"Online Design Platform" is worth $ 20 billion?

Author:Loud Time:2022.09.22

Author | Wang Bangge

How much is 20 billion US dollars? Xiaohongshu's financing valuation last year, the post -adjustment valuation of Mobileye, a subsidiary of Intel's autonomous driving technology company, the listing of Polestar, a Polestar of Geely Volvo, and the listing of the largest alternative asset investment company in Asia. estimated value.

Does anyone think that an online design collaboration platform can also sell $ 20 billion in prices?

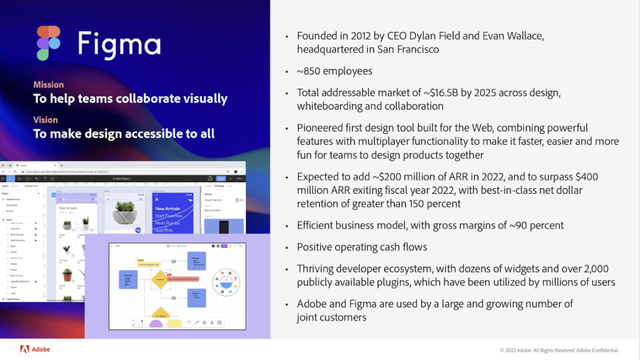

On September 15th, Eastern time, Adobe announced that it would acquire online design collaboration platform Figma for $ 20 billion. The acquisition will be paid by half cash and half of the stock. Among them, in terms of cash expenditure, the company may use cash+regular loans to pay. The transaction is expected to be completed in 2023. At the same time, it will also need to obtain the approval of relevant regulatory agency permission and Figma shareholders.

This is the largest acquisition of Adobe's history. But on the day of the announcement of the transaction, Adobe's stock price fell 17%, creating the largest decline since 2010. The market is expected to generate $ 400 million in ARR (annual recurring income) in 2022, so Adobe pays about 50 times that of ARR in 2022.

So, did you spend 20 billion US dollars?

Picture source: Figma Acquisition Presentation

In 2011, 19 -year -old Dylan Field had the idea of entrepreneurship and applied for a $ 100,000 entrepreneurial scholarship set up by Peter Thiel, and started starting a business from Brown University. He has tried to make drone software and emoticons, and finally made a tool for users to edit pictures and design directly in the web browser, and obtained the US $ 4 million of investors such as the CEO of the British CEO Seed wheel investment.

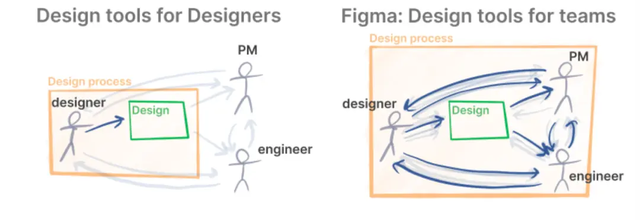

Figma was officially released in 2016, which is characterized by: it can run in the browser, and when developing the same APP or webpage, the team can collaborate in real time; there is no need to upload or download the files. Team collaboration members can see all the modifications and all the modifications and and in real time. Update, can be discussed in the message tool. In short, "real -time collaboration".

For today, these four words have been accustomed to the Internet people, but a few years ago, the designed rivers and lakes were dominated by PS. Although another pioneer tool Sketch can also implement the collaborative work of the computer and mobile devices through the plug -in, because Sketch insists on only doing the Mac OS system, this leaves a huge competitive gap for Figma -designers using Windows computer also It is worth having a good design tool. As of November 2019, Adobexd has launched the test function of "collaborative editing", which can be described as later conscious.

In 2018, star companies such as Airbnb, Dropbox, Uber, Microsoft have become Figma customers, and they basically turn from Sketch.

In 2019, Figma officially launched a third -party plug -in platform, allowing third -party developers to expand to a platform -based product for Figma development tools, and then launched the community to allow users to exchange their works on it and continuously expand their ecology.

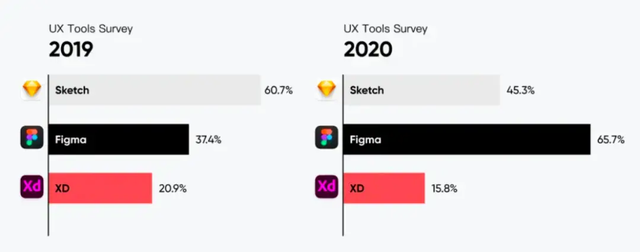

From tools to platform to ecology, this has enabled Figma to achieve network effects, and users have increased geometric growth. Uxtools data shows that Figma's global utilization rate is still lower than Sketch in 2019 (the third year of development), but in 2020, it doubles to achieve overtaking. In 2021, it increased to 77%, far away from the latter.

Picture source: Kevin Kwok, "WHY Figma Wins"

Picture source: Uxtools

There is no doubt that as a tool, an online collaboration platform, Figma is a classic textbook for product breakouts. But now, the problem is thrown to the capital market. In 2021, the valuation of Figma reached 10 billion U.S. dollars during the E round. Now just only one year, its valuation has doubled to 20 billion US dollars, which is comparable to automakers. Is Figma really so valuable?

Adobe CEO Shantanu Narayen believes: "Figma's products have attracted millions of users, and their growth rate, performance and profitability are very rare in SaaS companies, and Adobe needs Figma growth To maintain the company's dominant position in the design field. "

"Figma's customers are mainly software developers and product managers. These groups are new user bases for Adobe." Sausana Nu Narayan said. According to the Wall Street Journal, two -thirds of the 4 million users of Figma are not the core designer customers of Adobe.

David Wadhwani, CEO of Adobe Digital Media Business, said that it is now a very good timing of acquisition -the downturn of the stock market makes it more difficult for the stock market to be listed, which helps this transaction- "I think this is like this The moment created the opportunity not to exist at other times. "

Adobe's move can indeed fill the blank of Adobe in the field of Internet product design and open its cloud -based market through Figma. However, many outside sounds believe that this transaction is actually ADOBE's defensive strategic action, "buy it if it can't be hit." At present, the overall trend of visual content production tools is video, AI, synergy, and sceneization, which are the advantages of Figma. Figma did threaten Adobe. It can be seen that Adobe needs this cooperation more than Figma. After all, the rising examples of Snowflake and DataBricks have been placed in front of Salesforce.

However, it is sighing that the Dragon Tuzhong still lowered his head. Figma has been tense with Adobe sword, and even shouts on their official website that users should not use Adobe XD. Last year, Dylan Field vowed on Twitter: "Our goal is to become Figma instead of Adobe." But in front of Dylan, who was just 30 years old, 20 billion US dollars worthy of faces.

Adobe is known as the nickname of "software grave", whoever acquisitions and who is falling. Flash and Fireworks failed to escape the fate. Can Figma be? The answer is still floating in the wind.

However, it is certain that after the transaction is completed, Figma's investors will make a lot of money.

According to CNBC reports, the three venture capital companies participating in Figma's early investment -Inndex Ventures, GreyLock Partners and Kleiner Perkins — all have a dual -digit percentage equity, which means that after the transaction is completed, each institution will get more than more than A $ 1 billion return.

This may break the eyes of the online collaboration platform and its investors in the Chinese market.

At present, the Chinese version of "Figma" mainly has the following candidates:

Blue Lake. Completed AB financing in 2021, with a total financing amount of 300 million yuan. Among them, the A -round investor is China, the A+round of investment is Sequoia China, the round B financing is led by Jinshajiang Chuang Investment, and China and Sequoia China follow up. According to the interview in 2021, Blue Lake revealed that it already has tens of thousands of paid enterprise customers. Among the domestic Internet companies in China, the penetration rate exceeds 98%. The average annual unit price is 200 yuan/person. At the same time, "Blue Lake" provides free value -added services for C -side users and small independent projects, achieving nearly 5 million registered users.

Pixso. The listed company Wanxing Technology incubated internally. In March of this year, nearly 100 million yuan Pre-A-round financing was completed. It acquired ink knife in 2020. Its team believes that "Pixso" is not favored by users for Figma's short -term "alternative".

Instant design. Cloud design tools for professional UI designers and design teams completed tens of millions of dollars B+financing in June this year. It was led by Unicorn Capital Partners. Capital continues to follow. "We will use the fastest speed to strive to tie Figma in the comprehensive experience of the product ... We believe that what domestic users really need are not a Chinese version of Figma, but an independent product that is not inferior to Figma."

Others include customer technology, maker posts, paintings, and so on.

In terms of summary, the investment lineup behind the domestic online design platform is relatively luxurious. Many online design platforms in China have shouted the slogan of "Chinese version of Figma", but whether it is valuation or user situation, it and the situation of the user. Figma has a certain gap.

Figma's story of selling ADOBE with high valuation will not be staged in China. The lack of "pick -up man", the entrepreneurs and investors behind these platforms have inevitably fell into pessimism for a long time.

But this strong needle can give us more problems. How can we make large companies from a small incision? Is there a localization solution for SaaS in China? In addition to continuously benchmarking, catching up, and paying tribute to the great gods, are there any places that can innovate? This may be the real inspiration brought by $ 20 billion.

- END -

2022 Future Science Awards announced!Li Wenhui, Yang Xueming, and Mo Yiming won awards, with a single bonus of about 6.75 million yuan

The Future Science Awards Committee announced on August 21 to announce the winning...

Chinese is a key to better understand and understand China -American engineer Richard

Because of yearning, they came to China; because of their dreams, they chose to st...