Southeast Asian e -commerce, the struggle between giants

Author:Everyone is a product manager Time:2022.09.27

With the domestic e -commerce market tending to be saturated, Internet companies have begun to find new potential incremental markets. The development prospects of the Southeast Asia market have attracted the attention and layout of a large number of Internet companies. So what is the current situation of the Southeast Asian e -commerce market? If domestic Internet companies want to find new growth points in this market, which aspects can they break?

In 2022, Southeast Asia became the world's fastest growth and the largest potential growth market.

In the field of e -commerce, China's market is almost saturated, and the growth of Chinese e -commerce giants has encountered ceiling in China. So they set their sights on overseas, looking for a new way out -Southeast Asia.

Southeast Asia, a market with a population of nearly 600 million, has become a must for countless Internet companies.

1. Southeast Asian market conditions

1. Southeast Asia's digital economy will reach trillions of dollars

In 2021, the digital economy of Southeast Asia is 174 billion US dollars, and it is expected that the scale will reach trillion US dollars by 2030. Digitalization will inevitably reflect more value in e -commerce. The full -link digital service is driven by technology, which focuses on the supply side, operating side, delivery end to the performance end of the offshore enterprise, and provides a digital solution for cross -border offshore enterprises to help enterprises optimize business decisions and reduce costs. Increasing efficiency to achieve long -term operations.

2. The popularity of social media shopping is close to the e -commerce platform

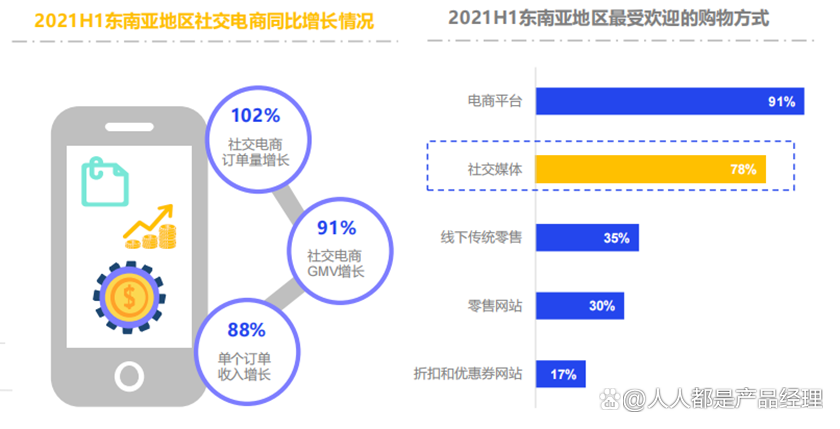

In 2020, the Southeast Asian social e -commerce market size has accounted for 44%of the total e -commerce market. In the first half of 2021, Southeast Asian social e -commerce orders increased by 102%year -on -year, GMV increased by 91%, and the average order revenue increased by 88%.

Social media such as TIKTOK, Facebook, WhatsApp and other social media have increased or optimized the functions of e -commerce business to enhance user experience. Social media shopping is close to e -commerce platforms. According to The Ken forecast, the social e -commerce market share will account for 60%to 80%of the total e -commerce market share in Southeast Asia in the next five years.

3. Diversified market, localized operation

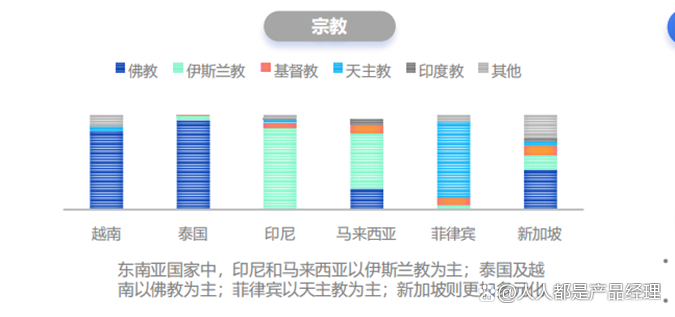

Major countries in Southeast Asia have a rich language environment, different religious beliefs and cultural backgrounds. For overseas companies, it is particularly critical to focus on the target market trend and fit user habits for product positioning and accurate selection.

1) Vietnam Vietnam

Chinese products have low acceptance and speak Vietnamese, mainly Buddhism. There are many young people in Vietnam, and they like to be entertaining and promoted. They are keen on new products and genuine products. Like clothing, small appliances, watches, beauty care, kitchen utensils, etc. 2) Thailand · THAILAND

Chinese products are moderate, speaking Thailand and advocating Buddhism. Like to try new products, like 3C and small appliances, consumption frequency is high. Like comments and scores, and social shopping interest is strong. 3) Indonesia · Indonesia

The acceptance of Chinese products is moderate, and Indonesian is mainly Islam. Millennium Muslims are the main users, like beauty care, maternal and infant supplies and accessories. Obtaining information from social media and social advertisements is sensitive to prices and crazy discounts. 4) Malaysia · Malaysia

Chinese products are highly acceptable, speaking Malay, English, and Chinese, mainly Islam. Muslims have a large proportion of population, like 3C, beauty, clothing and home products. Interacting with the brand through the social media platform, I like to promote activities, but consume rationally, and do not spend money. 5) Singapore Singapore

Chinese products are highly acceptable, and language and religion are more diversified. Most online consumers are post -80s and post -90s. They like social sharing, like women's clothing, 3C and home products. Low price sensitivity, tend to buy genuine, pay attention to products and services. 6) Philippines · Philippines

The acceptance of Chinese products is moderate, mainly Catholicism. I like social media, sensitive to price but superb shopping. Like Chinese smartphones, beauty cares, home or products that cannot be found locally. 2. The "Three Kingdoms Kill" of E -commerce in Southeast Asia

In the competitive landscape of the Southeast Asian e -commerce market, Lazada and SHOPEE are currently presenting the two stronger hegemony, and social e -commerce companies led by TIKTOK wait for the opportunity to attack the attack. Behind the three are Ali, Tencent, and byte beating. Due to the "different blood veins", the three e -commerce forms are different.

Look at Shopee first, and its development path is similar to Pindu. In Southeast Asia, Shopee settled in the market later than Lazada. At the beginning of its establishment, the foundations and scale were not as good as Lazada.

SHOPEE is the same as Pinduoduo. Starting from the sinking market, he kept smashing money to buy traffic, making large subsidies to attract traffic. Shopee's return to a large amount of money is still considerable. In just one year, Shopee caught up with Lazada, who has been working in Southeast Asia for many years, and received investment from Tencent.

Of course, there is a price to burn money. Since its establishment, Shopee has not been able to make a profit, and even brought the parent company SEA for many years.

In contrast, Lazada pays more attention to brand and user experience. It has more input and layout in e -commerce infrastructure, and is more technical driven.

Ali's Lazada is the earliest pioneer to the Nuggets of Southeast Asia, and has now been for 10 years. As the big tree behind Lazada, in these years, Ali has exported a set of methodology and experience of China's top Internet e -commerce to Lazada, insisting Continuous investment in other areas. Now, Lazada's e -commerce system has all been upgraded to the Ali technology support system to achieve full -stack technology reconstruction. Even in the face of Double 11, Double 12, etc., it can ensure the smooth experience of the platform.

In addition, Lazada has also built the largest existing logistics network in Southeast Asia's e-commerce platform, which is also the second largest B2C logistics network in Southeast Asia, which has achieved the average distribution cost of local order packages dropped to 20%-30%.

The long cycle and heavy investment of this series laid the foundation for Lazada's strong rise and stable development.

In the e -commerce industry, the byte beating time is long, but it does not affect its development potential.

At present, the Southeast Asian market has not yet formed a good private region flow environment, and private domain traffic has the characteristics of low commission and high repurchase rate, which is a major development trend of e -commerce in Southeast Asian.

As the foreign version of Douyin, Tiktok is itself a short video content platform. Through the continuous update and creation of content, TIKTOK gradually controls the huge number of users and traffic precipitation, which is more conducive to the sellers to build their own private domain traffic and achieve a new gameplay of "short video+live broadcast".

Southeast Asia's live e -commerce companies are still in their infancy. Although Tiktok e -commerce is not now a positive opponent of Shopee and Lazada, overall, the Tiktok's exotic arms overall, and the ecology has gradually formed in Southeast Asia.

In the future, with the sustainable development of Tiktok in Southeast Asia, Tiktok is likely to achieve curve overtaking in the field of live e -commerce by creating a head anchor.

3. Southeast Asian e -commerce development breakthrough points

1. Consider differentiation and perform localization operation

Major countries in Southeast Asia have a rich language environment, different religious beliefs and cultural backgrounds. For overseas companies, it is particularly critical to focus on the target market trend and fit user habits for product positioning and accurate selection.

If domestic experience is directly moved to Southeast Asia, it is likely to face the situation of "not accepting soil and water", resulting in heavy losses. Therefore, whether it is an e -commerce platform or a cross -border seller, we must first understand the lives and work habits of local people, and then apply the right medicine according to the needs.

At the same time, localized operations that focus on marketing promotion, account operations, after -sales service and warehousing and logistics will occupy more weight.

2. Technical empowerment and improve logistics infrastructure.

The reason why domestic e -commerce platforms can create trillion -level GMVs each year rely on domestic developed logistics networks, allowing parcels to reach anywhere in China within three days.

What Southeast Asia lacks these: supply, logistics transportation, payment technology, etc. all need to be improved. For example, by 2020, a product in Southeast Asia often takes 5-7 days to get it to consumers, and the user experience is extremely poor.

Therefore, who can solve these problems and build a complete e -commerce ecosystem, who can open up the new world, seize the cake of e -commerce in Southeast Asian, and become an e -commerce platform with a dominant status.

Fourth, conclusion

It is difficult for us to predict what the situation of e -commerce in Southeast Asian e -commerce will develop in the future.

However, in any case, with the continuous development of the e -commerce industry, its traffic will become more and more expensive. In the end, the e -commerce platform needs to be efficient, service, and experiments.

Columnist

Liu Zhiyuan, public account: Yuan Ge chats products. Product team Leader. The best -selling book "E -commerce Product Manager Treasure", starting point classroom product mentor. Many years of experience in e -commerce products, the author of best -selling e -commerce products. The establishment and update iteration of e -commerce products that dominate too much business. Pay attention to the field of e -commerce, including e -commerce China Taiwan, product growth, business models, and cross -border overall aspects.

This article was originally published in everyone's product manager. Reprinting is prohibited without permission.

The question map is from UNSPLASH, based on the CC0 protocol.

The point of view of this article only represents the author himself, and everyone is the product manager platform that only provides information storage space services.

- END -

Youcun Technology completes tens of millions of yuan B round financing

Science and Technology Board Daily news on August 31. Recently, Nanjing Youcun Tec...

After doing "exploring the fire to the moon", maintaining multiple "firsts", and TA in the first batch of industrial innovation centers

● Industrial innovation look at Henan series articles ●Industrial innovation loo...