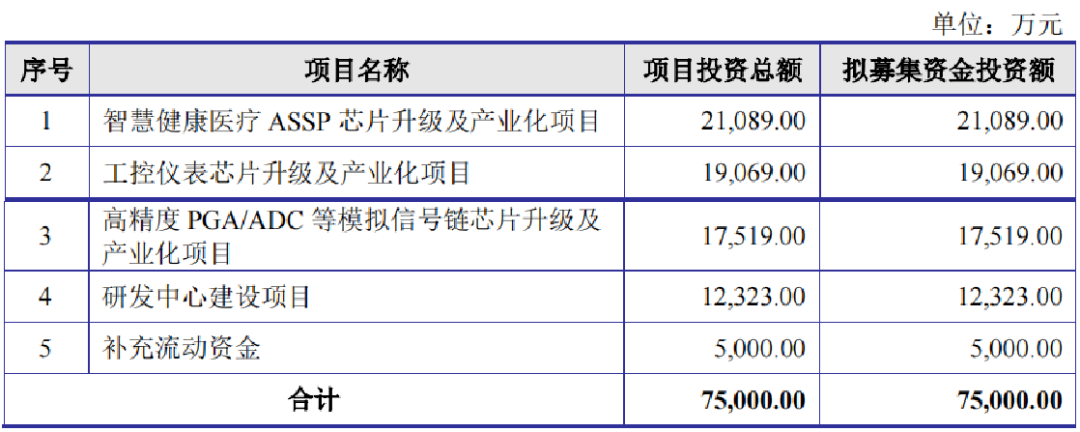

In the future, Jing Huawei will continue to deepen in the current field of medical and health, the field of industrial control instrument, and intelligent perception. This corresponds to the use of fundraising funds on the prospectus, that is, smart health medical ASSP chip industrial control instrument chips and high -precision PGA/ADC and other simulated signal chain chips upgrade and industrialization projects.

Jinghua Micro -raised funds, data Source: Jinghua Micro Fundamental Book

In addition to these areas, Jing Huawei will also expand to the new field. For example, the signal conditioning chip used for sensor applications in the industrial field begins to enter the mass production phase. The power management chip used in BMS such as electric bicycles and balance vehicles such as electric bicycles and balance cars will soon start to start. In the future Essence

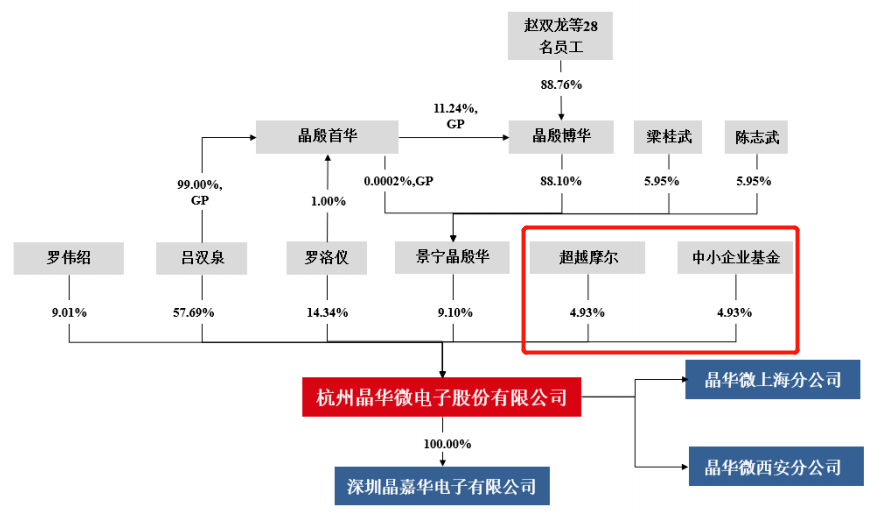

With the core technology and the high hairy profit brought by it, the equity structure before Jinghuawei was listed was very simple. In addition to the actual controller Lu Hanquan, Luo Luoyi, and the unanimous actor Luo Weichao, and the employee's shareholding platform, the external investors of the shareholders only surpassed the Moore and SME funds of the Moore and SME funds. Among them, the partners surpassing Moore's largest capital contribution are the National Fund, and the partners of the SME Fund Executive Affairs are SMIC.

Jinghua Micro Structure, Information Source: Jinghua Microemporant Book

According to the expected financial data of 2022Q1 of the prospectus, Jinghua's micro -revenue revenue from 50 million yuan to 55 million yuan, a year -on -year increase of 7.20%to 17.92%; net profit of deducting non -returnees was about 21.8 million yuan to 24.8 million yuan, a year -on -year increase of 6.83 %To 20.98%. Under the influence of the external environment, it still achieves positive growth year -on -year, and Jing Huawei is fulfilling the sustainability of performance growth.

No place to see the wind is also the gradually thickest of Jinghua and Micro in the 20 years. In the early stages of the development of the enterprise, not only the eyes of "hidden value" must be found, but also the perseverance of long -term investment in the industry.

Just as Pre-IPO's rotating investor beyond Moore's investment director He Hongli described to 36 氪, "signal chain IC is a highly difficult field, low domesticization rate, and in terms of medical, health, industrial control, and even automotive applications in automotive applications. The alternative space for domesticization. "At this moment when many semiconductor companies move to capitalization, although the fare after listing is still a suspension, it is even more worthy of the high and low industrial value, and the big event for listing is just a 20 -year chip company. A "little thing" in the development process.

36 The official public account of its subsidiary

- END -

2022 Shenzhen -Hong Kong -Macao Science and Technology Exchange Activities (Shenzhen Field) successfully held

Tongxin Chuangqian Road, join hands with the new journeyIn order to celebrate the ...

The Secret of the Public Science Day Program of the Institute of Physics of the Chinese Academy of Sciences, have you loved the TA?Intersection

Public Science Day, finally, finally come!Late joyEdit search mapIn this annual co...