Who trapped the "chip iron curtain" in the United States?

Author:Global Times Time:2022.09.05

The investment amount is high and the expected effect is doubtful. Who is the "chip iron curtain" trapped?

According to the latest US CNBC report, the U.S. government has allowed artificial intelligence computing companies to complete its exports required for its flagship artificial intelligence chip development. On August 31, Nvidia disclosed that the United States has restricted its export of two chips: A100 and H100 to China, and said that this will prevent the development of its flagship chip H100. Its competitor AMD was also required to stop exporting artificial intelligence chips to China on the same day. In this regard, the spokesman of the Ministry of Commerce, Shu Jingsing, said that the relevant practices of the United States departed from the principle of fair competition and violated the rules of international economic and trade. The global industrial chain supply chain is stable and the world economy is restored. On Thursday, US chip stocks plummeted, and the main semiconductor index fell more than 3%. Nvidia's stock price plummeted 11%, the largest single -day percentage decline since 2020, and AMD's stock price fell nearly 6%. Under the high pressure of the "2022 Chip and Science Act" (referred to as the "Act"), the United States is close to China's high -tech enclosure, but it remains to be observed whether it can affect the reinvention of the global chip industry pattern.

The investment amount is high, and the expected effect is doubtful

According to the White House website, with the passage of the "Act", American companies have announced the increase in investment in the chip and semiconductor industry, an increase of nearly $ 50 billion, making Bayeng's total investment since taking office to nearly $ 150 billion. Among them, Micron Technology announced its investment of US $ 40 billion for the manufacture of chips; Qualcomm announced that it plans to increase US semiconductor output by 50%in the next 5 years; Intel plans to invest more than $ 20 billion in two new chip factories in Ohio. It is considered to be the largest economic development project in Ohio's history.

Although the Act attracted the enthusiasm of American companies, not everyone is optimistic about this bill. John Abbott, a standard global market, believes that the industry's most successful company and chip startups are willing to outsourcing the manufacturing business instead of investing a lot of funds to strengthen their own manufacturing capabilities. At the same time, he believes that returning to local chip manufacturing does not solve the problem of chip shortage because the supply chain is too complicated and international. For example, he said that the Arizona factory proposed by TSMC may account for about 1%of its global production capacity. Once the chip is made in the United States, it must be shipped back to Asia for testing and packaging, and then it is transported to China to assemble smartphones and personal computers. In addition, he reminded that the "Act" is not helpful for innovative companies. TSMC and Samsung will receive subsidies to expand in the United States. Back to the United States.

Data map

The United States "Defense News" reported that "this is not a place for dreams." The manufacturer's only building a new factory does not mean that labor will come. Increasing technical labor has always been a long -term challenge, and the United States has seriously lacks talents in science and engineering education. "

For companies with ambitious brains, the construction and production upgrades of semiconductor manufacturers are extremely high, and the time spent is also ranging from 1 to 3 years. In addition, with the improvement of chip technology, the cost of manufacturing is getting higher and higher, and chip companies need to find more sources of funds. According to the Wall Street Journal, Intel and Canadian Asset Management Company Bo Feng signed a $ 30 billion financing cooperation agreement to jointly build the Arizona factory announced by Intel last year. After Intel CEO Pat Kilchinh exposed its ambition to expand its manufacturing business last year, the company's stock price fell more than 45%, dragging down the global semiconductor industry vane "Philadelphia Semiconductor Index" fell by 8%.

"Chip Alliance" is careful

According to a report from the international consulting agency McKinsey, with the intensification of digital life and commercial impact, the chip will be deepened to various segments, and about 70%of the growth will be driven by three industries of automobiles, computing and data storage, and wireless equipment. It can be seen that the ability of a country in the chip industry will be essential for the initiative of possessing future key industries.

Under the pressure of the United States Act, Samsung Electronics and SK Group have more than $ 10 billion in investment in the United States. Both companies are expected to be subsidized by the US government. At the same time, Samsung Electronics and SK Hynix have memory semiconductors and packaging factories in China. 40%of Samsung Electronic NAND flash memory shipments are produced in China, equivalent to 15%of the world's NAND flash memory market. If it is in accordance with the US "Act", South Korea cannot build factories with higher technical levels in China, and it is only a matter of time.

South Korea's "Korean National News" reported that all parties to join the "Chip Alliance" are both cooperative relationships and competitors. Therefore, "chip alliance" is not so sharp technical exchange, which is more likely to be the problem of unstable supply chain in front of you. The negotiation mechanism. Angeli, a special specialist of the South Korean Semiconductor Industry Association, believes that the chip is transforming from a global division of labor to a "home country" mechanism. The idea of the United States is "even if it takes a lot of time, it must realize the self -reliance of the United States in the United States", so Only the "chip alliance" was formed. Unlike the United States, although South Korea also wants to realize the localization of the chip industry chain, it is difficult to achieve the localization of South Korea in weak fields such as materials, components, and equipment, so it is necessary to continue to maintain a global division of labor mechanism. As far as Taiwan is concerned, the New York Times wrote that many Taiwanese businessmen, including TSMC, rely on mainland China to maintain their livelihood. Although some people in the semiconductor industry will seek US support, they still do not cut the new factories in the United States. Actually hesitated, the cost of the United States is high and lacks supporting industries. TSMC has established new production facilities in Japan and the United States, but also expands factory production capacity located in Nanjing, China.

It seems that Japan is the most willing to complement the chip industry in the "Chip Alliance", but this is only to get rid of the dependence on Taiwan. The chip used to be a strong industry in Japan. In 1988, the sales of Japanese chips exceeded 50%of the global market.

After the 1980s, the United States forced Japan to accept unfavorable competition conditions in Japan and the United States, which led to the increasingly declining Japanese semiconductor industry. The Japanese market share gradually declined, and Japan's global market share in 2019 fell to 10%.

There is a foundation, a market, the main body of the cultivation industry chain in China

According to data from the China Semiconductor Association (referred to as the "Association"), the total revenue of the domestic integrated circuit industry exceeded the trillion mark for the first time in 2021, an increase of 18.2%year -on -year to 1045.83 billion yuan. However, China is still the world's largest chip importer, accounting for one -third of the global semiconductor market.

Facing the United States' suppression, China is using market advantages to develop chip design and manufacturing, enhance the cultivation capacity of local software ecosystems, and reverse the chip industry's unfavorable pattern. In recent years, from chip design software, to the manufacture of advanced processes; from large -sized semiconductor silicon checked to the production of the self -developed chip architecture "Chiclet", China has continued to develop in domestic replacement. Among the 20 fastest -growing chip industry companies in the world, 19 are from mainland China. In the case of global chip tension, the expansion of China's chip production capacity will continue to be strengthened. It is expected that by 2024, China will build 31 large semiconductor factories.

Especially on the domestic alternative path, while chasing the traditional path of Western chips, China has also ushered in historic opportunities and the possibility of many technical path breakthroughs. Han Xiaomin, general manager of Jiwei Consultation, told the Global Times reporter that although there is still a little distance from the application in the quantum direction, the photoelectric chip and the "small chip" can only be said to be some new technical means to break through the performance of the performance of the existing silicon -based chip. There is still a big gap between enterprises and internationals, but at present China is exploring breakthroughs on these paths and made great progress. The British "Investment Monitoring" recently reported that China has special professional knowledge in developing new superconducting materials. In addition, China is in a leading position in semiconductor assembly, testing and packaging. According to GlobalData research, the development of advanced chip packaging, new transistor architecture and new carbon -based materials may change the rules of the game, making China a global semiconductor leader by 2025.

The leading advantages in other key industries have also prompted Chinese companies to stand on the same starting line with foreign manufacturers in some chip segmentation technology fields. For example, in the field of intelligent automobiles, a number of professional semiconductor teams and a large amount of funding support have emerged in China, which has caused China's semiconductor in the field of smart car chips. Zhang Ye, president of Chuxin Group, told the Global Times reporter that only in an open environment can innovation technology be born. Even if the United States restricts, controls, and blocks some high -end fields, it will not determine the competitive pattern of the global chip industry. It will not affect the development trend of economic globalization. He said that my country's manufacturing foundation has a solid foundation and the advantages of industrial chain clusters cannot be replaced in a short period of time. In addition, China, as an important manufacturing center in the world, has a complete industrial product department, industrial system, infrastructure and talent advantages, and will also become an important engine of global technology in the future. "This is an investment opportunity that global capital can be seen." Zhang Yan said.

The "China Integrated Circuit Industry Talent Development Report (2020-2021)" shows that in 2020, the scale of Chinese integrated circuit -related graduates is about 21,000. Another data shows that the talent gap between the integrated circuit industry in my country still exceeds 200,000 people. A vice president of a domestic chip company told the Global Times reporter that at present, China lacks professional talents and talents in the industrialization of chip technology in the chip process. He believes that the United States comprehensively engage in chip interruption and high -end chip design software for disconnection. It is expected that the United States will also have a combination of fists. Chinese chips will accelerate domestic replacement. challenge". Zhang Ye also believes that "the train runs fast and the front is band." China can set key enterprises as the core support core, make bigger and stronger subjects, and analyze the actual situation of each leading enterprise in detail. From the perspective of the national dimension, the domestic large market should be fully circulated, breaking the boundaries and resistance between regions and resistance, so that resource elements can flow and allocate a game of chess and land in the country. Global Times Special reporter in Japan, the United States, and South Korea, Yue Linwei Zhang Sisi Zhang Jing Global Times reporter Yuan Jirong

- END -

WeChat adds new features!Look at it →

recently,WeChat officially launched the youth model payment limit functionNow, as ...

Technology leaders, the innovation ability of Weihai Huancui District "walks ahead"

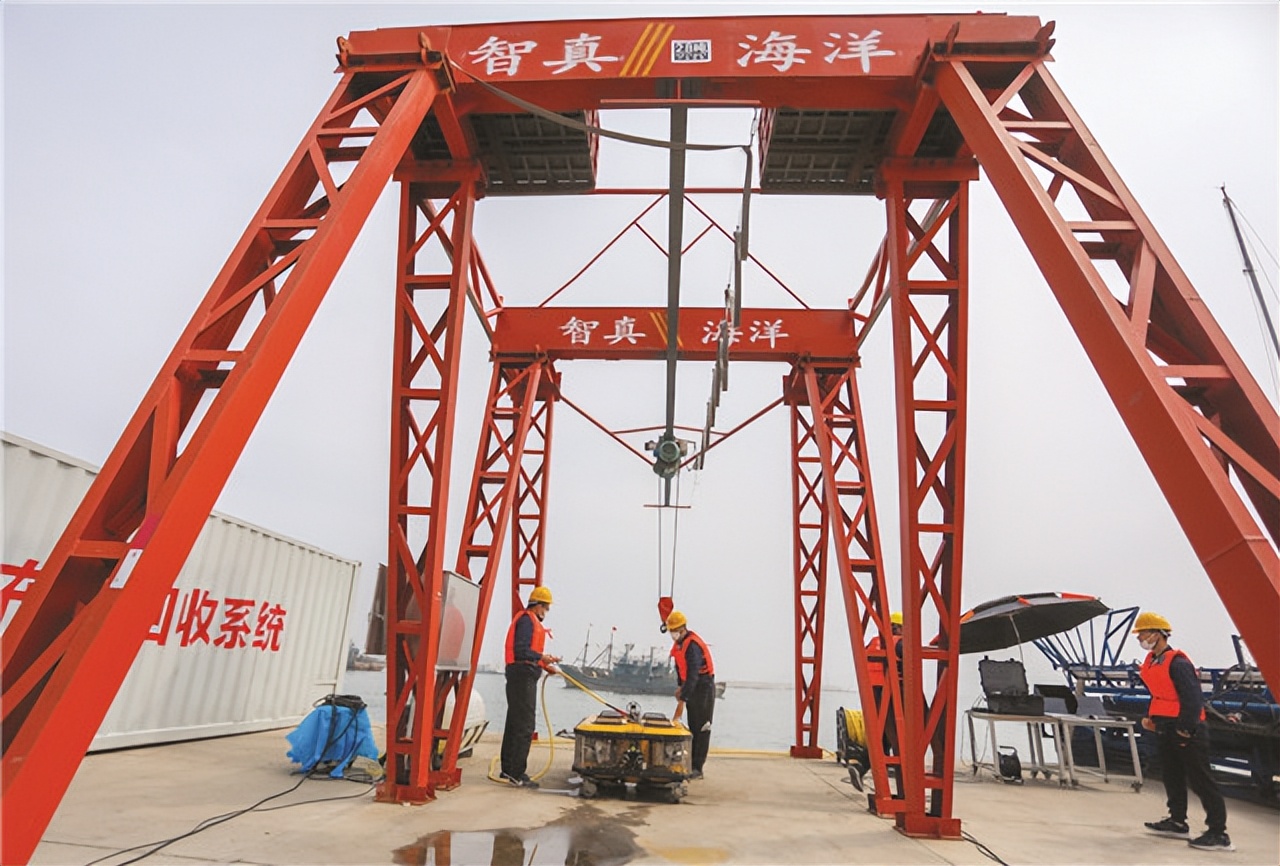

On June 20, the third multinational company leader Qingdao Summit Weihai Marine In...