Public Cloud Circuit: The market is divided by giants, and the prospects of small and medium -sized cloud manufacturers?

Author:Sword finger Time:2022.09.23

Text/Yang Jianyong

In the past few years, due to the impact of the epidemic, the digital transformation of enterprises has become a priority. With the advancement of digitalization, more and more enterprises have migrated their applications and deployed in the clouds, and players on the cloud service track have also gained this burden. However, the Matthew effect of the cloud service market is obvious. Among them, the domestic cloud service market has been firmly controlled by the four cloud giant manufacturers, showing the stronger pattern of the strong, and the opportunity to leave the small and small cloud players is getting less and less. Players' profitability is worrying, and growth is not optimistic.

The domestic cloud market Matthew effect is obvious, small and small cloud players' revenue is sluggish

Although the cloud service market has faced the impact of the new crown, it still maintains a steady growth trend this year. In the second quarter, the scale of cloud infrastructure service markets reached US $ 7.3 billion, an increase of 11%year -on -year. This data comes from the latest report released by the authoritative research agency Canalys. In China, the four giants of Alibaba Cloud, followed by Huawei Cloud, Tencent Cloud and Baidu Smart Cloud, occupied nearly 80 % of the domestic market share in China, still maintaining the leadership position in the cloud computing market.

However, in the huge public cloud market, small and medium -sized cloud players have declined. In the second quarter of 2022, Jinshan Yungong had a cloud revenue of 1.29 billion yuan, a year -on -year decrease of 16.9%. In the first half of 2022, Qingyun Technology's revenue decreased by 14.84%year -on -year; the core relied on the excellent carving of public clouds. In the first half of 2022, revenue fell by 30%to 1.046 billion yuan. You know, the cloud service market giant Lin Li, and the giants snatched the market through prices, and the competition is becoming increasingly fierce. As a small and medium -sized cloud player on the track, it is extremely difficult to survive in the giant seams.

In China, under the pressure of giants, such as Jinshan Cloud and Youyou, under the pressure of giants, the revenue show showed a sharp decline in revenue. In response to the significant decline in public cloud revenue, Jinshan Cloud said that the CDN service mainly reduced the CDN service, and the impact of the new crowns caused the deployment and bidding process of the enterprise cloud project. Due to the low performance of the public cloud business, Jinshan Cloud's total revenue decreased by 12.3%year -on -year in the second quarter to 1.9 billion yuan.

Qingyun said that cloud product revenue decreased by 24.48%year -on -year. At the same time, it is pointed out that the competition in the cloud computing industry is very fierce. Especially in the field of public clouds, due to the addition of giant competitors, the use price of resources in the industry is downward, and the company's cloud service business is under pressure to reduce prices. It should be pointed out that the Matthew effect of the public cloud industry is outstanding. Qingyun's cloud service business is in a disadvantaged position in market competition. There is a large gap in the industry's leading enterprises in terms of scale and brand, and the competitive pressure is greater.

In the prompt of intensifying market competition, its main product prices have shown a decline in the overall decline since 2018, and the price reduction is large. It also pointed out that the competition in the future cloud computing market may still be fierce. The possibility of competitive price reduction is to achieve a short -term market share. In the face of fierce market competition, there may be a situation of continuous price reduction of products in the next few years.

At the performance briefing meeting, it was engraved with the smooth growth of public cloud income. The edge cloud (mainly cloud distribution) revenue of 131 million yuan, 665 million yuan in the same period last year, a decrease of 80%at the same time; The year -on -year decline is mainly affected by the project cycle and epidemic. Among several major business segments, the mixed cloud business maintained a rapid growth rate, with revenue of 272 million yuan, a year -on -year increase of 34%. It also pointed out that the public cloud industry has changed significantly, the Internet industry has challenged, and the opportunities for digital transformation in new industries are increasing, such as AI, biopharmaceuticals, chips, new energy. Mixed cloud.

Continuous losses, the prospects of small and medium -sized cloud manufacturers are worried about

On the whole, cloud manufacturers crowded in the public cloud market to fight, and they wanted to achieve extremely high profit thresholds. The scale effect is the core factor for cloud manufacturers to achieve profitability. Because cloud computing is a heavy asset industry, it is necessary to invest a large amount of funds to build a huge data center and purchase servers around the world. Secondly, a large amount of funds need to be invested for innovation. For cloud manufacturers, not only the infrastructure of the world and the country, but also to provide cloud service capabilities such as the Internet of Things, artificial intelligence, and data analysis, and inject innovative vitality into thousands of industries.

Then, the huge cloud service track, before the revenue has not formed a scale, it is difficult to achieve a profit and loss balance. It is rare to achieve profitability with the advantages of scale. In terms of global perspective, among the cloud giants that can achieve profitable on the cloud service track, only Amazon Cloud Technology, Microsoft Smart Cloud, and Alibaba Cloud are currently only. AWS (Amazon Cloud Technology) is Amazon's core profit source. Microsoft Smart Cloud has grown into Microsoft's largest business sector and is also one of the important sources of profit. At the same time, Alibaba Cloud also realized the annual profitable financial report for the first time. In the opinion of Yang Jianyong, a senior IoT consultant, the first time to achieve annual profit is a milestone for Alibaba Cloud itself, and it is also of great significance to the industry, indicating that the cloud computing industry ushered in an important watershed.

However, for small and small cloud manufacturers, in the face of increasingly competitive cloud markets, and the market is mainly divided by giants, small and medium -sized cloud manufacturers, if they want to achieve profitability in the fiercely competitive public cloud market, are also like Shu Shu, as Shu Shu is also like Shu The difficulty of the Tao is difficult to go to the sky, including Jinshan Cloud, and the losses engraved with excellence have also increased year by year. In 2021, Jinshan Cloud's net loss was 1.598 billion yuan, an increase of 636 million yuan compared to the net loss in 2020. In the second quarter of 2022, the net loss was 810 million yuan, and the same period of 2021 was 220 million yuan. The loss increased by 590 million yuan. In the past two years, losses have also shown an upward trend. In 2020 and 2021, they lost 340 million yuan and 630 million yuan, respectively. Losses this year narrowed, and the losses in the first half of 2022 were 260 million yuan. It should be pointed out that it is different from the profitability before the listing. The performance after listing has begun to change. According to the disclosed data, in 2017, 2018, and 2019 before listing, the excellent engraved profit was 70.98 million, 77.21 million, and 21.19 million. The continuous profit changed with the face after listing, and the losses increased year by year. Receptions are also facing growth dilemma.

In the past few years, Qingyun Technology's losses have also expanded year by year. In the first half of 2022, it lost 153.5 million yuan. In 2020 and 2021, the losses were 163 million yuan and 283 million yuan, respectively. In response to the situation that has not yet achieved a profit during the reporting period, in the financial report, Qingyun Technology pointed out that on the one hand, the capital expenditure cost of fixed assets required to purchase cloud computing platforms in the early stage of the purchase of cloud computing platforms is relatively large; on the other hand, The competition in the cloud computing industry is very fierce. Especially in the field of public clouds, due to the addition of giant competitors, the use price of resources in the industry is downward, and the price of cloud service business has reduced prices, increasing the difficulty of profit. In addition, in order to maintain the company's competitiveness, the research and development of new technologies and new products is large, and the company's recruitment of outstanding talents has led to rising salary and expenses of employees. The current Mao profit contribution is not enough to cover the expenses and in a loss state.

at last

Under the influence of the new crown, all walks of life actively increased new technologies to drive intelligent transformation to achieve cost reduction and efficiency, bringing the cloud service market to continue to maintain a strong growth trend. Benefiting from more and more enterprises to migrate application and deploy in the cloud, the intelligent and digital speed of the cloud as the core is accelerating, prompting the traditional IT structure to move towards the cloud structure transformation. More and more mainstream, driving clouds everywhere. While companies around the cloud ecosystem will benefit from digital transformation and innovation, its cloud service sector will further grow.

Of course, for small and small cloud manufacturers, the problems of weak performance and continuous losses are the core of the market care, showing that it is extremely difficult to survive in the giant seams.

Yang Jianyong, a Forbes Chinese writer, is committed to in -depth interpretation of cutting -edge technologies such as the Internet of Things, cloud services and artificial intelligence.

- END -

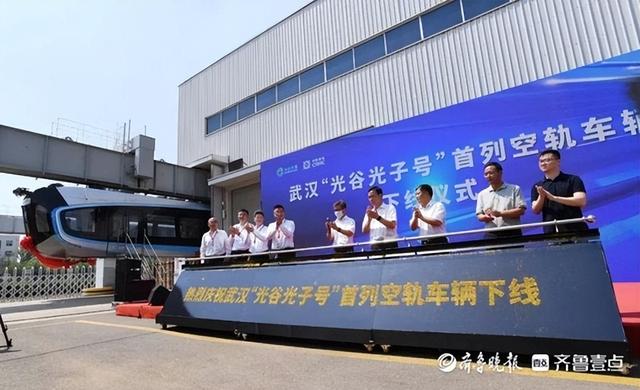

my country's first commercial "air rail train" is offline, and the per capita energy consumption has dropped by 15 %

On August 26, the first Optical Valley Photon air rail train was successfully offl...

Four years lost nearly 5 billion yuan, Latharbeel defeated, the Chinese version of ZARA regretted hi

In the past year, major industries have undergone major changes.In the field of fa...