Talking about it | Why does the video website must be merged and integrated?

Author:Film and television industry o Time:2022.06.23

Recently, Reuters quoted two people familiar with the matter and reported that Baidu was negotiating with potential acquirers and intended to sell 53%of the iQiyi shares held. Then iQiyi responded: "This news is not true, it is pure rumor." Regardless of the authenticity of this news, from the perspective of the future development of the video industry, a new merger and integration may be inevitable. The core reason is that the future growth prospects of membership paid revenue that video websites depend on survival are limited, and advertising revenue is also facing decline. This will undoubtedly consume the patience of the capital party behind the video website. The situation is better.

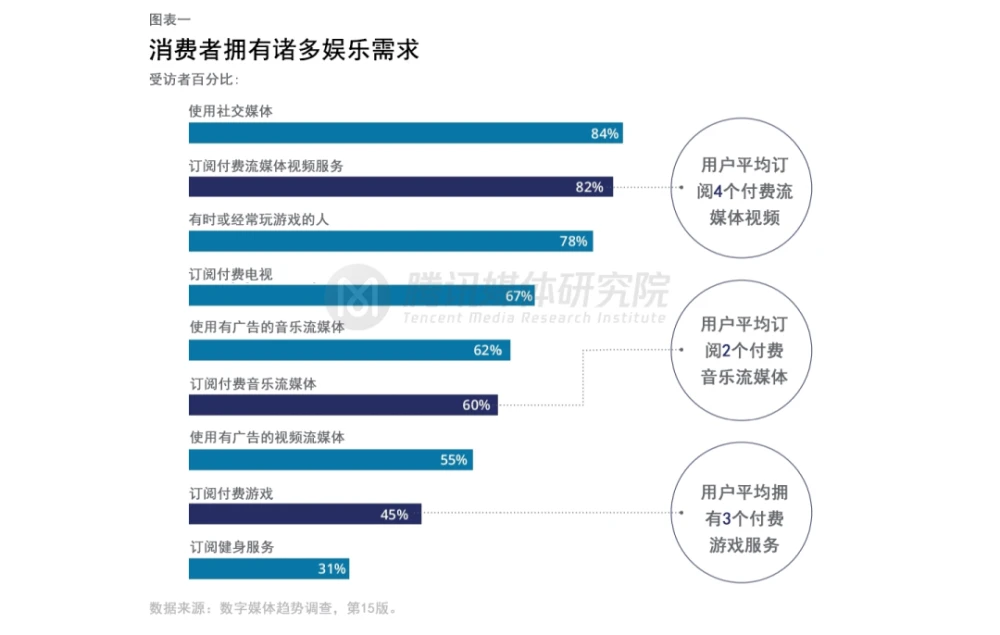

To make a bold prediction, the large video websites that may rely on member paid+advertising profit model to accommodate the Chinese market should be 3-4, which is determined by the average paid platform of members. I have not found the current average data of Chinese users to subscribe to video websites, but I can refer to the situation in the United States to make a calculation. Last year, the "Digital Media Trend Survey" released by Deloitte's Deloitte Four of the Four Cultural Firm shows that US streaming users subscribe to 4 paid streaming video platforms on average.

Figure source: Deloitte "Digital Media Trends Survey" 2021 edition

This article is transferred from the Chinese version translated by Tencent Media Research Institute

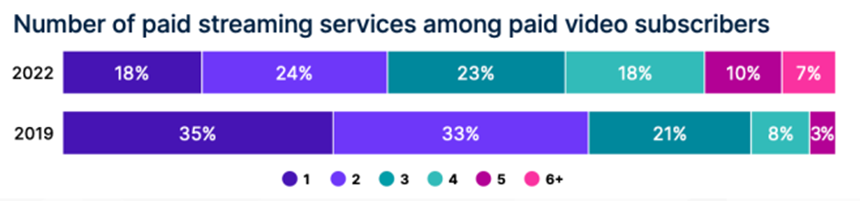

The State of Play report released by Nielson this year shows that in 2022, among American users, 18%of subscribing to 1 video platform, 24%of 2, 3 of 3, 4, 18%, 5, 5, 5 It accounts for 10%, and more than 6%subscribe to 7%. According to this, we estimate that the average number of subscriptions of the user is 3. In view of the differences in the level of economic development, the average number of subscriptions in Chinese users should not be higher than that of the United States. We use the number of US as an ideal situation to refer to the report of Deloitte and Nielson, that is, the average paid users of the video platform can accept subscriptions 3- 4 platforms.

Data source: Nelson State of Play report, 2022

Obviously, there are currently at least five platforms in China on the competition for these 3-4 membership paid seats, including iQiyi, Tencent Video, Youku, Mango TV and B Station. In addition to the advantages of Mango TV on Hunan Radio and Television, these platforms have achieved profitability of the quality and low copyright content provided by Hunan Satellite TV. In the first quarter of this year, iQiyi achieved quarterly profitability, which is indeed a news that makes the industry excited. But we must also pay attention to the profit of iQiyi's profit mainly to achieve profitability by compressed content costs. The content cost in the first quarter of this year was 4.4 billion yuan, and the content cost of the first quarter of last year was 5.4 billion yuan. However, the content of the film and television industry requires a long period. Most of the inputs of the content of the content broadcast broadcast in the first quarter of this year may be produced last year, the previous year, or even earlier. The cost of compressed content this year may affect the next year Content output. To maintain the high quality of the content in a large reduction in cost, this will be a greater test for the management capabilities of video websites. Whether it can maintain profit for a long time needs to be observed and verified.

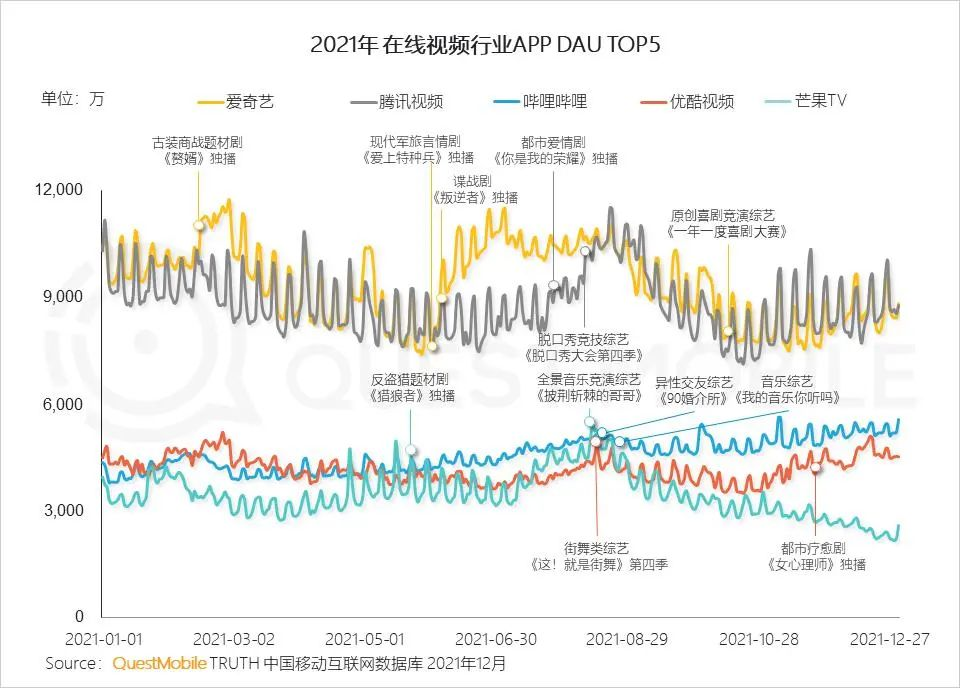

According to the financial report, as of the end of the first quarter of this year, the number of Tencent video paid members was 124 million, and the number of iQiyi paid members was 110.4 million. As of the end of 2021, the number of valid members of Mango TV was 50.4 million, and the number of effective members in Station B was 200,000. Essence Youku has not announced the number of paid users in recent years, but according to QuestMobile's "2021 China Mobile Internet Annual Report", 2021 Youku APP lives between 30 million and 60 million. Due to the outstanding performance of many episodes this year, Youku's daily living users have grown significantly. It announced that in April 2022, the average number of active users of Youku daily increased by 36%year -on -year and 20%month -on -month. However, the daily living users are not all paid users, so we are optimistic that Youku's paid users have reached 50 million. The total number of paid members of the five major video websites is about 350 million.

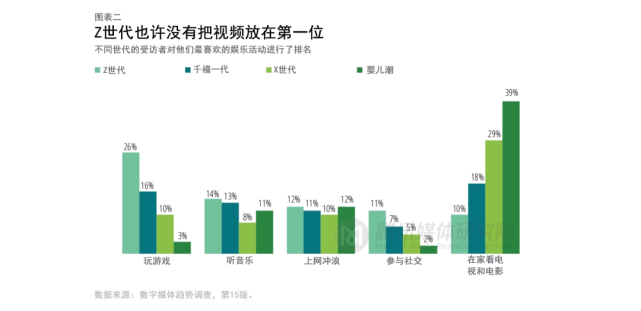

The consistent view of the industry is that the number of paid members on video websites may not increase much in the future, which is related to the scale of people with consumption power and consumption willingness. Deloitte's report shows that for American users, watching TV and movies at home are still the most popular projects. 57%of them ranked in the top three, and this is the millennial generation (born 1981-1996) The first choice for the X generation (born 1965-1980) and the infant tide (born from 1946 to 1964). But for generations Z, born in 1997 to 2007, playing video games is their favorite event (26%), followed by listening to music (14%), surfing the Internet (12%), and participating in social networking (11%) (11%) (11%) (11%) (11%) To. Only 10%of generations said that watching TV or movies at home is their favorite entertainment method, which has a significant difference from other generations of users. China may also have similar situations, and the interest in long -term video content after 95 and 00 is decreased, which will undoubtedly affect the growth rate of future paid users.

We assume that the total number of paid members in various video websites in China can reach 400 million, and optimistic estimates that each member will spend 200 yuan per year (according to iQiyi financial report, the average monthly single member income in the first quarter of 2022 is 14.69 yuan, which is equivalent to 176 yuan throughout the year. , Reserve a certain growth space, so it is estimated to be 200 yuan), then a total of 80 billion income for video websites can be generated. This is the most important source of income for video websites, and it is also a "cake" that is less expanded. If you are divided by 5 platforms, you may be in a state where you are not full, and if you are a 3-4 platform, you may live relatively calmly. As a state -owned holding listed company, Mango TV has achieved profitability in Hunan Radio and Television, and it should be able to occupy a place. Tencent Video is an important part of the overall ecology of Tencent's social content. Even if it is not profitable, the group can support it by the profit of the game and other sectors. You don't have to worry about it for a while. For iQiyi, Youku, and B Station, it will face greater survival pressure (the specific reason is in this article, I will not expand it carefully). From the perspective of the bystanders, if Baidu, who is difficult to transfusion for iQiyi, can find the right one. It is a good thing for the development of iQiyi's development.

In general, mergers and integration may indeed help video websites reduce the pressure of survival, but the possibility of the current five platforms is similar to Youku's acquisition of potatoes at that time. Small, because video website operations should not be a good business for capital, it is good to be able to lose money, it is unlikely to cause huge profits. It is most likely to acquire existing video websites as an industry -related company that can produce synergistic effects with existing businesses. This is why some people have speculated that the mobility may be shot, because the operating video website of communication service providers should have a certain resource advantage. Bandwidth cost is the cost item after the content of video website operations. For example, the bandwidth cost of iQiyi in 2020 was 2.446 billion, and 1964 million in 2021. In -depth binding with communication service providers may help further reduce this cost. On the other hand, although China Mobile's parent Migu Video has been operating, it is also high, but the market share is still very limited. At the time of the 5G era, China Mobile may indeed need a stronger video platform to carry its value -added business.

Of course, this article is only theoretically deductible from the perspective of industrial research. It is concluded that the video platform may move towards mergers and integration. However, the actual business decision will involve various more complicated factors such as policies and the game of various interests. We can only wait and see which video websites can be proud of the rivers and lakes.

- END -

Improve innovation capabilities to achieve technology self -reliance 2022 China Science and Technology Think Tank Forum held

On June 25, the 24th China Science and Technology Association Annual Conference 20...

Sorry!The 45 -year -old talent died suddenly, and it was just running at night before ...

A sneerhed bad news suddenly came:Dr. Sun Jian, a well -known scientist in the wor...