Five "death methods" of domestic chip companies

Author:Chinese science and technology Time:2022.09.09

From the end of the end, Fang De. From the beginning, we must consider the final result. In the end, the Chinese market does not need so many chip companies, big waves, and the winners are king.

The founders and investors of domestic chip companies may be known from the beginning.

At that time, write this article. The tide of entrepreneurship in the mighty Chinese chip is also time to the tide. However, Chinese entrepreneurs are "Xiaoqiang" that can't be killed. This stubborn and toughness is worthy of admiration and respect. However, the correct understanding and cognition of the industry is the most basic quality and requirement of an entrepreneur and investor. Otherwise, the enthusiasm will eventually put it into the east, hurting the country and the people. Every chip entrepreneur must always remember that every government subsidy is a taxpayer's money.

Are you a valuable chip? Are you making a valuable chip company? If so, please work hard to achieve the top three of the track, otherwise it will be eliminated. How to achieve the top three of the track, first avoid dying in the process of hard work and progress, and survive to have the opportunity.

If you know how to die, you know how to live. Today, talk about several "death methods" faced by domestic chip companies.

Died in the team

According to surveys from foreign authoritative entrepreneurship research institutions, 62%of the internal contradictions between the founders' teams died of the founder team, and the number of founder teams has a certain relationship with the success of entrepreneurship.

Some time ago, Nuo Ling Technology closed down and set off thousands of waves in the chip industry. Judging from the report, in November 2017, Wang Chengzhou took the lead in registering Nuo Ling Technology in China. Kong Xiaozheng joined the first week of 2018 and quickly formed a 12 -person core team to focus on chip design in the field of honeycomb IoT wireless communication. However, in the 2020s of completing 200 million yuan of financing, Kong Xiaoyu, as the core figure, suddenly left Nuo Ling Technology and returned to the United States to develop. The departure of the founder of the core technology of startup companies is a key factor in the failure of Nuo Ling Technology.

Through the case of Nuo Ling Technology, we can extend several common problems:

1

Pseudo -demand

According to online information, the first model launched by Nuo Ling Technology is also the only product of NB-IoT chip NK6010, which integrates GNSS. The product has no problems in performance and technology. However, Nuo Ling Technology had almost no revenue in 2020, and only about 1.5 million yuan in 2021. It can be seen from this that product planning and definition problems are a pseudo -demand product. In fact, this is a very pursuit team. They want to be valuable technology and products. They want to differentiate, but they lack a person who truly understands the market and products. The fault of a company was buried from the beginning of product planning. If they are also the same as other NB-IoT chip companies in the market, they do homogeneous products at most, and they have no profit on sales.

2

Paper team

Failure -failed startups lack partners who can command the overall situation and have complementary and shared interests. Entrepreneurship partners must go through the situation and adversity together, the distribution and conflict of interests, and inadequate opinions and ideas. After experiencing these, can this team still sit together and work together to work hard and persist in common goals. It is the key to distinguish whether this team is a paper team or a hard team. From the results, Nuo Ling Technology is a paper team.

3

Spend money

It is recommended that the chip company entrepreneurs now save money, because the cold winter of capital is coming, and the place where it should not be spent must be saved. In the past two years, chip entrepreneurship financing was easy, with a lot of money, spending big money, and spending high -priced hugs, leading to the rapid increase in industry costs. Therefore, making chips is increasingly burning money. In terms of research and development costs, Nuo Ling Technology spent nearly 80 million yuan in 2020, and it doubled in 2021 to reach 160 million yuan.

Dying

For chip companies, is the expansion of the product line or track, is it an opportunity or a trap? There is no unified answer, depending on the situation and timing of each company. For most startups, expansion is very dangerous and often died in expansion.

Chip startups basically start from a project. The choice of this project must be based on the judgment of opportunities and its own resources to concentrate all its forces to achieve its goals. Although, for startups, expanding scale is the vision of each enterprise, but the eagerness to expand the scale is like a dose of starting a startup poison. The premise of expanding the scale is "burning money". Most startups are unable to expand by their own profits. They can only rely on continuous financing. If the lack of later funding support, the company will die.

Why should chip startups choose to expand? There are three main reasons:

1

What you want to do, cater to investors

Some investors like to chase hot spots, like the track and market size. The more product lines planned by startup companies, the larger the market size, and the greater the interest of investors, the higher the return on investment. In order to get the favor of capital, some startups, blindly expand, lose their positions regardless of costs, and pursue those out of reach. Many investors do not understand the chip industry. They start from the goal, theoretical derivation, and analyzing the investment logic, so they invest in startups. The success of a case will cause many startups to follow.

2

Product homogeneity, find new tracks

Too many chip startups, the track is over crowded, causing the product homogeneity to be very serious. Either to kill your opponent or find a new track. This is a dilemma. It is waiting for death without looking for a new track expansion, but finding a new track expansion may be to find death. To this day, finding a new type of chip with opportunities is extremely difficult. Everywhere is a startup company or a monopoly market for entry into the market. Therefore, choosing a direction with technological evolution and iteration is particularly important. Through technical breakthroughs and rapid advancement, we can seize the first of technology and product opportunities, otherwise you can only be trapped in the quagmire of the same product homogeneity and cannot extricate themselves.

3

Demand guid, seize new opportunities

With the innovation of technology and the development of applications, many product opportunities have followed, maybe it is an opportunity or a trap. Whether you can choose the right opportunity, can you seize the opportunity, it is luck or life.

There are also such companies in the domestic chip industry. During the expansion process, the right technology and product direction was selected to seize the opportunity. During the expansion process, the guarantee of funds is the premise.

Dead to repurchase

When the cold winter of capital, some chip startup companies will die at the repurchase.

The repurchase agreement is the standard terms of financing of chip startup companies. Fund investment has a period of time, 8-10 years long, 3 to 5 years, and most of the repurchase protocols are between 3 and 5 years. If chip startups cannot be listed during this period, investors are likely to start the repurchase agreement.

Let's take a look at Article 71 and 137 of the "Company Law". If the equity investment fund and the target company agreed, the terms of the equity of the shareholders of the target company's shareholder repurchase the equity of the equity of the equity of the target company are equity transfer. In judicial practice, the court's agreement on the signing of the equity repurchase agreement between investors and shareholders, which is generally believed that it should respect the interests of not violating the legal invalidation of the contract, not infringing the interests of the target company and their creditors, etc., and should be respected. The parties' contractual freedom and autonomy, identify the legal and effective repurchase terms. When the repurchase clauses agreed in the contract, investors have the right to request the shareholders to fulfill their repurchase obligations.

The repurchase protocol in the investment agreement is real and effective, and it is a sword of Damocles hanging on the entrepreneur's head. In the previous chip industry, the capital of the chip industry was very hot, and entrepreneurs would not care about this terms, because the valuation rose rapidly, and the book investment income increased significantly. Even if investors started the repurchase agreement, new investors would take over. Once the capital is cold, the valuation returns to rationality, the market in the market, and the listing time of listing is lengtherable. Investors will face the risk of funds and the pressure of LP. The repurchase agreement will be launched. Either a new investor will pick up the old stock or the company's account will be pulled away. There is no doubt that some chip companies will die in repurchase.

Next, the domestic chip industry will enter the knockout, and most of the chip startups will close. Seeing that his investment is drifting, investors will quickly start the repurchase agreement to stop the loss in time. In this way, the death of chip startups has been accelerated.

How to avoid the company's death? Do not sign the repurchase agreement to avoid such risks, but the repurchase agreement is a conventional clause. Unless there are more financing choices for startups, they cannot get investment if they do not accept it. At the operational level, avoid triggering the consequences brought by the repurchase agreement, that is, appropriately lowered the valuation in the early period of financing. When the company's products and performance are all rising, the first three or opportunities to go on the track will be made. Financing. At this time, the previous investors will not choose to withdraw. Even if they choose to withdraw, a large number of investors are willing to take over the equity.

The early low valuation will allow startup companies to dilute more equity. It needs to be very cautious in terms of funding control, but it can bring more sense of security to startups.

Died in valuation

The overheating of the previous round of capital often leads to the cold winter of capital. In the past two years, fierce competition among investment institutions in the semiconductor industry has caused some institutions to prioritize themselves to "be able to grab" and high valuation investment semiconductor projects, thereby pushing the overall valuation of the industry. Before the valuation did not return to reason, the capital did not dare to act lightly.

Obviously, in the domestic semiconductor sector, investors in the secondary market are much calm than the first -level market investors. The market value of listed companies is not high, which directly lowers the valuation of the first -level market investors to chip startup companies. The valuation of the secondary market and the first -level market will even appear upside down. Under such circumstances, the high valuations of the first -level market cannot be made in financing, unless the company goes on sale to the secondary market.

Can you reduce valuation financing in the first -level market? Obviously not, the bottom line can keep up with the same round of valuation financing. If the first -level market still feels that the valuation is too high, then the road of financing will not work. In the previous investment agreement, the target company or actual controller shall not make financing below the previous round of valuation, otherwise it will need to compensate the loss of the previous round of investors.

This high valuation generally appears after the B or B round, and the company B financing needs to be carried out. Regardless of the number of employees and R & D investment, it already has a certain scale. Compared with the company that needs A round of financing, the monthly cost of the monthly cost is The expenditure is much higher. Coupled with the crowded track, the product is seriously homogeneous, and there is no profit in sales alone, and it cannot be positive for cash flow. If it is said that in the early stages of entrepreneurship in the round of A round, entrepreneurs can also tighten their trousers and belts, but for the company after the A round, any form of fund chain breaks are fatal.

On the other hand, the false valuation in the market is easy to mislead the entrepreneurs, so that entrepreneurs mistakenly believe that their company has the power to bear such a high valuation, so they will also be happy to believe that the exaggerated number reported by others will Think that you can get more financing for yourself to obtain more benefits. This mentality eventually harms others. Therefore, the most important thing is that entrepreneurs need to have a correct valuation space for their own company and maintain a certain elasticity in order to adjust the valuation at any time as the market heat changes. Accept the investor. In fact, in the C -round stage, the most important thing is not valuation, but speed. Who can sign and deliver with investors as soon as possible, who can occupy an advantage and reduce a lot of uncertainty.

In order to avoid dying from valuation, startups must reserve sufficient funds before round B or C financing. The time interval between angel rounds and round A financing is very short. Funders do not need to consider the problem of funds, but the interval between round A and round B, B and C -round financing may be long. According to incomplete data statistics, about 60%of the startups in recent years have "dead" in the A round B financing, which can support less than 12%of Series C. And cherish, be careful of high valuation.

Died in the market

Enterprise investigation data shows that there are 142,900 existing chips in my country. In the first half of 2022, 30,800 new chip -related companies in my country were added. From the perspective of regional distribution, Guangdong ranks first with 47,400 chip -related companies. Jiangsu and Shandong have 16,900 and 0.87 million chip -related companies, ranking top three. Since then, Zhejiang, Shanghai, Shaanxi and so on. Most companies have no substantial chip business.

However, the number of chip design companies in mainland China is relatively real. Statistics from ICCAD show that the number of chip design companies in mainland China in 2021 reached 2810, an increase of 26.7%from 2,218 in 2020. It is worth noting that in 2019, only 1,780 local chip design companies have increased significantly in the past two years.

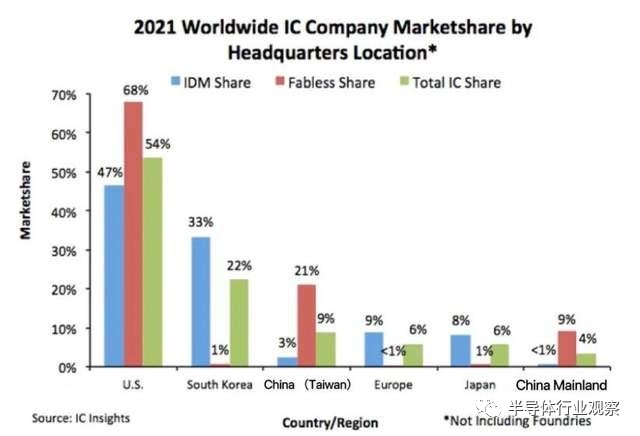

From the figure below, mainland China in chip design (Fabless) only accounts for only 9%of the world's. In other words, 2810 domestic companies have only won 9%of the world's share, but the number of companies is far exceeding the global total.

According to the China Semiconductor Association industry data, it is estimated that 413 chip design companies have sales of more than 100 million yuan in 2021, an increase of 42.9%from 289 in 2020. In 2021, the sales of the 413 companies were 328.8 billion yuan, which was higher than the 305 billion yuan in the previous year, accounting for 71.7%of the entire industry's sales.

According to this trend, the annual sales of 500 domestic chip design companies will soon exceed 200 million yuan. Can the science and technology board design so many chip design listed companies?

Objectively speaking, the science and technology board cannot accommodate so many chips to design listed companies. Even if it goes up, there is no market value and liquidity. Therefore, even some chip companies without profitability will eventually die in the future.

According to a option for the listing of the science and technology board, the market value is expected to not be less than RMB 1.5 billion, and the operating income in the past year is not less than RMB 200 million. Besium below 15%. However, there is no profit requirements. It is precisely because of this that some chip startups that have been listed on the market in China. If you can't go public successfully, these companies will fall directly without a chance to stretch.

There are three characteristics of chip companies that are listed on the market: there are three characteristics:

1

The product is almost the same, and will not be fine, everything is to sell for sales quickly.

2

Blind product lines and do not look at the input of output, just to increase sales and valuations.

3

Pursuing the number of employees and does not look at the per capita output, it makes them look like a big company.

The chip company, which is listed on the market, also sells sales for the most urgent dying price. Because these companies know that their purpose is not to do a good job, not for domestic replacement, but more to replace domestic sales. If there are more such companies, more companies will die before listing, and more companies will die after listing.

At the end

Accept reality, facing the future; seize the opportunity and work hard. If you want to win, you must understand. Understand the industry, understand products, understand technology, understand the market, understand management, understand operations, understand financing, and understand the competition pattern and strategy of the track. I do n’t understand which one, carelessly, lost all the way.

The era of extensive chip entrepreneurship has passed, and the requirements for entrepreneurs and entrepreneurial teams will become higher and higher. Start -up companies should take into account strategy and implementation, and the correct and effective strategy can be implemented and implemented, which plays a key role in the success or failure of startups.

Finally, borrowing a section of the founder of a chip listed company: "Before 2018, the chip design company made a little result. It became very strange to fall down, but the IPO listing is very common. " After taste, Fang Zhi answered.

About the Author

Zhong Lin, Jinjiang Sanwu Micro Electronics Co., Ltd.

- END -

Worried about food rotten?Plant -based antibacterial spray only needs to "spray a spray" simply

Science Fiction Network June 21 (Wang Ziyu) The weather in summer is very hot, and...

"Research Report on the Development of Human Resources of Science and Technology (2020)" will be officially released

China Science and Technology News Network, June 22 (Wang Huilan) Research Report o...