The brokerage firms are optimistic, and the northbound funds are upside -down!The semiconductor is expected to usher in the "high light moment"?

Author:Federation Time:2022.09.25

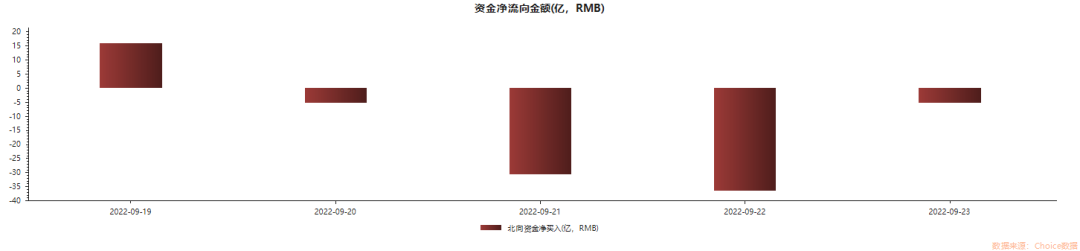

Data show that the cumulative net sales of the Northbound funds this week sold 6.134 billion yuan. Among them, the Shanghai Stock Connect was sold 3.101 billion yuan, and the Shenzhen Stock Connect was sold by 3.033 billion yuan.

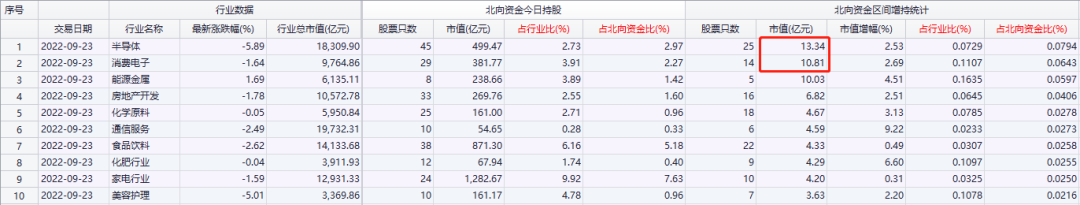

From the perspective of the industry increase, the northbound capital has increased its holdings of 40 industries this week. Among them, the semiconductor was the first, and the net purchase amount reached 1.334 billion yuan, followed by the consumer electronics industry, with a net purchase of 1.081 billion yuan.

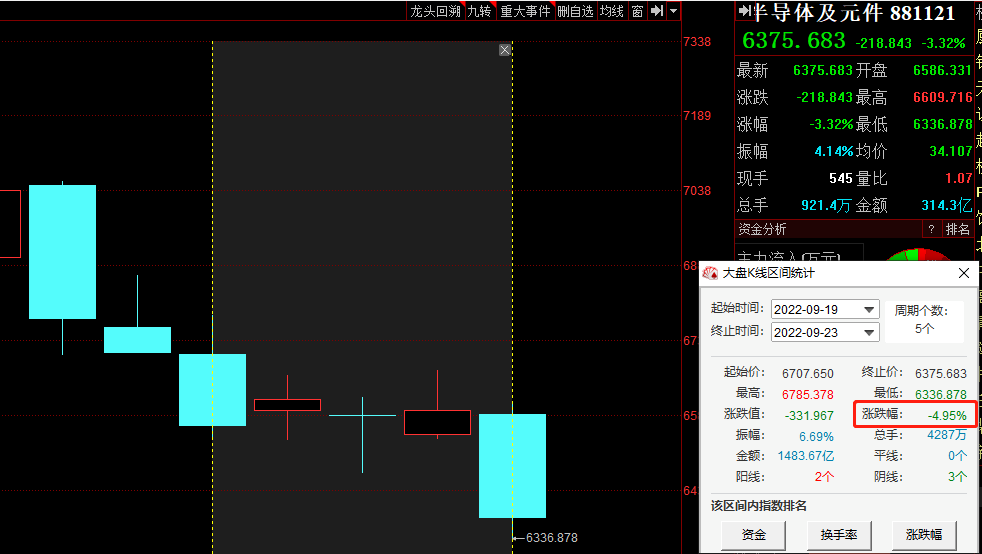

It is worth noting that the semiconductor sector in the top of the position has not improved this week, but continues the previous adjustment situation.

Although Wentai Technology in the sector has continued to decline since this year, a cumulative decline is as high as 61%. However, this week, the Northern Global funds spent 429 million yuan against the trend of 8.11 million shares, and the positions increased from 3,615 shares last weekend to 44.26 million shares, an increase of over 22%, and held a new high of 3 months. On the news, Wentai Technology acquired Guangzhou's Delta, a subsidiary of Ophi Guang last year, and successfully entered the Apple supply chain. Recently, the large -scale recruitment news of Wentai Technology Kunming Factory has frequently appeared in major media.

In addition, Lixun Precision, Zhenhua Technology, Northern Huachuang, Changying Precision, etc. in the sector also received a net purchase of more than 100 million yuan in northern funds this week.

On the news, a few days ago, the Huawei Mate 50 series new machines were seized by consumers as soon as they were released. Huawei Mate 50 Pro and Mate 50 RS Porsche design was even more "difficult to find." On the other side, the Apple iPhone 14 Pro, iPhone 14 Pro Max, which were released step by step, had also been snatched up before. The first day of the release of the "ox" or even increased the price of more than 1,000 yuan.

It is worth noting that the third quarter is the peak consumer electronics season. Recently, Apple and Huawei new products have been launched one after another. The hot sales phenomenon has attracted the attention of the main parties in the weak city. Essence

Brokerage companies have not had an optimistic expectation of the sector. The Northeast Securities Research Report stated that with the vigorous development of the integrated circuit industry in my country in recent years, major core equipment has achieved major breakthroughs, which has taken a big step towards the semiconductor industry. The expansion of the domestic+wafer plant promotes the growth of semiconductor equipment, and the "printer ink box" growth logic double -wheel drive semiconductor parts market. In the context of localization acceleration, major wafer fabry factories have expanded against high -speed production, and production capacity has continued to accumulate, bringing significant demand growth to semiconductor equipment. At the same time, parts of parts for semiconductor equipment, like ink cartridges to printers, have both the equipment driving parts and components, as well as the direct procurement of parts of the wafer plant. Direct mining of semiconductor equipment and wafer fabrics jointly promoted the needs of semiconductor parts, bringing market space beyond expected. Minsheng Securities believes that the semiconductor industry has ushered in rapid growth in recent years, while the controlling demand for autonomous and controllable in upstream components is becoming increasingly strong. With the emergence of a group of outstanding domestic suppliers, it is optimistic that the domestic semiconductor parts industry has benefited from the continuous growth of downstream demand and the acceleration of localization.

In terms of increased holdings of individual stocks, northbound funds bought Tianqi Lithium, Midea Group, Wentai Technology, Lixun Precision, and Vanke A. Among them, Tianqi Lithium was bought by 874 million yuan. The net purchase was 728 million yuan, Wen Tai Technology was bought 526 million yuan in net, Lixun Precision was bought 488 million yuan, and Vanke A was bought 432 million yuan.

From the perspective of the industry reduction, the northbound capital has reduced its holdings of 60 industries. Among them, the brewing industry has the largest amount, with a net sales amount of 1.268 billion yuan, followed by the battery industry, which sells 1.185 billion yuan.

In terms of reducing holdings of individual stocks, there are many big white horses in the top stocks of the northbound capital. Guizhou Moutai, Sunshine Power, Oriental Fortune, Muyuan Shares, Ningde Times and other industries such as the front of the industry are sold first. Among them, Moutai, Guizhou, was sold 1.244 billion yuan. With 651 million yuan, Makiyuan's shares were sold for 610 million yuan, and the Ningde Times was sold for 557 million yuan.

It is worth noting that recently, White Horse stocks have fallen into a turn, killing a white horse a day, including Oriental Wealth, Beauty, San'an Optoelectronics, Lixun Precision, Pianzi, and Sida Semiconductor, and other white horse stocks have stabbed sharply.

In A shares, the phenomenon of "one white horse every day" is not the first time. Data show that in mid -October 2020, and in mid -April 2021, there were more than 100 billion white horse stocks that continued to fall. These two occurred during the disclosure of the three quarters and annual reports, but it is clear that the A -share market has not yet yet been yet not yet yet yet yet -have. By the third quarterly report, the disclosure period.

In this regard, the Southern Fund pointed out that "a cliff trend appearing in a white horse stocks a day is not enough." Hua'an Securities said that the market recently is in the adjustment cycle, the overlapping peripheral market fluctuates sharply, and when the message surface is relatively calm Once the partial uncertainties are affected, individual stocks will fluctuate.

In summary, the northern direction of funds are mainly based on a small net outflow in the recent period, which is consistent with the direction of the market trend. Next week is the last week before the National Day holiday. The A -share market has always had a festive effect. The hedging fund will be reduced in advance to respond to the uncertainty of the long holiday. Investors should also keep a warning.

wx_fmt = png "data-nickName =" Financial Association "Data-ALIAS =" Cailianpress "data-signature =" Financial Association is hosted by Shanghai Newspaper Group, and the capital market reports financial news agencies to "accurate, fast, and authoritative authority."Professional" as a guideline, provides 7x24 hours financial information services. "Data-from =" 2 "data-is_biz_ban =" 0 " /> click" Look at it

"Stocks make a lot of money

- END -

Alibaba Cloud "retreats" a small step, cloud computing takes a big step forward

When encountering anti -winds in the technology industry, the to B industry with c...

Is the Arctic wolf cloned?

On September 19, the world's first body cell cloned Arctic wolf ushered in its own 100 -day banquet. After 100 days of careful care for the conservation personnel, its body characteristics are obvio...